Stopping your 401(k) contributions could come with drawbacks as it provides tax-deferred growth and you could be missing out on employer match contributions. However, if you have $200k in taxable, you might be more inclined to stop investing there and let that grow on its own while continuing to max out retirement accounts as long as possible.

| Characteristics | Values |

|---|---|

| Tax-deferred growth | Taxes are not paid on the growth of the investment |

| Employer match contributions | Employers may match a portion of the employee's contribution |

| Diversification | Consider diversifying your portfolio to include more recession-proof assets |

| Emergency fund | Focus on building an emergency fund in a high-yield savings account |

| Retirement savings | Maximize retirement accounts to avoid paying taxes |

| Early retirement | Contributing to the max 401k amount can help retire super early |

| Market recovery | Halt contributions can reduce the money invested in the market, missing potential rebound gains |

| Age | Consider reducing contributions if you are 50 or older |

What You'll Learn

Tax-deferred growth

Stopping contributions to a 401k can have drawbacks as it means missing out on the tax-deferred growth that is a key benefit of the investment. This can reduce the overall growth of the investment and impact the long-term financial goals of the investor.

Diversifying the investment portfolio is a key strategy to mitigate the risks associated with stopping contributions to a 401k. This can include more recession-proof assets and building an emergency fund in a high-yield savings account. This can provide a safety net and allow for continued investment in the 401k even if contributions are paused.

Maxing out retirement accounts is a key strategy to optimise the tax-deferred growth of a 401k. This can include contributing the maximum amount to the 401k and other retirement accounts to maximise the tax-deferred growth. This can include contributing to a 401k and other retirement accounts to optimise the tax-deferred growth.

Retiring early is a key consideration when deciding whether to stop investing in a 401k. This is because early retirement can significantly impact the overall growth of the investment and financial goals of the investor. Contributing to both the 401k and individual investments can optimise the tax-deferred growth and provide a safety net for early retirement.

