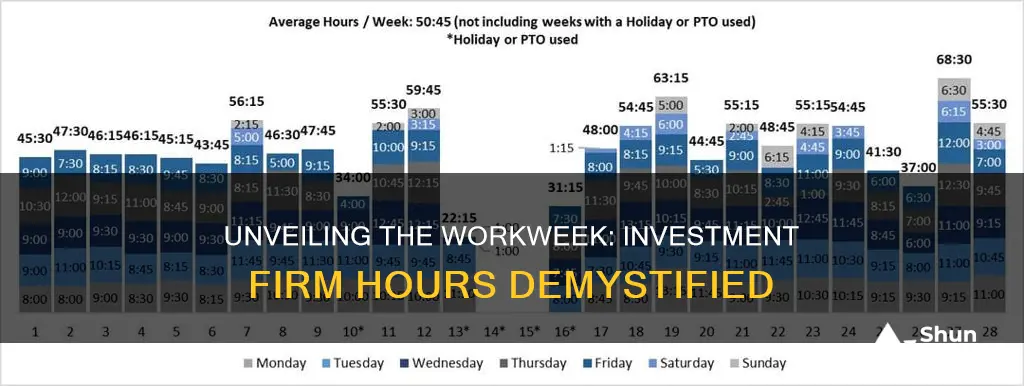

The average work hours at an investment firm can vary significantly depending on the specific role, industry, and company culture. Typically, investment professionals often work long hours, with a common expectation of 50-60 hours per week. This is due to the fast-paced and demanding nature of the job, which involves analyzing financial data, conducting research, and making critical investment decisions. However, it's important to note that many investment firms are increasingly focusing on work-life balance and promoting a healthier work environment, which may lead to more flexible work hours and a better work-life integration for employees.

What You'll Learn

- Industry Comparison: Research average hours across different investment firm types (e.g., hedge funds, asset management)

- Role-Specific Hours: Explore average work hours for analysts, traders, portfolio managers, and other roles

- Geographical Variations: Analyze average work hours in different regions and countries

- Company Culture: Investigate how company culture influences work hours and expectations

- Work-Life Balance: Examine the impact of long hours on employee satisfaction and retention

Industry Comparison: Research average hours across different investment firm types (e.g., hedge funds, asset management)

Before we delve into the industry comparison, it's essential to understand the general context of work hours in the investment industry. Investment firms, including hedge funds and asset management companies, often operate in a fast-paced and highly competitive environment. The nature of the job often requires long hours, especially during market hours, to monitor and analyze financial markets, execute trades, and provide investment advice.

Hedge Funds:

Hedge funds are known for their aggressive investment strategies and often operate with a more flexible and less structured work environment compared to traditional asset management firms. The average work hours at hedge funds can vary significantly, but it is not uncommon for employees to work long hours, sometimes exceeding 60 hours per week. This is particularly true for portfolio managers and traders who need to make quick decisions and react to market changes promptly. According to various sources, the average workweek for hedge fund professionals can range from 60 to 80 hours, with some individuals working even longer hours during peak market activity.

Asset Management:

Asset management firms, on the other hand, typically have a more traditional work structure. These firms focus on managing investment portfolios for clients, such as mutual funds, pension funds, and high-net-worth individuals. The average work hours in asset management can vary depending on the role and the specific firm. Analysts and researchers often work long hours to gather and analyze data, prepare reports, and support portfolio managers. However, compared to hedge funds, the workweek is generally more consistent and may average around 40-50 hours, with some firms offering more competitive work-life balance.

Industry-Wide Trends:

Across the investment industry, there is a noticeable trend towards longer work hours, especially in roles that require real-time market analysis and trading. This is particularly true for firms located in major financial hubs like New York, London, and Hong Kong, where the pressure to stay ahead of the market is intense. However, some investment firms are increasingly recognizing the importance of work-life balance and are implementing policies to encourage a healthier work environment. These may include flexible work arrangements, compressed workweeks, and enhanced leave policies.

Regional and Cultural Differences:

It's worth noting that work hours can also vary by region and cultural norms. For instance, investment firms in some European countries may have different expectations regarding work-life balance compared to their American counterparts. Additionally, cultural factors can influence the perception of long work hours, with some societies accepting longer hours as a sign of dedication and commitment.

In summary, the average work hours at investment firms, particularly hedge funds, can be significantly higher compared to asset management firms. However, the industry is witnessing a shift towards more balanced work environments, and firms are increasingly recognizing the importance of employee well-being. Understanding these industry-wide trends can help professionals in the investment sector make informed decisions about their career paths and work-life preferences.

