Investing in mutual funds is a popular choice for many, especially those who want a relatively hands-off, diversified investment. Mutual funds are an excellent option for those who don't want to pick individual stocks but still want to benefit from the stock market's average annual returns. They are also a good option for those who want to diversify their investments and reduce the risk of overconcentration.

However, it's important to note that mutual funds come with some risks and fees. The value of investments can fluctuate based on market conditions, and there are various fees and expenses associated with owning mutual funds. Therefore, investors should carefully consider their financial situation, risk tolerance, and investment goals before deciding whether to invest in mutual funds.

| Characteristics | Values |

|---|---|

| Number of funds available | Over 10,000 |

| Investment types | Stocks, bonds, real estate, commodities, etc. |

| Management | Actively managed or passively managed |

| Risk | Lower risk due to diversification |

| Affordability | Low minimum investment, reasonable fees |

| Taxation | Taxed on distributions unless in a qualified account |

| Accessibility | Can be bought through online brokers, 401(k)s, or IRAs |

What You'll Learn

Mutual funds vs. individual stocks

Mutual funds and individual stocks are both popular types of investments, but they have different traits that appeal to investors with different goals. Here is a detailed comparison of the two:

Mutual Funds

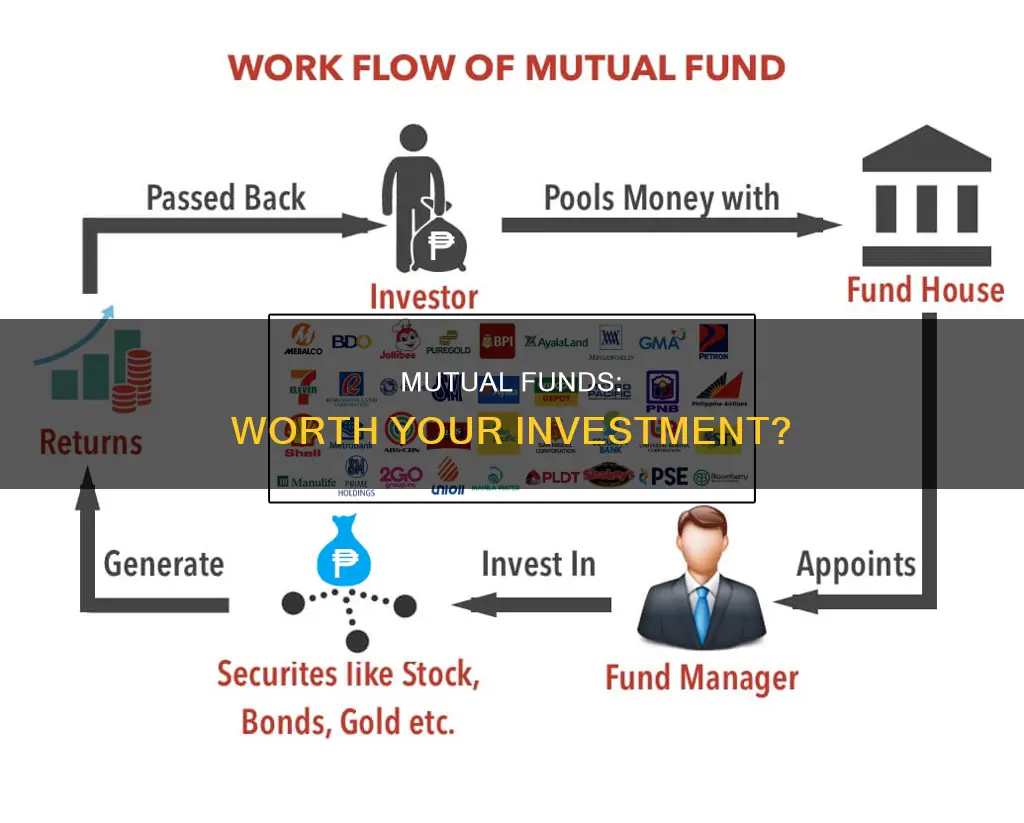

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of assets. They are managed by professionals and offer instant diversification, which reduces risk. Mutual funds are often safer and less complicated than individual stocks. Here are some pros and cons:

Pros:

- Instant Diversification: Mutual funds provide exposure to a wide range of stocks, bonds, or other assets, reducing the risk of losing your entire investment.

- Lower Costs: The cost of trading in mutual funds is spread across all investors, resulting in lower costs per individual.

- Professional Management: Financial professionals choose and manage the investments within the fund, reducing the need for monitoring by individual investors.

