An emergency fund is a safety net for life's unexpected events, such as medical emergencies, home repairs, or job loss. It is recommended to have three to six months' worth of living expenses set aside in an emergency fund, which can be kept in a savings account or invested to earn a return. However, investing emergency funds carries the risk of losing money, and it is important to weigh the potential benefits of investing against the need for liquidity and quick access to funds in case of an emergency.

| Characteristics | Values |

|---|---|

| Purpose | To cover financial surprises and emergencies such as medical or dental emergencies, unexpected home repairs, unplanned travel expenses, car repairs, etc. |

| Amount | Typically, 3-6 months' worth of living expenses |

| Type of account | Savings account, money market account, high-yield savings account, CDs, prepaid card, cash, etc. |

| Accessibility | Easily accessible and liquid |

| Risk | Low-risk, avoid volatile investments |

What You'll Learn

Emergency funds should be easily accessible

Liquid assets like money market accounts, high-yield savings accounts, and certificates of deposit (CDs) are among the ways you can invest your emergency fund money so that it can grow and remain accessible. Money market accounts are interest-bearing accounts at banks or credit unions that are a mix between a checking and savings account. They are considered low risk and can provide annual percentage yields (APYs) of about 3% to 4%. Most money market accounts are insured by the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Association (NCUA), which means your money will be protected up to $250,000 per account.

High-yield savings accounts, often offered through online banks, can also provide returns while keeping your emergency fund safe. These accounts generally provide higher interest rates than traditional savings accounts, allowing you to earn 3% to 4% compared to an average APY of about 0.3% from traditional savings accounts. Money in a high-yield savings account, including online-only accounts, is typically FDIC-insured. You can usually access the money through an online funds transfer, outgoing wire transfer, telephone transfer, or check request. However, if you use an online-only account, you cannot access your funds at a branch location, and some methods of accessing your savings may take several days.

CDs can also provide more interest than keeping your money in a checking account. Like money market accounts and high-yield savings accounts, CDs offer FDIC protection for up to $250,000 per account. Generally, CDs with longer maturities (such as five years) have higher interest rates. However, one drawback is that you usually must pay a penalty to cash out a CD before it matures, making it more difficult to access your money if you need it immediately. For example, the early withdrawal penalty on a five-year CD might be six months' worth of interest. If you cash out the CD before you have even earned six months' worth of interest, the bank may take the penalty out of your principal.

Creating a CD ladder, where you purchase several smaller CDs that mature at different intervals instead of one large CD, can help increase liquidity and avoid or minimize early withdrawal penalties. Some banks offer no-penalty CDs that allow you to withdraw your money without sacrificing any of the interest you have earned. You may earn a lower interest rate than with a regular CD, but your funds will be more liquid.

While investing your emergency fund can provide returns, it is important to consider the potential risks and ensure that your funds remain easily accessible when needed.

Index Funds: Utopia or Dystopia for Investors?

You may want to see also

Emergency funds can be invested in liquid assets

Emergency funds are a crucial financial buffer to protect you from unforeseen costs such as medical bills, car repairs, or even a job loss. While keeping your emergency funds in a traditional checking or savings account ensures easy access, you might want to explore other options to earn returns on this money.

Here's where liquid assets come in. Liquid assets are those that can be quickly converted into cash without incurring penalties. They are ideal for emergency funds because they provide liquidity, allowing you to access your money when unexpected expenses arise. Here are some ways you can invest your emergency funds in liquid assets:

- Money Market Accounts: These accounts, offered by banks or credit unions, are a mix between checking and savings accounts. They are considered low-risk and typically provide annual percentage yields (APYs) of around 3% to 4%. Many money market accounts are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Association (NCUA) up to $250,000 per account. Some accounts also offer debit card and check-writing privileges for instant access to your funds.

- High-Yield Savings Accounts: These accounts, often offered by online banks, provide higher interest rates than traditional savings accounts. You can earn around 3% to 4% APY compared to the average of about 0.3% in traditional savings accounts. The money in these accounts is typically FDIC-insured, and you can access your funds through various methods, although online-only accounts may have some access limitations.

- Certificates of Deposit (CDs): CDs offer higher interest rates than checking accounts, and like money market and high-yield savings accounts, they are FDIC-insured up to $250,000 per account. However, one drawback is the early withdrawal penalty for cashing out before maturity. To increase liquidity, consider creating a CD ladder with smaller CDs that mature at different intervals or look for no-penalty CD options.

