An emergency fund is a crucial financial safety net, but what's the best way to manage it? Should you invest your emergency fund, or keep it as cash? This is a complex question, and the answer depends on several factors. Firstly, let's understand what an emergency fund is and why it matters. An emergency fund is a sum of money set aside to cover unexpected expenses, such as car repairs, medical bills, or even job loss. The recommended amount to keep in this fund is typically three to six months' worth of living expenses.

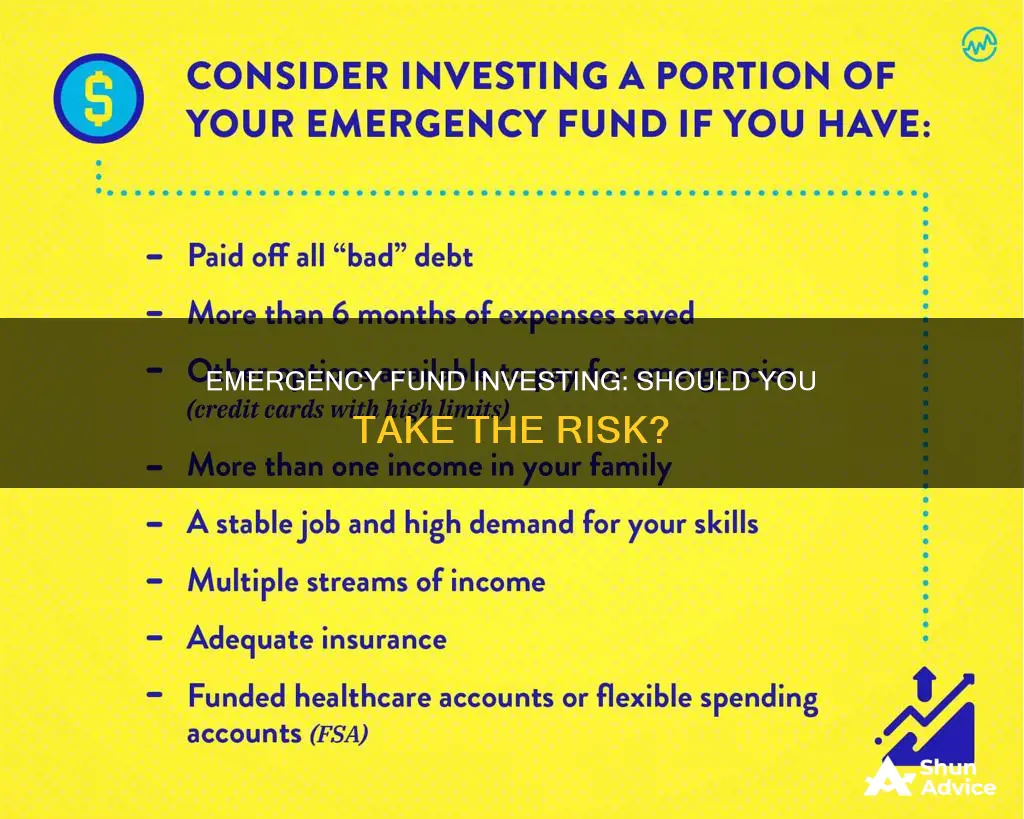

Now, should you invest this fund? On the one hand, investing it could help you grow your savings and protect your future purchasing power. Options like high-yield savings accounts, money market accounts, and certificates of deposit (CDs) offer higher interest rates than traditional savings accounts, allowing your emergency fund to grow. However, there are some considerations. Firstly, you want your emergency fund to be easily accessible in case of, well, an emergency. Some investment options, like CDs, may charge penalties for early withdrawals, so be sure to read the fine print. Additionally, investments come with some level of risk, and you could potentially lose money.

