ChatGPT has the potential to be a game-changer for investors, offering real-time insights and ideas. The AI tool can be used to navigate the complexities of the stock market and make well-informed investment choices. While it has certain limitations, such as a lack of access to the most recent data, it can still be a valuable assistant for investors. In this article, we will explore the ways in which ChatGPT can be utilised for investing, including analysing historical data, predicting market sentiment, and evaluating risks. We will also discuss the ethical considerations and limitations of relying solely on AI for investment decisions.

| Characteristics | Values |

|---|---|

| Explain financial terms | ChatGPT can explain complex financial terms in easy-to-understand language. |

| Learn about specific stocks | ChatGPT can provide an overview of a company, its business model, and historical performance. |

| Summarize earnings calls | ChatGPT can summarize earnings calls, highlighting key points and providing a streamlined way to digest essential information. |

| Analyze financial information | ChatGPT can analyze financial data, including revenue, expenses, and qualitative insights from news articles and social media posts. |

| Identify risks | ChatGPT can offer preliminary insights into potential risks associated with investing in a particular company. |

| Analyze investment opportunities | ChatGPT can provide bespoke analysis and comparisons of different stock options, helping investors make informed choices. |

| Identify stock picks | ChatGPT can identify potential stock investments based on specific criteria set by the user, such as minimal debt or consistent high growth in investor returns. |

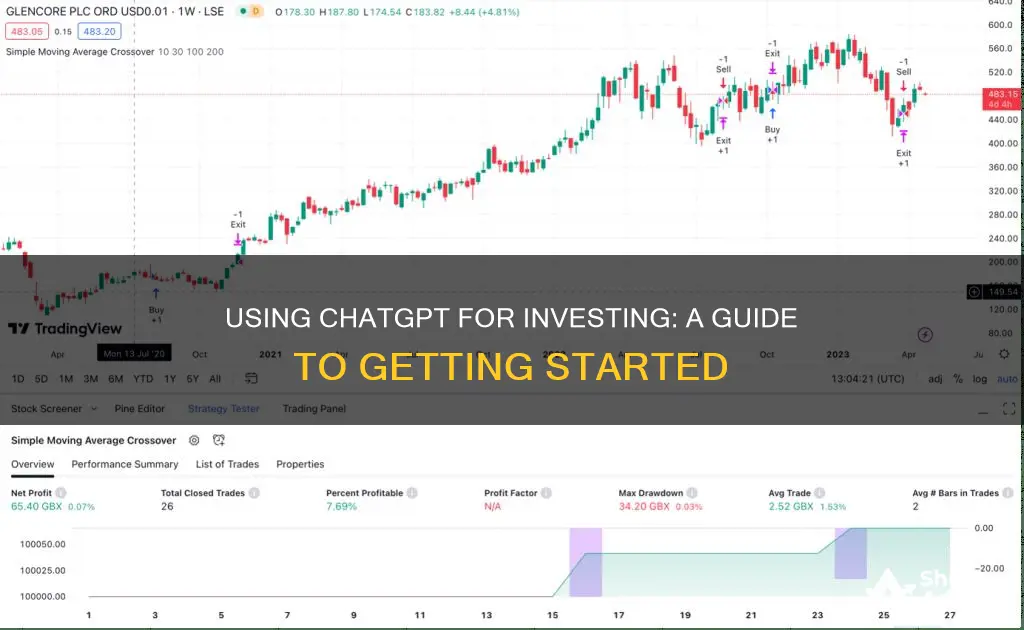

| Provide technical analysis | ChatGPT can be used for technical analysis of stocks and crypto, including price predictions and risk evaluation. |

| Limited data access | ChatGPT's data cut-off is 2021, so it may not have information about the most recent events and financial data. |

What You'll Learn

Explain financial terms

One of the most significant applications of ChatGPT in the realm of investing is its ability to explain complex financial terms in a simplified manner. This capability is particularly useful for newcomers to the world of investing or those seeking to broaden their understanding of financial concepts. ChatGPT serves as a knowledgeable guide, translating the intricate language of finance into easy-to-understand explanations.

Whether you're approaching investing for the first time or aiming to expand your knowledge, ChatGPT can be your trusted companion. It demystifies financial jargon, making investing more accessible and less intimidating. This AI chatbot empowers you to make more informed decisions by enhancing your financial literacy.

For instance, if you're curious about a company's business model, ChatGPT can provide a concise summary. This initial overview serves as a solid starting point for further research and analysis. Additionally, ChatGPT can offer insights into a company's historical performance during past recessions, shedding light on both the fundamental business performance and the stock price behaviour during economic downturns.

