The Zinser Investment's relevant cash flows are its cash inflows and outflows, which are recorded in its cash flow statement. This statement is one of three main financial statements and is essential for understanding the financial health of a company. It is divided into three sections: cash flow from operations, cash flow from investing, and cash flow from financing. The cash flow statement details the sources and uses of cash, including the purchase or sale of fixed assets, loans made or received, and payments related to mergers and acquisitions. It is important to note that negative cash flow does not always indicate poor financial health, as it may be due to investments in long-term growth strategies.

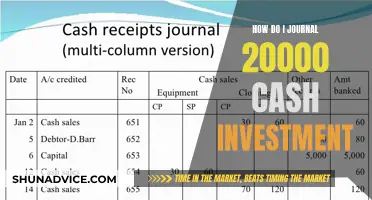

| Characteristics | Values |

|---|---|

| Definition | Cash flow from investing activities |

| Formula | Net cash flow = total cash inflows – total cash outflows |

| Types of Transactions | Acquisition and disposal of long-term assets, investing in securities, acquiring other companies, loans made to and received from third parties |

| Types of Activities | Capital expenditure, proceeds from sales of fixed assets, purchase of investment securities, bonds, debentures, and stock, proceeds from sales of investment securities, bonds, debentures, and stock, acquisition of another company, proceeds from sales of other business units |

| Exclusions | Short-term investments or cash equivalents, cash flows from financing activities, cash received from sales of goods and services, payments made to vendors and suppliers, tax-related payments, payment of dividends, expenses related to asset depreciation, debt and equity financing, income and expenses related to business operations |

| Calculation Steps | 1. Gather financial statements; 2. Determine the reporting period; 3. Choose the method (direct or indirect); 4. Identify cash transactions for investments; 5. Calculate net cash flow from investing activities; 6. Combine all sections; 7. Reconcile with beginning cash |

What You'll Learn

Capital investments and budgeting

Capital investments are long-term investments where the assets involved have useful lives of multiple years. For example, constructing a new production facility, investing in machinery, or purchasing equipment are all capital investments. Capital budgeting is a method used to estimate the financial viability of a capital investment over its lifetime.

Unlike other types of investment analysis, capital budgeting focuses on cash flows rather than profits. It involves identifying the inflows and outflows of cash associated with the investment. For instance, debt principal payments are included in capital budgeting because they are cash flow transactions, whereas non-cash expenses like depreciation are not.

There are several steps involved in capital budgeting:

- Identify long-term goals.

- Identify potential investment proposals to meet these goals.

- Estimate and analyze the relevant cash flows of the investment proposals.

- Determine the financial feasibility of each investment proposal using capital budgeting methods such as the Payback Period, Net Present Value, Internal Rate of Return, etc.

- Choose the projects to implement.

- Implement the selected projects.

- Monitor the projects and make adjustments as needed.

When assessing the relevant cash flows for an investment, it is important to consider the initial outlay, cash flows from taking on the project, terminal costs or value, and the scale and timing of the project. Positive incremental cash flow, or an increase in operating cash flow from taking on a new project, is a good indication that an organization should invest in that project.

Overall, capital budgeting is a valuable tool for businesses to assess the financial viability of long-term investments and make informed decisions about allocating resources.

Cashing in on Treasury Investment Growth: Receipt Redemption Guide

You may want to see also

Cash flow analysis

The analysis focuses on the cash available to a company to cover operating expenses, pay down debt, and reinvest in growth. A company's cash flow statement is divided into three sections: cash flow from operations, cash flow from investing, and cash flow from financing.

The cash flow from operations includes cash received from the sale of goods and services, salary and wage payments, and payments to suppliers. It reflects the cash generated from a company's core business activities.

The cash flow from investing includes cash inflows and outflows related to the purchase and sale of long-term assets, such as property, plant, and equipment. It also includes proceeds from the sale of a division or cash outflows from mergers and acquisitions.

The cash flow from financing includes cash received from investors and banks, as well as cash paid to shareholders in the form of dividends or stock repurchases. It also includes cash used to repay debt.

When conducting a cash flow analysis, it is important to examine the net cash flow, which is the sum of the net cash amounts from each of the three sections. A company with a consistently positive cash flow is in a strong financial position and indicates efficient operations.

Additionally, cash flow analysis involves calculating various ratios, such as the operations/net sales ratio, free cash flow, and comprehensive free cash flow coverage. These ratios provide valuable insights into a company's financial health and stability.

By analyzing the cash flow statement and calculating relevant ratios, investors can make informed decisions about potential investments, assessing the financial vibrancy, and stability of a company.

Invest Cash: Safe, Liquid Strategies for Beginners

You may want to see also

Cash flow statement

A cash flow statement is a crucial financial statement that provides insights into a company's financial health and operational efficiency. It summarises the inflow and outflow of cash, indicating how well a company manages its cash position and generates cash to meet its financial obligations. The statement is divided into three main sections: cash flow from operations, cash flow from investing, and cash flow from financing.

Cash Flow from Operating Activities

This section reflects the sources and uses of cash from a company's core business activities, including the sale of goods and services, payments to suppliers, salary and wage payments, and other operating expenses. It also includes changes in cash, accounts receivable, depreciation, inventory, and accounts payable.

