Cash flow investments refer to the potential for regular cash distributions from an investment. Cash flow investing is similar to receiving dividends from stocks. Cash flow investments are made in assets that can be leased or used to generate income. For example, real estate investing can generate cash flow from rent payments. Cash flow investments can also include purchasing ATM machines or laundromats. These types of investments provide a regular income.

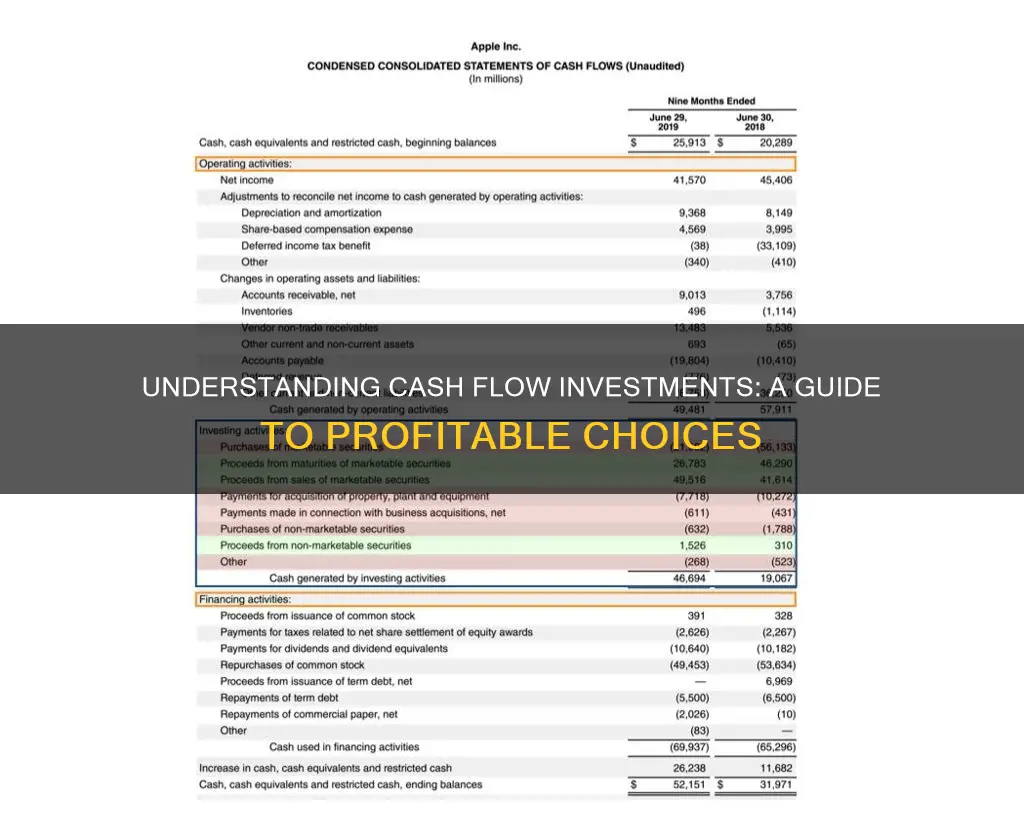

Cash flow investing is a strategy that can offer good returns, but it is important to perform due diligence to understand the possible outcomes. A company's cash flow statement will show how much money has been used to make investments during a specific time period. This statement includes cash flow from operating activities, investing activities, and financing activities.

| Characteristics | Values |

|---|---|

| Definition | Cash flow investing is the potential to receive regular cash distributions from an investment. |

| Time Interval | Monthly, quarterly, semi-annually or annually. |

| Type of Investment | Buying a portion, or all, of an asset that can be leased or otherwise used to generate income. |

| Examples | Real estate, ATM machines, laundromats. |

| Cash Flow Statement | A financial statement that displays how much money has been used in or generated from making investments during a specific time period. |

| Investing Activities | Purchases of long-term assets, acquisitions of other businesses, and investments in marketable securities. |

What You'll Learn

Cash flow investing activities

Positive cash flow in this area indicates that the company is generating cash from its investments, while negative cash flow indicates that the company is investing in long-term assets or the health of the company. It is important to note that negative cash flow from investing activities is not always a negative indicator of financial health, as it may signal that the company is investing in its future operations and growth.

