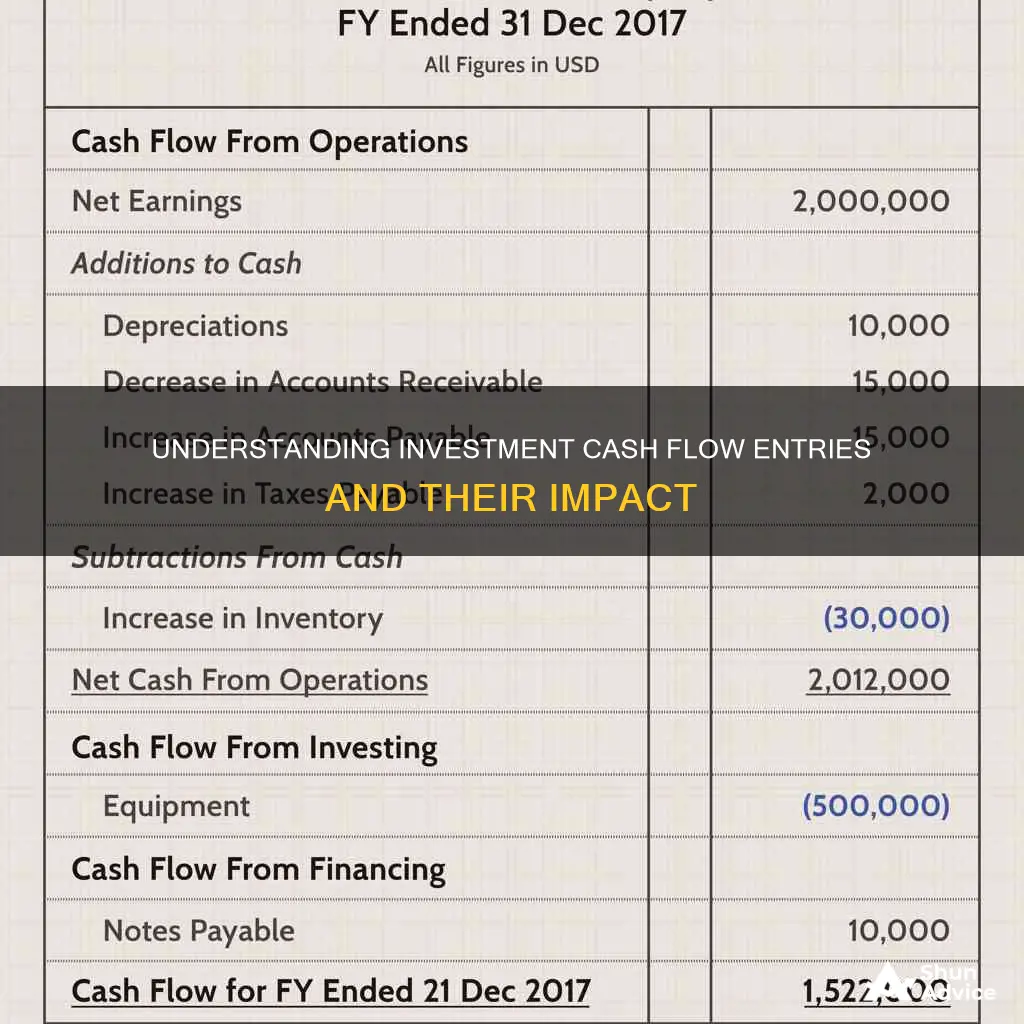

Cash flow from investing activities is a crucial aspect of a company's financial health, and it is typically the second section of a standardised cash flow statement. This section reveals a company's investment performance and capital allocation decisions, including transactions such as acquiring and disposing of assets, investing in securities, and acquiring other businesses. It is calculated by subtracting total outflows from total inflows related to investing activities, and it can be positive or negative, depending on the nature of the transactions. Positive cash flow indicates effective management of investments, while negative cash flow suggests investments in long-term growth. This paragraph provides an introduction to the topic of cash flow from investing activities, which is an essential metric for understanding a company's financial strategies and health.

