Foreign Direct Investment (FDI) is a powerful tool for economic growth and development, but its strategic implications extend far beyond mere financial gains. This paragraph explores the multifaceted impact of FDI, examining how it influences a country's economic, political, and social landscape. From fostering technological advancements and creating jobs to shaping international relations and impacting local communities, FDI's strategic implications are both complex and far-reaching. Understanding these implications is crucial for policymakers, businesses, and investors alike, as they navigate the intricate web of global economic interactions and strive to maximize the benefits while mitigating potential risks.

What You'll Learn

- Political Influence: FDI can shape a country's political landscape through economic ties and corporate lobbying

- Economic Growth: It drives GDP, creates jobs, and fosters technological advancement

- Market Access: Investors gain entry to new markets, expanding their global presence

- Resource Acquisition: FDI enables companies to secure resources, ensuring long-term sustainability

- Geopolitical Shifts: Foreign investment can alter power dynamics and international relations

Political Influence: FDI can shape a country's political landscape through economic ties and corporate lobbying

Foreign Direct Investment (FDI) has the potential to significantly influence a country's political landscape, often in ways that extend beyond the economic realm. One of the primary mechanisms through which this influence is exerted is through economic ties. When a foreign company invests in a country, it establishes a direct link between the two nations, fostering a relationship that can have long-lasting effects. These economic ties can create a sense of interdependence, where the host country's political decisions may be influenced by the economic interests of the foreign investor. For instance, a foreign company might invest in a country's infrastructure, creating jobs and stimulating economic growth. In return, the host government may be inclined to support policies that benefit the investor, such as tax incentives or regulatory relaxations, to ensure the sustainability and growth of the investment. This dynamic can lead to a form of political influence where the government's policies are shaped by the economic power of the foreign entity.

Corporate lobbying is another critical aspect of FDI's political influence. As foreign companies invest in a country, they often establish a local presence, which includes setting up offices, hiring local staff, and engaging in business operations. This presence can translate into a powerful lobbying force, as these companies have a vested interest in the country's political and regulatory environment. They may use their resources to influence policy-making, often advocating for regulations that favor their business model. For example, a technology company might lobby for relaxed data privacy laws, arguing that such laws could hinder innovation and competitiveness. This lobbying effort can significantly impact the political agenda, as governments may be pressured to adopt policies that align with the interests of these powerful investors.

The political influence of FDI is not limited to the immediate economic benefits but can also have long-term strategic implications. Over time, the economic ties created by FDI can lead to the formation of powerful business lobbies that have a significant say in political decision-making. These lobbies can shape the country's economic policies, trade agreements, and even its foreign policy, especially when these policies align with the interests of the foreign investors. For instance, a country heavily reliant on foreign investment in key industries might be more inclined to follow the investment strategies of these foreign entities, potentially leading to a form of economic colonialism where the host country's political sovereignty is compromised.

Furthermore, the political influence of FDI can also be observed in the realm of international relations. When a country attracts significant FDI from a particular foreign nation, it may find itself in a position where its political decisions are scrutinized and potentially influenced by the investor's home country. This can lead to a complex web of geopolitical relationships, where the host country's political independence is tested by the economic power of the foreign investor. In extreme cases, this influence can shape the country's foreign policy, potentially leading to a shift in alliances or a more aligned stance with the investor's home nation.

In summary, FDI's strategic implications extend far beyond economic growth. The political influence of foreign investors, through economic ties and corporate lobbying, can significantly shape a country's political landscape. This influence can lead to the adoption of policies that favor foreign investors, potentially impacting the country's economic, social, and political development. Understanding these dynamics is crucial for policymakers and economists alike, as it highlights the need for a balanced approach to FDI, one that maximizes economic benefits while safeguarding the host country's political sovereignty and long-term strategic interests.

Unlocking FDI: Understanding Key Determinants for Global Investment

You may want to see also

Economic Growth: It drives GDP, creates jobs, and fosters technological advancement

Foreign Direct Investment (FDI) plays a pivotal role in fostering economic growth and development, particularly in the context of strategic implications. When foreign investors channel their capital into a host country, it has a ripple effect on the economy, driving GDP growth, creating jobs, and catalyzing technological advancement.

One of the most direct impacts of FDI is its contribution to GDP growth. FDI brings in capital that can be utilized for various economic activities, including infrastructure development, manufacturing, and service industries. This influx of investment stimulates production, increases output, and boosts the overall economic activity, thereby driving up the GDP. For instance, a foreign investor setting up a manufacturing plant in a developing country not only increases the country's production capacity but also generates additional economic activity through the purchase of raw materials, transportation, and other supporting services.