When analyzing cash flow investing activities, it is essential to consider the context of the company's overall financial position and strategy. This includes examining the other sections of the cash flow statement, such as operating activities and financing activities, as well as reviewing the balance sheet and income statement.

By understanding cash flow investing activities, investors and analysts can gain insights into how effectively a company manages its cash and investments, making informed decisions about their own investments and the company's future prospects.

Cash Reserves: Smart Investment Strategy or Missed Opportunities?

You may want to see also

Cash flow investing intervals

Cash flow investing is similar to receiving dividends from stocks. With this type of investment, you are buying a portion or all of an asset that can be leased or used to generate income. Real estate investing is a common example of cash flow investing, where cash flow is the result of proceeds from rent payments. For instance, consider a multi-family apartment building with 50 units, each renting for $1,000 per month. Assuming an expense ratio of 40%, the net income per month on that property is $30,000. While a portion of that net income should be kept in reserves, the remainder is available for distribution.

Other examples of cash flow investments include purchasing ATM machines or laundromats—any asset that provides regular income. It's important to note that, as with any investment, there is a possibility that a cash flow investment will not perform as expected. For example, vacancies in rental properties can reduce income below total expenses. Therefore, it is crucial for investors to perform due diligence and understand the possible outcomes before making a cash flow investment.

Cash Value Life Insurance: Is It a Smart Investment?

You may want to see also

Cash flow statement preparation

Cash flow statements are one of the three fundamental financial statements used by financial leaders, alongside income statements and balance sheets. They are important tools for business owners, managers, and stakeholders to understand a company's value, overall health, and financial decision-making.

A cash flow statement details the flow of money in and out of a business, and how cash entered and left the business during a reporting period. It is comprised of three sections:

- Cash flow from operating activities: This refers to the primary revenue-generating activities, such as cash received from sales, royalties, and commissions, as well as cash paid to suppliers.

- Cash flow from investing activities: This section details the cash flow related to the buying and selling of long-term assets, such as property, facilities, and equipment. It includes any inflows or outflows from a company's long-term investments.

- Cash flow from financing activity: This section examines cash inflows and outflows related to financing activities, including both debt and equity financing.

To prepare a cash flow statement, follow these steps:

- Determine the starting balance: Establish the total amount of cash your business has in its bank accounts at the beginning of the reporting period.

- Calculate cash flow from operating activities: Subtract all the cash disbursements from operations from the cash collections during the reporting period.

- Calculate cash flow from investing activities: Detail the changes in investment gains or losses, as well as any new investments or sales of fixed assets during the reporting period.

- Calculate cash flow from financing activities: Summarize the cash inflows and outflows related to transactions with owners or lenders, including proceeds from debt and equity financing.

- Determine the ending balance: Calculate the final cash balance by adding or subtracting the cash flows from the three sections. A positive net cash flow indicates the company gained more cash, while a negative net cash flow shows higher expenses.

Cash flow statements can be prepared monthly, quarterly, or yearly, depending on the business's needs. They are essential for understanding a company's financial health, liquidity, and operational efficiency, and for making informed strategic decisions.

Investing via Cash App: A Guide for Under-18s

You may want to see also

Positive and negative cash flow

Cash flow investments are those that generate regular income at a particular interval, be it monthly, quarterly, semi-annually, or annually. An example of this is real estate investing, where cash flow is the result of proceeds from rent payments.

A company's cash flow statement can reveal what phase a business is in. For example, a startup may have negative cash flow as it invests in the facilities or equipment needed to ramp up its operations. Even established companies can experience negative cash flow when they invest in long-term assets such as property and equipment. This can be a positive sign, indicating that the company is investing in its future growth.

Negative cash flow from investing activities can be a warning sign if it is the result of poor decisions by management. However, it is not always a bad thing and can indicate that management is positioning the company for future growth. For example, a company may invest in fixed assets such as property, plant, and equipment to grow the business, which can lead to positive cash flow in the long term.

