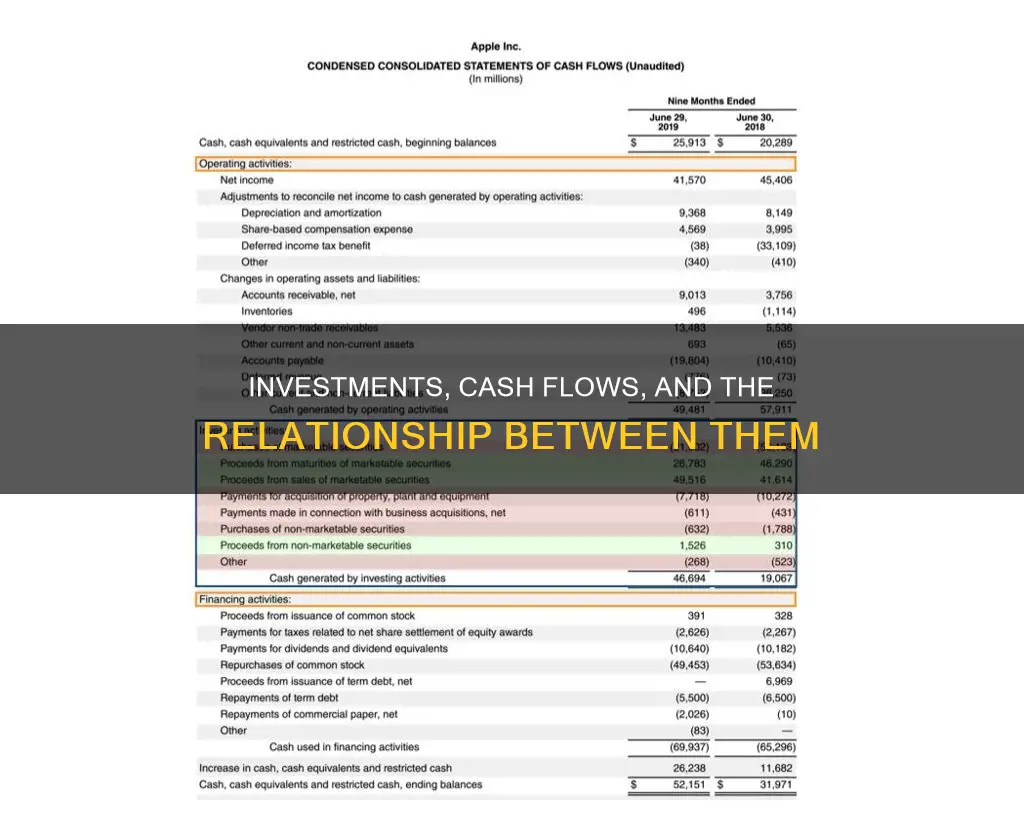

Understanding the impact of investments on cash flow is crucial for businesses aiming to expand and make strategic financial decisions. Cash Flow from Investing Activities (CFI) is a section of a company's cash flow statement that reveals the money spent or generated from investments over a specific period. This includes purchases of long-term assets, acquisitions, and investments in marketable securities. While investing activities can lead to negative cash flow in the short term, they are often necessary for the long-term health and growth of the company. It's important to analyze CFI alongside other financial statements to gain a comprehensive view of a company's financial health and potential.

What You'll Learn

Investing in physical assets

Physical assets are considered long-term assets that will deliver value in the future. They are also known as non-current assets, which are expected to deliver value and benefits in the long run (over 1 year). They are highly illiquid, meaning they cannot be easily or quickly converted to cash.

Some examples of physical assets are property, plant, and equipment (PP&E). This type of investment is a capital expenditure (CapEx). When a company invests in PP&E, it is considered an investing activity. This information can be found in the investing section of the cash flow statement.

An increase in capital expenditures means the company is investing in future operations. However, it also means a reduction in cash flow. Typically, companies with significant capital expenditures are in a state of growth.

For example, if a company purchases new land and a building to house its business operations, this is considered a physical asset investment. This type of investment is necessary to keep the company running but will result in a negative impact on the net increase in cash from all activities.

Overall, investing in physical assets is an important aspect of a company's growth and capital strategy. It provides an indication of how the company is allocating its cash for the long term. While it may result in negative cash flow in the short term, it can help generate cash flow in the long term and contribute to the company's overall financial health.

Investing Activities: Do Cash Flows Stay Positive?

You may want to see also

Investing in securities

The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities. Investing in securities falls under investing activities, which include the acquisition and disposal of non-current assets and other investments not included in cash equivalents.

