A company's cash flow statement is a crucial indicator of its financial health and stability. It provides a detailed breakdown of the cash inflows and outflows, offering insights into its liquidity and ability to cover expenses. The statement is divided into three main sections: cash flow from operations, cash flow from investing, and cash flow from financing. Each section reveals different sources and uses of cash, with cash flow from investing activities covering the acquisition and disposal of long-term assets, such as property, plant, and equipment. This includes both the purchase and sale of physical assets, investments in securities, and the repayment of loans.

The analysis of cash flow is vital as it goes beyond accounting profits, focusing on the actual cash available to a company. This reveals its ability to pay bills, invest in its business, and cover operating expenses. Positive cash flow is generally a good sign, indicating efficient operations and potential for growth. However, negative cash flow may not always be detrimental, as it could signal investments in the long-term health of the company, such as research and development.

| Characteristics | Values |

|---|---|

| Cash flow statement sections | Operating cash flow, investing cash flow, financing cash flow, net increase/decrease in cash and closing cash balance |

| Cash flow statement calculation methods | Direct method, indirect method |

| Cash flow types | Operating cash flow, investing cash flow, financing cash flow |

| Cash flow analysis indicators | Operations/net sales ratio, free cash flow, comprehensive free cash flow coverage |

| Cash flow analysis limitations | Doesn't depict a company's net income, doesn't offer a comprehensive view of the company's overall liquidity |

| Cash accounting types | Accrual accounting, cash accounting |

What You'll Learn

Capital expenditures

In the cash flow statement, capital expenditures are recorded as a reduction in cash flow. This is because the purchase of physical assets, such as property, plant, and equipment (PPE), involves cash outflows. However, it's important to note that negative cash flow from investing activities due to capital expenditures is not always a negative sign. It may indicate that the company is investing in its future operations and long-term health.

When analysing capital expenditures, it's common to normalise the data by averaging the capital expenditure over a certain period, such as 5 years. This is because firms typically incur large capital expenditures in one year, followed by smaller expenditures in subsequent years. Additionally, the acquisition of other firms is also considered a form of capital expenditure.

The cash flow statement provides valuable insights for investors, analysts, and company management. It helps evaluate a company's ability to generate cash, meet its financial obligations, and manage its operations effectively. By examining capital expenditures, investors can assess whether a company is investing in its physical assets, maintaining its competitiveness, and positioning itself for future growth.

In summary, capital expenditures are a critical component of a company's financial strategy and are closely scrutinised by investors and analysts. They represent a company's investment in long-term assets and can provide a strong indication of its financial health, growth prospects, and ability to meet its obligations.

Chipper Cash Investment: A Guide to Getting Started

You may want to see also

Cash flow from operations

If a client pays a receivable, it is recorded as cash from operations. Changes in current assets or current liabilities (items due in one year or less) are also recorded as cash flow from operations. This section also includes cash received from the sale of goods and services, salary and wage payments, and payments to suppliers for inventory or goods needed for production.

The cash flow from operations section provides insight into a company's ability to generate cash from its core business activities and can be used to evaluate its financial health and operational efficiency. It is an important metric for investors, as it indicates whether a company is on solid financial ground and can meet its operating expenses and debt obligations.

The direct method of calculating cash flow from operations involves listing all cash receipts and payments during the reporting period. This method is less common and is typically used by smaller businesses that use the cash basis accounting method.

The indirect method, which is more common, starts with net income and adjusts for changes in non-cash transactions. This method is useful for reconciling items on the balance sheet with net income on the income statement, providing a more comprehensive view of the company's financial position.

Flip Cash Investment: Legit or Scam?

You may want to see also

Cash flow from financing activities

The cash flow from financing activities provides a clear picture of how a company raises and spends money. It includes:

- Debt Issuances: When a company borrows money by taking out loans or issuing bonds, it incurs debt. The cash received from these activities is considered a cash inflow.

- Equity Issuances: Selling stocks or shares to investors in exchange for capital is another way to raise funds, and this also represents a cash inflow.

- Share Buybacks: When a company repurchases its own shares from the market, it reduces the number of shares in circulation. This activity is considered a cash outflow.

- Debt Repayment: Repaying the principal amount of loans or bonds is a cash outflow, as the company is paying back the borrowed funds.

- Dividends: Dividend payments to shareholders are a cash outflow. These payments return a portion of the company's profits to its investors.

The formula for calculating cash flow from financing activities is:

> Cash Flow from Financing = Debt Issuances + Equity Issuances + (Share Buybacks) + (Debt Repayment) + (Dividends)

Here, the items in parentheses represent cash outflows, while debt and equity issuances are cash inflows.

