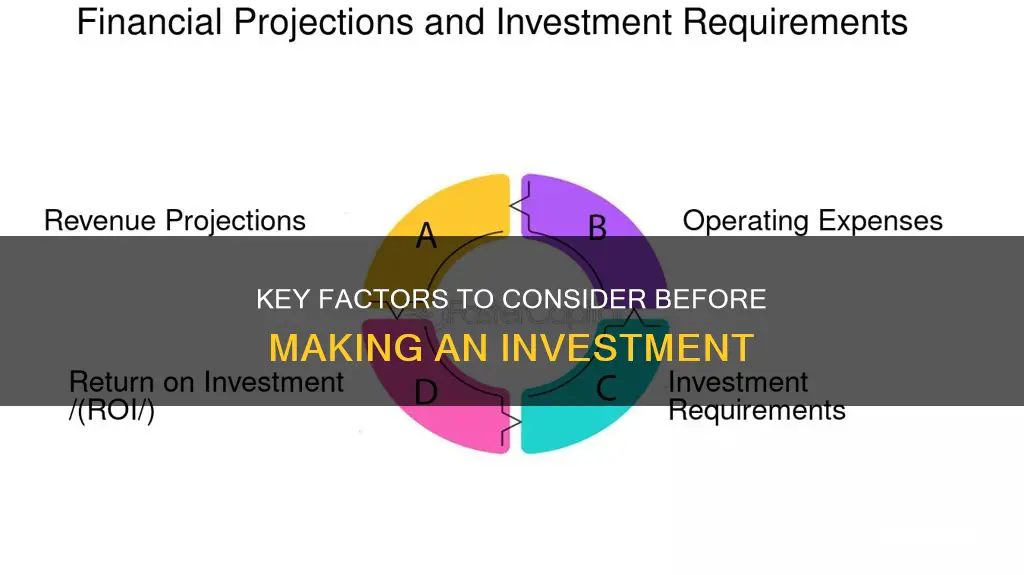

Investing is the act of allocating resources, usually capital or money, with the expectation of generating income, profit, or gains. Before you start investing, it's important to consider your financial goals, time horizon, and risk tolerance. You should also evaluate your comfort with taking on risk and understand that all investments involve some degree of risk.

There are a few main choices you need to make when it comes to investing: what type of account to use, how much money to invest, and what to invest it in. You can choose from various investment accounts, such as brokerage accounts, 401(k) plans, and individual retirement accounts (IRAs). The amount of money you need to start investing can vary depending on your financial situation and goals, but it's generally recommended to start with a small amount and gradually increase your contributions over time.

When deciding what to invest in, you can choose from different types of investments, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. It's important to diversify your portfolio and consider the risk and return potential of each investment. You can also seek the help of a financial advisor or use a robo-advisor, which uses algorithms to make investment recommendations based on your risk profile.

| Characteristics | Values |

|---|---|

| Financial goals | Retirement, buying a house, education, etc. |

| Financial situation | Monthly spending, savings |

| Time horizon | Short-term, long-term |

| Risk tolerance | Volatility, potential loss |

| Investment account type | 401(k), IRA, 529 plan, brokerage account |

| Asset allocation | Stocks, bonds, cash |

| Investment types | Mutual funds, exchange-traded funds (ETFs), individual stocks, bonds |

| Investment management strategy | Self-directed, robo-advisor, financial advisor |

What You'll Learn

Define your financial goals and risk tolerance

Before you make any investment decisions, it's important to define your financial goals and risk tolerance. This involves taking an honest look at your entire financial situation, especially if you've never made a financial plan before. Here are some key considerations:

Retirement Planning

Retirement should be the first investing goal on your list. It's important to start saving for retirement as early as possible to maximize the power of compounding, where your earnings generate their own earnings over time. When planning for retirement, consider the following:

- Time horizon: Determine how many years you have until retirement. If you have a long time horizon, you may be comfortable taking on more risk in your investments.

- Risk tolerance: Think about the amount of market volatility and potential loss you're willing to accept. Your risk tolerance will likely be higher for long-term goals like retirement.

- Investment account type: Consider using a 401(k) plan, an individual retirement account (IRA), or a brokerage account for retirement savings. Each option has different tax implications and flexibility.

Other Financial Goals

In addition to retirement, it's important to plan and save for other goals such as buying a house or a child's education. When defining these financial goals, consider the following:

- Financial situation: Figure out your monthly expenses and how much you can save towards each goal.

