In the game of life, long-term investments are strategic moves that require patience and a long-term vision. These investments are not about quick gains but rather about building a solid foundation for the future. They involve making choices that may not yield immediate results but can lead to significant rewards over time. Whether it's investing in education, starting a business, or acquiring assets, long-term investments are about nurturing growth and creating a secure future, often requiring a disciplined approach and a willingness to weather the short-term ups and downs.

What You'll Learn

- Education: Pursuing higher education or skills training for long-term career growth

- Entrepreneurship: Starting a business for financial independence and legacy building

- Real Estate: Investing in property for rental income and asset appreciation

- Retirement Accounts: Saving for retirement through IRAs, 401(k)s, or similar vehicles

- Charitable Giving: Donating to causes for personal fulfillment and societal impact

Education: Pursuing higher education or skills training for long-term career growth

In the game of life, investing in education is a powerful strategy for long-term success and personal fulfillment. It is a fundamental long-term investment that can significantly impact your future, opening doors to numerous opportunities and enhancing your overall quality of life. Higher education and skills training are essential tools that can shape your career trajectory and provide a solid foundation for a prosperous and meaningful life.

Pursuing higher education is a commitment to personal growth and intellectual development. It allows individuals to acquire specialized knowledge and skills in their chosen fields, making them more competitive in the job market. A degree or certification can be a powerful asset, especially in today's rapidly evolving job landscape. For instance, a computer science degree can equip you with the technical expertise to excel in software development, data analysis, or artificial intelligence, ensuring you remain relevant and in demand. Similarly, a business administration degree can provide a comprehensive understanding of management principles, finance, and marketing, enabling you to pursue various career paths in leadership and entrepreneurship.

Skills training, on the other hand, focuses on practical abilities and technical proficiency. It is an excellent way to upskill or reskill, especially in industries where technology and innovation are rapidly transforming job roles. For example, learning data analysis skills can make you an invaluable asset to any organization, as data-driven decision-making is crucial for success. Similarly, acquiring digital marketing skills can empower you to thrive in the ever-evolving online marketing landscape, where businesses are increasingly relying on online platforms for promotion and sales. These skills can be learned through online courses, boot camps, or vocational training programs, often providing more flexible and accessible learning options compared to traditional academic degrees.

The beauty of investing in education is that it offers a wide range of choices to suit individual interests and career goals. Whether it's a traditional four-year degree, a specialized master's program, or a short-term vocational course, the options are vast. Online learning platforms have further democratized education, making it more accessible and affordable, allowing individuals to learn at their own pace and convenience. This flexibility is particularly beneficial for those with family commitments or full-time jobs, ensuring that education remains a viable option for long-term career growth.

Furthermore, education provides a sense of personal fulfillment and self-improvement. It encourages critical thinking, problem-solving, and creativity, which are essential skills for navigating life's challenges. The knowledge and skills acquired through education can boost confidence and open doors to new opportunities, such as internships, mentorship programs, and networking events, all of which contribute to long-term career success. Investing in education is not just about the immediate benefits; it is a long-term strategy that can lead to increased earning potential, job satisfaction, and a more secure future.

Maximizing Long-Term Health: Strategies for Smart Investments

You may want to see also

Entrepreneurship: Starting a business for financial independence and legacy building

The concept of long-term investments in life is a powerful metaphor for building a secure and prosperous future, especially when it comes to entrepreneurship. Starting a business is a significant step towards achieving financial independence and creating a lasting legacy. It requires a strategic approach, a clear vision, and a commitment to long-term success. Here's a guide to help you navigate this journey:

Define Your Vision: Begin by envisioning your ideal future. What does financial independence mean to you? Is it about having a substantial net worth, achieving a certain income level, or securing a comfortable retirement? Define your long-term financial goals and break them down into specific, measurable milestones. For instance, you might aim to build a business that generates a passive income stream, allowing you to retire early and pursue other passions. This vision will guide your decisions and keep you motivated during the challenging times.