A good approach might be to keep a portion of your emergency fund in a high-yield savings account, which provides easy access and competitive interest rates. You could then invest the rest in options like money market accounts or CDs, but be mindful of any restrictions and risks involved. Ultimately, the decision to invest your emergency fund depends on your financial goals, risk tolerance, and the level of accessibility you need.

| Characteristics | Values |

|---|---|

| How much emergency fund should I have? | Most experts recommend keeping an amount to cover three to six months of living expenses, particularly in case of a job loss. |

| Where should I keep my emergency fund? | High-yield savings account, money market account, certificate of deposit, traditional bank account, Roth Individual Retirement Account |

| Why is it important to have an emergency fund? | Emergencies can take a physical, mental, and emotional toll. Having a designated fund for the unexpected can prevent you from taking out a high-interest loan to cover unforeseen expenses. |

| How to build an emergency fund? | Set a total dollar-amount goal, determine how much you can set aside each month, and transfer your monthly contribution to the emergency fund on a set date each month. |

What You'll Learn

High-yield savings accounts

- SoFi Checking and Savings: This account has no minimum balance requirement and earns an APY of 4.30% (variable and subject to change). SoFi also offers a checking account, so you can keep your emergency fund and everyday finances in the same place.

- CIT Bank Platinum Savings: This account has a minimum opening deposit of $100 and earns an APY of 4.70% on balances of $5,000 or more.

- Barclays Tiered Savings Account: This account has no minimum balance requirement and earns an APY of 4.50% on balances of $0 to $250,000, and 4.80% on balances over $250,000.

- Capital One 360 Performance Savings: This account has no minimum balance requirement and earns an APY of 4.10%. Capital One also offers a checking account that earns interest.

- LendingClub Bank: This account has no minimum opening deposit requirement and no monthly service fee. It offers a top-tier savings APY on its LevelUp account if you deposit at least $250 each month. If you don't meet this requirement, you will still earn a competitive yield.

When choosing a high-yield savings account, consider the APY, fees, minimum deposit and balance requirements, and ease of access.

Fidelity Mutual Funds: Investing in Corporate Debt

You may want to see also

Money market accounts

- Discover® Money Market Account: Best for Money Market Account, 3.80% APY

- Quontic Money Market Account: Best for Money Market Account, 5.00% APY

- Vio Bank Cornerstone Money Market Account: Best for Money Market Account, 5.05% APY

- Sallie Mae Money Market Account: Best for Money Market Account, 4.20% APY

- Ally Bank Money Market Account: Best for Money Market Account, 4.00% APY

- Zynlo Money Market Account: Best for Money Market Account, 5.00% APY

- EverBank Performance℠ Money Market: Best for Money Market Account, 4.00% APY

- First Foundation Bank Online Money Market: Best for Money Market Account, 4.90% APY

Single Investment Strategies to Fund Your Future

You may want to see also

Certificates of deposit

CDs typically earn a higher interest rate than other bank accounts. A CD's "term" can be as short as a month or as long as five or more years. Once it ends, you can access your initial funds and any interest you earned.

Earning a higher APY is great, but there is some risk with having your emergency fund tied up in a CD. What if you face an emergency before your CD has fully matured? You can still withdraw money from a CD during this time, but in most cases, you'll have to pay an early withdrawal penalty. Some banks charge a flat fee, while others may charge a percentage of the interest earned on your CD.

One way around this is to create what's called a CD ladder. This involves rolling over several CDs of varying term lengths. Doing this allows you to earn at a higher rate while leaving some of your emergency fund accessible. You could have one CD with a three-month term, another with a 12-month term, another with an 18-month term, and so on.

CDs can be a good idea if you have cash that you don't need now but that you will want within a few years. They are also a good option if you want some of your savings invested conservatively.

A Guide to Index Fund Investing in the US

You may want to see also

Savings accounts

A high-yield savings account is a good option, as it offers a higher interest rate than a traditional savings account. You can earn 3% to 4% from many high-yield savings accounts, compared to an average of 0.3% from traditional savings accounts. Money in a high-yield savings account is typically FDIC-insured, and you can usually access the money through an online funds transfer, outgoing wire transfer, telephone transfer, or check request. However, if you use an online-only account, you cannot access your funds at a branch location, and some methods of accessing your savings may take several days.

