Investment consultants advise clients on how to invest their money to reach their financial goals. They can work with individuals or businesses, helping them to develop investment strategies and maintain their portfolios. Investment consultants are usually paid a base salary, and/or through fees and commissions. So, how much do they make? Well, it depends on a variety of factors, including qualifications, experience, and the type of institution they work for.

| Characteristics | Values |

|---|---|

| Average annual base salary | $73,057 |

| Typical global total compensation | $131,000 |

| Typical base annual salary | $106,000 |

What You'll Learn

- Investment consultants earn a median salary of $79,000 annually

- Qualifications and experience: Bachelor's degree and work experience in economics, accounting, business administration, finance or a related field

- Types of investment consultants: CFP, CFA, RIA, ChFC

- Investment consultant responsibilities: helping clients reach their financial goals by developing investment strategies and maintaining portfolios

- How to become an investment consultant: Bachelor's degree and relevant work experience are required, along with licenses to advise clients?

Investment consultants earn a median salary of $79,000 annually

Investment consultants advise their clients on how to invest their money to reach their financial goals. They may work with individuals or institutions, and they must perform research and analysis on market trends, create financial forecasts, and assess the goals of their clients. Building long-term relationships with clients is an important part of the job, as this helps to gain their trust.

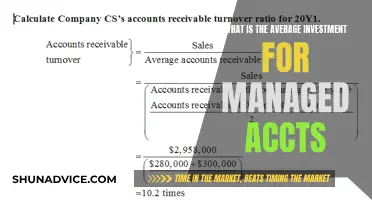

Investment consultants typically receive a combination of base salary, fees, and commissions. According to PayScale, the average annual base salary for an investment consultant is $73,057. This figure can vary depending on experience, qualifications, and the specific role. For example, a 2019 CFA Institute compensation study found that investment consultants reported a typical global total compensation of $131,000, including a base annual salary of $106,000.

The closest occupation to an investment consultant, according to the U.S. Bureau of Labor Statistics, is a personal financial advisor. The median pay for this role in 2020 was $42.95 per hour or $89,330 per year. The job market for personal financial advisors is expected to grow by 5% from 2020 to 2030, indicating increasing demand for these financial services.

It is important to note that salaries can vary based on geographic location, the size and type of the company, and other factors. Additionally, investment consultants may have the opportunity to increase their earnings through performance-based incentives or by taking on additional responsibilities.

Overall, investment consultants can expect to earn a competitive salary, reflecting the specialized knowledge and skills required for this role in the financial industry.

Smart Investment Decisions: Strategies for Success

You may want to see also

Qualifications and experience: Bachelor's degree and work experience in economics, accounting, business administration, finance or a related field

To become an investment consultant, you will typically need a bachelor's degree in a related field such as economics, accounting, business administration, finance, or a similar subject.

A degree in these areas will provide you with the necessary knowledge and skills to understand the financial industry and advise clients effectively. It is also beneficial to have detailed knowledge of investment theories and practices, financial markets, and various business models. This can be gained through a degree with coursework covering economics, accounting, or business administration.

In addition to a bachelor's degree, some employers may prefer candidates with a master's degree, often an MBA. This can help increase your salary and provide a more comprehensive understanding of the field.

Beyond your academic qualifications, gaining work experience in economics, accounting, business administration, or finance is crucial. On-the-job training can provide you with the practical skills and knowledge needed to succeed as an investment consultant. This includes duties such as analyzing investment performance, monitoring financial market trends, and recommending investments to clients.

Some employers may also prefer candidates with specific licenses or certifications, such as the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) designation. These certifications demonstrate a comprehensive understanding of the field and can make you a more competitive candidate.

Overall, a bachelor's degree and work experience in economics, accounting, business administration, or finance are the essential qualifications and experience needed to become a successful investment consultant.

Tracking Investments: A Guide for Indians

You may want to see also

Types of investment consultants: CFP, CFA, RIA, ChFC

Investment consultants are financial professionals who advise clients on financial goals and help them reach their financial objectives. They can work with individuals or larger business clients, and they often develop long-term relationships with their clients.

Certified Financial Planner (CFP)

CFPs assist individuals with their finances and financial planning. They can help with a wide range of needs, including personal financial planning, tax planning and preparation, and retirement planning. To become a CFP, individuals must complete a rigorous certification process, including passing challenging exams, and meet strict standards set by the Certified Financial Planner Board of Standards. CFPs are required to have a bachelor's degree or higher and several years of financial planning experience. They must also complete a board-registered program or hold another credential, such as a CPA or CFA.

Chartered Financial Analyst (CFA)

CFAs are financial professionals certified by the CFA Institute to help value securities that investors buy and sell. They work in the field of institutional money management and stock analysis, providing research and ratings on various forms of investments. To obtain the CFA designation, candidates must pass a challenging three-part exam, gain at least 4,000 hours of work experience over three years, and meet high ethical and professional standards.

