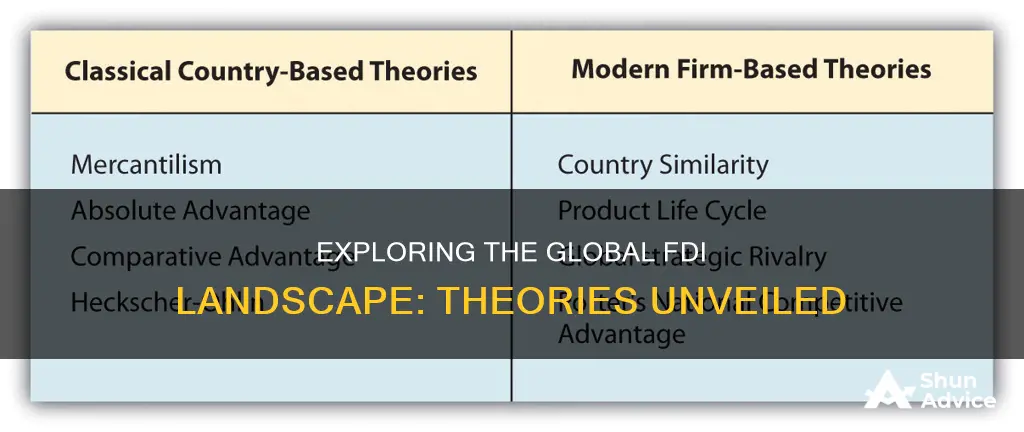

Foreign Direct Investment (FDI) is a crucial aspect of international business, and understanding the underlying theories can provide valuable insights into its dynamics. This paragraph introduces the topic by highlighting the importance of FDI in the global economy and the need to explore the various theories that explain its behavior. It mentions that several economic and strategic theories, such as the Market Entry Theory, Resource Seeking Theory, and Strategic Asset Allocation Theory, offer different perspectives on why companies invest abroad. By examining these theories, we can gain a comprehensive understanding of the factors driving FDI and its impact on host countries and multinational corporations.

What You'll Learn

- Theories of FDI Motivation: Focuses on why firms invest abroad

- Market Size and Access: Explores the role of host market size and potential

- Resource Acquisition: How FDI is used to secure resources like raw materials

- Strategic Advantage: Discusses the pursuit of competitive edge through FDI

- Political Economy Factors: Examines the impact of political and economic conditions on FDI

Theories of FDI Motivation: Focuses on why firms invest abroad

Theories of FDI Motivation: Understanding the Drivers Behind Foreign Direct Investment

Foreign Direct Investment (FDI) is a complex phenomenon, and understanding the motivations behind it is crucial for businesses, policymakers, and researchers alike. FDI involves a company investing in a foreign country, either by acquiring an existing business, establishing a new one, or expanding its operations in a foreign market. The 'Theories of FDI Motivation' aim to explain why firms make these strategic decisions to venture beyond their domestic borders.

One prominent theory is the Market Expansion Theory. This theory suggests that firms engage in FDI to access new and larger markets. By investing abroad, companies can tap into untapped consumer bases, increase their customer reach, and diversify their revenue streams. For example, a technology company might set up a subsidiary in a foreign country to sell its products directly to local consumers, bypassing potential import restrictions or high local competition. This theory highlights the pursuit of market growth and the desire to capitalize on international demand.

Another influential theory is the Resource Seeking Theory. Here, the focus is on the acquisition of resources that are not readily available or cost-effective in the home country. Firms may invest abroad to secure natural resources, such as raw materials, minerals, or energy sources, which are abundant in certain regions. For instance, an oil company might establish a drilling operation in a foreign country rich in oil reserves, ensuring a steady supply of raw materials for its production processes. Additionally, this theory encompasses the pursuit of skilled labor, advanced technologies, or favorable tax incentives that may be more readily available in specific foreign markets.

