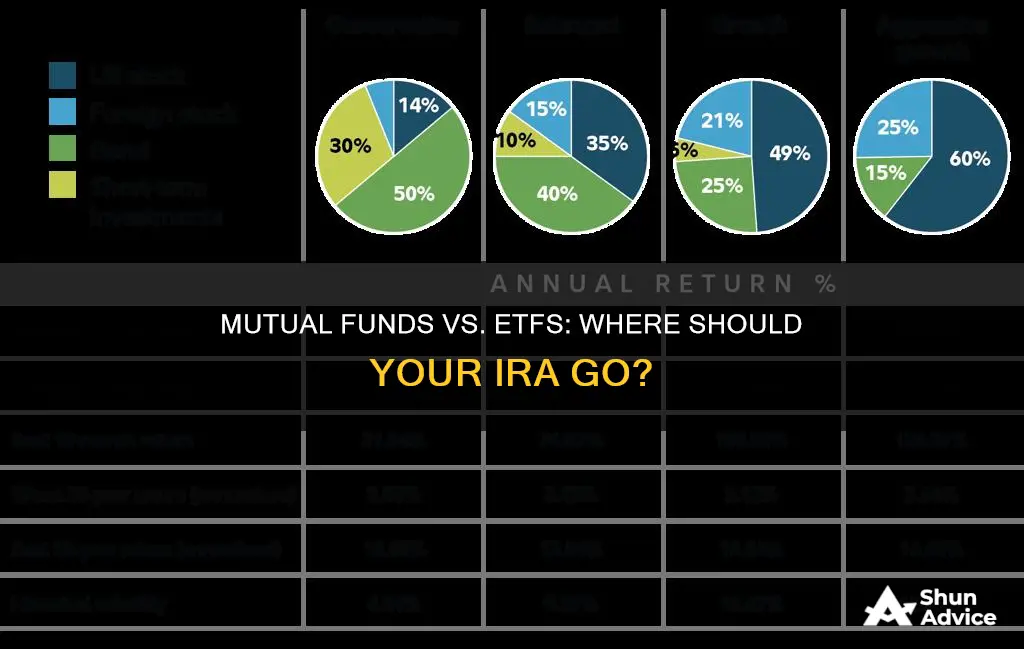

Exchange-traded funds (ETFs) and mutual funds are both popular investment vehicles for those looking to diversify their portfolios. While they share some similarities, there are key differences that investors should consider when deciding where to allocate their money.

ETFs are known for their flexibility, trading like stocks throughout the day, while mutual funds are bought and sold at the end-of-day net asset value (NAV) price. ETFs are often considered more tax-efficient, with lower expense ratios, and no minimum investment requirements, making them accessible to investors with limited capital. On the other hand, mutual funds may have higher expense ratios, especially when actively managed, and often come with minimum investment amounts.

Both options provide investors with a simple and flexible way to gain exposure to a wide range of assets, but it's important to understand the differences to make an informed decision about which is the best fit for your Individual Retirement Account (IRA).

| Characteristics | Values |

|---|---|

| Liquidity | Mutual funds are bought and sold at the end of the day, whereas ETFs can be traded throughout the day. |

| Investment minimums | Mutual funds often have minimum investment amounts, whereas ETFs can be bought for the price of a single share. |

| Control over trade price | ETFs allow for more control over the trade price, whereas mutual funds mean everyone gets the same price at the end of the day. |

| Automatic investments and withdrawals | ETFs do not allow for automatic investments or withdrawals, but mutual funds do. |

| Tax efficiency | ETFs are considered more tax-efficient as they generate fewer taxable events. |

| Expense ratios | ETFs typically have lower expense ratios than mutual funds. |

| Management | ETFs are predominantly passively managed, whereas mutual funds can be actively managed. |

| Sales charges | ETFs generally do not have sales charges, but some mutual funds may impose sales loads. |

What You'll Learn

Mutual funds vs. ETFs: pros and cons

Exchange-traded funds (ETFs) and mutual funds are similar in many ways. Both are professionally managed collections or "baskets" of stocks or bonds, offering built-in diversification and access to a wide variety of investment options. They are also overseen by professional portfolio managers and are subject to regulatory oversight to protect investors.

However, there are some key differences to consider:

Pros of ETFs:

- ETFs are traded on stock exchanges throughout the day, providing intraday trading flexibility.

- ETFs typically have lower expense ratios due to passive management and fewer administrative costs.

- ETFs are often considered more tax-efficient as they minimize capital gains distributions to investors.

- ETFs usually have no minimum investment requirements, making them accessible to investors with limited capital.