Registered Investment Advisor (RIA)

RIAs are companies registered with the U.S. Securities and Exchange Commission (SEC) or individual states. They employ individual financial advisors who have the ability to make investment decisions on behalf of their clients. These advisors are paid for their services by charging fees, either at an hourly or flat rate or as a percentage of assets under management.

Chartered Financial Consultant (ChFC)

ChFCs offer services that overlap with CFPs but have specialized knowledge in estate planning and employee benefits. They can work with individuals or organizations, providing guidance on retirement planning, corporate investment strategies, and administration of employee benefits. ChFCs are certified by the American College of Financial Services and are required to complete several online self-study courses and a final exam. They must also maintain their knowledge with 30 hours of continuing education every two years.

Equity Investments: Do They Cost Money?

You may want to see also

Investment consultant responsibilities: helping clients reach their financial goals by developing investment strategies and maintaining portfolios

Investment consultants are financial professionals who help clients reach their financial goals by developing investment strategies and maintaining portfolios. They advise clients, including asset owners, fund managers, and trustees, on various aspects of investing, such as which funds, asset classes, and countries to invest in as part of their investment and asset allocation strategy.

One of the key responsibilities of investment consultants is formulating investment strategies for their clients. They work closely with clients to understand their unique financial goals and objectives, whether they are individuals or large corporations. Based on these goals, investment consultants conduct research and analysis on market trends, create financial forecasts, and suggest suitable investment opportunities that align with the client's risk tolerance and financial objectives.

To develop effective investment strategies, investment consultants need to have a strong understanding of investment theories and practices, financial markets, and industry business models. They also need to stay updated with legislative and regulatory contexts within which they operate. Additionally, knowledge of tax planning, asset allocation, risk management, and retirement planning enables consultants to cater to a diverse range of clients at different life stages and financial circumstances.

Another crucial aspect of an investment consultant's role is portfolio construction and maintenance. They assist clients in building and maintaining investment portfolios that align with their goals and risk appetite. This involves regularly monitoring investment markets and client portfolios, managing risk, and making necessary adjustments to the investment strategies over time. For example, as a client approaches retirement age, an investment consultant might recommend switching to lower-risk investments to preserve their financial stability.

Effective communication and client relationship management are also essential for investment consultants. They need to build long-lasting relationships with clients, gain their trust, and keep them informed about any changes to their investment strategies. Clear and transparent communication ensures that clients understand the recommendations and strategies being implemented to achieve their financial goals.

Solar Power for Homes: Is It Worth the Investment?

You may want to see also

How to become an investment consultant: Bachelor's degree and relevant work experience are required, along with licenses to advise clients

To become an investment consultant, you'll need a bachelor's degree, relevant work experience, and a license to advise clients.

A bachelor's degree in economics, finance, accounting, or a related field is typically required for a career as an investment consultant. Some investment consultant roles may require a master's degree, such as an MBA. In addition to a degree, you will need relevant work experience in the financial industry. This can include experience in tax planning, asset allocation, risk management, retirement planning, or estate planning.

Investment consultants are also required to obtain the necessary licenses to advise clients. In the United States, this includes registering with the Securities and Exchange Commission (SEC) and obtaining licenses from the Financial Industry Regulatory Authority (FINRA). To obtain these licenses, you will need to pass the required exams, such as the FINRA Series 7 Exam and the Uniform Investment Advisor Law Examination.

Investment consultants advise clients on how to invest their money to achieve their financial goals. They work with individuals or businesses to formulate investment strategies, construct and maintain investment portfolios, and monitor their clients' investments over time. Strong analytical, problem-solving, and communication skills are essential for this role, as consultants need to explain complex financial concepts to their clients clearly and effectively.

According to PayScale, the average annual base salary for an investment consultant is $73,057. However, a 2019 CFA Institute compensation study reported a higher global total compensation of US$131,000 (US$106,000 base annual salary) for investment consultants.

Diversity Investments: Managers' Role in Creating Inclusive Spaces

You may want to see also

Frequently asked questions

An investment consultant is a financial professional who advises clients on financial goals and helps them develop investment strategies to meet their financial objectives.

The average salary for an investment consultant varies depending on the source. According to PayScale, the average annual base salary is $73,057. Zippia reports a median salary of $79,000 annually, while the CFA Institute found a higher global total compensation of $131,000 ($106,000 base annual salary). The U.S. Bureau of Labor Statistics (BLS) reported a median salary of $99,590 for investment consultants and related professions in 2023.

A bachelor's degree in a relevant field such as finance, economics, or business is typically required. Some employers may prefer a master's degree. Relevant work experience in finance is also necessary, with some sources stating a range of 2-8 years.

Investment consultants should possess strong analytical, problem-solving, and math skills. Excellent communication and interpersonal skills are also crucial, as consultants need to explain complex financial concepts to clients clearly and effectively.

The job market for personal financial consultants is expected to grow in the next decade. According to data from 2023, there were approximately 280,616 positions for investment consultants in the United States, and a 16.1% increase in jobs is projected over the next 10 years.