Silver has been used as currency for millennia, and its value is backed by its price as a physical commodity. As such, silver coins can be a great way to diversify your investment portfolio. Silver coins are also a good investment because they are easily recognisable, and their value tends to increase as they age.

When it comes to choosing which silver coins to invest in, there are a few factors to consider, including purity, design, availability, and authenticity. It's also worth noting that government-issued coins tend to be more valuable than those produced by private mints.

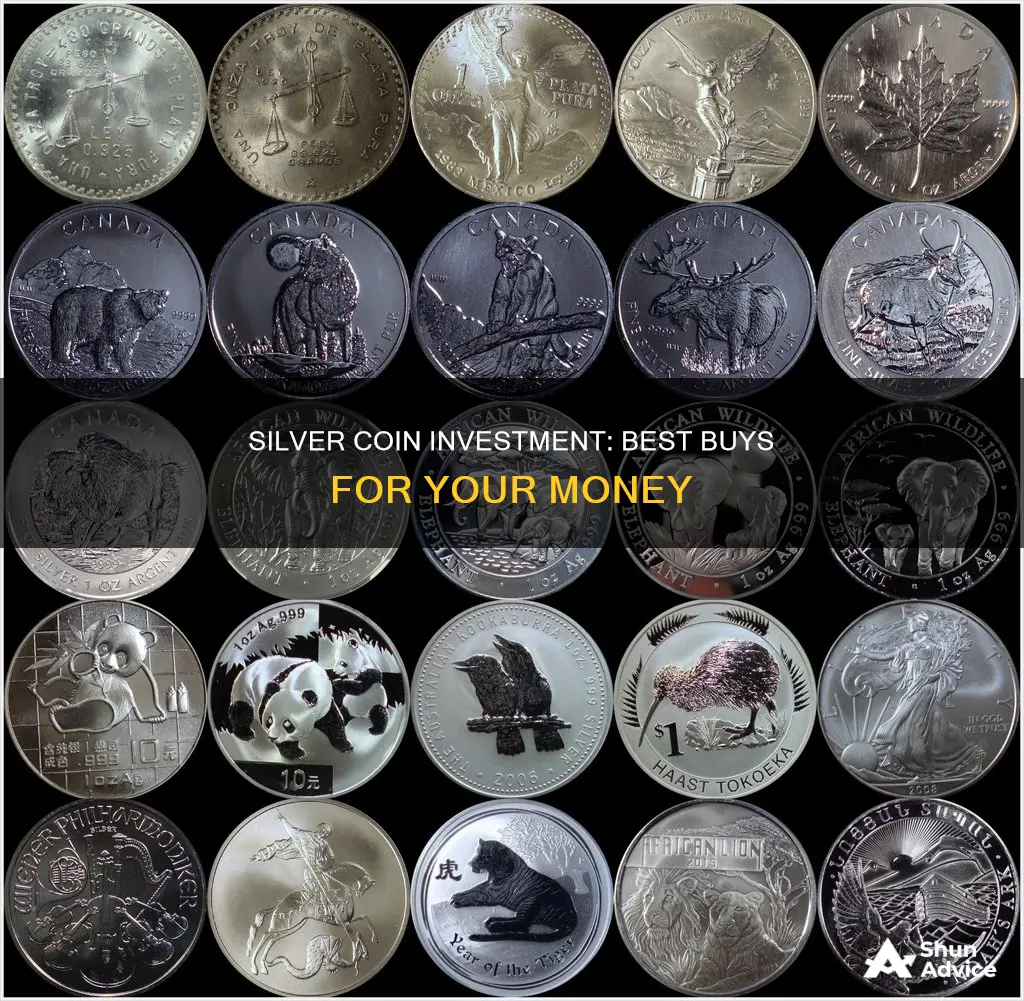

- American Silver Eagle

- Canadian Silver Maple Leaf

- British Silver Britannia

- Mexican Silver Libertad

- Austrian Silver Philharmonic

- Morgan Silver Dollar

- Australian Silver Kangaroo

- Chinese Silver Panda

What You'll Learn

Silver coin vs. silver bar

Silver coins and silver bars are two of the most common forms of silver investment. They differ in several ways, and each has its own advantages and disadvantages. This comparison will help you decide which option is best for your investment portfolio.

Liquidity and Market Demand

Silver coins are highly liquid and easily recognised, making them popular among retail investors. They are also easy to buy and sell due to their wide acceptance and legal tender status. Silver bars, on the other hand, are less liquid and have a smaller market, mainly consisting of large-scale investors.

Storage and Security

The smaller size of silver coins makes them easier to store at home or in safe deposit boxes. Silver bars, especially larger ones, may require professional storage in a high-security vault, which can be costly.

Price and Premiums

Silver bars generally have lower premiums and a lower price per gram than coins. Silver coins often carry higher premiums due to their collectibility and the cost of minting by government institutions.

Purity and Authenticity

Silver coins are manufactured to high purity standards by government mints, making them easier to verify. Silver bars, on the other hand, may require professional verification and are more susceptible to counterfeiting.

