When people invest in a company, they are buying a small piece of that company. This gives them partial ownership and a chance to participate in its gains (and losses). Investors buy stocks for a variety of reasons, including capital appreciation, dividend payments, and the ability to vote and influence the company. Stocks can be a risky investment, as there are no guaranteed returns and individual companies may go out of business. However, they offer the greatest potential for growth over the long term. Before investing, it's important to consider your financial situation, ensure you have a budget that allows for extra money at the end of each week or month, and have an emergency cash fund in place.

| Characteristics | Values |

|---|---|

| Ownership | A percentage of ownership in the company |

| Control | Voting rights |

| Returns | Dividends, capital gains, income |

| Risk | Loss of money, market fluctuations |

What You'll Learn

Shareholders gain voting rights and dividends

When people buy stocks in a company, they are buying a share of ownership in that company. This ownership comes with certain rights and privileges, including voting rights and dividends.

Voting Rights

Shareholders of a company have the right to vote on certain corporate matters. The specific issues that shareholders can vote on vary from company to company, but typically include voting in elections for the board of directors and on proposed operational changes such as shifts in corporate aims, fundamental structural changes, stock splits, mergers, and acquisitions. Shareholders may also have the right to vote on executive compensation packages and other administrative issues.

The number of votes a shareholder has corresponds to the number of shares they own. Common stock ownership always carries voting rights, with common shareholders typically having one vote per share. On the other hand, preferred shareholders usually do not have voting rights.

Shareholders can exercise their voting rights in person at the company's annual general meeting or by proxy if they are unable to attend. Proxy votes can be cast by mail, phone, or online, and proxy forms list and describe all the issues on which shareholders have the right to vote.

Dividends

Dividends are payments made by a company to its shareholders, typically from the company's earnings. Dividend payments can be made in a few different ways, including through a dividend reinvestment plan, which allows shareholders to buy more shares of the company's stock by reinvesting their dividend payments.

The type of stock held by a shareholder can affect the dividend payments they receive. For example, preferred stockholders typically receive dividend payments before common stockholders and have priority over common stockholders if the company goes bankrupt. Additionally, some stocks, known as income stocks, pay dividends consistently, while others, such as growth stocks, rarely pay dividends.

Dividend payments may also be subject to taxes, such as Tax Deducted at Source (TDS), depending on the laws of the country in which the company is located.

Startups: Invest or Avoid?

You may want to see also

Investors seek a return on investment

When people invest in a company, they are buying a share of ownership in that company. This is usually done with the expectation of receiving a return on their investment.

Investing is the process of buying assets that increase in value over time and provide returns in the form of income payments or capital gains. In the world of finance, investing is the purchase of securities, real estate, and other items of value in the pursuit of capital gains or income.

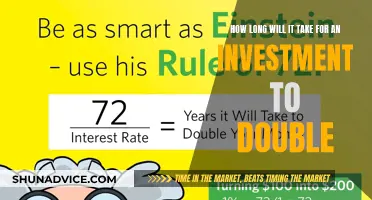

A return, also known as a financial return, is the money made or lost on an investment over a period of time. It can be expressed as the change in dollar value of an investment over time or as a percentage derived from the ratio of profit to investment. A positive return represents a profit, while a negative return marks a loss. Returns are often annualized for comparison purposes.

The total return for stocks includes price change as well as dividend and interest payments. Stocks are a common type of security that gives stockholders a share of ownership in a company. Investors buy stocks for various reasons, including capital appreciation, dividend payments, and the ability to vote shares and influence the company.

The required rate of return (RRR) is the minimum amount of profit (return) an investor will seek or receive for assuming the risk of investing in a stock or another type of security. It is used to determine an investment's return on investment (ROI) and signals the level of risk involved in committing to a given investment or project. The greater the return, the greater the level of risk.

ROI is a popular profitability metric used to evaluate how well an investment has performed and is calculated by dividing an investment's net profit (or loss) by its initial cost or outlay. It is expressed as a percentage and can be used to compare returns across a number of investments. However, ROI does not take into account the holding period, opportunity costs, or the effect of inflation on investment returns.

GME Investors: Who's In?

You may want to see also

Shareholders do not have direct control

When people invest in a company, they are buying securities, real estate, or other items of value. Stocks are a type of security that gives stockholders a share of ownership in a company. Stocks are also called equities. Investors buy stocks for various reasons, including capital appreciation, dividend payments, and the ability to vote shares and influence the company.

