Time series models are an essential tool for forecasting and prediction, and they are widely used in finance and investment to guide decision-making. These models can help investors and analysts make sense of historical data and use it to predict future trends, patterns, and behaviours.

Time series models are particularly useful for analysing data that changes over time and exhibits sequential relationships, where each observation is dependent on previous ones. This type of data is common in finance, where stock prices, market trends, and investment portfolios can be modelled using time series techniques.

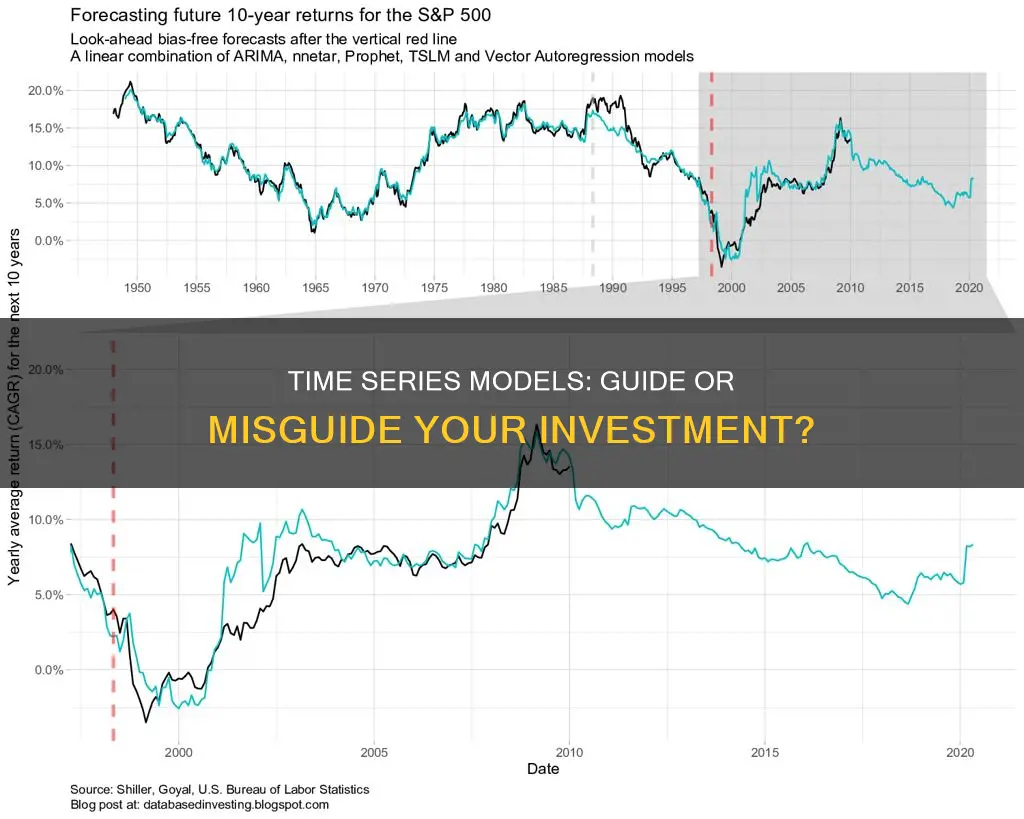

The ability to forecast future values and behaviours is a powerful tool for investors and financial institutions. By understanding how stock prices have changed over time, investors can gain insights into potential future movements and adjust their strategies accordingly. This can help identify profitable investment opportunities and manage risks associated with market fluctuations.

However, it is important to note that time series models have limitations and may not always provide accurate predictions, especially in volatile and complex markets. Additionally, the choice of the right model depends on various factors, including the characteristics of the data and the specific forecasting goals.

| Characteristics | Values |

|---|---|

| Definition | A time series is a set of data points ordered in time, where time is the independent variable. |

| Use | Used in forecasting the future, e.g. predicting financial market trends or electricity consumption. |

| Components | Trend, seasonality, and noise. |

| Importance | Used to inform investment decisions, e.g. whether to hedge a portfolio's exposure to changes in value. |

| Models | Moving Average (MA), Autoregressive (AR), Autoregressive Moving Average (ARMA), Autoregressive Integrated Moving Average (ARIMA), Seasonal ARIMA (SARIMA), Exponential Smoothing, Vector Autoregression (VAR), Machine Learning Models. |

What You'll Learn

Time series models can be used to predict stock prices

Time series analysis is a valuable tool in finance for studying stock prices, predicting market trends, managing investment portfolios, and assessing risks. It helps investors and financial analysts make informed decisions by examining past patterns and trends in the stock market.