- ETFs provide real-time pricing and allow for more sophisticated order types, giving investors more control over the price of their trade.

- ETFs are often considered more tax-efficient, as their structure minimizes capital gains distributions.

Cons of ETFs:

- ETFs may be thinly traded, resulting in wider bid-ask spreads and higher trading costs.

- ETFs may not be suitable for investors who want to repeat specific transactions automatically, as they don't allow for automatic investments or withdrawals.

Pros of Mutual Funds:

- Mutual funds may be more suitable for investors who want to keep things simple, as they are traded only once a day at the end of the trading day.

- Mutual funds may be preferable for investors who want to set up automatic investments or withdrawals, based on their preferences.

- Mutual funds may be more suitable for investors who prefer actively managed funds, as they can be actively or passively managed.

Cons of Mutual Funds:

- Mutual funds are bought and sold at the end-of-day net asset value (NAV) price, which may be less convenient for some investors.

- Mutual funds can have higher expense ratios, especially when they are actively managed, which can impact long-term returns.

- Mutual funds may generate capital gains within the portfolio, which are distributed to investors and may result in taxable events.

- Mutual funds often have minimum investment requirements, which may be a barrier for smaller investors.

When deciding whether to invest in mutual funds or ETFs for your IRA, consider factors such as investment minimums, trading flexibility, tax efficiency, and management style. Both options have their advantages and can be suitable for different types of investors depending on their specific needs and goals.

A Guide to Investing in Franklin India Bluechip Fund

You may want to see also

The tax implications of mutual funds vs. ETFs

When it comes to the tax implications of investing in mutual funds or ETFs, there are a few key differences to be aware of. Both are subject to capital gains tax and dividend income taxation. However, due to their structure, ETFs often prove to be more tax-efficient than mutual funds. Here's a detailed overview:

Tax Efficiency:

ETFs:

- ETFs generally have fewer "taxable events" than mutual funds, making them more tax-efficient.

- They are structured to minimize taxes for the holder, resulting in a lower tax bill after selling and incurring capital gains tax.

- ETF managers accommodate investment inflows and outflows by creating or redeeming "creation units", baskets of assets that mirror the ETF's investment exposure. This reduces the likelihood of investors being exposed to capital gains on individual securities.

- Most ETFs are passively managed, resulting in fewer transactions and taxable events compared to actively managed funds.

- Dividends from ETFs held for more than 60 days are considered "qualified dividends" and are taxed at a lower rate (0-20%) depending on the investor's income tax rate.

Mutual Funds:

- Mutual fund managers constantly rebalance the fund by selling securities to accommodate shareholder redemptions or reallocate assets. This creates capital gains for shareholders, even those with unrealized losses on their overall investment.

- Mutual funds may carry forward capital losses from previous years and employ tax mitigation strategies to reduce the impact of annual capital gains taxes.

- Index mutual funds are more tax-efficient than actively managed funds due to lower turnover.

Capital Gains Taxation:

ETFs:

- Capital gains from selling an ETF are taxed based on the holding period. Long-term capital gains (held for over a year) are taxed at a rate of up to 23.8% (including the 3.8% Net Investment Income Tax), while short-term capital gains (held for less than a year) are taxed at the ordinary income rate, up to 40.8%.

- ETFs that invest in commodities, such as oil or gold, may be subject to the "60/40 rule", where gains or losses are treated as 60% long-term and 40% short-term, regardless of the holding period.

- Currency ETFs structured as grantor trusts treat gains as ordinary income, while those structured as limited partnerships use the 60/40 rule.

Mutual Funds:

Mutual fund capital gains are taxed based on the holding period, similar to ETFs. Long-term capital gains are taxed at 0%, 15%, or 20%, while short-term gains are taxed at the ordinary income tax rate.

Dividend Taxation:

ETFs:

- ETFs that hold dividend-paying stocks will distribute earnings to shareholders, usually annually.

- Dividends from ETFs held for less than 60 days are taxed at the investor's ordinary income tax rate.

Mutual Funds:

Dividends from mutual funds are taxed similarly to ETFs, with qualified dividends taxed at lower capital gains rates and non-qualified dividends taxed at the ordinary income rate.

Tax Considerations for IRAs:

When considering an IRA, it's important to understand the tax implications of both mutual funds and ETFs:

- IRAs offer flexibility in terms of investment options, including mutual funds and ETFs.

- ETFs are often favoured for IRAs due to their lower expense ratios and tax efficiency, making them attractive for tax-conscious investors.