Positive cash flow properties are often considered low risk and are attractive to investors seeking financial freedom. They are also suitable for those who want to avoid the time and losses associated with developing properties or negative cash flow properties. These properties typically have high rents and low-interest rates, and they are usually bought with a minimal loan figure.

Negative cash flow properties, on the other hand, are sought after by investors who are more interested in capital growth than income. There can be tax benefits to negative gearing, but these may be offset by capital gains tax when the property is sold. Negative cash flow properties come with certain risks, such as the possibility of losing one's job and being unable to cover the costs, or sudden increases in maintenance or repair costs.

Invest to Conceal Cash: Strategies for Discreet Money Management

You may want to see also

Cash flow analysis

Understanding Cash Flow

Cash flow refers to the money flowing in and out of a business. It is distinct from profit, which is the money remaining after deducting business expenses from revenue. A positive cash flow indicates that a company's liquid assets are increasing, while negative cash flow means its liquid assets are decreasing.

Types of Cash Flow

There are three main types of cash flow that companies should track and analyse:

- Cash flow from operating activities: This reflects the cash generated from a company's core business operations, including receipts from sales, payments to suppliers, salary and wage payments, and other operating expenses.

- Cash flow from investing activities: This relates to the cash generated or spent on investments, such as purchases or sales of assets, acquisitions of other businesses, and investments in marketable securities.

- Cash flow from financing activities: This involves the sources and usage of cash from investors, banks, shareholders, and creditors, including dividends, stock repurchases, and debt repayment.

Preparing a Cash Flow Statement

A cash flow statement is a financial report that summarises a company's liquid assets and their changes over time. It provides insights into the company's ability to manage its cash position, generate cash, and meet its financial obligations. The statement is prepared using either the direct or indirect method:

- Direct Method: This method involves listing all cash receipts and payments during the reporting period, including customer collections, supplier payments, employee wages, interest, and taxes.

- Indirect Method: This method starts with net income and adjusts for changes in non-cash transactions, such as depreciation, inventory changes, accounts receivable, and payable accounts.

Benefits of Cash Flow Analysis

- It helps determine a company's working capital, which is the money available to run operations and complete transactions.

- It provides insights into the financial health and solvency of the business, indicating its ability to pay bills and sustain operations.

- It assists in understanding the sources of cash inflows, such as sales, loans, or investors, and the nature of outflows.

- It helps identify unexpected problems or confirm a healthy operating cash flow.

- It aids in financial planning and preparing for future economic fluctuations or downturns.

Considerations and Limitations

When analysing cash flow, it is important to consider the context and broader financial landscape. Negative cash flow may not always indicate poor financial health. It could be a result of strategic investments in long-term growth, such as research and development or the purchase of fixed assets. Similarly, positive cash flow may not always be favourable, as it could signal the sale of assets to cover operating expenses.

In conclusion, cash flow analysis is a powerful tool for businesses and investors to assess a company's financial well-being, identify trends, and make informed decisions. It provides a comprehensive view of the company's liquidity, solvency, and ability to sustain operations in the short and long term.

Depreciation's Impact on Cash Flow: Investing Activities

You may want to see also

Frequently asked questions

Cash flow investments are those that provide regular cash distributions over a set interval, such as monthly, quarterly, semi-annually, or annually. These investments involve buying an asset that can be leased or used to generate income, such as real estate, ATM machines, or laundromats.

Cash flow investing is similar to dividends in that they both provide regular cash distributions. However, with cash flow investing, you are buying a portion or all of an asset that can generate income, whereas dividends are typically paid out based on a company's profits.

Real estate is a common example of a cash flow investment, where cash flow is generated through rent payments. Other examples include investing in ATM machines or laundromats, or any asset that provides regular income.

To calculate cash flow from investing activities, identify the cash transactions related to investments, such as purchasing fixed assets or investing in securities. Then, subtract the cash payments for investments from the cash receipts from sales of investments.

Positive cash flow occurs when a company's cash inflows exceed its outflows, indicating strong financial health. Negative cash flow, on the other hand, occurs when cash outflows exceed inflows, which can be a sign of poor financial performance or a company investing in long-term growth.

It is important to note that negative cash flow from investing activities does not always indicate poor financial health, as it may be a result of investing in the long-term health of the company.