- Time horizon: Determine the timeframe for achieving each goal. For example, buying a house in 5 years is a short-term goal, while saving for a child's education may be a long-term goal.

- Risk tolerance: Consider the level of risk you're comfortable with for each goal. For short-term goals, you may want to choose more conservative investments to reduce the risk of significant losses.

Understanding Risk and Return

When investing, it's crucial to understand the relationship between risk and return. Low-risk investments, such as certificates of deposit (CDs), typically offer lower expected returns. Higher-risk investments, such as stocks or equities, have the potential for higher returns but also come with a greater possibility of loss. Here are some additional considerations:

- Investment types: Different types of investments carry different levels of risk. For example, bonds or fixed-income instruments are considered higher-risk than CDs, while commodities and derivatives are among the riskiest investments.

- Diversification: Diversifying your investments across different asset classes, sectors, and geographical regions can help reduce risk and improve your chances of achieving your investment goals.

- Risk capacity: This refers to the amount of investment risk you can afford to take on. It's important to consider your financial situation and future needs when determining your risk capacity.

Seeking Professional Help

If you're unsure about defining your financial goals and risk tolerance, you may want to consider seeking advice from a financial professional or a robo-advisor. They can provide guidance based on your specific circumstances and goals, helping you make more informed investment decisions.

Homeownership: Impact on Your Investment Portfolio Choices

You may want to see also

Choose an account type

There are several different types of investment accounts to support your goals. Here are some of the most common ones:

- Brokerage account: This is a standard-issue investment account that offers flexibility. Anyone over the age of 18 can open one and you can add as much money as you want, whenever you want. You'll also have access to a wide range of investment options. However, it is a taxable account, so you'll generally have to pay taxes on any realised investment profits.

- 401(k): This is an employer-sponsored retirement plan and may be the most readily available investment account. It offers tax-advantaged investment growth potential with relatively high contribution limits. You can contribute pre-tax, and you generally don't pay any taxes while your money is in the account. Many employers will also match your contributions, which can help your savings grow faster. However, there are rules to follow on how much you can contribute and when and how you can take money out.

- Individual retirement account (IRA): This is an account for retirement that you can open and invest in yourself. Traditional IRAs come with similar tax benefits to 401(k)s, although there are some differences. For example, you can't contribute pre-tax but you may get a tax deduction for the year your contribution is made. You also often have more investment choices and can trade individual stocks. However, there are rules and restrictions on who is eligible to receive a tax deduction, how much you can contribute each year, and how and when you can take money out.

- 529 plan: This is a tax-advantaged account specifically for education savings. Contributions could be state tax-deductible and you benefit from tax-deferred growth and tax-free withdrawals for qualified education expenses.

Strategies for Evaluating Your Investment Portfolio

You may want to see also

Open the account and put money in it

Now that you've decided on your investment goals, it's time to open an account and deposit some money.

If you're investing in a 401(k) then you'll open it through your employer, with whatever company is handling their 401(k)s. With an IRA or brokerage account, you'll need to choose a financial institution to open your account with.

How much money you invest is up to you, but it's recommended that you eventually aim to save an amount equal to 15% of your income each year for retirement. If your employer offers matching contributions, consider investing at least enough to capture the full amount of the match. For example, if your employer offers a dollar-for-dollar match up to 3%, you would contribute 3% to take full advantage.

If you're opening an IRA or brokerage account, you can start by depositing a lump sum of money and then add to it when you're ready. If you can, set up regular automatic contributions so that you keep investing every month.

There's no minimum amount you need to start investing, and you can always start small and gradually increase your contributions over time.

Saving and Investing: Building Wealth and Security

You may want to see also

Pick investments

Picking investments is a crucial step in the investment process. Here are some detailed instructions on how to select your investments wisely:

- Understand the different types of investments: Familiarise yourself with the various investment options available, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and alternative investments like hedge funds and private equity. Each type of investment has its own characteristics, risks, and potential rewards.

- Consider your financial goals and risk tolerance: Determine your financial objectives, such as saving for retirement, buying a house, or funding education. Assess your risk tolerance, which is your comfort level with market volatility and potential losses. Your risk tolerance will likely vary depending on the time horizon for each of your goals.

- Diversify your portfolio: Diversification is a key strategy to reduce risk. Invest in different asset classes, such as stocks, bonds, and cash. Additionally, consider investing in different sectors within each asset class, such as technology, healthcare, and finance. You can also invest in different geographical regions to further reduce risk.