It's important to recognize that ChatGPT has limitations, especially when it comes to accessing the most recent data. Its knowledge cutoff is 2021, which means it may not have the latest information to answer certain queries. For example, it cannot provide summaries of the latest quarterly or annual results, nor can it offer insights into a company's current financial health or balance sheet.

Despite these limitations, ChatGPT can still be a valuable tool in your investment research process. It can assist with understanding business descriptions, management teams, business segments, and potential risks. However, it's crucial to approach the information provided by ChatGPT with a critical eye and verify it through additional sources.

In summary, while ChatGPT can be incredibly useful for explaining financial terms and providing a foundational understanding of investing concepts, it should not be solely relied upon for making investment decisions. It serves as a valuable assistant, but further research, consultation with financial advisors, and careful consideration of your risk tolerance are essential components of a comprehensive investment strategy.

Smart Ways to Invest a Windfall of $300K

You may want to see also

Summarise earning calls

Summarising earnings calls is a useful way to leverage ChatGPT for investing. Earnings calls are a rich source of insights for investors, as they cover a company's quarterly performance and future outlook. However, keeping up with these calls for every stock of interest can be time-consuming. Here's how ChatGPT can help summarise earnings calls efficiently:

First, find the transcript of the specific earnings call you're interested in by searching for it online. For example, you could search for "Tesla Q4 2022 earnings call transcript" to get the relevant links. Copy the entire transcript, including the management's prepared remarks and the Q&A session with analysts.

Then, paste the transcript into ChatGPT and write a prompt at the top, such as, "Please summarise the key financial results, operational highlights, future guidance, and main points from the Q&A session." ChatGPT will then provide a concise summary of the earnings call, saving you time and effort.

It's important to note that there are some potential drawbacks to this method. Finding transcripts for certain earnings calls may be challenging, as they may be hidden behind paywalls. Additionally, listening to the earnings call directly allows you to gauge the management team's tone and confidence, which a transcript may not capture. Nevertheless, using ChatGPT to summarise earnings calls can be a valuable tool for investors to quickly gain insights from these calls.

Investing Activity: Largest Source of Cash Flows?

You may want to see also

Analyse financial information

Financial information analysis is a critical aspect of investing, and ChatGPT can be a valuable tool for this process. Here are some ways in which ChatGPT can assist in analysing financial information:

Quantitative Data Analysis

ChatGPT can help investors analyse a company's financial dynamics by interpreting quantitative data such as revenue and expenses. It can provide immediate and accurate insights into a company's financial health, bridging the gap between raw figures and the narrative they convey. This enables investors to make more informed decisions about potential investments.

Qualitative Insights

In addition to quantitative data, ChatGPT can analyse qualitative information from textual sources such as news articles, analyst reports, and social media posts. By assessing market sentiment, ChatGPT can offer a comprehensive perspective on the financial environment, helping investors identify potential risks and opportunities.

Risk Evaluation

ChatGPT can evaluate the risks associated with a particular stock by analysing historical data, financial statements, and other relevant information. This is especially useful for risk-averse investors or those looking to diversify their portfolios. By providing insights into potential pitfalls, ChatGPT assists investors in making more cautious and well-informed decisions.

Predicting Market Trends

By analysing historical data, ChatGPT can make predictions about future market trends. Investors can use these predictions to anticipate short-term fluctuations and make more strategic investment choices. This is particularly valuable for new investors who may not yet have the experience to interpret market data effectively.

Summarising Earnings Calls

Earnings calls are packed with valuable insights, but they can be time-consuming to follow for every stock of interest. ChatGPT simplifies this process by summarising key points from earnings calls, allowing investors to quickly digest essential information about a company's financial performance and future outlook.

While ChatGPT can be a powerful tool for financial information analysis, it is essential to recognise its limitations. As an AI model, ChatGPT's knowledge is limited to the data it was trained on, and it may not have access to the most recent information. Therefore, investors should use ChatGPT as a supplementary tool in their decision-making process, combining its insights with their own research and the guidance of financial advisors.

ThinkorSwim: A Guide to Getting Started with Investing

You may want to see also

Predict market sentiment

Market sentiment is a crucial aspect of investing, as it reflects investor psychology and can influence stock prices. ChatGPT offers features that enable users to predict and analyze market sentiment effectively. Here are some ways in which ChatGPT can be utilized to predict market sentiment:

News Articles and Social Media Analysis

ChatGPT can analyze news articles, social media posts, and other textual sources to gauge market sentiment. By inputting relevant news headlines, social media trends, or even company press releases, ChatGPT can provide insights into how investors and the general public feel about a particular stock or company. This analysis can help investors make informed decisions by understanding the prevailing sentiment and potentially anticipating market movements.

