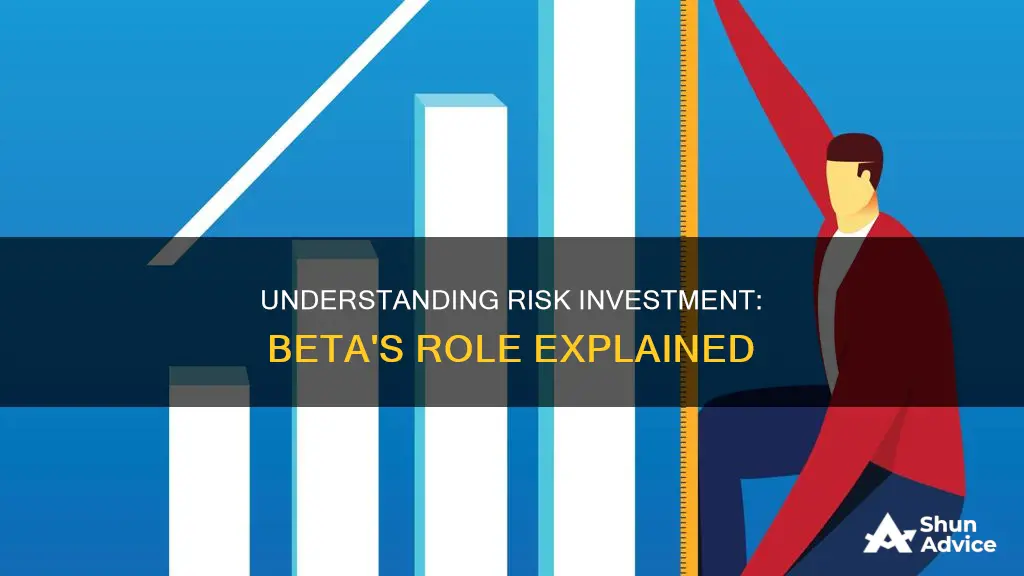

Beta is a measure of a stock's volatility in relation to the overall market. It is a crucial metric in finance, especially in the stock market, as it helps investors assess the risk associated with stocks and understand their volatility compared to the broader market. The beta coefficient, denoted as β, compares a stock or portfolio's volatility or systematic risk to the market, usually the S&P 500, which has a beta value of 1.0. Stocks with betas above 1.0 are considered more volatile than the market, while those with betas below 1.0 are less volatile. Beta plays a significant role in the capital asset pricing model (CAPM), helping to determine the relationship between risk and expected returns for assets. By calculating beta, investors can gain insights into a stock's potential volatility and make more informed investment decisions.

| Characteristics | Values |

|---|---|

| Definition | Beta is a measure of a stock's volatility in relation to the overall market |

| Purpose | Beta helps investors understand how much risk a stock will add to a diversified portfolio |

| Calculation | Beta = Covariance ÷ Variance |

| Benchmark | The S&P 500 is often used as the benchmark for calculating beta, with a value of 1.0 |

| Interpretation | Stocks with beta values greater than 1.0 are more volatile than the market, while stocks with beta values less than 1.0 are less volatile |

| Risk and Returns | Higher beta stocks are riskier but provide the potential for higher returns, while lower beta stocks pose less risk but may offer lower returns |

| Limitations | Beta is a theoretical measure and may not always accurately predict a stock's future movements; it is better suited for short-term risk assessments |

What You'll Learn

Beta is a measure of a stock's volatility

Beta (β) is a measure of a stock's volatility or systematic risk in relation to the overall market. It is calculated by measuring the covariance of a stock's returns with the returns of the overall market and dividing it by the variance of the market returns over a specified period. The overall market, such as the S&P 500, has a beta of 1.0, and individual stocks are ranked based on their deviation from this market.

A stock with a beta greater than 1.0 is more volatile than the market, indicating that its returns are theoretically more sensitive to market movements. Conversely, a stock with a beta less than 1.0 is less volatile than the market, suggesting that its returns are less sensitive to market fluctuations.

Beta plays a crucial role in the Capital Asset Pricing Model (CAPM), helping determine the relationship between risk and expected returns for assets. It allows investors to gauge the potential volatility of a stock compared to the market and understand how much risk it will add to a diversified portfolio.

However, it is important to note that beta has its limitations. It is based on historical data and may not always accurately predict a stock's future movements. Beta also does not consider a company's fundamentals, earnings, or growth potential. Therefore, it should be used alongside other metrics and analysis methods when making investment decisions.

Creating a Diverse Investment Portfolio: A Beginner's Guide

You may want to see also

Beta helps investors understand how much risk a stock adds to a portfolio

Beta is a measure of a stock's volatility in relation to the overall market. It is a crucial metric in finance, especially in the stock market, as it helps investors understand how much risk a stock adds to a portfolio.

Beta is calculated by measuring the covariance of a stock's returns with the returns of the overall market and dividing it by the variance of the market returns over a specified period. The benchmark commonly used for beta calculations is the S&P 500, which has a beta value of 1.0. This means that the S&P 500, by definition, has a beta of 1.0, and individual stocks are ranked according to how much they deviate from this market.

A stock with a beta value greater than 1.0 is considered more volatile than the market, while a stock with a beta value less than 1.0 is considered less volatile. For example, a high-risk technology company with a beta of 1.75 would have returned 175% of what the S&P 500 returned in a given period. Conversely, a utility company with a beta of 0.45 would have returned only 45%.

