Cash flow is the movement of money into and out of a company over a certain period of time. It is an important aspect of a company's financial management as it reveals the cash available to pay bills and invest in its business. Positive cash flow indicates that a company's liquid assets are increasing, enabling it to cover obligations, reinvest in its business, and return money to shareholders. On the other hand, negative cash flow could indicate financial trouble, although it may also be due to a company investing in its future, such as through research and development.

There are three types of cash flow: cash flow from operations, cash flow from investing, and cash flow from financing. Cash flow from investing activities (CFI) is a section of a company's cash flow statement that reports the cash inflows and outflows resulting from investment activities. These activities primarily involve the acquisition and disposal of long-term assets such as property, plant, equipment, and investments in marketable securities.

| Characteristics | Values |

|---|---|

| Cash flow type | Investment activities |

| Cash flow statement section | Cash Flow from Investing Activities (CFI) |

| Description | Reports how much cash has been generated or spent from various investment-related activities in a specific period |

| Investment activities | Purchases of physical assets, investments in securities, sales of securities or assets, research and development |

| Positive cash flow from investing activities | The business is either selling its assets or receiving interest or dividends |

| Negative cash flow from investing activities | The company is buying new assets or paying principal or interest on its loans |

| Importance | Provides valuable information about a business’s long-term health and growth potential |

| Calculation | Total cash inflow from investing activities – Total cash outflow from investing activities |

| Example | Hershey's net annual cash flow from investing activities for the year 2023 was -$1,198,676 thousand |

What You'll Learn

Cash Flow From Operating Activities

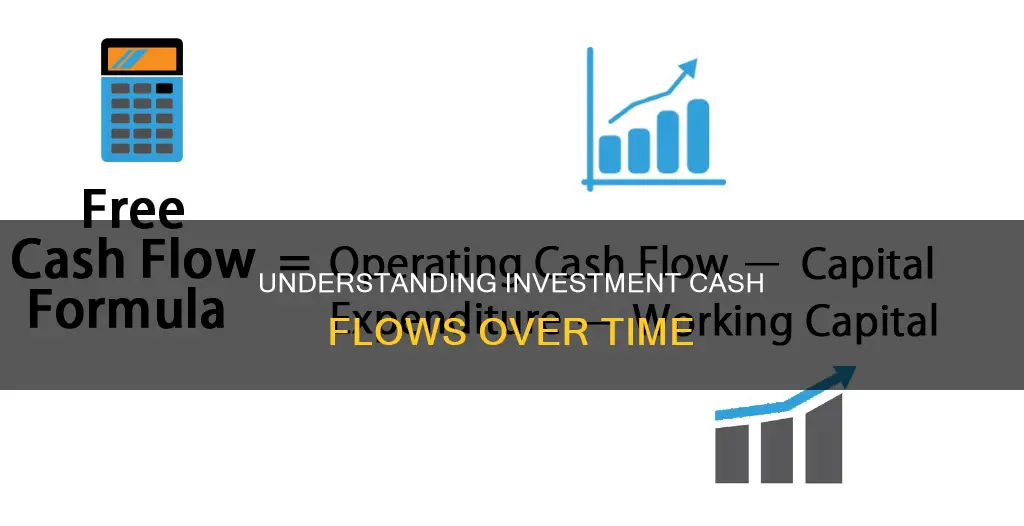

CFO can be calculated using the following generic formula:

> Cash Flow from Operations = Net Income + Non-Cash Items + Changes in Working Capital

The exact formula will differ for each company, depending on the items on their income statement and balance sheet. Net income is adjusted for non-cash expenses like depreciation, stock-based compensation, and others. Once net income is adjusted for non-cash expenses, it must also be adjusted for changes in working capital balances.

There are two methods for depicting CFO on a cash flow statement: the indirect method and the direct method. The indirect method is simpler and is more commonly used, while the direct method offers a clearer picture of cash flow.

The indirect method begins with net income from the income statement and adds back non-cash items to arrive at a cash basis figure. The direct method tracks all transactions in a period on a cash basis and uses actual cash inflows and outflows on the cash flow statement.

Positive (and increasing) CFO indicates that the core business activities of the company are thriving. It provides an additional measure of a company's profitability potential. A positive cash flow also indicates that a company's liquid assets are increasing, enabling it to cover obligations, reinvest in its business, and return money to shareholders.