The Strategic Asset Location Theory provides another perspective. It argues that FDI is driven by the need to optimize production and distribution processes. Companies may invest abroad to establish production facilities closer to their customers, reducing transportation costs and lead times. For instance, a manufacturing firm might set up a factory in a foreign country to produce goods for the local market, minimizing shipping expenses and allowing for quicker delivery. This theory emphasizes the strategic placement of assets to enhance operational efficiency and competitiveness.

Furthermore, the Internationalization Theory explores the internal motivations of firms. It suggests that multinational corporations (MNCs) invest abroad as part of their growth strategy and to achieve a competitive advantage. By expanding internationally, MNCs can diversify their product portfolio, gain a better understanding of foreign markets, and develop a more resilient business model. This theory also highlights the role of corporate culture and the desire to replicate successful domestic practices in foreign markets.

In summary, the theories of FDI motivation offer valuable insights into the complex decision-making processes of firms investing abroad. These theories emphasize market access, resource acquisition, strategic asset location, and internal corporate strategies as key drivers of FDI. Understanding these motivations is essential for analyzing the patterns and impacts of FDI on the global economy and individual industries.

A Guide to Navigating Investing.com Like a Pro

You may want to see also

Market Size and Access: Explores the role of host market size and potential

The concept of market size and access is a critical factor in understanding foreign direct investment (FDI) theories. When considering FDI, the potential host country's market size and growth prospects are often key considerations for investors. Larger markets offer a greater consumer base, which can be attractive for companies aiming to expand their operations and increase sales. For instance, a multinational corporation might view a country with a rapidly growing economy and a large population as an ideal location for setting up a new manufacturing plant or a regional distribution hub. This market access can provide a significant competitive advantage, allowing the investor to tap into new customer segments and potentially capture a larger market share.

The idea of market potential is closely tied to the host country's economic growth and development. Countries with emerging markets and a rising middle class often present substantial market potential. These markets may have a higher demand for goods and services, especially in sectors like consumer electronics, automobiles, and fast-moving consumer goods. Investors are drawn to these markets as they offer the opportunity to capitalize on the growing consumer spending power and to establish a strong local presence. For instance, a technology company might seek to enter a developing country with a large youth population and increasing internet penetration to launch new products and services, leveraging the market's potential for rapid adoption and growth.

Market size and access also influence the choice of investment location within a country. Investors often consider the distribution of market potential across different regions or cities. A country with a large and diverse market might have varying levels of development and consumer behavior across its regions. For instance, a company might decide to set up a manufacturing facility in a specific city or region that has a well-developed infrastructure, a skilled workforce, and a higher concentration of potential customers. This strategic decision ensures that the investment is aligned with the most promising market opportunities.

Furthermore, the concept of market size and access extends beyond the physical market and includes the regulatory and policy environment. Host countries with favorable investment policies, low barriers to entry, and a stable economic climate can significantly enhance the market's attractiveness. Investors often seek countries that provide incentives, such as tax benefits, streamlined business registration processes, and protection for foreign investors. These factors contribute to the overall market access and can influence the decision to invest in a particular country.

In summary, market size and access are fundamental considerations in FDI theories, as they directly impact the potential for growth and profitability. Investors are drawn to host countries with large and growing markets, as well as those offering specific regional advantages and favorable investment climates. Understanding these factors is essential for businesses and policymakers to attract FDI and promote economic development effectively.

Maximizing Investment Earnings: Strategies for Optimal Utilization

You may want to see also

Resource Acquisition: How FDI is used to secure resources like raw materials

Foreign Direct Investment (FDI) plays a crucial role in the global economy, particularly in the context of resource acquisition. When companies or governments invest in foreign assets, they often do so with the primary goal of securing valuable resources, such as raw materials, minerals, and energy sources. This strategic move is driven by the understanding that these resources are essential for production, manufacturing, and the overall sustainability of various industries.