By understanding beta, investors can gain valuable insights into a stock's risk profile and determine how well it aligns with their overall investment strategy and risk tolerance. A high beta indicates a greater level of risk, as the stock is more susceptible to market volatility, while a low beta suggests a lower level of risk and greater stability.

However, it is important to note that beta is a theoretical measure and may not always accurately predict a stock's future movements. Beta is more suitable for short-term risk assessments and does not consider a company's fundamentals or provide forward guidance. Therefore, it should be used alongside other metrics and analysis methods when making investment decisions.

Goldman's Investment Management: Powering Success and Growth

You may want to see also

Beta is used in the Capital Asset Pricing Model (CAPM)

Beta is a key component of the Capital Asset Pricing Model (CAPM). CAPM is a model that describes the relationship between the expected return and risk of investing in a security. It shows that the expected return on a security is equal to the risk-free return plus a risk premium, which is based on the beta of that security.

Beta is used in the CAPM formula to calculate the expected return of an asset, given its risk. The formula is as follows:

Expected return of investment = risk-free rate + (beta of the investment x market risk premium)

Where:

- Expected return of investment = the expected return of a capital asset over time, given all of the other variables in the equation

- Risk-free rate = typically the yield on a 10-year US government bond

- Beta of the investment = a measure of a stock's risk (volatility of returns)

- Market risk premium = the return expected from the market above the risk-free rate

The CAPM formula is used to evaluate whether a stock is fairly valued when its risk and the time value of money are compared with its expected return. By knowing the individual parts of the CAPM, it is possible to determine whether the current price of a stock is consistent with its likely return.

Beta is a measure of a stock's volatility in relation to the overall market. The market, such as the S&P 500, has a beta of 1.0, and individual stocks are ranked according to how much they deviate from the market. A stock with a beta greater than 1.0 is more volatile than the market, while a stock with a beta less than 1.0 is less volatile.

The beta coefficient can be interpreted as follows:

- Β = 1: exactly as volatile as the market

- Β > 1: more volatile than the market

- Β < 1: less volatile than the market

- Β = 0: uncorrelated to the market

- Β < 0: negatively correlated to the market

Beta is used in the CAPM to help investors understand the relationship between the expected risk and return of an investment. It allows investors to assess how sensitive a security is to market risk and determine whether a stock is fairly valued based on its risk and expected return.

Manager's Investment: Broadest Responsibilities, Greatest Impact

You may want to see also

Beta is calculated using regression analysis

Beta, denoted by the Greek letter β, is a measure of a stock's volatility in relation to the overall market. It is a statistical measure that quantifies the risk of an investment security, such as a stock, by calculating its volatility or systematic risk relative to the market.

Beta = Covariance(Re, Rm) / Variance(Rm)

Where:

- Covariance represents how changes in a stock's returns are related to changes in the market's returns.

- Re is the return on an individual stock.

- Variance represents how far the market's data points spread out from their average value.

- Rm is the return on the overall market.

By definition, the market, such as the S&P 500 Index, has a beta of 1.0, and individual stocks are ranked based on how much their returns deviate from the market returns. A beta greater than 1.0 indicates that the stock is more volatile than the broader market, while a beta less than 1.0 suggests lower volatility.

Beta is an important concept in investment risk analysis as it helps investors understand the potential risk and return of a stock relative to the overall market. It is a component of the Capital Asset Pricing Model (CAPM), which is used to determine the expected rate of return based on the perceived investment risk.

Equity-Based Investment Products: What Are They?

You may want to see also

Beta has pros and cons as a measure of risk

Beta is a measure of a stock's volatility in relation to the overall market. It is a statistical measure that helps investors assess risk in the stocks that they buy or sell. While it is a useful tool, it does have some limitations.

Pros of Using Beta as a Measure of Risk

- Beta is widely used by investors and analysts to understand how much risk a stock carries.

- Beta can be used with other measures, such as alpha, to make investment decisions.

- Beta is easy to calculate and understand.

- Beta can guide investors in diversifying their portfolios.

- Beta is a clear, quantifiable measure that is easy to work with.

- Beta is a convenient measure that can be used to calculate the costs of equity used in a valuation method.

- Beta is generally more useful as a risk metric for traders moving in and out of trades.

Cons of Using Beta as a Measure of Risk

- Beta is only one measure of risk and should not be used in isolation.

- Beta values can change over time, so it is essential to monitor them regularly.

- Beta can be influenced by market conditions and might not reflect a stock's individual risk well.

- Beta only measures past volatility, and past performance does not guarantee future results.

- Beta does not give enough information about the fundamentals of a company and is of limited value when making stock selections.

- Beta is probably a better indicator of short-term rather than long-term risk.

- Beta does not distinguish between upside and downside price movements.

- Beta does not pay attention to a stock's fundamentals or incorporate new information.

- Beta is based on past price movement, which does not necessarily predict future behaviour.

Direct EB-5 Investment: Equity's Essential

You may want to see also

Frequently asked questions

Beta (β) is a measure of a stock's volatility in relation to the overall market. It is calculated using regression analysis and provides insight into the risk and potential returns of an investment.

Beta is calculated by dividing the covariance of a stock's returns with the returns of the overall market (usually the S&P 500) by the variance of the market returns over a specific period.

A beta value of 1 indicates that a stock's volatility is similar to the overall market. Values above 1 suggest higher volatility and potential returns but also increased risk. Values below 1 indicate lower volatility and risk but may result in lower returns.

Beta is based on historical data and past performance, which may not accurately predict future movements. It also does not consider qualitative factors such as company funding, mergers, or other market disruptions. Additionally, beta is more suitable for short-term risk assessments and may not be effective for long-term predictions.