Cash vs Investing: Is Holding Cash Ever Better?

You may want to see also

Cash Flow From Investing Activities

CFI can be positive or negative. A positive cash flow is generated by sales, which produce income, whereas purchases require spending money and generate negative cash flow. A negative cash flow from investing activities is not always a bad sign, as it can indicate that management is investing in the long-term health of the company. For example, a company might be investing heavily in plant and equipment to grow the business. These long-term purchases would be cash-flow negative but could be positive in the long term.

There are several types of investing activities that can appear on a cash flow statement. These include:

- Purchase of fixed assets

- Purchase of investments such as stocks or securities

- Sale of fixed assets

- Sale of investment securities

- Collection of loans and insurance proceeds

- Proceeds from the sale of other businesses (divestitures)

The cash flow statement is one of three financial statements used by a business, alongside the balance sheet and income statement. It bridges the gap between the income statement and balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities.

Cash in Your Investment Allocation: Wise or Unwise?

You may want to see also

Cash Flow From Financing Activities

CFF includes transactions related to debt, equity, and dividends. Companies raise funds through debt or equity. When taking on debt, a company may issue bonds or take out loans, and they must make interest payments to creditors and bondholders. When opting for equity, a company issues stock to investors, who become shareholders and may receive dividend payments, representing a cost of equity for the company.

The formula for calculating CFF is:

> CFF = CED − (CD + RP)

Where:

- CED = Cash inflows from issuing equity or debt

- CD = Cash paid as dividends

- RP = Repurchase of debt and equity

A positive CFF indicates that more money is flowing into the company, increasing its assets. However, this could be a sign that the company is not generating sufficient earnings and is relying heavily on debt or equity. On the other hand, a negative CFF could mean the company is servicing, retiring debt, or making dividend payments and stock repurchases, which can be viewed positively by investors.

Overall, CFF is a critical component of a company's cash flow statement, providing valuable insights into its financial health and capital management strategies.

Transferring Cash to Fidelity Investments: A Step-by-Step Guide

You may want to see also

Positive Cash Flow

A company's cash flow statement reflects its sources and use of cash over a specific period. Positive cash flow indicates that a company can meet its financial obligations and manage its operating expenses effectively. This is particularly attractive to investors, who seek consistent positive cash flow as an indicator of financial stability and growth potential.

There are three main types of cash flow:

- Operating cash flow: This reflects the day-to-day operating activities, including income from sales and outflows from salaries, lease payments, taxes, and interest payments.

- Investing cash flow: This refers to cash inflows and outflows related to long-term investments, such as purchases or sales of securities or assets.

- Financing cash flow: This pertains to the net cash linked to financing activities, including transactions involving debt, equity, and dividend payments.

Overall, positive cash flow is a critical hallmark of a profitable business, indicating strong financial management and the potential for successful growth.

Investments, Cash Flows, and the Relationship Between Them

You may want to see also

Negative Cash Flow

There are three types of negative cash flow: initial, temporary, and chronic. Initial negative cash flow is typical for new businesses, which often invest heavily in resources to increase brand awareness. Temporary negative cash flow can occur when an established business adopts an expansion strategy, such as increasing salaries, hiring new employees, or providing dividend growth to shareholders. Chronic negative cash flow is a cause for concern and indicates that a company is either overinvesting or losing money over time.

To improve negative cash flow, businesses can negotiate payment terms with customers and vendors, turn to investments or financing, and reduce operating expenses.

Cash as an Investment: Pros and Cons

You may want to see also

Frequently asked questions

Cash flow from investing activities is a part of a company's cash flow statement that reports the cash inflows and outflows resulting from investment activities. These activities primarily involve the acquisition and disposal of long-term assets such as property, plant, equipment, and investments in marketable securities.

Examples of cash flow from investing activities include:

- Sales of property, plant, and equipment

- Proceeds from sales of assets

- Purchases of marketable securities

- Purchase of property, plant, and equipment

- Investment in joint ventures

- Payments for business acquisitions

To calculate cash flow from investing activities, you add the purchases or sales of property and equipment, other businesses, and marketable securities.

The formula is:

> Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures (sale of investments)