The creation of jobs is another significant outcome of FDI. As foreign companies invest in a country, they often establish new operations or expand existing ones, leading to an increase in the number of employees. This is particularly beneficial in sectors where local labor markets are underdeveloped or where specific skills are in high demand. For example, a technology company setting up a research and development center in a country can create high-skilled jobs, contributing to the local workforce's skill development and enhancing the country's human capital.

Moreover, FDI fosters technological advancement and innovation. Foreign investors often bring advanced technologies, management practices, and expertise to the host country. This transfer of knowledge can lead to the adoption of more efficient production methods, the development of new products, and the improvement of existing ones. For instance, a foreign auto manufacturer might introduce cutting-edge manufacturing techniques, leading to higher-quality vehicles and potentially attracting more FDI in the automotive sector.

In addition, the technological spillover effects of FDI can have a broader impact on the host country's economy. Local businesses can benefit from the advanced technologies and practices introduced by foreign investors through knowledge transfer, joint ventures, and partnerships. This can lead to the development of new industries, the enhancement of existing ones, and the overall improvement of the country's economic competitiveness.

In summary, FDI is a powerful catalyst for economic growth, with its strategic implications extending to GDP growth, job creation, and technological advancement. The influx of foreign capital and the associated transfer of knowledge and expertise can significantly contribute to a country's economic development, making it an essential tool for policymakers aiming to boost their nation's economic performance.

Choosing the Right Investment Broker: Key Factors to Consider

You may want to see also

Market Access: Investors gain entry to new markets, expanding their global presence

Foreign Direct Investment (FDI) plays a pivotal role in facilitating market access for investors, enabling them to expand their global footprint and tap into new markets. This strategic move is a powerful tool for businesses aiming to increase their international presence and gain a competitive edge in the global marketplace. By investing directly in foreign markets, companies can establish a physical presence, which is often a prerequisite for successful market penetration.

One of the primary benefits of FDI in terms of market access is the ability to overcome geographical barriers. Investors can enter regions that were previously inaccessible due to distance, cultural differences, or regulatory constraints. For instance, a technology company might invest in a foreign market to set up a research and development center, allowing them to access a talented local workforce and tap into new markets for their innovations. This direct involvement in the host country's economy can lead to a better understanding of local consumer preferences and business practices, enabling the investor to tailor their products or services accordingly.

The strategic implications of FDI in market access are far-reaching. It allows investors to establish a local presence, which can lead to increased brand visibility and customer trust. By setting up operations in a new market, companies can directly engage with local customers, gather valuable market insights, and adapt their strategies to suit the specific needs and preferences of the region. This localized approach often results in higher customer satisfaction and loyalty, which are essential for long-term success in international markets.

Furthermore, FDI can facilitate the transfer of knowledge, technology, and skills across borders. Investors bring their expertise and best practices, which can enhance the capabilities of local businesses and contribute to economic development in the host country. This knowledge transfer can lead to improved productivity, innovation, and competitiveness, benefiting both the investor and the local economy. As a result, FDI becomes a catalyst for economic growth and market expansion, creating a win-win situation for all parties involved.

In summary, FDI is a powerful strategy for investors seeking to expand their global presence and access new markets. It provides a direct pathway to establish a physical presence, overcome geographical barriers, and gain a deeper understanding of local markets. By leveraging FDI, businesses can increase their competitiveness, foster economic development, and create sustainable value in international markets. This strategic approach to market access is essential for companies aiming to thrive in today's globalized business environment.

Zinser Investment: Relevant Cash Flows and Their Impact

You may want to see also

Resource Acquisition: FDI enables companies to secure resources, ensuring long-term sustainability

Foreign Direct Investment (FDI) plays a pivotal role in resource acquisition, offering companies a strategic avenue to secure essential assets and ensure long-term sustainability. This process involves companies investing in foreign markets, either by establishing a physical presence or acquiring assets, which can significantly enhance their resource portfolio.

One of the primary benefits of FDI in resource acquisition is the access it provides to raw materials and natural resources. Many industries, such as manufacturing, energy, and agriculture, rely heavily on these resources. By investing in foreign markets, companies can tap into regions rich in these resources, ensuring a steady supply for their operations. For instance, a manufacturing company might invest in a country with abundant mineral deposits, securing a consistent supply of raw materials for its production processes. This strategic move not only reduces the risk of resource scarcity but also provides a competitive edge by ensuring a reliable and consistent supply chain.

FDI also facilitates the acquisition of specialized skills and knowledge. When companies invest in foreign markets, they often gain access to local expertise and talent pools. This is particularly valuable in sectors where technical knowledge and specific skills are essential. For example, a technology company might establish a research and development center in a country with a strong STEM (Science, Technology, Engineering, and Mathematics) education system, allowing them to tap into a talented workforce and foster innovation. This strategic resource acquisition can lead to the development of cutting-edge technologies and processes, giving the company a significant advantage in the market.

