Many individuals opt to purchase term life insurance, which provides coverage for a specific period, and then invest the surplus funds elsewhere. This strategy allows them to secure their loved ones' financial future while also growing their wealth through strategic investments. By understanding the benefits of both term insurance and investment opportunities, people can make informed decisions to protect their families and build a more secure financial future.

What You'll Learn

- Market Demand: Understanding the demand for term insurance and investment products

- Financial Planning: How term insurance fits into comprehensive financial planning strategies

- Risk Management: Term insurance as a tool for managing financial risk and uncertainty

- Investment Strategies: Techniques for investing the savings from term insurance premiums

- Regulatory Compliance: Adherence to regulations when selling term insurance and investment products

Market Demand: Understanding the demand for term insurance and investment products

The concept of term insurance and the act of investing the difference is an intriguing aspect of the financial market, capturing the attention of many investors and insurance seekers. Understanding the market demand for these products is crucial to grasping the financial landscape and the strategies individuals employ to secure their future.

Term insurance, a type of life insurance, provides coverage for a specific period, offering financial protection to the policyholder's beneficiaries in the event of their untimely demise. It is a popular choice for those seeking affordable and comprehensive coverage for a defined duration, such as until their children become financially independent or a mortgage is paid off. The demand for term insurance is driven by individuals' natural instinct to safeguard their loved ones and assets, ensuring financial stability during challenging times.

On the other hand, investing the difference between the insurance premium and the death benefit is a strategy that involves allocating the surplus funds generated by the insurance policy into various investment avenues. This approach allows individuals to potentially grow their money over time, providing an additional layer of financial security. The investment aspect of term insurance is appealing to those who recognize the dual benefits of insurance protection and the potential for wealth accumulation.

Market research indicates that a significant portion of the population is increasingly aware of the importance of financial planning and risk management. As a result, the demand for term insurance and investment products has been steadily rising. People are becoming more proactive in securing their financial future, especially with the growing complexity of life events and the associated risks. This shift in mindset has led to a surge in the number of individuals seeking insurance and investment solutions that cater to their specific needs.

The market demand for term insurance and investment products is further fueled by the availability of various financial instruments and the increasing accessibility of financial advice. With a wide range of investment options, individuals can tailor their strategies to align with their risk tolerance and financial goals. Moreover, financial advisors and online platforms play a vital role in educating and guiding people through the process, ensuring they make informed decisions about their insurance and investment choices.

In summary, the market demand for term insurance and investment products is a reflection of individuals' growing awareness of financial risks and their desire to secure their future. This demand is driven by the need for comprehensive protection and the potential for wealth creation. As the financial landscape continues to evolve, understanding and catering to this demand will be essential for insurance providers and investment firms to meet the changing needs of their customers.

Commission Fees: The Long-Term Investment Conundrum

You may want to see also

Financial Planning: How term insurance fits into comprehensive financial planning strategies

Term insurance is a fundamental component of financial planning, offering a safety net for individuals and their families during unforeseen circumstances. It provides a critical function in comprehensive financial planning strategies, especially for those seeking to protect their loved ones and assets. When considering the purchase of term insurance, many people often explore the idea of investing the difference in other financial instruments, which can be a strategic move to enhance their overall financial health.

In the context of financial planning, term insurance serves as a protective layer, ensuring that financial obligations are met even in the absence of the primary breadwinner. It provides a fixed period of coverage, typically 10, 15, or 20 years, during which the policyholder pays regular premiums. Upon the insured individual's death, the policy pays out a death benefit to the designated beneficiaries, offering financial security and peace of mind. This is particularly crucial for families with dependents, as it ensures that their financial needs are met, including mortgage payments, children's education, and daily living expenses.

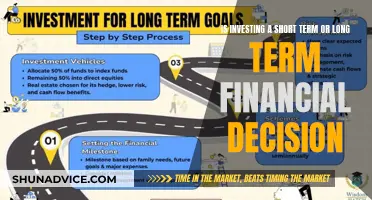

The concept of investing the difference is where term insurance's value extends beyond its immediate purpose. After purchasing term insurance, individuals may find themselves with a surplus of funds, which can be strategically allocated to build a robust financial portfolio. This surplus can be invested in various assets, such as stocks, bonds, mutual funds, or real estate, depending on the individual's risk tolerance and financial goals. By investing the difference, people can take advantage of compound interest and potentially grow their wealth over time.

Financial planning strategies often involve a combination of insurance and investment products to create a comprehensive financial safety net. For instance, term insurance can be paired with whole life insurance for long-term financial security, while the surplus funds can be directed towards retirement plans, education savings, or business ventures. This approach ensures that individuals are prepared for both short-term and long-term financial obligations while also working towards their future goals.