Identify Your Niche: Long-term investments in life often thrive in specific niches. Identify a problem or a gap in the market that your business can address. Conduct thorough market research to understand your target audience, competitors, and industry trends. Look for opportunities where you can offer unique solutions or products that cater to a specific need. For example, if you're passionate about sustainable living, you could start an eco-friendly product line, targeting environmentally conscious consumers. Finding your niche will help you build a dedicated customer base and establish a strong brand.

Create a Solid Business Plan: Entrepreneurship requires a well-structured plan to navigate the path to success. Develop a comprehensive business plan that outlines your business concept, market analysis, strategies, operations, and financial projections. This plan will be your roadmap, helping you secure funding, attract investors, and make informed decisions. Include a detailed financial forecast, considering startup costs, revenue streams, and potential expenses. A robust business plan demonstrates your commitment and provides a clear direction for your venture.

Build a Strong Foundation: Starting a business is a marathon, not a sprint. Focus on building a solid foundation that can support your long-term goals. This includes establishing a legal structure for your business, registering for taxes, and setting up accounting systems. Hire or outsource key roles to build a competent team, ensuring you have the right talent to manage operations, marketing, and finance. Additionally, consider networking and building relationships with mentors, industry peers, and potential partners who can provide guidance and support.

Embrace Adaptability: The business landscape is ever-evolving, and long-term success often requires adaptability. Stay agile and be prepared to pivot when necessary. Keep an eye on industry trends, customer feedback, and market dynamics. Regularly review and update your business plan to incorporate new insights and opportunities. By embracing change, you can stay ahead of the competition and ensure your business remains relevant and profitable over time.

Focus on Legacy: Entrepreneurship is not just about personal financial freedom; it's also an opportunity to create a lasting legacy. Consider how your business can have a positive impact on society or contribute to a cause you believe in. Build a brand that reflects your values and mission. Engage with your customers and stakeholders, fostering a community around your business. By aligning your venture with a meaningful purpose, you can create a business that stands the test of time and leaves a positive mark on the world.

Maximizing Savings: The Power of Term Life Insurance and Investing

You may want to see also

Real Estate: Investing in property for rental income and asset appreciation

Real estate investment is a powerful strategy for building long-term wealth and security. It involves purchasing properties, such as houses, apartments, or commercial spaces, with the primary goal of generating rental income and capital appreciation over time. This approach has been a cornerstone of financial success for many generations, offering a tangible and often reliable path to financial growth.

When investing in real estate, the initial step is to identify the right property. This requires a thorough understanding of the market and a strategic mindset. Investors should consider factors such as location, which is crucial as it directly impacts rental demand and potential value appreciation. For instance, properties in areas with strong job markets, good schools, or desirable amenities tend to attract tenants and maintain their value over the long term. Conducting thorough market research and analyzing local trends can help investors make informed decisions.

The next phase is securing financing. Many investors opt for traditional bank loans, but creative financing options like private money lenders or hard money loans can also be explored. These alternatives often provide more flexibility in terms of down payment and interest rates, making it easier for investors to acquire properties. Once the property is purchased, the focus shifts to generating rental income. Effective property management is essential to ensure timely rent collection and maintain the property's condition. This may involve hiring a property management company or developing a system to handle tenant inquiries and maintenance requests promptly.

As the property appreciates in value, investors can benefit from two primary sources of return: rental income and capital gains. Rental income provides a steady cash flow, offering a regular return on the investment. Over time, as the property's value increases, investors can also benefit from selling the property for a profit, especially if the market conditions are favorable. This long-term strategy allows investors to build a substantial portfolio of real estate assets, providing financial security and a hedge against inflation.

In summary, investing in real estate for rental income and asset appreciation is a strategic approach to building long-term wealth. It requires careful research, strategic property selection, and effective management. By understanding the market, securing appropriate financing, and focusing on property maintenance, investors can create a robust and reliable investment portfolio. This method has proven to be a successful and tangible way to navigate the game of life, offering financial stability and the potential for significant returns over time.