The impact of investing in securities on cash flow depends on the specific context and the company's overall financial health. For example, a company with a negative cash flow from investing activities may not be a cause for concern if it indicates that management is investing in the long-term health of the company.

Overall, investing in securities is a way for companies to allocate their cash for the long term, and it is an important aspect of their growth and capital strategies.

Cash Investments: What Are They?

You may want to see also

The sale of securities or assets

For example, a company may choose to sell marketable securities, such as stocks, bonds, or commodities contracts, which are typically held for less than a year. These sales can provide cash inflows to fund other areas of the business.

Additionally, the sale of fixed assets, such as property, plant, and equipment (PP&E), can also result in positive cash flow. This may involve selling off or leasing PP&E that is no longer required or has been replaced by newer models.

The cash generated from these sales can be reinvested into the company to promote long-term health and performance. It can be used to fund research and development, purchase new equipment, or invest in short-term marketable securities to boost profits.

Overall, the sale of securities or assets is an important aspect of cash flow management, providing companies with the flexibility to adapt to changing market conditions, fund future growth initiatives, and make strategic decisions to improve their financial position.

Journaling a Large Cash Investment: A Step-by-Step Guide

You may want to see also

Long-term investments in the company's health or performance

Long-term investments are crucial for a company's financial stability and growth. These investments, such as stocks, bonds, real estate, and cash, are typically held for more than a year and are listed on the asset side of a company's balance sheet.

Long-term investments contribute to the company's health and performance in several ways:

Diversification and Income Streams

Long-term investments help diversify a company's asset portfolio, ensuring steady income streams. For example, investing in real estate can provide rental income and potential capital gains. Equity investments, such as shares in other companies, can offer dividends and capital appreciation, enhancing the firm's financial stability and value.

Creditworthiness and Profitability

A robust portfolio of long-term investments can improve a company's financial strength and credit rating. The ongoing income streams and potential capital gains from these investments can significantly improve profitability.

Research and Development

Negative cash flow from investing activities is not always detrimental. It can indicate that the company is investing in its long-term health, such as research and development, which may lead to significant growth and gains if managed well.

Strategic Investment

Long-term investments can support business expansion and help companies identify and exploit new areas of growth. For example, adding new services or products can increase profits from existing operations, as in the case of Home Depot, which added installation services and do-it-yourself clinics to its existing stores.

Capital Budgeting

Planning and managing a company's long-term investments is called capital budgeting. This involves selecting and overseeing investments that align with the company's long-term financial objectives and risk tolerance.

In summary, long-term investments are a crucial aspect of a company's financial strategy, contributing to its health, performance, and potential for future growth. These investments require patience and a certain level of risk tolerance but can provide significant rewards, including improved financial stability, diversified income streams, and enhanced profitability.

Cashing Out on Robinhood: A Guide to Withdrawing Your Investments

You may want to see also

Capital expenditures

CapEx is important for companies to grow and maintain their business, but it does not initially appear on the income statement. Instead, it is recorded on the balance sheet and is considered an investment by a company in expanding its business. CapEx is a reduction in cash flow, and companies with significant capital expenditures are usually in a state of growth.

There are two types of CapEx expenses: maintenance CapEx, which involves expenditures to maintain current levels of a company's operations; and growth CapEx, which involves expenditures that will enable an increase in future growth.

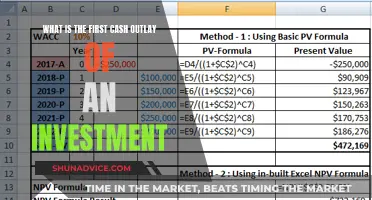

CapEx is calculated using the following formula:

> Current Period’s PP&E - Previous Period’s PP&E + Current Period’s Depreciation = CapEx

Where PP&E refers to Property, Plant, and Equipment, which are the fixed assets on a company's balance sheet.

CapEx is an important consideration for companies as it can have a significant impact on their cash flow and financial health. Wise CapEx decisions are critical to the financial health of a company.

Investing in Cash Balance Plans: Understanding Your Options

You may want to see also

Frequently asked questions

Cash flow from investing activities is one of the sections of a company's cash flow statement. It shows how much cash has been spent or generated from investment activities over a specific period.

Investing activities can include the purchase of physical assets, investments in securities, or the sale of securities or assets. These purchases require spending money, which generates negative cash flow. However, sales produce income, resulting in positive cash flow.

Not necessarily. Negative cash flow from investing activities can indicate that a company is investing in the long-term health of the business, such as research and development, which may lead to significant growth and gains if managed well.

There is no singular formula, but a commonly accepted one is: Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions - divestitures (sale of investments).