- The choice between mutual funds and ETFs depends on the specific IRA and its tax implications. Consult a tax professional for personalised advice.

Smart Strategies for Investing Your Child's College Fund

You may want to see also

How to choose between active and passive funds

When choosing between active and passive funds, it is important to consider the differences between the two and how they align with your investment goals, risk tolerance, and beliefs.

Active funds are managed by fund managers who actively make investment decisions, aiming to beat the market's average returns. This approach involves a hands-on, dynamic strategy where fund managers can buy and sell investments based on their short-term performance. Active funds offer the advantage of flexibility, allowing managers to make specific investment choices and hedge their bets using techniques like short sales or put options. They can also provide risk management by exiting particular holdings or sectors when risks become too significant. Additionally, active funds enable tax management strategies tailored to individual investors. However, active funds tend to be more expensive due to the extensive research, analysis, and transaction costs involved.

On the other hand, passive funds follow a "buy-and-hold" strategy, aiming to mirror the performance of a specific market index. Passive funds are often index funds that hold a diversified portfolio of assets designed to match the composition of the index they track. This approach offers the benefit of ultra-low fees since there is no need for active stock picking, and the fund simply follows its benchmark index. Passive funds also provide good transparency, as investors always know what assets are included in the fund. Additionally, passive funds are tax-efficient because their buy-and-hold strategy typically does not result in substantial capital gains taxes annually. However, passive funds may be considered too limited by some investors, as they are locked into a specific index or set of investments, regardless of market conditions.

When deciding between active and passive funds, it is essential to evaluate your investment goals, risk tolerance, and beliefs about active versus passive strategies. Active funds may be more suitable if you seek a dynamic approach, desire more flexibility in investment choices, and are willing to pay higher fees. In contrast, passive funds could be preferable if you prefer a more hands-off, long-term strategy with lower fees and greater transparency. Ultimately, the decision should be based on your individual financial circumstances and goals.

A Guide to UAE Residents Investing in Vanguard Index Funds

You may want to see also

The impact of fund fees on long-term returns

When deciding whether to invest your IRA in a mutual fund or an ETF, it's important to understand the impact of fund fees on long-term returns. Here are some key points to consider:

Mutual Fund Fees

Mutual funds typically charge various fees that can impact your investment returns over time. These fees include management fees, 12b-1 fees (covering marketing and sometimes employee bonuses), account fees, redemption fees, exchange fees, and purchase fees. The expense ratio, which combines management fees and other operating expenses, is an important metric to consider when evaluating mutual funds. The expense ratio is expressed as a percentage of your annual investment that is deducted from your balance each year. This percentage is known as an expense ratio. (If you buy a fund with the help of a financial advisor, there may be other one-time fees known as loads.) Mutual funds with high expense ratios can significantly reduce your long-term gains. It's important to carefully review the prospectus and fact sheets of a mutual fund to understand all the associated fees.

ETF Fees

Exchange-Traded Funds (ETFs) generally have lower fees compared to mutual funds, especially when it comes to passive or index funds. ETFs are often passively managed, meaning they aim to replicate the performance of a specific market index rather than actively trying to outperform it. This passive approach results in lower management fees. Additionally, ETFs do not charge 12b-1 fees, which are common in mutual funds. The absence of these fees makes a significant difference in reducing the overall cost of ETFs. It's important to note that while the average ETF has a lower expense ratio than the average mutual fund, a direct comparison may be misleading as most ETFs are index funds, whereas only a portion of mutual funds fall into this category. When comparing similar index funds, the fee difference between ETFs and mutual funds becomes less significant.

Impact on Long-Term Returns

The fees associated with mutual funds and ETFs can have a substantial impact on your long-term investment returns. Even small differences in expense ratios can lead to substantial differences in your investment balance over time. For example, a 1% expense ratio will leave you with a lower balance compared to a fund with a 0.1% expense ratio, assuming the same initial investment and annual returns. Therefore, it's crucial to carefully consider the fee structure of the fund you're investing in, especially if you're planning for long-term retirement savings.

Tax Efficiency

In addition to fees, it's worth considering the tax efficiency of mutual funds and ETFs. ETFs are generally considered more tax-efficient due to their structure, which minimizes capital gains distributions to investors. Mutual funds, on the other hand, can generate capital gains within the portfolio, which are then distributed to investors, potentially resulting in taxable events. However, it's important to note that the tax status of your IRA may impact this, and certain types of IRAs can offer tax advantages that mitigate these considerations.