- Liquid Mutual Funds: Liquid mutual funds offer low volatility, high liquidity, and efficient taxation. They invest in short-term debt instruments and typically have a maturity of around 1-2 months. Due to their low risk and quick redemption, liquid mutual funds are an excellent choice for emergency funds. You can usually access your funds within one to three days.

By investing your emergency funds in these liquid assets, you can earn returns while maintaining easy access to your money during unexpected financial situations. Remember, the key is to balance safety, liquidity, and returns to ensure your emergency funds are readily available when needed.

Inverse Funds: Strategies for Savvy Investing

You may want to see also

Emergency funds can be kept in a savings account

Emergency funds are crucial to have in place to support you through difficult times. They can help you avoid debt or being forced to dramatically alter your lifestyle in the face of unexpected costs. It is recommended to have at least three to six months' worth of living expenses saved in an emergency fund.

Keeping your emergency fund in a savings account is a great option. It ensures your money is easily accessible, which is crucial when emergencies arise. Here are some reasons why keeping your emergency fund in a savings account is a good idea:

Accessibility and Liquidity

Easy access to your emergency fund is essential, as you'll need to withdraw money quickly in an emergency. Savings accounts allow you to access your funds without penalties, ensuring you can pay for unexpected expenses immediately.

Safety of Funds

Putting your emergency fund in a savings account preserves your initial deposit. In contrast, investing in the stock market or other volatile assets could result in losing your initial investment if the value of your assets falls. With a savings account, you know your money will be there when you need it.

Avoiding Investment Risks

Investing your emergency fund in the stock market or other volatile assets could force you to sell at a loss when you urgently need cash. Savings accounts provide a safer option, protecting your principal pot of money.

Interest Earnings

While interest rates on savings accounts may be relatively low, they still allow you to grow your emergency fund over time. High-yield savings accounts can offer more significant returns while keeping your money safe and accessible.

Tax Benefits

In some countries, specific types of savings accounts offer tax benefits. For example, a Tax-Free Savings Account (TFSA) in Canada shelters interest earnings from income tax, allowing your emergency fund to grow faster.

Peace of Mind

Keeping your emergency fund in a savings account provides peace of mind. You don't have to worry about market volatility or losing your initial investment. You know your money is there when you need it, giving you financial security during challenging times.

In summary, keeping your emergency fund in a savings account offers accessibility, safety, and the ability to earn interest. It ensures your money is there when unexpected expenses arise, providing a financial buffer during challenging times.

A Guide to Investing in Franklin Templeton Mutual Funds

You may want to see also

Emergency funds can be kept in a checking account

An emergency fund is a crucial financial safety net, helping you stay afloat when unexpected costs arise. While it's tempting to invest your emergency fund to maximise its growth, it's generally a bad idea. Instead, consider keeping your emergency fund in a traditional checking account. Here's why:

Accessibility

The primary purpose of an emergency fund is to cover unforeseen expenses, such as medical bills or car repairs. Therefore, your emergency fund should be easily accessible, allowing you to pay for these expenses immediately. Keeping your emergency fund in a checking account ensures you can quickly withdraw funds without penalties. While savings accounts also offer accessibility, transfers may take a day or two, so keeping at least a portion of your emergency fund in a checking account ensures immediate access.

Liquidity

Checking accounts provide highly liquid assets, allowing you to convert your funds into cash quickly and easily. In contrast, investing in less liquid assets like real estate or stocks may force you to sell at a loss or incur penalties if you need to access your money urgently.

Risk

The value of investments can fluctuate, and there is a chance you could lose your initial investment. By keeping your emergency fund in a checking account, you preserve your principal, ensuring the money is there when you need it.

Peace of Mind

With an emergency fund in a checking account, you won't have to worry about market volatility or losing your capital. This peace of mind is invaluable, especially during stressful times.

While keeping your emergency fund in a checking account has its advantages, you may want to consider other options for higher returns. Money market accounts and high-yield savings accounts, for example, offer higher interest rates and easy access to your funds. However, they may not be as readily accessible as a checking account, and you may face withdrawal limits.

Ultimately, the best place for your emergency fund depends on your financial goals and comfort level with risk. If you prioritise accessibility and stability, a checking account is an excellent choice.