- Conduct thorough research: Before investing, research the specific investments you are considering. Look into the financial health and performance of companies whose stocks or bonds you want to buy. For mutual funds and ETFs, examine the underlying assets and the fund's historical returns.

- Consider costs and fees: Investing entails various costs, such as annual fees, transaction fees, and expense ratios. These fees can impact your overall investment returns over time, so be sure to factor them into your decision-making process.

- Seek professional guidance if needed: If you feel overwhelmed or unsure about selecting investments on your own, consider seeking advice from a financial advisor or a robo-advisor. Financial advisors can provide personalised guidance based on your goals and risk tolerance, while robo-advisors offer automated, low-cost investment recommendations.

- Monitor and adjust your investments: Investing is an ongoing process. Regularly review the performance of your investments and make adjustments as necessary. Remember that markets can be volatile, and it's normal for investments to fluctuate in the short term. Focus on your long-term goals and adjust your portfolio accordingly.

Aggressive Investing: Quick Wealth or Risky Business?

You may want to see also

Buy the investments

Once you have a clear financial goal in mind, the next step is to choose an account type. There are several different types of investment accounts to support your goals. Here are some of the most common ones:

K) plan

A 401(k) is a retirement plan offered by your employer. It allows you to save a portion of your paycheck before taxes are deducted. Your employer may even match your contributions, helping you save faster. 401(k) plans offer tax-advantaged investment growth potential with relatively high contribution limits. This means you can contribute to the account pre-tax and generally won't pay any taxes while your money is sitting in the account, potentially growing.

Individual Retirement Account (IRA)

An IRA is a powerful tax-advantaged account designed to help you save for retirement. Depending on whether you choose a traditional or Roth IRA, your earnings will grow tax-deferred or tax-free. IRAs often offer flexible investment options, making them a great way to further diversify your investments and boost your retirement savings.

529 plan

A 529 plan is a tax-advantaged account specifically for education savings. It offers a variety of benefits and flexibility. For example, 529 plans can be used not only for four-year college degrees but also for other types of education, and can be transferred to another qualified family member. Contributions may be state tax-deductible, and you could benefit from tax-deferred growth and tax-free withdrawals for qualified education expenses.

Brokerage account

A brokerage account allows you to buy and sell various investments, including individual stocks, bonds, and funds. Brokerage accounts are a good option for investors who want more control over their investments. Since it's a taxable account, you might owe taxes when selling investments that have increased in value.

After you've chosen an account type, it's time to open the account and put money into it. With a 401(k), you contribute through payroll deductions, meaning the money is automatically taken out of your paycheck. If your employer offers matching contributions, consider investing enough to capture the full amount of the match. For other account types, you can start by depositing a lump sum and then adding to it when you're ready.

Now it's time to pick your investments. There are three basic methods:

- Individual stocks and bonds: This is the most complicated and labor-intensive way, but it's what many people think of when they hear "investing." If you want to go this route, you'll need to learn about researching stocks, building a diversified portfolio, and more.

- Mutual funds or ETFs: Mutual funds and exchange-traded funds (ETFs) pool money from many investors to purchase a collection of stocks, bonds, or other securities. You can use them like building blocks, putting a few together to create a portfolio, or you can buy an all-in-one fund, which is an easy-to-manage diversified portfolio in a single fund.

- Hire a professional manager: If you're getting stuck, consider getting help from a robo-advisor or a human financial advisor.

Finally, it's time to buy your chosen investments. For stocks, mutual funds, and ETFs, you'll generally look up the investment's ticker symbol—a string of 1 to 5 letters unique to that investment—and then decide on a dollar amount or number of shares to buy. In a 401(k), it's often easiest to set up your investment choices when you're setting your regular contribution amount, and your money will be invested in the choices you've selected automatically.

Savings and Investments: Strategies for Effective Money Allocation

You may want to see also

Frequently asked questions

Before investing, it's important to take an honest look at your entire financial situation and figure out your goals and risk tolerance. Once you have a goal in mind, you need to choose an account type, how much money to invest, and what to invest it in.

The amount of money you need to start investing can vary widely depending on where you choose to invest. In fact, it can range from $1 to several thousand depending on the investment product and company you choose.

Some common types of investments include stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, certificates of deposit (CDs), and commodities.