Divisibility and Flexibility

Silver coins come in smaller, divisible units, allowing for flexible and incremental investments. Silver bars lack divisibility and are better suited for bulk investments.

Tax and Legal Considerations

In some jurisdictions, silver coins that are legal tender may be exempt from certain taxes, such as Capital Gains Tax. Silver bars, on the other hand, may incur taxes when sold.

Overall Recommendation

For most retail investors, silver coins are generally the better option due to their liquidity, security, storage advantages, and tax benefits. Silver bars can be a good addition to a silver portfolio to reduce the overall purchase cost per gram.

Best Silver Coins for Investment

When investing in silver coins, consider the following:

- American Silver Eagles

- Canadian Silver Maple Leafs

- British Silver Britannias

- Mexican Silver Libertads

- Austrian Silver Philharmonics

- Morgan Silver Dollars

- Australian Silver Kangaroos

- Chinese Silver Pandas

Doge Coin: Worth the Investment Risk?

You may want to see also

Silver coin purity

Silver coins are a great way to begin building an investment portfolio. They come in various finishes, such as Brilliant Uncirculated (BU) or Proof, and in a range of designs. Silver coins from sovereign mints are often chosen by investors due to their government backing and guaranteed silver content.

When investing in silver coins, you have three options: bullion, proofs, and junk silver. Bullion coins are minted and stored for investment purposes, with their value based on the weight of the precious metal used. Proof coins are created with specially treated metals and come in protective packaging with certificates of authenticity. Junk silver is made up of pre-1965 silver coins that can be melted down for their silver content.

Silver standards refer to the millesimal fineness of silver alloys, or in other words, the purity of the silver. Fine silver, also known as pure silver, has a millesimal fineness of 999, meaning it contains 99.9% silver. While fine silver is used to make bullion bars, it is too soft for general use. For this reason, manufacturing jewellers and silversmiths mix copper with fine silver to give it strength.

Coin silver is an alloy of 90% silver and 10% copper, with a millesimal fineness of 900. Most US silver coins are made of coin silver. In the US, silver coins must be at least .900 fine, meaning they cannot contain less than 90% pure silver.

Sterling silver, on the other hand, has a millesimal fineness of 925, meaning it is 92.5% silver and 7.5% copper. Sterling silver is more valuable than coin silver due to its higher purity. It is also more commonly used in jewellery and silverware.

Govt ID: A Necessary Evil for Bitcoin Investment?

You may want to see also

Silver coin designs

American Silver Eagle

The American Silver Eagle is one of the world's most recognised silver bullion coins. Its design includes the famous Walking Liberty design by Adolph A. Weinman on the obverse, depicting Lady Liberty covered by the flag, with the word "Liberty" surrounding her figure. The reverse features an eagle about to land, carrying oak branches in its talons, designed by John Mercanti.

Canadian Silver Maple Leaf

The Canadian Silver Maple Leaf is one of the most highly recognised coins in the world. It features the iconic Canadian silver maple leaf, a national symbol, on the reverse. The obverse features a portrait of Queen Elizabeth II, though the 2024 issue will feature King Charles III. The design also includes the words "Canada", "9999", "Fine Silver", "1 OZ", "Argent Pur", and "9999" in English and French.

Austrian Silver Philharmonic

The Austrian Silver Philharmonic features a design by Thomas Pesendorfer. The obverse depicts the Musikverein, the Great Organ of the Golden Hall in Vienna's concert hall. The reverse shows an array of musical instruments from the orchestra, including a cello, violin, harp, French horn, and bassoon.

British Silver Britannia

The British Silver Britannia features a depiction of Britannia holding the Union Jack Shield and a trident on the reverse, referring to Great Britain's naval history. The obverse features a portrait of Queen Elizabeth II, though newer versions depict King Charles III. The Latin inscription reads, "CHARLES III - D - G - REX - F - D - 2 POUNDS - 2024", which translates to "Charles III, by the Grace of God, King, Defender of the Faith".

Mexican Silver Libertad

The Mexican Silver Libertad features the current seal of the "Casa de Moneda" or Central Bank of Mexico in the centre of the obverse, surrounded by the ten previous seals. All feature an eagle in a battle position, defending the nation. The reverse design features the Angel of Victory, or the Monument of Freedom, located in Mexico City.

Australian Silver Kangaroo

The Australian Silver Kangaroo features a hopping kangaroo on the reverse, based on Stuart Devlin's original idea for the Australian Copper Penny. The obverse depicts Queen Elizabeth II, though the 2024 issue is expected to feature King Charles III.

Trinidad and Tobago's Bitcoin Investment Strategy

You may want to see also

Silver coin availability

The American Silver Eagle, for example, is the world's best-selling silver coin and is recognised universally. This means that sellers will always find ready buyers for this coin. The Canadian Maple Leaf is the second most popular silver coin and is also one of the most recognisable coins globally. The Austrian Philharmonic, while not as popular as the previous two, is still the highest-minted and most well-known silver bullion coin in Europe.