Furthermore, FDI enables companies to diversify their resource base, reducing the risks associated with over-reliance on a single source. By investing in multiple countries and regions, companies can create a more resilient and sustainable resource portfolio. This diversification strategy is crucial for long-term success, as it mitigates the impact of potential disruptions in any one region, ensuring a consistent supply of resources.

In summary, FDI is a powerful tool for resource acquisition, offering companies the opportunity to secure essential assets, gain access to specialized knowledge, and diversify their resource base. By strategically investing in foreign markets, companies can ensure long-term sustainability, reduce risks, and maintain a competitive edge in their respective industries. This approach to resource acquisition is a key consideration for businesses aiming to establish a robust and resilient global presence.

Unraveling the Metrics: Measuring Foreign Direct Investment

You may want to see also

Geopolitical Shifts: Foreign investment can alter power dynamics and international relations

Foreign direct investment (FDI) is a powerful tool that can significantly impact a country's geopolitical landscape and international relations. When a foreign entity invests in a host country, it often leads to a shift in power dynamics, influencing the political, economic, and social spheres of both nations involved. This phenomenon can have both positive and negative consequences, shaping the global order in various ways.

One of the most notable effects of FDI is the potential for a country to gain or strengthen its economic power. Foreign investors bring capital, technology, and expertise, which can boost the host country's infrastructure, create jobs, and stimulate economic growth. For instance, a foreign company investing in a developing nation's manufacturing sector can lead to the establishment of new factories, providing employment opportunities and potentially reducing poverty rates. This economic growth can, in turn, lead to increased political influence as the host country becomes more prosperous and potentially more assertive on the global stage.

However, the influx of foreign investment can also lead to geopolitical shifts and altered power dynamics. As foreign entities gain a foothold in a country's economy, they may acquire significant influence over its decision-making processes. This could result in a loss of sovereignty, especially if the host country's policies and regulations become heavily dependent on the foreign investor's interests. For example, a foreign oil company investing in a region's energy sector might have a say in the country's energy policies, potentially impacting its ability to make independent decisions regarding resource management and environmental regulations.

Moreover, FDI can create or intensify geopolitical rivalries and alliances. Countries may compete to attract foreign investors, offering favorable policies and incentives, which can lead to a race to the bottom in terms of regulatory standards and environmental protections. On the other hand, strategic partnerships can form between nations, where one country's investment in another's critical sectors strengthens their diplomatic ties. These alliances can shift the balance of power in the region, potentially impacting international relations and global security.

In summary, foreign direct investment has far-reaching implications for geopolitical shifts and international relations. It can empower nations economically, potentially leading to increased political influence, but it may also result in a loss of sovereignty and the formation of complex power dynamics. Understanding these strategic implications is crucial for policymakers and global leaders to navigate the challenges and opportunities presented by FDI, ensuring that its impact is managed to promote sustainable development and maintain a balanced global order.

Angel Investing: A Founder's Guide to Success

You may want to see also

Frequently asked questions

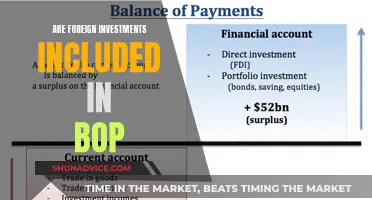

Foreign direct investment has significant strategic implications for host nations, primarily in terms of economic development and industrialization. FDI can lead to the transfer of capital, technology, and expertise from foreign investors to the host country, fostering local industrialization and creating new job opportunities. This can be particularly beneficial for developing economies, as it can accelerate their economic growth and reduce dependency on traditional aid.

FDI often influences a country's economic policies and governance structures. Host countries may need to implement favorable regulations and policies to attract foreign investors, which can include tax incentives, streamlined business procedures, and improved infrastructure. These changes can have long-term effects on the country's economic landscape, potentially improving its business environment and attracting further investment.

While FDI can bring numerous benefits, it may also raise security concerns. Foreign investors might gain significant control over critical infrastructure or industries, potentially impacting national security. Host countries should carefully assess the strategic implications of FDI, especially in sectors like energy, telecommunications, and transportation, to ensure that foreign investments do not compromise their sovereignty or critical assets.

Maximizing the benefits of FDI while minimizing risks requires a strategic approach. Host countries can encourage FDI through transparent and well-regulated investment promotion agencies, providing clear guidelines and support to investors. Diversifying investment portfolios across various sectors and countries can also reduce risks. Additionally, implementing robust environmental and social impact assessments can help identify and address potential issues related to FDI.