One of the key theories behind FDI in resource acquisition is the 'Resource Curse' hypothesis. This theory suggests that countries rich in natural resources often experience economic challenges due to the 'resource curse' phenomenon. Instead of fostering development, these resources can lead to corruption, conflict, and a lack of diversification in the economy. To mitigate this, foreign investors can step in to acquire these resources, ensuring a steady supply chain and potentially bringing much-needed capital and expertise to the region. For instance, oil-rich countries like Saudi Arabia have attracted significant FDI to develop their energy sector, which has contributed to the country's economic growth and infrastructure development.

The process of resource acquisition through FDI often involves several stages. Firstly, investors conduct thorough market research and due diligence to identify regions with abundant natural resources. This includes assessing the availability and quality of raw materials, as well as understanding the local political and economic landscape. Once a suitable location is identified, investors may engage in negotiations with local governments or companies to secure the necessary permits and licenses for extraction or production. This step is crucial to ensure legal compliance and establish a solid foundation for the investment.

After securing the necessary permissions, the actual resource acquisition begins. This phase can vary depending on the type of resource. For instance, in the case of mining, investors might employ advanced extraction techniques to mine precious metals or minerals. In the energy sector, FDI could involve the construction of new oil or gas fields, power plants, or renewable energy facilities. The goal is to establish a sustainable and efficient supply chain, ensuring that the resources are extracted or produced in an environmentally and socially responsible manner.

Resource acquisition through FDI has the potential to bring numerous benefits to both the host country and the investing entity. For the host country, it can lead to increased revenue, improved infrastructure, and the creation of local jobs. Investors, on the other hand, gain access to essential resources, ensuring a steady supply for their production processes. Moreover, FDI in resource-rich sectors can stimulate economic growth, attract further investment, and foster long-term partnerships between countries. However, it is essential to ensure that these investments are managed transparently and sustainably to avoid the pitfalls of the 'resource curse' and promote long-term economic prosperity.

France's Foreign Investment Expropriation: A Historical Overview

You may want to see also

Strategic Advantage: Discusses the pursuit of competitive edge through FDI

Foreign Direct Investment (FDI) is a powerful tool for businesses seeking to gain a strategic advantage in the global market. This approach involves investing in assets in a foreign country, such as establishing a subsidiary, acquiring a local company, or building a production facility. The primary goal is to secure a competitive edge and enhance market position.

One of the key theories behind FDI for strategic advantage is the concept of 'Market Expansion'. By investing in foreign markets, companies can tap into new customer bases and expand their reach. This is particularly beneficial for businesses that have already established a strong presence in their domestic market and now seek to diversify and grow internationally. For instance, a technology company might set up a research and development center in a foreign country to access local talent and tap into emerging markets, thereby gaining a competitive edge over domestic competitors.

Another strategy is 'Resource Acquisition', where FDI is used to secure resources that are not readily available in the home country. This could include raw materials, skilled labor, or specific technologies. For example, a manufacturing company might invest in a foreign country to access cheaper raw materials or a more skilled workforce, which can reduce production costs and improve efficiency, ultimately giving them a competitive advantage over local competitors.

'Strategic Alliances' is another FDI approach. This involves forming partnerships with local companies to gain a mutual advantage. By combining resources, expertise, and market knowledge, these alliances can lead to joint ventures, co-development projects, or even the creation of new products or services. Such collaborations can help businesses navigate complex foreign markets, share risks, and ultimately gain a competitive edge over their rivals.

Furthermore, FDI can be a powerful tool for 'Innovation and Technology Transfer'. By investing in foreign markets, companies can access new ideas, research, and development capabilities. This is especially valuable for industries driven by technological advancements. For instance, a pharmaceutical company might set up a research facility in a country with a strong scientific community to accelerate drug discovery and development, thereby staying ahead of the competition.

In summary, FDI for strategic advantage involves a range of activities, from market expansion and resource acquisition to forming strategic alliances and fostering innovation. Each of these strategies can contribute to a company's ability to gain a competitive edge, enhance its market position, and ultimately succeed in the global marketplace. Understanding these theories and implementing them effectively can be a game-changer for businesses aiming to dominate their respective industries.