Other silver coins that are widely available and traded include the British Silver Britannia, the Australian Silver Kangaroo, the Mexican Silver Libertad, and the Chinese Silver Panda. These coins are produced by respected government-owned mints such as the US Mint, the Royal Canadian Mint, and the British Royal Mint, which gives them added legitimacy and makes them easily identifiable.

The availability of a silver coin can also be impacted by its mintage. A lower mintage can increase a coin's value as it becomes rarer and more sought-after by collectors. For example, the lowest mintage for the American Silver Eagle bullion coin was the 1996 issue, with a mintage of 3.6 million.

It is worth noting that some silver coins are only available in certain sizes. For instance, the American Silver Eagle is only offered in a 1 oz version, while the Austrian Philharmonic is available in 1 oz and 500 oz mint cases.

When investing in silver coins, it is important to consider not only their availability but also factors such as purity, design, authenticity, and your own investment goals.

Square's Bitcoin Investment: A Bold Move

You may want to see also

Silver coin authenticity

Silver is a great choice for investing in precious metals. However, as with other valuable items, silver coins can be counterfeited. Luckily, there are several ways to check for the authenticity of silver coins. Here are some detailed and direct instructions on how to do so:

Official Stamps and Mint Marks

Official stamps are usually present on pure silver coins, indicating their purity. For example, investment-grade silver coins typically have a 999.9 or 999.0 purity. However, not all countries require an official stamp, so its absence doesn't necessarily indicate a fake coin. Mint marks, on the other hand, indicate where the coin was produced, and fake silver coins may lack these or have poor copies of legitimate mint marks.

Visual Inspection

A counterfeit silver coin may have minor imperfections upon closer inspection. The design may lack detail, have a weak luster, or be off-centre. Older fake coins may even show signs of rust or other damage that is uncommon with pure silver.

Weight and Diameter

Uncirculated silver dollars weigh 26.73 grams, while circulated ones may weigh slightly less due to wear. The diameter of silver dollars should be 38.1 millimetres. Comparing these measurements to a standard kitchen scale and ruler can help verify authenticity.

Magnetism

Coins made of precious metals like silver are non-magnetic. Therefore, if a strong magnet, such as a neodymium magnet, attracts your silver coin, it is likely a fake. However, note that there are other non-magnetic metal alloys that resemble silver, so this test is best used in conjunction with others.

Ice Cube Test

Silver has the highest thermal conductivity among metals. Thus, if you place an ice cube on a silver coin, it should melt faster than on other metals. This test can be easily performed at home and helps distinguish real silver from fakes.

Sound Test

Silver coins produce a high-pitched, bell-like ringing sound when struck or dropped on a flat surface. If the sound is dull, the coin is likely mixed with other metals.

Density Test

This test requires measuring the weight and volume of the coin and then calculating its density. Silver has a density of 10.49 g/cc (grams per cubic centimetre). If the calculated density is significantly different, the coin is likely not pure silver.

Bleach Test

Bleach is a powerful oxidizing agent, and silver tarnishes quickly when exposed to it. Therefore, applying a drop of bleach to the coin and observing if it tarnishes or turns black can indicate its authenticity.

Hallmarks and Discolorations

Silver items often have hallmarks indicating their weight, purity, and serial numbers. Fake coins may have faded or incorrect hallmarks. Additionally, fine silver (.999 and above) does not easily tarnish or corrode, so any discolourations may indicate a lower purity or silver plating.

Acid Test

A chemical test can be performed using a silver acid test kit, but it may slightly damage the coin. This test involves scratching the coin and applying acid to the scratched area to observe any colour changes. Pure silver will turn orange, while sterling silver turns red.

Professional Appraisal

The most definitive way to determine silver coin authenticity is to seek a professional opinion. Jewellers and appraisers have specialised tools and equipment to accurately test the silver content of coins.

A Guide to Investing in Bitcoin in Kenya

You may want to see also

Frequently asked questions

Some of the best silver coins to buy for investment include the American Silver Eagle, the Canadian Silver Maple Leaf, and the Austrian Silver Philharmonic.

When choosing silver coins to invest in, it is important to consider factors such as purity, design, availability, and authenticity. The purity and composition of the coin will impact its durability, resistance to wear, and price. The design of the coin may feature historical figures or icons and can be part of a special series or classical design. The availability and rarity of a coin can also affect its price, as a lower mintage may result in higher demand and prices. Additionally, it is important to ensure the authenticity of the coin, preferably backed by a sovereign mint institution with anti-counterfeiting measures in place.

Investing in silver coins offers several benefits. Silver has been used as a form of currency and wealth preservation for centuries and serves as a hedge against inflation. It holds intrinsic value due to its physical nature and has a long history of application in various fields, including technology and jewelry. Silver coins are also globally recognized and respected, providing liquidity and flexibility in buying and selling. Additionally, high-quality coins tend to gain value over time, and some may hold semi-numismatic value due to their artistic designs.