Investment fund classes, or mutual fund classes, are different types of shares offered by a mutual fund. Each class has the same investment objectives and policies, but different shareholder services and distribution arrangements, resulting in different fees and expenses. The most common mutual fund share classes are Class A, Class B, and Class C shares, each with its own benefits and drawbacks. Understanding these classes is crucial when deciding to invest in a mutual fund, as they determine the type and number of fees charged for the shares.

Characteristics of Investment Fund Classes

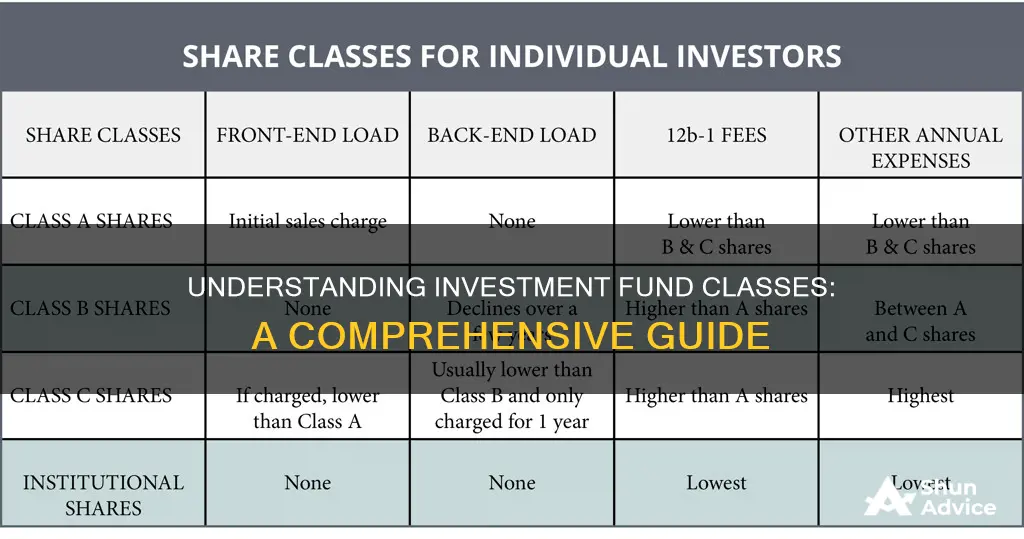

| Characteristics | Values |

|---|---|

| Class A shares | Charge upfront fees and have lower expense ratios; better for long-term investors and wealthy investors |

| Class A shares upfront fees | Called front-end load and are deducted from the initial investment |

| Class A shares upfront fees reduction | Larger investments qualify for breakpoints, or discounts |

| Class B shares | Charge high exit fees and have higher expense ratios; convert to A-shares after several years |

| Class B shares upfront fees | No front-end fees |

| Class B shares back-end fees | Contingent deferred sales load, or CDSL, which decreases the longer an investor holds the shares |

| Class B shares conversion | Convert to Class A shares after a specific holding period |

| Class C shares | Have higher expense ratios than A-shares and a small exit fee, usually waived after one year; popular with retail investors and best for short-term investors |

| Class C shares upfront fees | No front-end fees |

| Class C shares back-end fees | Small back-end load of typically 1% |

| Class C shares back-end fees waiver | Usually waived after shares have been held for one year |

| Class C shares conversion | Many cannot be converted into Class A shares |

| Class I shares | Lower overall fees but sold only to institutional investors making large fund share purchases; may be available to retail investors through their employers |

Class A shares

Investment fund classes are types of shares offered by a mutual fund to investors. Mutual funds are a type of investment company that pools money from investors to purchase a range of securities to meet specified objectives.

Now, let's focus on Class A shares:

However, Class A shares tend to have a lower 12b-1 fee and lower annual expenses compared to other mutual fund share classes. The 12b-1 fee is a marketing and distribution fee included in the fund's expense ratio. Class A shares also tend to have lower expense ratios overall, making them more suitable for long-term investors.

Additionally, Class A shares may offer breakpoints, which are discounts on the front-end sales load for larger investments. For instance, if the first breakpoint is $25,000, investing that amount initially would result in a discounted sales load. Breakpoints favour investors with more money to invest.

Furthermore, some companies offer Letters of Intent, where individuals who express the intent to invest a certain amount over a specific breakpoint by a particular time may receive a front-end load discount.