In summary, term insurance plays a vital role in financial planning by providing essential coverage during critical periods. The idea of investing the difference allows individuals to maximize the benefits of term insurance, creating a more robust financial strategy. By understanding the value of term insurance and strategically allocating the surplus, people can achieve a balanced approach to financial planning, ensuring both protection and growth. This comprehensive strategy empowers individuals to navigate life's uncertainties with confidence and work towards a secure financial future.

Securities: Cash Equivalent or Long-Term Investment?

You may want to see also

Risk Management: Term insurance as a tool for managing financial risk and uncertainty

Term insurance is a powerful financial tool that can help individuals effectively manage their financial risk and uncertainty, especially when it comes to providing financial security for their loved ones. This type of insurance is designed to offer coverage for a specific period, often 10, 20, or 30 years, and it can be a strategic choice for those seeking to protect their family's financial well-being. The concept is simple: you pay a premium for a defined period, and in return, you receive a death benefit if you pass away during that term. This benefit can be a crucial source of financial support for your dependents, ensuring they have the means to maintain their standard of living even if the primary breadwinner is no longer around.

When considering term insurance, many people often wonder about the strategy of buying a policy and then investing the difference. This approach involves using the savings from the insurance premiums to build a separate investment portfolio. By doing so, individuals can potentially increase their overall wealth while still having a safety net in place. For instance, if someone purchases a $500,000 term life insurance policy with a 20-year term and invests the difference, they could allocate the funds to various investment vehicles, such as stocks, bonds, or mutual funds, aiming to grow their money over the same 20-year period.

The key advantage of this strategy is that it combines the security of insurance with the potential growth of investments. If the insured individual survives the term, the investment portion can provide additional financial benefits. This approach allows individuals to take control of their financial destiny, ensuring that their family's financial future is protected while also offering the possibility of wealth accumulation. However, it's essential to strike a balance; while investing the difference can be beneficial, one must also ensure that the insurance coverage remains adequate to meet the family's needs.

Risk management is a critical aspect of financial planning, and term insurance plays a pivotal role in this process. By providing a defined period of coverage, it offers a sense of financial security and peace of mind. For those with a long-term financial strategy, this type of insurance can be a valuable component, allowing them to focus on other aspects of their financial planning, such as retirement planning or business succession, without the constant worry of financial uncertainty.

In summary, term insurance is a practical tool for managing financial risk and uncertainty. It provides a safety net for loved ones while also offering the potential for investment growth. By understanding the value of this insurance and exploring strategies like investing the difference, individuals can make informed decisions to protect their families and build a more secure financial future. This approach empowers people to take control of their financial destiny and make the most of their hard-earned money.

Maximizing Affiliate Investments: Strategies for Long-Term Success

You may want to see also

Investment Strategies: Techniques for investing the savings from term insurance premiums

Term insurance is a popular choice for many individuals seeking affordable coverage for a specific period. When purchasing term insurance, a significant portion of the premium goes towards covering the cost of the policy, leaving a substantial amount of savings. These savings present an opportunity for investors to explore various strategies to grow their money over time. Here are some techniques to consider when investing the savings from term insurance premiums:

- Diversified Portfolio: One of the fundamental principles of investing is diversification. Instead of putting all your savings into a single investment, consider creating a well-diversified portfolio. This approach involves allocating your funds across different asset classes such as stocks, bonds, real estate, and commodities. Diversification helps reduce risk by not concentrating your investments in a single asset or sector. You can invest in a mix of stocks from various sectors, government bonds for stability, and explore real estate investment trusts (REITs) for exposure to the property market. Regularly reviewing and rebalancing your portfolio ensures that your investments stay aligned with your financial goals and risk tolerance.

- Long-Term Investment Horizon: Term insurance often provides coverage for a defined period, typically 10, 15, or 20 years. When investing the savings, adopting a long-term perspective is crucial. Short-term market fluctuations should not deter you from your investment strategy. Focus on long-term goals and consider investing in assets that have historically shown the potential for steady growth over extended periods. This approach may include investing in index funds or exchange-traded funds (ETFs) that track the performance of a specific market index, providing broad market exposure.

- Risk Assessment and Management: Before investing, it is essential to assess your risk tolerance. Understand your financial goals and the level of risk you are comfortable with. More aggressive investment strategies may offer higher potential returns but also come with increased risk. Consider your age, financial obligations, and investment time horizon when determining your risk profile. Younger investors might opt for more aggressive strategies, while those closer to retirement may prefer a more conservative approach. Regularly reviewing and adjusting your investment strategy based on market conditions and your changing circumstances is essential for long-term success.

- Regular Contributions and Dollar-Cost Averaging: Another effective strategy is to invest a fixed amount regularly, regardless of the market's performance. This approach is known as dollar-cost averaging. By investing a consistent amount at regular intervals, you buy more shares when prices are low and fewer when prices are high. Over time, this strategy can lead to a more stable and potentially higher return on investment. It removes the emotional aspect of market timing and allows investors to benefit from long-term market trends.