Cons:

- Limited Control: Investors give up some control as they don't choose the specific stocks in the fund.

- Potential Underperformance: Actively managed mutual funds may underperform the market and incur higher fees.

- Tax Inefficiency: Mutual funds may distribute gains that create taxable events for investors, even if they haven't sold their shares.

Individual Stocks

Individual stocks represent ownership in a specific company, and their value fluctuates based on the company's performance and market conditions. Investing in individual stocks offers the potential for higher returns but also carries higher risk and volatility. Here are some pros and cons:

Pros:

- Potential for Large Gains: Investing in individual stocks can lead to significant wealth if the stock performs well.

- Control: Investors have complete control over which stocks they choose to invest in.

- Low Trading Costs: Many brokerages do not charge trading fees for individual stocks.

Cons:

- Higher Risk: The potential for large gains is counterbalanced by the risk of substantial losses if the stock price drops.

- Time Commitment: Researching and monitoring individual stocks can be time-consuming.

- Emotional Stress: Investing in individual stocks can be an emotional rollercoaster due to the volatility and potential for losses.

The choice between mutual funds and individual stocks depends on an investor's goals, risk tolerance, and time horizon. Mutual funds offer diversification and reduced risk, making them suitable for long-term retirement portfolios. Individual stocks provide the opportunity for higher returns but come with more volatility. Investors can also choose to invest in both to benefit from the advantages of each.

Best S&P Index Funds: Top Picks for Your Portfolio

You may want to see also

Diversification and risk

Diversification is a crucial concept in investing, and it is particularly relevant when considering mutual funds. By definition, mutual funds offer a level of diversification as they pool money from many investors to purchase a variety of assets, such as stocks, bonds, or other investments. This inherent diversification is one of the main advantages of investing in mutual funds.

Reducing Risk

The primary goal of diversification is to reduce risk. By spreading your investments across various assets, sectors, or industries, you lower the chances of experiencing significant losses. This is because different investments don't always move in the same direction or at the same rate. As such, a decline in one investment may be offset by gains in another. This helps to reduce the overall volatility of your portfolio.

However, it's important to remember that diversification does not eliminate risk entirely. While it can help mitigate unsystematic risk (the risk associated with individual stocks), systematic risk (inherent market risk) will still affect your portfolio to some extent.

Types of Mutual Funds for Diversification

There are several types of mutual funds that can help you achieve diversification:

- Equity Mutual Funds: These funds invest in the stock market and offer various options depending on your investment goals and risk tolerance. You can choose from large-cap, mid-cap, small-cap, or multi-cap funds, ensuring your investments are spread across different industries and sectors.

- Debt Mutual Funds: Debt mutual funds invest in a range of debt securities, such as corporate bonds, money market instruments, and treasury bills. They offer higher liquidity than traditional fixed deposits and can provide attractive returns over time. Additionally, they are tax-efficient, especially for long-term holdings.

- Balanced Mutual Funds: Also known as hybrid funds, these funds invest in both equity and debt. They are ideal for novice investors who want to balance equity-related risks with the stability of fixed-income instruments.

Optimal Number of Mutual Funds for Diversification

When diversifying with mutual funds, it's important to not over-diversify. While diversification is beneficial, investing in too many funds can dilute the impact of strong-performing stocks and limit your potential gains. It can also make it challenging to effectively monitor your investments. The optimal number of mutual funds for diversification typically ranges from 3 to 5, depending on your investment goals, risk tolerance, and the amount you have to invest.

Vanguard Total Bond Fund: A Smart Investment Move?

You may want to see also

Management fees

Actively managed funds tend to have higher management fees than passively managed funds, such as index funds. This is because actively managed funds aim to outperform the market, requiring more active investment decisions and research. As a result, they are more expensive to operate. On the other hand, index funds aim to mirror a specific market index and, therefore, have lower management fees.

When evaluating mutual funds, it is essential to consider not only the management fee but also the management expense ratio (MER) or expense ratio. The MER includes the management fee and a range of other expenses, such as administrative, operational, legal, accounting, and marketing costs. By comparing the MER of different funds, investors can gain a clearer understanding of the overall cost of investing in a particular fund.

It is worth noting that management fees are generally not negotiable for individual investors in mutual funds. However, institutional investors or high-net-worth individuals investing significant sums may have more leverage to negotiate lower fees, especially in private funds or separate accounts.

Overall, management fees are an important consideration when deciding whether to invest in mutual funds. While these fees are necessary to compensate fund managers and advisors for their expertise, they can significantly impact investment returns over time. Therefore, investors should carefully review and compare the management fees and expense ratios of different funds before making investment decisions.