Ripple: A Long-Term Investment Strategy?

You may want to see also

Retirement Accounts: Saving for retirement through IRAs, 401(k)s, or similar vehicles

Retirement accounts are a cornerstone of long-term financial planning, offering a structured way to save for your future and ensure financial security during your golden years. These accounts provide a tax-advantaged way to grow your savings, allowing your money to work harder over time. Here's a detailed look at how retirement accounts can be a vital part of your investment strategy:

Understanding Retirement Accounts:

Retirement accounts, such as Individual Retirement Accounts (IRAs) and 401(k) plans, are designed to encourage long-term savings. When you contribute to these accounts, you typically get tax benefits, which can significantly boost your savings over time. For example, in a traditional IRA or 401(k), contributions are often tax-deductible, reducing your taxable income for the year. This immediate benefit allows your money to grow faster, as you're not taxed on the contributions.

Types of Retirement Accounts:

- Traditional IRA (Individual Retirement Account): This is a personal retirement account that offers tax advantages. Contributions may be tax-deductible, and earnings can grow tax-free until withdrawal. It's an excellent option for those who want to maximize their tax benefits and have a long-term investment horizon.

- Roth IRA: With a Roth IRA, you contribute after-tax dollars, but qualified withdrawals in retirement are tax-free. This account is ideal for those who prefer tax-free growth and want to have access to their contributions in the long term.

- 401(k) Plan: Offered by employers, a 401(k) allows employees to contribute a portion of their paycheck before taxes. Many employers also offer matching contributions, essentially providing free money to boost your savings. This is a powerful tool for long-term wealth accumulation.

Benefits of Retirement Accounts:

- Compounding Growth: The power of compounding is a significant advantage. Over time, your investments can grow exponentially, as earnings are reinvested and earn interest or returns.

- Long-Term Financial Security: By consistently contributing to a retirement account, you build a substantial nest egg for your future. This ensures you have funds available for living expenses, travel, healthcare, and other retirement goals.

- Flexibility: Many retirement accounts offer flexibility in investment choices. You can choose from a variety of investment options, such as stocks, bonds, mutual funds, or exchange-traded funds (ETFs), allowing you to tailor your portfolio to your risk tolerance and goals.

Maximizing Retirement Savings:

To make the most of retirement accounts, consider the following:

- Start Early: The earlier you begin saving, the more time your investments have to grow. Compounding interest works more powerfully over extended periods.

- Maximize Contributions: Try to contribute the maximum allowed by your retirement account plan. This could include the annual contribution limits set by the IRS for IRAs or the limits set by your employer's 401(k) plan.

- Diversify Your Portfolio: Diversification is key to managing risk. Spread your investments across different asset classes to ensure a balanced approach. Regularly review and adjust your portfolio as your financial situation and goals evolve.

- Take Advantage of Employer Matches: If your employer offers a 401(k) match, contribute enough to get the full match. It's essentially free money that can significantly boost your retirement savings.

Retirement accounts are a powerful tool for building long-term wealth and ensuring financial security in your later years. By understanding the different types of accounts and their benefits, you can make informed decisions about saving for retirement and take control of your financial future. Remember, consistent and disciplined savings, combined with a well-diversified investment strategy, can lead to a comfortable and stress-free retirement.

The Ultimate Guide to Investing in Water: A Long-Term Strategy for a Thirsty World

You may want to see also

Charitable Giving: Donating to causes for personal fulfillment and societal impact

Charitable giving is a powerful tool that allows individuals to invest in the long-term well-being of their communities and themselves. It is an act of generosity that can bring about significant personal fulfillment and societal impact. When you donate to a cause, you are not just giving money; you are contributing to a legacy that can have a lasting effect on the world. This form of investment is unique because it combines the power of financial resources with the passion and dedication of individuals, creating a ripple effect that can transform lives and communities.