- Consult a Financial Advisor: Given the complexity of investment strategies, seeking professional advice can be invaluable. A financial advisor can provide personalized guidance based on your financial situation, goals, and risk tolerance. They can help you navigate the various investment options, create a tailored plan, and offer ongoing support. Financial advisors can also assist in tax-efficient investment strategies, ensuring your savings grow while minimizing tax implications.

Debt Trading: Understanding Short-Term vs. Long-Term Investments

You may want to see also

Regulatory Compliance: Adherence to regulations when selling term insurance and investment products

When it comes to the insurance industry, regulatory compliance is a critical aspect that cannot be overlooked, especially when dealing with term insurance and investment products. The sale of these financial instruments is highly regulated to protect consumers and ensure fair practices. Here's an overview of the regulatory considerations and best practices in this domain:

Understanding the Regulatory Landscape: Selling term insurance and investment products requires a deep understanding of the legal and regulatory framework. Insurance regulators, such as the Insurance Regulatory Authority (IRA) in various countries, set guidelines and standards to govern the industry. These regulations aim to prevent fraudulent activities, ensure transparency, and protect policyholders' interests. It is essential for insurance agents and advisors to stay updated on these rules, as they may vary across different regions and jurisdictions.

Compliance with Sales Practices: Regulatory bodies often mandate specific sales practices to ensure ethical conduct. For instance, when selling term insurance, advisors must provide clear and accurate information about the policy's coverage, benefits, and potential risks. They should disclose any associated fees or commissions and ensure that the customer understands the terms and conditions. Similarly, when offering investment products, advisors must assess the customer's financial goals, risk tolerance, and provide suitable recommendations. Compliance with these practices helps build trust and ensures that customers make informed decisions.

Documentation and Record-Keeping: Maintaining accurate records is crucial for regulatory compliance. Insurance companies and advisors should keep detailed documentation of all sales transactions, customer interactions, and policy-related activities. This includes sales scripts, customer agreements, policy documents, and any correspondence. Proper record-keeping ensures transparency, facilitates audits, and provides evidence of compliance with regulatory requirements. In the event of an investigation or dispute, these records can be essential to demonstrate adherence to the rules.

Regular Training and Education: To ensure ongoing compliance, insurance companies should invest in regular training programs for their sales teams. This education should cover the latest regulatory updates, industry best practices, and ethical selling techniques. By keeping advisors informed, companies can minimize the risk of non-compliance and ensure that their sales practices remain within the legal boundaries. Additionally, providing resources and support for continuous learning empowers advisors to offer better advice and build stronger relationships with their clients.

Staying Informed and Adapting: The regulatory environment is dynamic, with frequent changes in laws and regulations. Insurance professionals must stay informed about these updates to adapt their sales strategies accordingly. Industry associations and regulatory bodies often provide resources and notifications, ensuring that advisors are aware of any modifications to the rules. By being proactive and responsive to regulatory changes, insurance companies can maintain a strong compliance posture and provide the best service to their customers.

In summary, regulatory compliance is an essential aspect of selling term insurance and investment products. It requires a comprehensive understanding of the legal framework, adherence to sales practices, meticulous documentation, and a commitment to ongoing education. By prioritizing compliance, insurance companies can build a solid reputation, protect their customers' interests, and contribute to a fair and transparent insurance industry.

Unraveling the Misconception: Treasury Bills as Long-Term Investments

You may want to see also

Frequently asked questions

The number of people who purchase term insurance and invest the saved premiums can vary widely. It depends on individual financial goals, risk tolerance, and the specific circumstances of each person. Some financial advisors suggest that a significant portion of the population, especially those with a higher risk profile or those seeking comprehensive financial planning, might consider this strategy. However, it's essential to note that this is a personal decision, and the number of adopters can range from a small percentage to a substantial portion of the insured population.

Combining term insurance with investment offers several advantages. Firstly, it provides immediate financial security through insurance coverage, ensuring that your loved ones are protected in the event of your passing. Simultaneously, the invested portion can grow over time, potentially offering tax advantages and the opportunity for long-term wealth accumulation. This strategy allows individuals to manage both their short-term and long-term financial goals effectively, ensuring that their family's needs are met while also building a financial nest egg.

While combining term insurance with investment can be beneficial, there are a few considerations. Firstly, the investment component may be subject to market volatility, and there's a risk that the invested amount might not grow as expected. Additionally, the complexity of managing both insurance and investment products might require more time and expertise. It's crucial to carefully review the terms and conditions of both the insurance policy and the investment vehicle to ensure they align with your financial objectives. Regular reviews and adjustments may be necessary to stay on track.