Creating a Computer Program for Automatic Investing

You may want to see also

Employer match contributions

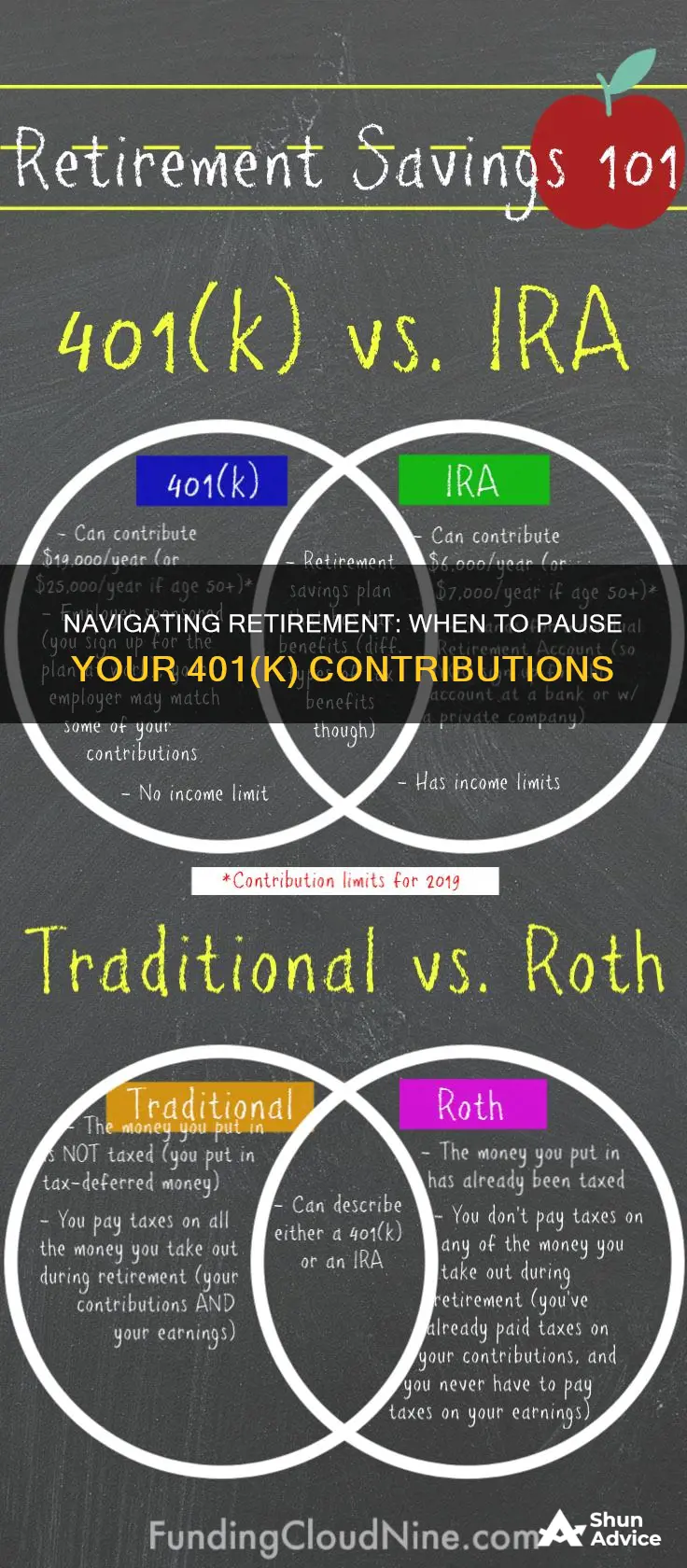

Depending on the terms of the 401(k) plan, an employer may choose to match your contributions dollar-for-dollar or offer a partial match. Some employers may also make non-matching 401(k) contributions. One way employers determine matching contributions is to match a percentage of an employee's contribution, up to a certain limit. Employees may contribute up to $23,000 to their 401(k) in 2024 (it was $22,500 in 2023). This doesn't include what the employer contributes to the account. Depending on the terms of your 401(k), your contributions to your retirement savings plan may be matched by your employer in several ways. Typically, employers match a percentage of an employee's contributions up to a specific portion of their total salary.

Your 401(k) not only provides you with the benefit of tax-deferred growth, but you also could be missing out on employer match contributions. Moreover, when you halt contributions, you reduce the money invested in the market, missing potential rebound gains if the market recovers. Instead of stopping 401(k) contributions altogether, he recommends you consider diversifying your investment portfolio to include more recession-proof assets.

Savings Accounts: Invest or Save?

You may want to see also

Diversifying investment portfolio

Diversifying your investment portfolio is a great way to prepare for a recession and protect your financial future. Here are some steps to help you get started:

- Build an emergency fund in a high-yield savings account to cover 3-6 months of living expenses. This will provide a safety net in case of unexpected financial setbacks.

- Consider investing in recession-proof assets such as real estate, commodities, or dividend-paying stocks. These assets tend to perform well during economic downturns and can help stabilize your portfolio.

- Review your current investments and assess their performance. Identify any underperforming assets and consider selling them to reallocate capital towards more promising opportunities.

- Consider consulting a financial advisor who can provide personalized guidance based on your financial goals and risk tolerance. They can help you create a diversified portfolio that aligns with your investment strategy and long-term objectives.

- Stay informed about market trends and economic conditions. Regularly monitor your investments and adjust your portfolio as needed to take advantage of emerging opportunities or mitigate potential risks.

Remember, diversification is key to managing risk and maximizing returns in the long run. By spreading your investments across different asset classes, you can reduce the impact of any single investment's performance on your overall portfolio.

Unlocking Safety: Strategies for Concrete Investment Success

You may want to see also

Building an emergency fund

- Determine your emergency fund goal: Aim to save enough to cover 3-6 months of living expenses. This will provide you with a buffer in case of unexpected expenses or loss of income.

- Choose a high-yield savings account: Look for an account that offers a competitive interest rate to help your savings grow.

- Automate your savings: Set up automatic transfers from your checking account to your emergency fund savings account. This will help you build your fund without having to remember to manually transfer funds.

- Start small and build gradually: If you're just starting, don't feel overwhelmed. Start with a small amount and gradually increase it as you're able.

- Avoid using your emergency fund for non-emergencies: Only use your emergency fund for unexpected expenses or emergencies. Avoid using it for non-essential purchases or paying off credit card debt.

- Keep your emergency fund liquid: Make sure your emergency fund is easily accessible in case of an emergency. Avoid investing in assets that may take time to liquidate.

Remember, building an emergency fund is an important step in ensuring you have a financial safety net in place. By following these steps, you can build a fund that will provide you with peace of mind and help you navigate unexpected expenses or loss of income.

Pre-IPO Investing: A Guide to India's Private Markets

You may want to see also

Missing potential rebound gains

Stopping your 401(k) contributions could come with drawbacks. Your 401(k) not only provides you with the benefit of tax-deferred growth, but you also could be missing out on employer match contributions. When you halt contributions, you reduce the money invested in the market, missing potential rebound gains if the market recovers.

Diversifying your investment portfolio to include more recession-proof assets is a good idea. Focus on building an emergency fund in a high-yield savings account to cover 3-6 months of living expenses.

If you're 50 or older, you can contribute an additional $7,500 to your 401k. Retirement will be here before you know it.

If you have $200k in taxable already, you'd be more inclined to stop investing there and let that grow on its own while continuing to max out retirement accounts as long as possible.

If you're 35 and have $450k in various 401k and IRA accounts, you should be contributing both to the max 401k amount as well as to individual investments.

Savings, Investments, and Risk: Losing it All?

You may want to see also

Frequently asked questions

If you have $200k in taxable already, you might be inclined to stop investing there and let that grow on its own while continuing to max out retirement accounts as long as possible.

Stopping your 401k contributions could come with drawbacks. Your 401k not only provides you with the benefit of tax-deferred growth, but you also could be missing out on employer match contributions. Moreover, when you halt contributions, you reduce the money invested in the market, missing potential rebound gains if the market recovers.

Instead of stopping 401k contributions altogether, you should consider diversifying your investment portfolio to include more recession-proof assets. Focus on building an emergency fund in a high-yield savings account to cover 3-6 months of living expenses.

The 401k contribution limit for 2024 is $23,000. If you’re 50 or older, you can contribute an additional $7,500.

If you really want to retire super early, you should be contributing both to the max 401k amount as well as to individual investments. The individual investments can then hold you over until you start drawing on retirement accounts, but keep investing in your 401k first.