In summary, when deciding between investing your IRA in a mutual fund or an ETF, it's crucial to understand the fee structure of each option and how it will impact your long-term returns. ETFs generally have a reputation for lower fees, especially when comparing passive or index funds. However, a direct comparison of average expense ratios between ETFs and mutual funds may be misleading due to the higher proportion of index funds among ETFs. Mutual funds have various fees, and it's important to carefully review the prospectus to understand the full range of costs associated with a particular fund. Remember, even small differences in fees can compound over time and significantly impact your long-term investment returns. Therefore, carefully evaluating and comparing fees should be a key part of your investment decision-making process.

Mutual Funds: Electric Vehicle Investments for the Future

You may want to see also

The importance of diversification when investing in funds

Diversification is a common investing technique used to reduce the chances of experiencing significant losses. By spreading your investments across different assets, you are less likely to suffer substantial losses due to negative events impacting a single holding. Instead, your portfolio is spread across different types of assets and companies, preserving your capital and increasing your risk-adjusted returns.

Diversification is the process of spreading investments across different asset classes, industries, and geographic regions to reduce the overall risk of an investment portfolio. The idea is that by holding a variety of investments, the poor performance of any one investment can be offset by the better performance of another, leading to a more consistent overall return.

- Reduced risk: Diversification helps to lower the impact of poor-performing individual investments. By investing in a range of vehicles that span different financial instruments, industries, and categories, you can reduce the overall risk of your portfolio. While diversification does not guarantee against losses, it is an important component of reaching long-term financial goals while minimising risk.

- Better opportunities: Diversification can lead to better investment opportunities. For example, by investing in a streaming service to diversify away from transportation companies, you can benefit from positive changes in a different sector, such as a major partnership or investment in content.

- Enjoyment: For some, diversification can make investing more enjoyable. It involves researching new industries, comparing companies, and emotionally investing in different areas.

- Risk-adjusted returns: Diversification is thought to increase the risk-adjusted returns of a portfolio. This means that investors earn greater returns when factoring in the risk they are taking.

- Preservation of capital: Diversification is particularly important for older investors and retirees who need to preserve their wealth. It also helps individuals approaching retirement who may no longer have a stable income and need to rely on their portfolio to cover living expenses.

- Diversify across asset classes: Combine different types of investments, or asset classes, which carry different levels of risk. The main asset classes are stocks, bonds, and cash alternatives. Some investors also include real estate and commodities, like gold and coal. Each asset class tends to perform differently under similar market conditions, so splitting your assets among categories helps to balance your portfolio.

- Diversify within asset classes: For stocks, the possibilities for diversification are vast. You can diversify by the size of the companies (large-, medium-, or small-cap stocks), geography (domestic or international), industry, and sector. Mutual funds or exchange-traded funds (ETFs) are a good option if you want to diversify among stocks but don't have the time or inclination to do so.

- Diversify across sectors and industries: For example, buying railroad stocks can protect against detrimental changes to the airline industry.

- Diversify across companies: Risk is often present at a company-specific level. A company with a revolutionary leader may be negatively affected if that leader leaves or passes away.

- Diversify across borders: Political, geopolitical, and international risks can impact companies worldwide. Different countries operating with different monetary policies will provide different opportunities and risk levels.

- Diversify across time frames: Consider the time frame in which investments operate. For example, a long-term bond has a higher inherent risk but also a higher rate of return, while a short-term investment is more liquid and yields less.

It is important to note that diversification does not eliminate all risk. There will always be some inherent risk to investing that cannot be diversified away. Additionally, diversification can potentially lower returns, as a diversified portfolio is optimised for risk-adjusted returns rather than absolute returns. Therefore, it is essential to strike a balance between diversification and maximising returns, taking into account your risk tolerance and investment goals.

Index Fund Investing: Financial Independence Strategy

You may want to see also

Frequently asked questions

Mutual funds are a great way to build a well-diversified portfolio. They are overseen by a portfolio manager, who can take an "active" approach by trying to pick winning stocks that will outperform the market, or a newer "index" approach, aiming to match market returns. Mutual funds are also regulated by the Securities and Exchange Commission, which requires each fund to publish a prospectus including key information such as investment objectives, risks, performance and fees.

Exchange-traded funds (ETFs) are traded throughout the day on an exchange, like the stocks they own, and can be bought and sold at any point. They are also often considered more tax-efficient, as their structure minimises capital gains distributions to investors. ETFs are also less expensive to own and trade, making them more liquid.

Mutual funds are bought and sold once a day, at market close, and often have minimum investment requirements. ETFs, on the other hand, can be purchased for the price of a single share, and provide real-time pricing. ETFs are also predominantly passively managed, whereas mutual funds can be actively managed.