Emerging Market Funds: Where to Invest and How

You may want to see also

Class B shares

When it comes to investing in mutual funds, it is important to understand the different classes of shares available, as they come with varying fees and expenses. This is particularly true for Class B shares, which have their own unique set of characteristics.

One of the key advantages of Class B shares is that they do not have any upfront fees, meaning that an investor's entire initial contribution benefits from capital gains and interest income. This can be particularly advantageous for new investors saving for retirement, as it allows for the power of compound returns to take effect. Additionally, Class B shares automatically convert to Class A shares after a specific holding period, which is beneficial as Class A shares have a lower yearly expense ratio.

However, there are also some drawbacks to Class B shares. They typically do not provide breakpoints on the deferred sales load, which can be a significant disadvantage for wealthy investors. Furthermore, Class B shares may also charge a sales commission when the shares are sold, and they generally impose a higher 12b-1 fee than Class A shares.

In summary, Class B shares can be a good option for investors with limited cash who are planning for the long term. While they offer benefits such as no front-end fees and the potential for conversion to Class A, it is important to carefully consider the higher expense ratios and potential sales commissions associated with this share class.

Broad-Based Index Funds: A Comprehensive Investment Guide

You may want to see also

Class C shares

However, Class C shares are not a good option for long-term investors due to their higher ongoing expenses. They are also not suitable for investors who plan to withdraw funds within a year, as a back-end load will be charged on short-term redemptions.

When deciding whether to invest in Class C shares, it is important to consider the investment time horizon and the amount available to invest.

Target Date Funds: Diversifying Your Retirement Savings

You may want to see also

Class I shares

Institutional share classes, including Class I, usually have the lowest fees and expenses of any mutual fund share classes. This is because they are designed for institutional investors, who typically have much higher amounts to invest than individual investors. As a result, the low expense ratios offered by institutional share classes tend to result in the best returns.

For example, investment company Vanguard offers three share classes: Investor, Admiral, and Institutional shares. Investor shares, which are available to individual investors, require initial deposits of between $1,000 and $3,000 and have an average expense ratio of 0.18%. Admiral shares, which are available to investors with larger amounts to invest, have higher minimum deposits of between $3,000 and $100,000 but a lower expense ratio of 0.11%. Institutional shares, which are only available to institutional investors with a minimum of $5 million to invest, have the lowest expense ratio of just 0.05%.

Therefore, Class I shares can be a great option for institutional investors or retail investors with access to these shares through their employers, as they offer the benefits of mutual fund investing at a lower cost than other share classes.

Closed-End Funds: Worth Your Investment?

You may want to see also

Transaction shares

However, it is important to note that brokerage firms may still charge a separate sales commission when investors buy transaction shares. This means that transaction shares may not always be the most cost-effective option, especially if the investor plans to hold the fund for a long period. In such cases, other share classes with front-end loads and lower annual expenses may result in lower overall costs.

When considering transaction shares, investors should carefully evaluate their investment goals, time horizon, and trading frequency. While transaction shares may be suitable for active traders, they may not offer the same cost benefits as other share classes for long-term investors or those who qualify for breakpoint discounts. It is important for investors to understand the fees associated with each share class and to choose the one that aligns with their investment strategy and objectives.

In summary, transaction shares are a class of fund shares that do not carry any front-end or back-end sales charges, 12b-1 fees, or other asset-based fees. While they offer the advantage of lower transaction costs for active traders, they may not provide the same cost benefits as other share classes for long-term investors or those eligible for breakpoint discounts. Therefore, investors should carefully consider their investment goals and trading frequency when deciding whether transaction shares are the most suitable option for their needs.

Best Mutual Funds for Short-Term Investment Goals

You may want to see also

Frequently asked questions

Investment fund classes are the different types of shares offered by a mutual fund, each with its own set of fees, expenses, and shareholder services. The main types of mutual fund classes are Class A, Class B, and Class C shares, also known as A-shares, B-shares, and C-shares.

Class A shares typically charge upfront fees and have lower expense ratios, making them suitable for long-term investors. Class B shares, on the other hand, charge high exit fees and have higher expense ratios but convert to A-shares after several years. Class C shares are popular with retail investors and are best for short-term investors as they have a small exit fee that is usually waived after one year.

When choosing a mutual fund class, it is important to consider your investment goals, time horizon, and the amount you have available to invest. Additionally, you should read the fund's prospectus to understand the different fees, expenses, and shareholder services associated with each class.