The act of charitable giving provides an opportunity to align your financial decisions with your personal values and beliefs. By identifying causes that resonate with you, you can make a meaningful impact on the issues you care about. Whether it's supporting education, fighting poverty, promoting environmental sustainability, or advancing medical research, your donations can contribute to the betterment of society. For instance, funding educational programs can empower individuals to gain knowledge and skills, opening doors to better opportunities and a brighter future. Similarly, supporting environmental initiatives can help preserve natural resources and ensure a healthier planet for future generations.

One of the most significant advantages of charitable giving is the potential for long-term societal impact. When you invest in a cause, you are not just making a one-time contribution; you are becoming a part of a movement that can create lasting change. For example, supporting a non-profit organization focused on poverty alleviation can lead to the development of sustainable solutions that break the cycle of poverty for countless individuals. Similarly, funding medical research can accelerate scientific progress, potentially leading to groundbreaking discoveries and improved healthcare for all. These long-term investments can shape the future and create a more equitable and just society.

Personal fulfillment is another crucial aspect of charitable giving. The act of donating can provide a sense of purpose and satisfaction, knowing that your efforts are making a tangible difference. When you witness the positive outcomes of your donations, it reinforces the belief that your actions matter. For instance, receiving a letter from a beneficiary expressing gratitude for your support can be incredibly rewarding. Additionally, many charitable organizations offer transparency and regular updates, allowing donors to track the progress of their contributions and feel a deeper connection to the cause.

In the game of life, charitable giving is a strategic move that combines personal values, financial resources, and a desire to make a difference. It is an investment in the future, where your actions today can shape a better tomorrow. By donating to causes that align with your passions, you can create a positive cycle of impact, inspiring others to join the journey. Remember, the power of charitable giving lies not only in the monetary value but also in the collective effort it represents, fostering a sense of community and shared responsibility for a brighter future.

Dow ETF: A Quick-Win Strategy for Short-Term Investors?

You may want to see also

Frequently asked questions

Long-term investments in the context of life can be seen as strategic decisions and actions that provide benefits over an extended period. These investments often involve a commitment of time, effort, and resources with the goal of building a secure future. Examples include education, career development, financial planning, and personal growth. For instance, pursuing higher education can lead to increased earning potential and job satisfaction in the long run. Similarly, investing in one's health through regular exercise and a balanced diet can result in improved quality of life and reduced medical expenses over time.

Identifying suitable long-term investments requires careful consideration of your personal goals, values, and circumstances. Start by defining your short-term and long-term objectives. Are you saving for a house, retirement, or a specific career milestone? Research and understand the various investment options available, such as stocks, bonds, real estate, or business ventures. Evaluate the risk and potential return associated with each. Seek professional advice from financial advisors or mentors who can provide tailored guidance based on your unique situation. Regularly review and adjust your investments as your life progresses and priorities change.

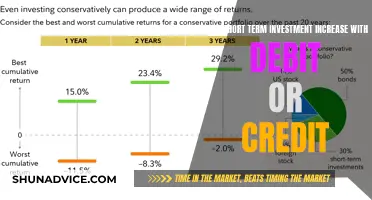

One common mistake is the lack of a long-term perspective. Many individuals focus on short-term gains or quick returns, which can lead to impulsive decisions and missed opportunities. Another pitfall is over-diversification or under-diversification. Finding the right balance between different investment types is crucial to managing risk effectively. Additionally, failing to regularly review and rebalance investments can result in an unintended allocation of assets. It's essential to stay informed, educate yourself, and make informed choices to avoid potential pitfalls.

A young professional might consider a long-term investment strategy centered around building wealth through a combination of education, career development, and financial planning. This could involve investing in a high-quality education, acquiring relevant skills through certifications or courses, and networking to enhance career prospects. Additionally, they could allocate a portion of their income towards a retirement savings account, taking advantage of employer-matched contributions if available. Diversifying investments across stocks, bonds, and potentially real estate can help grow their wealth over time. Regularly reviewing and adjusting the investment strategy as they progress in their career is essential to staying on track.