Cash Flow from Investing Activities

This part of the cash flow statement focuses on the sources and uses of cash from a company's investments. It includes purchases or sales of assets, loans made or received, and payments related to mergers and acquisitions. Any changes in equipment, assets, or investments fall under this category. Typically, changes in cash from investing activities are considered cash outflows, as cash is used to acquire new equipment, buildings, or short-term assets. However, when a company divests an asset, it is considered a cash inflow.

Cash Flow from Financing Activities

This section captures the sources and uses of cash from investors and financial institutions, as well as payments to shareholders. It includes cash received from issuing stocks or debt, cash spent on stock repurchases, and repayment of debt principal. Changes in cash from financing activities are considered cash inflows when capital is raised and cash outflows when dividends are paid.

The cash flow statement is prepared using two methods: the direct method and the indirect method. The direct method involves listing all cash receipts and payments during the reporting period, while the indirect method starts with net income and adjusts for changes in non-cash transactions.

The statement is a valuable tool for investors, creditors, and analysts, as it provides a clear picture of a company's liquidity, financial stability, and ability to meet its financial obligations. It helps assess whether a company is on solid financial ground and aids in making informed investment decisions.

Where Should Your Cash Go: Mortgage or Investment?

You may want to see also

Long-term cash flow

The long-term cash flow section of the cash flow statement provides insights into a company's investment performance and capital allocation decisions. It covers transactions such as acquiring and disposing of assets, investing in securities, and acquiring other companies. These activities can have a significant impact on a company's financial health and must be carefully managed.

Positive long-term cash flow indicates that a company is generating more cash from its investments than it is spending. This suggests effective management of investments and strategic investments to enhance future growth and profitability. On the other hand, negative cash flow in this area may not always be a negative indicator. It could mean that the company is investing heavily in long-term assets or research and development, which could lead to significant growth and gains in the long term.

To calculate long-term cash flow, one would need to consider the purchases or sales of property, equipment, and other long-term assets, as well as investments in marketable securities. The formula for calculating long-term cash flow is:

By analyzing long-term cash flow, investors and analysts can gain insights into a company's financial stability, capital expenditure strategies, and long-term financial health. It is a critical factor in determining the overall financial viability and potential of a company.

Gross PPE Cash Flow: Investing Strategies for Success

You may want to see also

Calculating cash flow

There are two main methods for calculating cash flow: the direct method and the indirect method. The direct method is often used by small businesses that employ the cash basis accounting method. It involves listing all cash receipts and payments during the reporting period, including cash paid to suppliers, cash receipts from customers, and salaries paid. This method is straightforward and presents a clear picture of cash flow.

On the other hand, the indirect method is more common among larger companies that use the accrual basis accounting method. This method starts with net income and makes adjustments for changes in non-cash transactions. It identifies increases and decreases in asset and liability accounts, adding or subtracting these differences from the net income figure to determine accurate cash inflows and outflows.

The cash flow statement is divided into three main sections: cash flow from operations, cash flow from investing, and cash flow from financing. Each section provides insights into different sources and uses of cash.

Cash flow from operations reflects the cash generated from a company's core business activities, such as sales and payments for goods and services. It includes receipts from sales, payments to suppliers, salary and wage payments, and other operating expenses. It also considers changes in accounts receivable, inventory, accounts payable, and other working capital accounts.

Cash flow from investing focuses on long-term uses of cash and involves any inflows or outflows from a company's investments. This includes the purchase or sale of fixed assets, such as property, plant, and equipment, as well as proceeds from mergers or acquisitions. Any changes in equipment, assets, or investments fall under this category.

Cash flow from financing pertains to the sources of cash from investors and banks, as well as payments to shareholders. It includes cash received from issuing stocks or debt and cash spent on debt repayment or stock repurchases. It also covers dividends and interest payments.

To calculate the overall change in cash and cash equivalents for a specific period, the net cash flows from operating, investing, and financing activities are combined. This calculation helps determine the liquidity and financial health of a company, providing valuable insights for investors and creditors.

Additionally, when assessing potential investments or projects, companies may calculate incremental cash flow. This metric represents the potential increase or decrease in cash flow related to accepting a new project or investing in a new asset. A positive incremental cash flow indicates that the investment is expected to be more profitable than the expenses incurred, making it a favourable option.

Cash is Not King: Exploring Investment Alternatives

You may want to see also

Frequently asked questions

The relevant cash flows for the Zinser investment are the inflows and outflows of cash from the investment. This includes cash from the sale of goods and services, payments made to suppliers, salary and wage payments, and other operating expenses. It's important to consider both the direct and indirect methods of calculating cash flow, which differ in how they determine cash inflows and outflows.

To calculate the relevant cash flows for the Zinser investment, you can use the following formula:

> ICF = Revenues – Expenses – Initial Cost

Where:

- ICF = Incremental Cash Flow

- Revenues = Projected revenues from the investment

- Expenses = Projected expenses associated with the investment

- Initial Cost = The initial cash outlay required for the investment

While analysing relevant cash flows is a good tool for assessing the potential profitability of an investment, it should not be the only resource for making investment decisions. Positive incremental cash flow may indicate that an investment is profitable, but it's important to consider other factors and seek a more comprehensive understanding.