Satori Fund: A Guide to Investing in This Unique Opportunity

You may want to see also

Tax efficiency

When deciding whether to invest in mutual funds, it is important to consider the tax implications, as these investments can create a significant tax burden in some cases. Mutual funds are taxed on dividend income and capital gains distributions, as well as gains from market transactions. The tax efficiency of a mutual fund depends on several factors, including the types of distributions it makes, the frequency of trading activity, and the longevity of each investment in the portfolio.

Mutual funds with lower turnover ratios, or less frequent buying and selling of securities, tend to be more tax-efficient. This is because they generate income that is taxed at the lower capital gains rate rather than the higher ordinary income tax rate. Funds that employ a buy-and-hold strategy, investing in long-term growth stocks and bonds, fall into this category. Additionally, funds with assets that are at least one year old are taxed at lower capital gains rates.

Mutual funds with dividend distributions can provide extra income but are typically taxed at the higher ordinary income tax rate. However, certain qualified dividends, such as those from government or municipal bonds, may be taxed at lower rates or even be tax-free. These types of investments can make mutual funds more tax-efficient.

Exchange-Traded Funds (ETFs) are often considered more tax-efficient than mutual funds due to their structure and passive management. ETFs generally have fewer "taxable events" and generate lower capital gains due to their collective buying and selling mechanism and lower portfolio turnover. However, certain types of ETFs, such as leveraged/inverse ETFs and commodity ETPs, may be less tax-efficient because of their use of derivatives and the resulting tax treatment.

When comparing mutual funds, investors can consider the tax cost ratios to understand how much the fund's returns are reduced by taxes. Additionally, some mutual funds may be more tax-efficient than others, depending on their investment strategies and the types of securities they hold.

Index Funds in India: Risky Business

You may want to see also

Long-term performance

Mutual funds are often favoured for their ability to provide diversification and stability to an investment portfolio over the long term. By investing in a wide range of assets, mutual funds reduce the impact of any single investment on overall portfolio performance. This diversification benefit is particularly advantageous during volatile market periods, as losses in one sector may be offset by gains in another.

Additionally, mutual funds offer access to professional fund management. Fund managers conduct extensive research, select investments, and monitor the portfolio's performance, leveraging their expertise to make investment decisions. Their ability to make large trades on behalf of multiple investors results in cost-effective, diversified portfolios. This professional management can be especially beneficial for investors who lack the time or expertise to actively manage their investments.

The performance of mutual funds is also influenced by their fees and expense ratios. While many mutual funds offer low expense ratios, some funds may charge high fees, including sales loads, redemption fees, and transaction fees, which can erode returns over time. It is crucial for investors to carefully evaluate the fees associated with a mutual fund before investing.

When assessing the long-term performance of mutual funds, it is recommended to evaluate a fund's performance through a full-market cycle, typically spanning three to ten years. This comprehensive view can provide a more accurate understanding of the fund's performance across different market conditions.

Furthermore, the performance of mutual funds is closely tied to the specific holdings and the manager's skill. Active funds, which aim to outperform the market, depend heavily on the fund manager's ability to make prudent investment decisions. On the other hand, index funds, which are passively managed, seek to mimic the performance of a specific market index and are generally less dependent on individual management skills.

In summary, mutual funds offer long-term performance potential through diversification, professional management, and access to a wide range of assets. However, investors should carefully consider the fees, fund management style, and historical performance over full-market cycles to make informed investment decisions.

Foreign Mutual Funds: Invest or Avoid?

You may want to see also

Frequently asked questions

Mutual funds offer diversification and convenience at a low cost. They are also accessible to individual investors with various budget sizes, allowing anyone to participate in the market and benefit from its returns.

You should consider your financial goals, risk tolerance, and the rest of your portfolio. You can also look at the fund's historic returns and the reputation of the fund house.

Mutual funds can be categorized by the types of investments they own, such as stock funds, bond funds, money market funds, balanced funds, and target date funds.

Mutual funds may have a variety of fees, but the two most important ones to look out for are the expense ratio and the sales load. The expense ratio is an annual fee charged by the fund management, typically expressed as a percentage of your investment. A sales load is like a commission paid to buy the fund, which may be paid upon purchase, throughout the fund's life, or when it is sold.

Yes, it is possible to lose money by investing in mutual funds, as with any investment. However, diversification is inherent in mutual funds, which helps to spread the risk across multiple companies or industries.