Passive Investment Funds: A Guide to Understanding Their Basics

You may want to see also

The amount of emergency funds depends on your situation

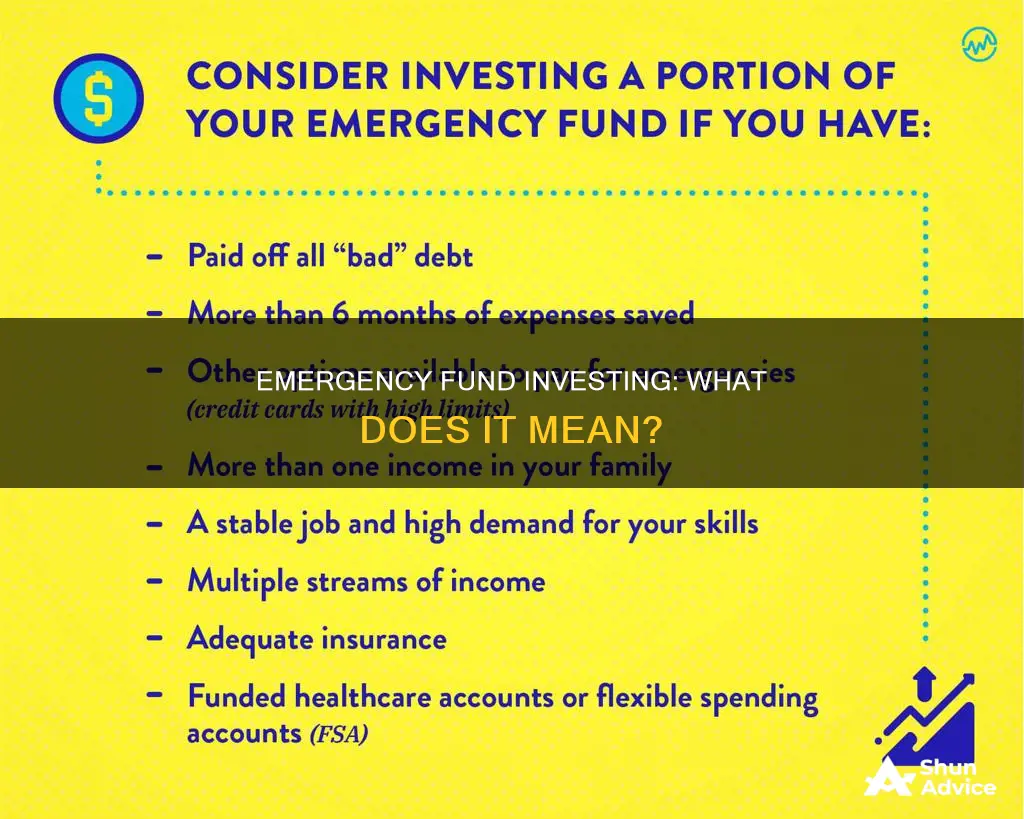

The amount of emergency funds you need depends on your personal situation and financial obligations. The general rule of thumb is to have enough to cover three to six months' worth of living expenses. However, this amount can vary depending on your circumstances.

If you have inconsistent income or live paycheck to paycheck, even a small amount of savings can provide financial security. For example, you might aim to save at least $1,000 or $2,000, whichever is greater, to protect yourself from financial fallout. This can be a good starting point for your emergency fund.

On the other hand, if you have higher expenses, such as a mortgage, or if you have a spouse or children, you might want to aim for six months or more of savings. This will provide a more substantial cushion in case of unexpected expenses or a loss of income.

Additionally, consider the types of unexpected costs you may encounter. Think about the most common unexpected expenses you've had in the past and how much they cost. This can help you set a more personalised goal for your emergency fund.

It's also important to remember that your emergency fund should be easily accessible and separate from your daily spending money. This will ensure that you can quickly cover unexpected costs without having to resort to high-interest loans or credit cards.

Monthly Mutual Fund Investment: A Step-by-Step Guide

You may want to see also

Frequently asked questions

An emergency fund is a sum of money set aside to cover unexpected expenses such as medical bills, car repairs, home repairs, and unplanned travel expenses.

It is recommended that you save enough to cover three to six months' worth of living expenses. However, if you are just starting out, you can aim for $500 or $1,000, and gradually work your way up.

It is best to keep your emergency fund in a savings account with a high interest rate and easy access. Some options include a high-yield savings account, money market account, or certificate of deposit (CD).

Investing your emergency fund in the stock market or other volatile assets may result in losing your initial investment or being forced to sell at a loss in the event of an emergency. It is generally recommended to keep your emergency fund in low-risk, liquid assets.