What You'll Learn

Capital expenditure on fixed assets

Capital expenditures (CapEx) are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. CapEx is often used to undertake new projects or investments by a company. Making capital expenditures on fixed assets can include repairing a roof if it extends the useful life of the roof, purchasing a piece of equipment, or building a new factory.

This type of financial outlay is made by companies in an effort to increase the scope of their operations or to add some future economic benefit to the operation. Spending is important for companies to maintain existing property and equipment and to invest in new technology and other assets for growth.

An item must be expensed on the income statement rather than capitalized if it has a useful life of less than one year, so it isn't considered CapEx. Operating expenses (OpEx) are shorter-term expenses used for the day-to-day operations of a business, unlike CapEx.

Examples of CapEx include the purchase of land, vehicles, buildings, or heavy machinery. CapEx can tell you how much a company invests in existing and new fixed assets to maintain or grow its business. It's any type of expense that a company capitalizes or shows on its balance sheet as an investment rather than on its income statement as an expenditure.

The amount of capital expenditure a company is likely to have depends on its industry. Some of the most capital-intensive industries with the highest levels of CapEx include oil exploration and production, telecommunications, manufacturing, and utilities.

CapEx can be found in the cash flow from investing activities in a company's cash flow statement. Companies can highlight CapEx in various ways. You may see it listed as capital spending, purchases of property, plant, and equipment (PP&E), or acquisition expenses.

CapEx is a popular measure of capital investment used in the valuation of stocks. An increase in capital expenditures means the company is investing in future operations. Typically, companies with significant capital expenditures are in a state of growth.

If a company has differences in the values of its non-current assets from period to period (on the balance sheet), it might indicate investing activity on the cash flow statement. Capital expenditures involving the acquisition of fixed assets, plants, and machinery are included in cash flow from investing activities.

Strategies to Maximize Cash Investments in Just One Year

You may want to see also

Proceeds from sales of fixed assets

Proceeds from the sales of fixed assets are an important aspect of a company's cash flow from investing activities. This involves the sale of long-term assets such as property, plant, or equipment. Fixed assets are those that are generally not expected to be converted to cash within a year of the balance sheet date.

When a company sells a fixed asset, the money received is referred to as the proceeds. If the amount received is greater than the book value or carrying value of the asset, the company recognises a gain on the sale. Conversely, if the amount is less than the book value, the company incurs a loss.

The gain or loss is calculated as the net disposal proceeds minus the asset's carrying value. This calculation is essential for determining the financial impact of the asset sale on the company's financial statements.

The proceeds from the sale of a fixed asset are reported as a positive amount in the investing activities section of the cash flow statement. This section provides insights into the company's investment performance and capital allocation decisions. It is important for stakeholders to assess the company's ability to invest in growth opportunities, acquire assets, and manage its long-term financial health.

In summary, proceeds from the sales of fixed assets are a key component of a company's cash flow from investing activities. They represent the cash received from the sale of long-term assets and can result in either a gain or a loss for the company, depending on the difference between the sale price and the asset's carrying value. Proper accounting for these transactions is crucial for maintaining accurate financial records and assessing the company's financial performance.

Strategies for Investing Uninvested Cash in a VA529 Plan

You may want to see also

Purchase of investment securities

Investment securities are a category of securities—tradable financial assets such as stocks, bonds, or derivatives—that are purchased with the intention of holding them for investment. They are often held by banks as collateral and can take the form of equity or debt securities.

When a company purchases investment securities, it is considered a cash outflow from investing activities. This is because the company is spending money on long-term assets that will hopefully deliver value in the future. This is distinct from cash flow from operating activities, which includes any spending or sources of cash that are part of a company's day-to-day business operations.

The purchase of investment securities is an important aspect of a company's financial strategy, as it can provide a source of income and help boost profits. It also indicates that the company is investing in its future and allocating cash for the long term.

