The G Fund is a low-volatility, virtually risk-free US bond fund. It is part of the Thrift Savings Plan (TSP), which is the federal government's equivalent of a 401(k) account. The G Fund is invested in short-term US Treasury securities, which are specially issued to the TSP by the US government. The fund's objective is to preserve capital and generate returns above those of short-term US Treasury securities. The G Fund's interest rate is calculated monthly, based on the average yield of US Treasury securities with four or more years to maturity.

What You'll Learn

The G Fund's investment objective

The G Fund is a low-volatility, virtually risk-free US bond fund. It is invested in short-term US Treasury securities specially issued to the TSP. The payment of principal and interest is guaranteed by the US government, and there is no credit or default risk. The G Fund's interest rate is calculated monthly, based on the average yield of all US Treasury securities with 4 or more years to maturity.

The G Fund is intended for very conservative investors. It is the only TSP fund that does not invest in an index and the only one that guarantees the return of the investor's principal. It has the lowest risk of the five core funds offered in the TSP.

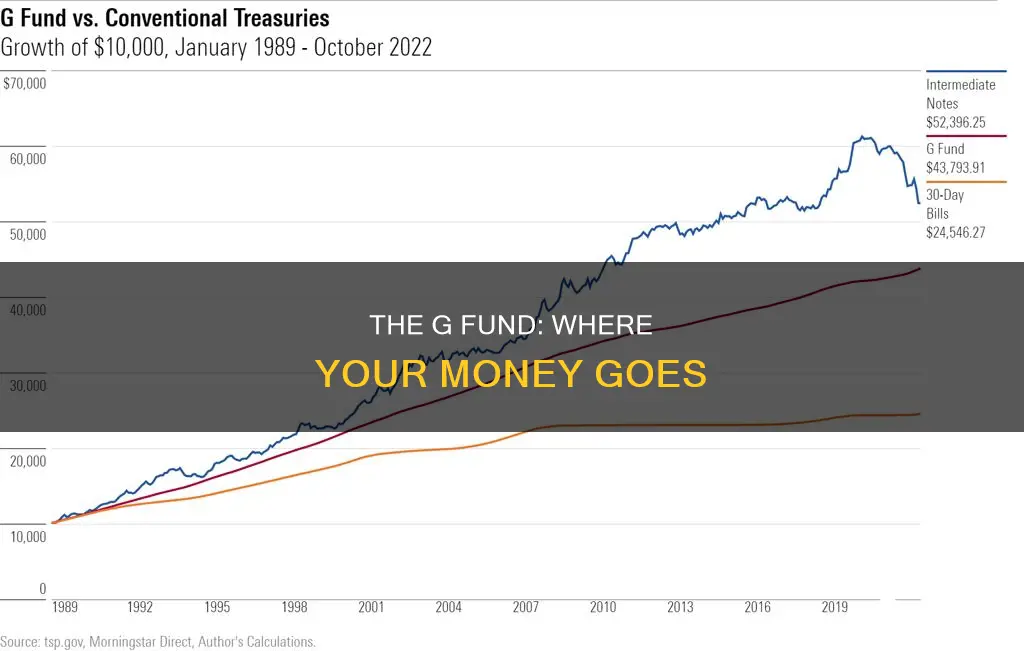

The G Fund has historically provided the lowest rate of return of any of the core funds. However, it has easily outpaced the growth of the Consumer Price Index. Over the past 34 years, an investment in the G Fund almost doubled its real value. The G Fund has earned a compound annualized return of 4.2% since August 1990.

Vanguard Funds: Exploring India-Centric Investment Opportunities

You may want to see also

The G Fund's interest rate

The G Fund, or Government Securities Investment Fund, is part of the Thrift Savings Plan (TSP) offered to all US government employees. As of October 2024, the TSP G Fund interest rate is 3.875%. The rate is calculated monthly, based on the average yield of US Treasury securities with four or more years to maturity.

The G Fund interest rate is calculated by the US Treasury as the weighted average yield of approximately 191 US Treasury securities on the last day of the previous month. The fund's investment objective is to ensure the preservation of capital and generate returns above those of short-term US Treasury securities.

The G Fund has historically provided the lowest rate of return of any of the core funds in the TSP. However, it is also the lowest-risk fund. The G Fund is subject to inflation risk, meaning that investments may not grow enough to offset the reduction in purchasing power that results from inflation.

The G Fund has earned a compound annualized return of 4.2% since August 1990. Its year-to-date return is 3.64%, and its 1-year return is 4.48%. A $1,000 investment in 1990 would be worth $4,140 today.

A Swiss Guide to Index Funds Investing

You may want to see also

The G Fund's historical performance

The G Fund, or Government Securities Investment Fund, is a unique and secure investment option within the Thrift Savings Plan (TSP). It was created to offer federal employees and uniformed services members a risk-free investment choice as part of their retirement savings plan. The G Fund's primary objective is to preserve capital and generate returns above those of short-term U.S. Treasury securities.