Sentiment Analysis with ChatGPT

ChatGPT's sentiment analysis capabilities allow users to assess investor sentiment towards a specific company or stock. By using prompts such as "How are investors' sentiments towards [company]?" or "Based on the headlines, is the market sentiment bullish or bearish for [company]?", ChatGPT can provide an indication of the overall market sentiment. This feature enables investors to make more informed decisions, especially when combined with fundamental and technical analysis.

Impact of Events on Investor Sentiment

ChatGPT can also help in understanding how investors' sentiments may change following specific events. For instance, you can ask, "Gauge the investor sentiment for [company] post an [event]." This can provide insights into how the market perceives a company's response to a particular incident, such as an earnings report, product launch, or management change.

Real-time Market Sentiment Updates

To stay ahead of the market, investors can use ChatGPT to set up real-time alerts and notifications for significant changes in market sentiment. By monitoring relevant news sources and social media platforms, ChatGPT can notify users of any sudden shifts in investor sentiment, helping them make timely investment decisions.

Historical Analysis of Market Sentiment

Understanding historical market sentiment can provide context for current and future investments. ChatGPT can analyze historical data, including news articles and social media posts from the past, to identify patterns and long-term trends in market sentiment. This analysis can help investors recognize recurring themes that influence investor psychology and make more informed decisions accordingly.

While ChatGPT offers valuable tools for predicting and analyzing market sentiment, it is essential to combine these insights with other investment strategies and due diligence. Additionally, as ChatGPT relies on historical data, it may not always capture sudden market shifts or reflect the most recent news. Therefore, investors should use ChatGPT as a complementary tool within their broader investment decision-making process.

Apple's Cash: Where Does it Go?

You may want to see also

Evaluate risk

Evaluating risk is an essential aspect of investing, and ChatGPT can be a valuable tool in this process. By analyzing historical data, financial statements, and other relevant information, ChatGPT provides investors with an assessment of the potential risks associated with a particular stock. This feature is especially beneficial for risk-averse individuals or those aiming to diversify their portfolios.

One of the limitations of ChatGPT is its data cutoff, which is currently set at 2021. This means that it cannot provide up-to-date insights on quarterly or annual results, financial health, or balance sheets. However, when evaluating risk, ChatGPT can still offer a general overview of potential risks that a company may face. These risks might include economic downturns, changing consumer behaviour, or industry-specific challenges.

For instance, if you ask ChatGPT about the risks of investing in a specific company, it will provide a list of considerations. In the case of Tesla, ChatGPT highlights significant risks, such as regulatory changes, competition, and the impact of autonomous driving technology on the insurance industry. This information can serve as a foundation for further analysis and help investors make more informed decisions.

While ChatGPT's risk evaluation capabilities are a valuable starting point, it's important to remember that its responses are based on data up until 2021. Therefore, recent developments or events that could impact a company's risk profile might not be included. As an investor, it's crucial to complement ChatGPT's insights with the latest data and your own due diligence to make well-informed investment choices.

In summary, ChatGPT assists in evaluating risk by analyzing historical data and providing an overview of potential risks. However, investors should also consider more recent information and conduct their own research to make fully informed decisions.

E*Trade Cash Balance Program: Investing Strategies for Beginners

You may want to see also

Frequently asked questions

ChatGPT can be a valuable tool for investors, offering real-time insights and ideas. It can help analyze historical data, predict market sentiment, and evaluate risks associated with a particular stock. ChatGPT's ability to process vast amounts of data quickly and efficiently can help investors make more informed decisions.

ChatGPT analyzes historical data on stocks and uses machine learning algorithms to make predictions about future trends. It also takes into account market sentiment by analyzing news articles, social media posts, and other sources of information.

Yes, ChatGPT can evaluate the risks associated with a particular stock by analyzing historical data, financial statements, and other relevant information. This can be especially useful for investors who are risk-averse or looking to diversify their portfolios.

While ChatGPT can provide information and insights to help you make more informed investment decisions, it should not be solely relied upon for stock recommendations. It is important to do your own research, consult financial advisors, and carefully consider your risk tolerance.

ChatGPT has limited data beyond 2021, so it may not have the most recent information for quarterly/annual results, financial health, or news about a company. Additionally, ChatGPT cannot provide intrinsic value calculations or complex financial metrics that require up-to-date data.