Cash App Investing: Dividends and Your Money

You may want to see also

Political Economy Factors: Examines the impact of political and economic conditions on FDI

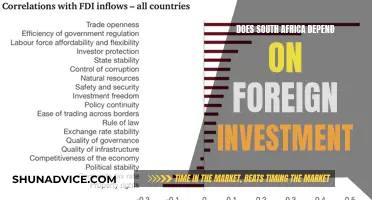

The political and economic environment plays a crucial role in shaping Foreign Direct Investment (FDI) decisions, and understanding these factors is essential for businesses and policymakers alike. Political economy analysis provides a framework to assess how political and economic conditions influence investment choices, especially in the context of FDI. This approach recognizes that FDI is not solely driven by economic factors but is also significantly impacted by the political and regulatory landscape in which it operates.

In the realm of political economy, several key factors come into play. Firstly, political stability is paramount. Investors seek environments with consistent and predictable policies, as sudden changes in government or frequent policy shifts can deter FDI. Countries with a history of political unrest or frequent changes in leadership may face challenges in attracting foreign investors, as uncertainty often discourages long-term commitments. Moreover, the rule of law and the protection of property rights are critical. Investors need to know that their rights and assets are secure, and a robust legal framework that enforces contracts and protects investors is essential.

Economic conditions also significantly influence FDI. Macroeconomic stability is a primary consideration, as volatile exchange rates, high inflation, and unpredictable fiscal policies can create a hostile investment climate. Investors often seek countries with stable economies, low inflation rates, and sustainable fiscal policies. Additionally, the availability of skilled labor and the overall business environment are vital. A country with a large, educated workforce and a supportive business climate can attract FDI, especially in sectors requiring specialized skills or innovative capabilities.

Furthermore, the impact of political ideology and governance cannot be overlooked. Different political ideologies may lead to varying approaches to economic management, taxation, and regulation. For instance, a left-leaning government might prioritize social welfare and environmental regulations, which could attract impact-driven investors but potentially deter those seeking more traditional economic incentives. On the other hand, a right-leaning government might focus on free-market policies and deregulation, making the country more appealing to certain types of investors.

In summary, political economy factors are integral to understanding FDI dynamics. They encompass political stability, the rule of law, economic stability, labor market conditions, and the influence of political ideology. By considering these factors, investors can make more informed decisions, and policymakers can design strategies that foster a conducive environment for FDI, ultimately contributing to economic growth and development. This analysis highlights the intricate relationship between politics, economics, and investment, emphasizing the need for a comprehensive approach to FDI promotion and regulation.

A Simple Guide to Scottrade's S&P 500 Investment

You may want to see also

Frequently asked questions

Foreign direct investment theories primarily focus on understanding the motivations and drivers behind a company's decision to invest in a foreign market. The most prominent theories include the Internalization Theory, the Resource-Based View, and the Market Expansion Theory. Internalization Theory suggests that firms engage in FDI to integrate production processes and gain control over resources that are not available domestically. The Resource-Based View emphasizes the importance of unique resources and capabilities that multinational corporations (MNCs) possess, allowing them to create value through FDI. Market Expansion Theory posits that FDI is driven by the desire to access new markets and expand customer reach.

The Internalization Theory, proposed by John Dunning, argues that FDI is a strategic response to the limitations of the domestic market. MNCs seek to internalize production activities and resource inputs that are not available in their home country. By establishing foreign operations, firms can gain control over these resources, reduce transaction costs, and enhance their competitive advantage. This theory highlights the importance of market, resource, and asset specificity in FDI decisions.

The Resource-Based View (RBV) is a perspective that emphasizes the role of unique resources and capabilities in a firm's competitive advantage. In the context of FDI, RBV suggests that MNCs invest abroad to acquire or leverage resources that are not readily available in their home market. These resources could include natural resources, skilled labor, or specific technologies. By accessing these resources through FDI, firms can create value, innovate, and sustain a competitive edge in both domestic and international markets.