A time series is a set of observations on a variable's outcomes at different time intervals. In the context of stock prices, it involves collecting and analysing data points such as the daily closing stock price, trade volume, and other relevant indicators over a period of time.

When applying time series models to predict stock prices, there are several components and characteristics to consider:

- Trend Component (Tt): This represents the overall movement of the stock price over time, which can be upward or downward.

- Seasonal Component (St): This captures repetitive upward or downward movements from the trend that occur at fixed time intervals, such as monthly, quarterly, or yearly.

- Cyclical Component (Ct): This reflects fluctuations around the trend line due to economic changes, such as recession or boom periods.

- Irregular Component (It): This represents random, uncorrelated fluctuations in the stock price data with a mean of zero.

Various time series models can be utilised to predict stock prices, including:

- Moving Average (MA) Model: This model calculates the average of past stock price observations to predict future values, capturing short-term fluctuations.

- Autoregressive (AR) Model: This model predicts future stock prices based on a linear combination of past observations, capturing long-term trends.

- Autoregressive Moving Average (ARMA) Model: This model combines AR and MA models to capture both short-term and long-term patterns in stock prices.

- Autoregressive Integrated Moving Average (ARIMA) Model: This model extends ARMA by incorporating differencing to handle non-stationary data, making it suitable for stock prices with trends or seasonality.

- Seasonal ARIMA (SARIMA) Model: This model includes seasonal components and is useful for analysing and forecasting stock prices with recurring seasonal patterns.

- Exponential Smoothing Models: These models use weighted averages of past stock price observations to make predictions, effectively capturing trends and seasonality.

When applying these models, it's important to consider the specific characteristics of the stock price data, such as the presence of trends, seasonality, and the level of stationarity. Additionally, evaluating the performance of time series models involves using metrics like Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), and Mean Absolute Percentage Error (MAPE).

While time series models provide a framework for predicting stock prices, it's important to acknowledge that stock market predictions are inherently uncertain. External factors, market sentiment, and unexpected events can significantly influence stock prices, making accurate predictions challenging.

Smart Ways to Invest a Windfall of $300K

You may want to see also

Time series models can be used to detect anomalies

Time series models are an effective tool for anomaly detection, which is the process of identifying data points that deviate from the expected patterns in a dataset. Anomalies, also known as outliers, are data points that differ significantly from the underlying pattern of the time series.

In the context of time series data, anomaly detection algorithms are crucial for spotting odd patterns in the data that would otherwise be difficult to identify by simply examining the raw data. Anomalies in time series data can manifest as abrupt increases or decreases in values, unusual patterns, or unexpected seasonality.

- Fraud Detection: Anomaly detection in financial transactions can help identify fraudulent activities, such as unusual spending patterns or unauthorized transactions.

- Predictive Maintenance: In manufacturing, anomaly detection can predict equipment failures by identifying deviations from normal behavior, enabling timely maintenance and reducing downtime.

- Healthcare Monitoring: Time series models can aid in early detection of medical conditions by monitoring patients' vital signs. Anomalies in heart rate, blood pressure, or glucose levels can trigger alerts for medical professionals.

- Environmental Monitoring: Tracking parameters like pollution levels or seismic activity can help identify unusual events that require attention.

- Network Security: Anomaly detection in network traffic helps identify unusual patterns that may indicate Distributed Denial of Service (DDoS) attacks or unauthorized access attempts.

- Energy and Utilities: Detecting anomalies in real-time energy consumption data helps maintain a stable power supply by quickly responding to faults or outages.

There are several statistical and machine learning techniques used by time series models for anomaly detection, including:

- Z-Score and Standard Deviation: The Z-score quantifies the number of standard deviations a data point deviates from the mean. Points exceeding a predefined threshold are flagged as anomalies.

- Moving Average and Exponential Smoothing: These techniques smooth out noise and fluctuations in time series data. Anomalies are detected by comparing observed values to the smoothed values, with significant deviations indicating potential anomalies.

- Autoregressive Integrated Moving Average (ARIMA): ARIMA models time series data and anomalies can be identified by comparing predicted values with actual values.

- Isolation Forest: This machine learning algorithm isolates anomalies in data by constructing random decision trees.

- One-Class Support Vector Machines (SVM): This supervised learning technique separates normal data from anomalies by finding a hyperplane that maximizes the margin between normal data points and anomalies.

- Long Short-Term Memory (LSTM): LSTM, a type of recurrent neural network, is well-suited for time series data. Anomalies are detected when the model's prediction significantly deviates from the actual values.