There are various types of investment securities that a company can purchase, including:

- Equity securities: These provide ownership rights to holders and can take the form of common or preferred shares. Equity securities often pay out dividends and entitle the holder to some control of the company via voting rights.

- Debt securities: These are essentially loans that must be repaid, with terms stipulating the size of the loan, interest rate, and maturity or renewal date. Examples include government and corporate bonds, certificates of deposit, and collateralized securities.

- Hybrid securities: These combine aspects of both debt and equity securities. Examples include equity warrants, convertible bonds, and preference shares.

- Money market securities: These are short-term investments that can be quickly converted to cash, such as commercial paper, repurchase agreements, and negotiable certificates of deposit.

Overall, the purchase of investment securities is a key component of a company's cash flow from investing activities, and it can provide valuable insights into the company's financial health and investment strategies.

Cashing Out Refinance: A Smart Investment Move?

You may want to see also

Proceeds from sales of investment securities

Proceeds from the sale of investment securities are an important aspect of a company's cash flow from investing activities. This involves the sale of various investment securities such as bonds, debentures, and stocks. When a company sells these securities, it generates a cash inflow that is considered a positive cash flow from investing activities.

For example, if a company sells stocks or shares that it holds as investments, the money received from the sale is considered proceeds from the sale of investment securities. This can also include the sale of marketable securities, as seen in Apple's cash flow statement, where they had proceeds of $5.83 billion from the sale of marketable securities.

It is important to note that proceeds from the sale of investment securities are different from proceeds from the sale of trading securities. Trading securities are held principally for the purpose of selling them in the near term, and thus are held for only a short period of time. On the other hand, investment securities are typically held for a longer period, and their sale may result in capital gains or losses.

When calculating the net proceeds from the sale of investment securities, all costs and expenses associated with the sale must be deducted from the gross proceeds. These costs can include fees, commissions, advertising costs, and closing costs, depending on the nature of the investment. For example, in the sale of a house, the net proceeds would be calculated by deducting costs such as real estate agent fees, advertising costs, and closing costs from the gross sale price of the house.

Positive net cash flow from investing activities indicates that a company is effectively managing its investments and may be acquiring assets or making strategic investments to enhance future growth and profitability. It is important for stakeholders to assess a company's cash flow from investing activities to understand its capital expenditure and investment strategies and their impact on the company's long-term financial health.

Flip Cash Investment: Legit or Scam?

You may want to see also

Acquisition of another company

When a company acquires another business entity, it is considered an investing activity and is recorded under the "Cash Flow from Investing Activities" section of the company's cash flow statement. This section of the cash flow statement details the cash inflows and outflows resulting from investment activities, including acquisitions.

The acquisition of another company is typically recorded as a cash outflow, as the acquiring company is spending cash to purchase the target company. The amount recorded under "Acquisitions, Net of Cash Acquired" represents the net cash spent on the acquisition, taking into account any cash acquired as part of the transaction. This figure can be calculated by subtracting the cash acquired from the total amount spent on the acquisition.

For example, if Company A purchases Company B for $100 million, and Company B has $20 million in cash, the net cash spent on the acquisition would be $80 million. This would be recorded as a negative $80 million under "Acquisitions, Net of Cash Acquired" in the cash flow statement.

It is important to note that acquisitions are considered long-term investments, and the negative cash flow from such activities does not necessarily indicate poor financial health. Instead, it may signal that the company is investing in its long-term growth and competitive position in the industry.

Cash or Invest: Where Should Your Money Go?

You may want to see also

Frequently asked questions

Cash flow from investing activities is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities.

Cash flow from investing activities includes the purchase of physical assets, investments in securities, or the sale of securities or assets. For example, if a business owner invests in a new factory building to expand its operations, that purchase would be considered a cash outflow from investing activities.

Cash flow from investing activities is important because it shows how a company is allocating cash for the long term. For instance, a company may invest in fixed assets such as property, plant, and equipment to grow the business. While this may signal a negative cash flow from investing activities in the short term, it may help the company generate cash flow in the longer term.