Financial Institutions: Encouraging Savings and Investment Strategies

You may want to see also

Role-Specific Hours: Explore average work hours for analysts, traders, portfolio managers, and other roles

The average work hours at an investment firm can vary significantly depending on the specific role and the nature of the work. Here's an overview of the typical work patterns for different positions:

Analysts: Investment analysts often work long hours, especially in the early stages of their careers. The average workweek for junior analysts can range from 60 to 80 hours, with some firms even expecting 100-hour weeks during busy periods. This high volume of hours is common in the first few years as analysts gain experience and knowledge of the industry. As analysts progress to more senior roles, the hours tend to stabilize, with a typical workweek settling around 50-60 hours. Senior analysts often have more flexibility and may be expected to work more independently, allowing for a better work-life balance.

Traders: Trading roles are known for their demanding work culture and long hours. Traders often work in a fast-paced environment, requiring quick decision-making and constant market monitoring. The average workweek for traders can easily exceed 80 hours, and it is not uncommon for them to work 100 hours or more, especially during market-moving events or when managing critical trades. The pressure to stay ahead of the market and the potential for high rewards often contribute to these extended work hours.

Portfolio Managers: Portfolio management roles typically involve a more structured work schedule compared to analysts and traders. Portfolio managers are responsible for making strategic investment decisions and overseeing a portfolio's performance. The average workweek for portfolio managers is generally around 50-60 hours, with a focus on strategic planning, research, and client meetings. While they may work longer hours during critical periods, the nature of the role often allows for a more balanced approach, emphasizing strategic thinking and long-term planning.

Other Roles: In addition to the above, other roles within an investment firm, such as compliance officers, risk managers, and administrative staff, also have varying work hours. Compliance officers, for instance, may work standard 40-hour weeks, ensuring regulatory adherence and managing internal controls. Risk managers might work longer hours to assess and mitigate potential risks, especially during market volatility. Administrative roles can vary, with some offering more flexible hours to support the team's needs.

It's important to note that while these averages provide a general idea, individual experiences can differ. Factors such as company culture, market conditions, and personal preferences also play a role in shaping work hours. Additionally, many investment firms are increasingly focusing on work-life balance and promoting healthier work environments, which may lead to more flexible schedules and reduced average hours over time.

Yuan Investment: Worth the Risk?

You may want to see also

Geographical Variations: Analyze average work hours in different regions and countries

The average work hours at investment firms can vary significantly across different regions and countries, influenced by a multitude of factors including cultural norms, economic conditions, regulatory frameworks, and industry standards. This geographical variation is an essential aspect to consider when understanding the global landscape of work-life balance in the financial sector.

In North America, particularly the United States, investment professionals often work long hours, with a common expectation of 60-80 hours per week. This is partly due to the competitive nature of the industry, where success is often measured by long hours and a strong work ethic. However, this culture is gradually shifting towards promoting a healthier work-life balance, with many firms implementing policies to encourage shorter workweeks and better employee well-being.

In contrast, European countries like Germany, France, and the Netherlands tend to have more standardized work hours, often adhering to the EU's Working Time Directive. This directive limits the working week to 48 hours on average, including overtime. As a result, investment firms in these regions typically operate within these boundaries, promoting a more balanced approach to work. For instance, in Germany, the average workweek is around 35-40 hours, with a strong emphasis on personal time and leisure activities.

The Asian market presents a diverse range of work cultures. In Japan, for example, the traditional long-hour work culture persists, with investment professionals often working over 60 hours per week. This is partly due to the high-pressure environment and the desire to climb the corporate ladder. In contrast, Singapore and South Korea have adopted more Westernized work cultures, with average workweeks of around 40-50 hours, reflecting a balance between professional demands and personal life.

In the Middle East, the work culture is often more aligned with the global trend of longer workweeks, especially in the financial hubs of Dubai and Abu Dhabi. However, this is changing as the region focuses on improving work-life balance and attracting a more diverse talent pool. Australia and New Zealand also exhibit a mix of work cultures, with some firms adopting the long-hour model and others promoting a more balanced approach, often influenced by the country's strong emphasis on outdoor activities and leisure.

Understanding these geographical variations is crucial for both employers and employees in the investment industry. For employers, it highlights the need to adapt work cultures and policies to different regions, ensuring they remain competitive while promoting a healthy work environment. For employees, it provides insights into the potential work-life balance they can expect in different parts of the world, influencing their career choices and overall satisfaction.

February: A Month for Investing?

You may want to see also

Company Culture: Investigate how company culture influences work hours and expectations

The culture of an investment firm plays a pivotal role in shaping the work hours and expectations of its employees. Investment firms, known for their fast-paced and dynamic nature, often demand a significant commitment from their staff. The average work hours in this industry can vary widely, but it is not uncommon for employees to work long hours, sometimes exceeding 60 hours per week. This is particularly true in the front office, where traders and analysts are expected to be constantly on call, monitoring markets and making split-second decisions. The culture here often glorifies long hours, with the assumption that dedication and hard work equate to success.