- Ensemble Techniques: Combining multiple models through methods like Random Forest, Gradient Boosting, or Voting Classifier improves accuracy and reduces false positives in anomaly detection.

Betting on Sports: An Investment Strategy Guide

You may want to see also

Time series models can be used to forecast sales

Time series models are an effective tool for forecasting sales. They are statistical tools that help to uncover patterns, trends, and relationships in data, which can be used to make informed predictions about the future.

Time series data is a set of data points ordered in time, with time as the independent variable. This data can be broken down into three primary components: trend, seasonality, and noise. The trend represents the long-term direction of the data, while seasonality refers to patterns that repeat at fixed intervals. Noise represents random fluctuations or irregularities that cannot be explained by the trend or seasonality.

There are several types of time series models that can be used for forecasting, including:

- Moving Average (MA) Model: Calculates the average of past observations to predict future values.

- Autoregressive (AR) Model: Predicts future values based on a linear combination of past observations.

- Autoregressive Moving Average (ARMA) Model: Combines AR and MA models to capture both short-term and long-term patterns.

- Autoregressive Integrated Moving Average (ARIMA) Model: Extends the ARMA model by incorporating differencing to handle non-stationary data.

- Seasonal Autoregressive Integrated Moving-Average (SARIMA) Model: Extends the ARIMA model by adding a linear combination of seasonal past values and/or forecast errors.

When using time series models for sales forecasting, it is important to consider factors such as the volume of data available, the required time horizon of predictions, and the forecast update frequency. Additionally, understanding the goal of the forecasting and selecting the appropriate model based on the characteristics of the data are crucial for accurate predictions.

Cash App Investing: How to Stop and Withdraw

You may want to see also

Time series models can be used to analyse stock trends

Time series data is a set of observations recorded over a period, where each observation is dependent on the time component. This data is widely collected by financial services companies to inform future policies and strategies.

A time series can be broken down into four components:

- Trend: This is the overall movement of the time series over a given period, which can be upward or downward.

- Seasonal: This is the repetitive upward or downward movement from the trend that occurs during fixed time intervals, such as monthly, quarterly, or yearly.

- Cyclical: This is the movement or fluctuation around the trend line at random intervals, often due to economic changes.

- Irregular: This is the random, uncorrelated fluctuation in time series data with a mean of zero.

For example, time series models can be used to identify the growth of a stock over a certain period. The formula for finding out the growth of stock prices is:

[Growth Rate = ((Ending Price – Beginning Price) / Beginning Price) x 100]

Time series models can also be used to compare stocks in the same industry, which is a crucial component of fundamental analysis. Stocks can be compared using metrics such as price-to-earnings (P/E), return on equity (ROE), and debt-to-equity ratios.

Additionally, time series models can be used to analyse the daily return of a stock. In the stock market, it is often assumed that the daily return of any stock price is 0%, meaning there is zero return on investment in one day. This can be proven using a one-sample t-test, where if the p-value is greater than 0.05, the null hypothesis (that the daily return is zero) cannot be rejected.

Furthermore, time series models can be used to calculate the moving average of a stock, which is a commonly used stock indicator. The moving average is calculated by taking the average of a certain number of past data points, and it helps smooth out price data. A rising moving average indicates an uptrend, while a declining moving average indicates a downtrend.

Finally, time series models can be used to forecast future stock prices. This can be done using libraries and tools such as Facebook's Prophet, which is a popular time series forecasting library.

In conclusion, time series models are a powerful tool for analysing stock trends and making informed investment decisions. By examining the historical data and predicting future patterns, investors can identify opportunities and manage their portfolios effectively.

Fidelity's Cash Policy: What Investors Need to Know

You may want to see also

Time series models can be used to forecast economic growth

Time series models can be used to analyse and predict stock prices and market trends. By understanding how stock prices have changed over time, investors can gain insights into potential future movements and adjust their strategies accordingly. Additionally, time series models can be applied to sales data to forecast revenue and inform business decisions. This is especially relevant for businesses that experience seasonal fluctuations, such as those in retail, tourism, and agriculture.

Time series models can also be used to analyse economic indicators such as GDP, income per capita, and employment rates to predict future economic conditions. This information is valuable for governments and central banks in determining fiscal and monetary policies. Furthermore, time series models can be applied to other areas such as energy consumption prediction, hospital capacity management, and predictive maintenance of industrial equipment.

When using time series models for economic growth forecasting, it is important to consider the characteristics of the data, the presence of trends or seasonality, and the specific forecasting objectives. The choice of model depends on these factors, and a combination of models may be necessary to capture the complexity of economic data.

Wealthsimple: Investing for Beginners

You may want to see also