Another option is a money market account, which is a sort of mix between a checking account and a savings account. They are considered low risk, so they can be ideal for an emergency fund. Money market accounts can provide APYs of about 3% to 4%. Most money market accounts are insured by the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Association (NCUA), which means your money will be protected up to $250,000 per account. Some banks offer money market accounts that come with debit card and/or check-writing privileges, which gives you instant access to your funds. You can often make a certain number of free withdrawals per month as well.

A more traditional savings account through a bank or credit union is another option for your emergency fund. While it may not offer as high of an interest rate as a high-yield savings account or money market account, it will still allow you to earn some interest on your savings.

When choosing a savings account for your emergency fund, it is important to consider the level of risk you are comfortable with, the interest rate offered, and the accessibility of the account. It is also important to remember that savings accounts do not always keep pace with inflation, meaning that your money may lose value over time.

Maximizing Your HSA: To Invest or Not to Invest?

You may want to see also

Roth IRA

A Roth IRA is a type of tax-advantaged individual retirement account (IRA) that allows you to contribute after-tax dollars toward your retirement. This means that you pay taxes on money going into your account, and then all future withdrawals of earnings are free from tax and penalty once you reach the age of 59 and a half, and the Roth IRA has been open for at least five years.

Advantages of a Roth IRA

- Your contributions and the earnings on those contributions can grow tax-free.

- You can withdraw your contributions (but not earnings) at any time, tax- and penalty-free.

- There are no required minimum distributions (RMDs) during the account holder's lifetime, as there are with 401(k)s and traditional IRAs.

- There is no age limit to contribute to a Roth IRA.

- You can leave amounts in your Roth IRA for as long as you live.

- If you pass your Roth IRA onto your heirs, their withdrawals of contributions are tax-free.

- If you buy a home, pay for college, or need your Roth funds for the birth or adoption of a child, you can also withdraw without paying a penalty.

Disadvantages of a Roth IRA

- Unlike 401(k)s, Roth IRAs do not include an upfront tax break.

- Annual contribution limits are about a third of 401(k)s.

- For some high-income individuals, contributions are either reduced or not allowed.

Should you invest your emergency fund in a Roth IRA?

The general recommendation is to have at least three to six months' worth of living expenses saved for emergencies. While a Roth IRA can be used as an emergency fund, it is not advisable to rely on it as your sole source of emergency funds. This is because the primary purpose of a Roth IRA is to secure your financial future during retirement, and withdrawing funds early can hinder the compound growth potential of your account. Additionally, if you withdraw earnings before the age of 59 and a half, you will face a 10% penalty in addition to paying taxes on the amount.

A better strategy may be to keep your emergency fund in a regular savings account or a high-yield savings account and use your Roth IRA for long-term investments. However, if you do not have enough money to max out your Roth IRA contribution for the year and want to avoid missing out on the opportunity, you could consider contributing to your Roth IRA but keeping the money in cash or a high-yield savings account within the Roth IRA. That way, if you have an emergency, you can withdraw the money from the Roth IRA without losing anything. If you don't have an emergency, you can slowly start converting the cash into investments.

L&T India Value Fund: A Smart Investment Strategy

You may want to see also

Frequently asked questions

An emergency fund is money set apart from other savings to help deal with unexpected events and their financial ramifications. It is meant to be used for true emergencies and not as a backup cash account.

Most experts recommend keeping an amount to cover three to six months of living expenses, especially if you lose your job.

It is recommended to keep your emergency fund separate from your other bank accounts to avoid the temptation of dipping into it. High-yield savings accounts, money market accounts, and certificates of deposit (CDs) are good options as they offer liquidity, protection, and competitive interest rates.

Checking accounts are designed for regular transactions and typically offer low or no interest rates. Keeping your emergency fund in a separate account can help prevent you from dipping into it for non-emergency purposes.

Cash is susceptible to damage from water or fire. A fireproof safe or a locked safe can help protect your cash in the event of a burglary or natural disaster.