Analysing the cash flow from financing activities helps investors and analysts assess a company's financial stability and capital structure management. It provides insights into the company's ability to generate cash, meet its financial obligations, and fund its operations.

Investment Bankers: Crafting Precise Cash Flow Statements

You may want to see also

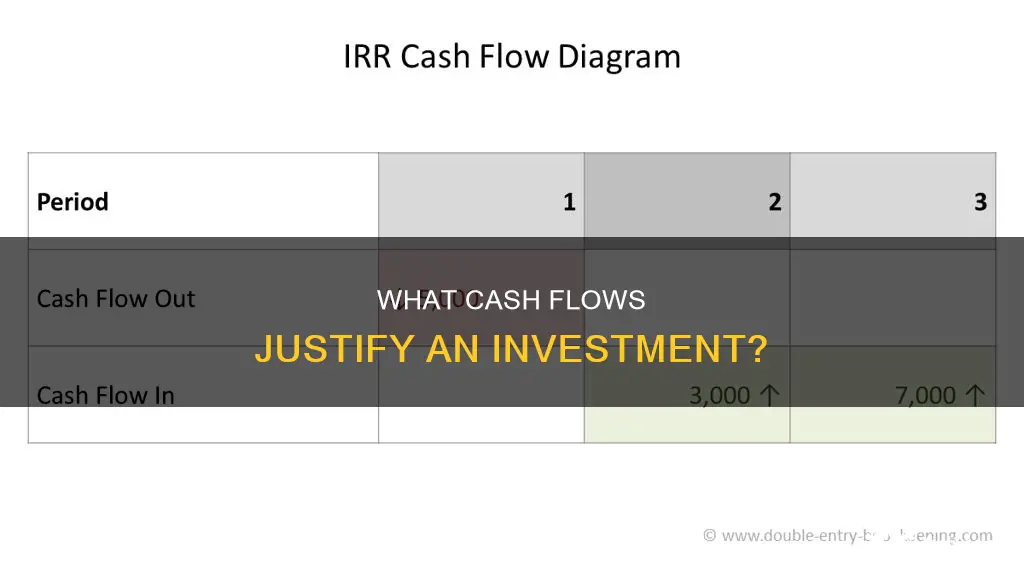

Cash flow from investing activities

The cash flow from investing activities is calculated by subtracting total cash outflows from total inflows related to these investment activities, resulting in a net cash flow figure. This calculation provides stakeholders with valuable information about the company's capital expenditure and investment strategies, enabling them to assess its ability to invest in growth opportunities, acquire assets, and maintain long-term financial health.

A positive net cash flow in this area indicates effective management of investments, suggesting that the company is making strategic investments to enhance future growth and profitability. On the other hand, a negative cash flow from investing activities does not necessarily imply poor financial health. It often signifies that the company is investing in assets, research, or long-term development activities that are crucial for its continued success.

Some common types of investing activities that may be listed in this section include:

- Purchase of fixed assets, such as property, plant, and equipment (PP&E).

- Proceeds from the sale of PP&E.

- Acquisition of other businesses or companies.

- Proceeds from the sale of other business units.

- Purchase of investment securities, bonds, debentures, and stocks.

- Proceeds from the sale of investment securities.

It is important to note that cash flow from investing activities does not include short-term investments, cash equivalents, or cash flows from financing activities. Instead, it focuses on long-term investment decisions and their impact on the company's cash position.

Cash Value Investing: Strategies for Long-Term Wealth Preservation

You may want to see also

Cash flow analysis

Cash Flow from Operations (CFO)

This section of the cash flow statement focuses on the cash flows associated with the company's core business activities, such as sales and payments for goods and services. It includes accounts receivable, accounts payable, and income taxes payable. A positive cash flow from operations indicates efficient operations and the potential for successful growth.

Cash Flow from Investing (CFI)

The cash flow from investing activities reflects the acquisition and disposal of long-term assets, such as property, plant, and equipment (PPE), as well as investments in securities. It covers capital expenditures and sales of these long-term investments. Investors closely monitor this section to understand how a company is investing in itself and maintaining its competitiveness.

Cash Flow from Financing (CFF)

This section reports debt and equity transactions, including the issuance and repayment of debt, dividend payments, and the repurchase or sale of stocks and bonds. It is crucial for investors who prefer dividend-paying companies as it shows cash dividends paid.

Analysis and Indicators

Understanding E-Trade Cash Calls: What Investors Need to Know

You may want to see also