The G Fund has a long history of stable performance, making it a benchmark for security among TSP investment options. It is the only TSP fund that guarantees the return of the investor's principal, providing the lowest risk of the five core funds. The fund invests in non-marketable, specially issued U.S. Treasury securities, which means its value does not fluctuate, only the interest rate changes. This makes the G Fund different from typical bond funds, where the principal can fluctuate with interest rate changes.

Historically, the G Fund has offered modest but consistent returns, generally ranging between 1% and 2.5% annually over the past decade. In the late 1980s, the fund returned over 9% per year. More recently, the G Fund has earned a compound annualized return of 4.2% since August 1990, with a year-to-date return of 3.64% and a 1-year return of 4.48%. As of June 2024, the G Fund rate was 4.75%, the highest it has been in over 17 years.

The G Fund's performance is influenced by prevailing Treasury interest rates and broader economic conditions. The fund's rate of return is sensitive to interest rates on short-term federal debt but still offers a higher rate than most other short-term government securities available to the public. The G Fund's low-risk nature makes it attractive to risk-averse investors, particularly during economic downturns, despite the trade-off of typically lower long-term growth potential compared to more aggressive funds.

Invest 529 Funds: Strategies for Maximizing College Savings

You may want to see also

The G Fund's advantages

The G Fund, or Government Securities Investment Fund, is a low-volatility, virtually risk-free US bond fund. Here are some of its advantages:

Guaranteed Returns and Low Risk

The G Fund is a very low-risk investment option. It is subject to inflation risk, but it guarantees the return of the investor's principal. The payment of principal and interest is guaranteed by the US government, meaning there is no credit or default risk. This makes it very different from a typical bond fund, where the principal fluctuates with interest rates.

Long-Term Rates and Short-Term Security

The G Fund is invested in short-term US Treasury securities, which are generally safer than long-term notes as there is less uncertainty about interest rates changing. However, the interest rate for the G Fund is calculated based on the weighted average yield of long-term US Treasury securities, meaning investors benefit from the higher interest rates of long-term securities while investing in a safe, short-term fund.

Capital Preservation and Returns

The G Fund's investment objective is to preserve capital and generate returns above those of short-term US Treasury securities. It has been successful in meeting this objective, with a historical annualized return of 4.2% since August 1990.

Liquidity

The G Fund can be redeemed on any business day with no risk to the principal, providing daily liquidity.

Low Volatility

The G Fund has virtually zero volatility. It does not fluctuate with the stock market, so investors can be confident their investment will not lose value, even during a bear market.

Overall, the G Fund is an attractive investment option for those seeking capital preservation, low risk, and stable returns, particularly those with a low-risk appetite or those looking to balance a higher-risk portfolio.

Sector Fund Investment: Strategies for Success

You may want to see also

The G Fund's disadvantages

The G Fund, part of the Thrift Savings Plan (TSP), is a government securities investment fund that invests in nonmarketable US Treasury securities. It is only available to those who invest through TSP and is intended for conservative investors. While the G Fund has its advantages, there are also some disadvantages to consider. Here are some key disadvantages of the G Fund:

Inflation Risk

The G Fund is subject to inflation risk, which means that the investment may not grow enough to offset the reduction in purchasing power due to inflation. This is an important consideration, as it could impact the overall returns and value of the investment over time.

Low Rate of Return

Historically, the G Fund has provided a lower rate of return compared to other core funds available in the TSP. While it offers stability and preservation of capital, investors seeking higher returns may find this fund less appealing.

Limited Growth Potential

By prioritizing stability and preservation of capital, the G Fund may not offer the same potential for significant long-term growth as other TSP funds. Investors seeking higher returns and greater capital appreciation may prefer to explore other investment options within the TSP or in the broader market.

Limited Accessibility

The G Fund is unique to the TSP and is not available to the general public. This exclusivity limits its accessibility to only US government employees and members of the uniformed services who participate in the TSP.

Interest Rate Sensitivity

In a rare interest rate inversion, where short-term rates are higher than long-term rates, the G Fund's performance may be impacted. This sensitivity to interest rates can affect the overall returns of the fund, especially when compared to other investment options that may be more responsive to changing market conditions.

In summary, while the G Fund offers stability and preservation of capital, it also comes with certain disadvantages. Investors considering the G Fund should carefully weigh these disadvantages against their investment goals, risk tolerance, and alternative investment options available to them.

Unlocking Pension Funds: Impact Investing with Fitzpatrick and Omidyar

You may want to see also

Frequently asked questions

The G Fund is a low-volatility, virtually risk-free US bond fund. It is part of the Thrift Savings Plan (TSP), which is the federal government's equivalent of a 401(k) account.

The G Fund invests in short-term US Treasury securities specially issued to the TSP by the US government.

The G Fund's investment objective is to ensure the preservation of capital and generate returns above those of short-term US Treasury securities.

As of October 2024, the TSP G Fund interest rate is 3.875%. The rate is calculated monthly, based on the average yield of all US Treasury securities with 4 or more years to maturity.