Shareholders, or stockholders, are the owners of a corporation. They have a right to control the company and participate in corporate elections. However, this does not imply direct control as only a majority percentage of shareholders can exercise control. In practice, there are often significant differences of opinion among shareholders, and arriving at a consensus is not always possible. Therefore, the provision that a majority percentage of shareholders are needed to have effective control or say in decision-making has been established.

A single shareholder who owns and controls more than 50% of a company's outstanding shares is called a majority shareholder. They wield considerable power to influence critical operational decisions, including replacing board members and C-level executives. However, shareholders with less than 50% of the stocks can also have a controlling interest as long as they own enough stocks to vote at shareholders' meetings.

Shareholders also have certain rights, including the right to inspect the company's books and records, the power to sue the corporation, and the right to vote on critical matters such as naming board directors, mergers, and dividend distributions.

In summary, while shareholders have a right to control the company, this control is not direct as it depends on having a majority percentage of votes and is subject to differences of opinion and the need for consensus among shareholders.

Why Invest in Entertainment?

You may want to see also

Investments may come with restrictions

When people invest in a company, they are buying stocks, or shares, in that company. Stocks are a type of security that gives stockholders ownership of a company. Stocks are also called equities.

There are two main types of stocks: common stock and preferred stock. Common stockholders are entitled to vote at shareholder meetings and receive dividends. Preferred stockholders usually don't have voting rights but are paid dividends before common stockholders and are prioritized if the company goes bankrupt.

When investing in a company, it's important to be aware of the potential restrictions and risks involved. Here are some key points to consider:

- Risk of Loss: Investing in stocks comes with the risk of losing money. There is no guarantee that the company will perform well, and stock prices can fluctuate. If a company goes bankrupt, common stockholders are last in line to receive proceeds.

- Restricted Securities: Some investments, especially in private placements, involve restricted securities. These securities are highly illiquid, meaning they are difficult to resell. Investors may need to hold these securities indefinitely or comply with specific exemptions to resell them.

- Limited Disclosure: Private placements are not subject to the same disclosure requirements as public companies. Investors may have limited information to make informed decisions, including details on the company's financial health and performance.

- High Risk: Private placements often involve early-stage, high-risk companies. Investors should carefully assess their risk tolerance and ability to withstand potential losses.

- Fraud Risk: Fraudulent actors may use unregistered offerings to conduct scams. It can be challenging or impossible to recover money lost in fraudulent investments.

- State Securities Laws: Even if an offering is exempt from SEC registration, it may still need to comply with state securities laws, including registration requirements.

- Limited Resale Opportunities: Investments in private companies may have restricted transferability. It can be challenging to find buyers for these securities compared to publicly traded companies.

- Contractual Restrictions: Investment contracts or agreements may contain provisions that restrict or prevent the free transfer of securities.

- Speculative Nature: Investing in startups and early-stage companies is speculative, as the business may fail. Unlike mature companies, startups often rely on unproven business models, products, or services.

- Illiquidity: Some investments may need to be held indefinitely or for extended periods due to a lack of resale restrictions or plans to list them on an exchange.

Dividend ETFs: Smart Investment for Young People?

You may want to see also

Shareholders have no entitlement to discounts

When people invest in a company, they are buying stocks, or shares, in that company. Stocks are a type of security that gives stockholders a share of ownership in a company. They are also called equities.

There are two main types of stocks: common stock and preferred stock. Common stock entitles owners to vote at shareholder meetings and receive dividends. Preferred stockholders usually don't have voting rights but are paid dividends before common stockholders, and they have priority in the event of a company's bankruptcy and liquidation of assets.

Shareholders are not entitled to discounts on the company's products or services. However, they may be offered the opportunity to buy more shares at a discounted price through a rights offer. A rights offer is when a company raises money by giving existing shareholders the chance to buy more shares, usually at a discounted price and in proportion to the number of shares they already own. For example, a '1 for 10' entitlement ratio means a shareholder can buy one new share for every 10 shares they already own.

While shareholders are not entitled to discounts, they do have certain rights and benefits associated with their ownership of company stock. These can include dividend payments, the ability to vote and influence the company, and potential capital appreciation if the stock price rises.

Why Invest in Farms?

You may want to see also

Frequently asked questions

Stocks are a type of security that gives stockholders a share of ownership in a company. Stocks are also called equities.

Stocks offer investors the greatest potential for growth (capital appreciation) over the long haul. Investors who stick with stocks over long periods of time, say 15 years, are generally rewarded with strong, positive returns. Stocks also allow investors to receive dividends, which are small regular payments of companies' profits.

Stock prices move down as well as up. There’s no guarantee that the company whose stock you hold will grow and do well, so you can lose money. If a company goes bankrupt and its assets are liquidated, common stockholders are the last in line to share in the proceeds.