However, the culture in the back office or support functions might be different. These roles, such as compliance, risk management, and operations, often have more structured work hours. While the work may be less demanding in terms of immediate decision-making, it still requires a high level of expertise and attention to detail. The culture here tends to emphasize the importance of a healthy work-life balance, with firms encouraging employees to take time off and maintain a reasonable work schedule. This is a strategic move to prevent burnout and maintain the long-term productivity and well-being of the workforce.

The influence of company culture on work hours is evident in the way firms communicate and enforce expectations. In investment firms, the culture often dictates that employees are expected to be responsive and available outside of standard working hours. This is facilitated by technology, with many firms using communication tools that allow for instant messaging and email access 24/7. The culture, therefore, becomes a driving force behind the expectation of round-the-clock availability, even if it is not explicitly stated in job descriptions or company policies.

Furthermore, the culture of an investment firm can impact the perception of 'normal' work hours. In some firms, the norm might be to work late into the night, with the understanding that this demonstrates dedication and commitment. In contrast, other firms might have a culture that values early mornings and a more traditional 9-to-5 schedule, with the belief that productivity is maximized during these hours. The expectations set by the company culture can significantly impact employee morale and job satisfaction, as individuals may feel pressured to conform to the perceived norm.

Investigating company culture is essential to understanding the average work hours and expectations within an investment firm. By examining the values, norms, and communication patterns within the organization, one can gain insight into the unspoken rules that govern the work environment. This includes understanding the firm's approach to work-life balance, the level of flexibility offered, and the expectations regarding availability and responsiveness. Ultimately, the culture of an investment firm is a critical factor in shaping the work hours and experiences of its employees, influencing their sense of purpose, satisfaction, and long-term commitment to the organization.

Unlocking the US Investment Landscape: A Comprehensive Guide

You may want to see also

Work-Life Balance: Examine the impact of long hours on employee satisfaction and retention

The investment industry is renowned for its demanding nature, often requiring employees to work long hours, sometimes well beyond the standard 40-hour workweek. This culture of extended work hours can significantly impact employee satisfaction and retention, which are critical factors in the success and sustainability of any organization.

Long work hours can lead to a variety of issues that affect employee well-being. Firstly, it contributes to increased stress levels, which can have detrimental effects on physical and mental health. Employees may experience higher rates of burnout, a condition characterized by emotional exhaustion, cynicism, and reduced performance. This is particularly concerning in the investment sector, where the pressure to meet targets and make critical decisions can be intense. Over time, chronic stress can lead to more serious health issues, including cardiovascular problems and a weakened immune system.

The impact of long hours on employee satisfaction is also evident in the form of decreased morale and motivation. When employees consistently work long shifts, they may feel a sense of fatigue and dissatisfaction with their jobs. This can result in lower productivity, increased absenteeism, and a higher turnover rate. Happy and satisfied employees are more likely to be engaged in their work, take initiative, and contribute to a positive company culture.

Moreover, the lack of work-life balance can lead to personal issues and strained relationships. Employees may struggle to find time for family, hobbies, and personal development, which can result in feelings of isolation and dissatisfaction. This can further contribute to high turnover, as individuals seek opportunities that offer a better work-life balance.

To address these challenges, investment firms should consider implementing strategies to promote a healthier work environment. This could include flexible work arrangements, such as remote work options or flexible hours, which can help employees manage their personal and professional lives more effectively. Additionally, providing access to wellness programs, counseling services, and regular team-building activities can contribute to a happier and more satisfied workforce. By prioritizing employee well-being and work-life balance, investment firms can foster a more productive and loyal workforce, ultimately benefiting the organization's long-term success.

The NFT Investment Craze: Why?

You may want to see also

Frequently asked questions

The average workweek at an investment firm can vary significantly depending on the role, department, and the specific firm's culture. However, it is common for professionals in this industry to work long hours, often exceeding the standard 40-hour workweek. Analysts and associates might work around 60-80 hours per week, especially during busy periods or when dealing with critical projects. Partners and senior executives may have more flexible schedules but can still work extended hours due to the nature of the business.

Overtime is not uncommon in the investment industry, particularly for roles that involve trading, research, or client management. Many firms operate 24/7, especially those with global reach, and employees may be required to work outside regular hours to cover different time zones or to meet client demands. While some firms have policies in place to ensure a healthy work-life balance, others may encourage a more traditional '9-to-5' mindset, which can lead to a blurring of boundaries between work and personal time.

Investment firms are increasingly recognizing the importance of employee well-being and work-life balance. Some firms offer flexible work arrangements, such as remote work options or adjustable schedules, to accommodate personal needs. They may also provide wellness programs, mental health support, and employee assistance programs to help staff manage their workload and personal lives. Additionally, many firms have established policies to limit working hours, encourage time off, and promote a culture of respect for personal time, although the effectiveness of these policies can vary across different organizations.