High-yield corporate bonds, also known as junk bonds, are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. They are issued by corporations with a greater estimated default risk, which may include highly leveraged companies, those experiencing financial difficulties, or smaller/emerging companies. High-yield bonds are typically considered non-investment grade, with credit ratings below BBB- from Standard & Poor's and Fitch, or below Baa3 from Moody's.

High-yield bonds can be a good investment option for those seeking impressive cash flow, a relatively high degree of price stability, and instant diversification. Mutual funds and ETFs are common ways to gain exposure to high-yield bonds. Some examples of high-yield bond funds include the Vanguard High-Yield Corporate Fund (VWEHX), iShares iBoxx $ High Yield Corporate Bond ETF (HYG), and SPDR Bloomberg High Yield Bond ETF (JNK).

| Characteristics | Values |

|---|---|

| Definition | Debt securities issued by corporations |

| Other Names | Junk bonds |

| Credit Rating | Below BBB- from Standard & Poor's and Fitch, or below Baa3 from Moody's |

| Risk | More likely to default, higher price volatility |

| Advantages | Potential for higher returns |

| Disadvantages | Default risk, higher volatility, interest rate risk, liquidity risk |

| Issuers | Startup companies, capital-intensive firms with high debt ratios, former investment-grade companies in decline, emerging companies |

| Investment Options | Mutual funds, ETFs individual bonds from broker-dealers |

Mutual funds and ETFs

Mutual Funds

Mutual funds are a good option for investors who want to diversify their portfolios without having to research and choose individual stocks or bonds. They are also a good choice for those who want the benefits of professional money management without having to pay high fees.

- Vanguard High-Yield Corporate Fund (VWEHX)

- Fidelity Floating Rate High Income Fund (FFRHX)

- Fidelity Capital & Income Fund (FAGIX)

- American Funds Emerging Markets Bond Fund Class F-1 (EBNEX)

- T. Rowe Price Credit Opportunities Fund (PRCPX)

- American Century High Income Fund Investor Class (AHIVX)

- Northern Multi-Manager High Yield Opportunity Fund (NMHYX)

- Touchstone Ares Credit Opportunities Fund Class Y (TMAYX)

- Vanguard High-Yield Corporate Investor Shares (VWEHX)

- T. Rowe Price Intermediate Tax-Free High Yield Fund (PRIHX)

ETFs

ETFs, or exchange-traded funds, are a type of investment fund that trades on an exchange like a stock. They are a good option for investors who want the diversification and low costs of a mutual fund, but with the ability to buy and sell throughout the trading day.

- IShares iBoxx $ High Yield Corporate Bond ETF (HYG)

- JPMorgan BetaBuilders USD High Yield Corporate Bond ETF (BBHY)

- SPDR Portfolio High Yield Bond ETF (SPHY)

- VanEck High Yield Muni ETF (HYD)

- IShares BB Rated Corporate Bond ETF

- IShares Broad USD High Yield Corp Bd ETF

- Xtrackers USD High Yield Corp Bd ETF

- SPDR® Portfolio High Yield Bond ETF

- BNY Mellon High Yield Beta ETF

- Xtrackers Low Beta High Yield Bond ETF

Contingency Fund Investment: Where to Place Your Safety Net?

You may want to see also

Fallen angels

Some bond funds and ETFs specifically focus on investing in fallen angels. Examples include the VanEck Vectors Fallen Angel High-Yield Bond ETF and the iShares Fallen Angels USD Bond ETF.

Today's market conditions are particularly favourable for fallen angel bonds. The credit risk-to-yield ratio is attractive, offering higher income without a significant increase in default risk. Additionally, fallen angels tend to perform well during recessions due to their par values and coupon repayments.

Overall, fallen angels offer a unique opportunity for investors to achieve high yields and capital gains with relatively lower credit risk.

A Guide to Investing in Mutual Funds via Zerodha

You may want to see also

Rising stars

A rising star bond is issued by a company that is improving its credit quality. This means that the company is becoming more financially stable and is at less risk of defaulting on its debt obligations. As a result, the credit rating agencies will increase their rating of the bond, reflecting the improved creditworthiness of the issuing company.

Rising star bonds are an attractive investment opportunity for investors seeking to balance risk and reward. While these bonds may still carry the higher risks associated with junk bonds, their improving credit quality means that they are becoming less risky over time. This can make them a good option for investors who want to benefit from the potentially higher returns of high-yield bonds while also reducing their overall risk exposure.

When considering investing in rising star bonds, it is important to carefully research the issuing company's financial health and prospects. This includes reviewing the company's financial statements, analysing its business performance and outlook, and assessing the overall economic and market conditions that may impact its future credit quality.

Additionally, investors should be aware that rising star bonds can still carry significant risks, including default risk, higher volatility, interest rate risk, and liquidity risk. Diversification and careful risk management strategies remain essential when investing in these types of bonds.

Venture Capital Funds Backing Xenex Disinfection Services

You may want to see also

Default risk

The primary way for investors to manage default risk is through diversification. By investing in a variety of high-yield bonds across different issuers, industries, and regions, investors can reduce the impact of a default by any single bond issuer. However, diversification limits investment strategies and increases fees for investors.

Another way to manage default risk is to invest in high-yield bond funds, such as mutual funds or exchange-traded funds (ETFs). These funds provide exposure to a diverse range of high-yield bonds, reducing the risk of default by any individual bond. For example, the Vanguard High-Yield Corporate Fund invests in medium and lower-quality corporate bonds, holding about 880 different bonds. Similarly, the iShares iBoxx $ High Yield Corporate Bond ETF aims to track the performance of an index of US high-yield corporate bonds and held about 1,200 bonds as of August 2024.

While diversification can help manage default risk, it is important to note that high-yield bonds are still riskier than investment-grade bonds. Investors should carefully consider their financial situation, risk tolerance, and investment goals before investing in high-yield bonds.

Free Mutual Fund Investment: A Step-by-Step Guide

You may want to see also

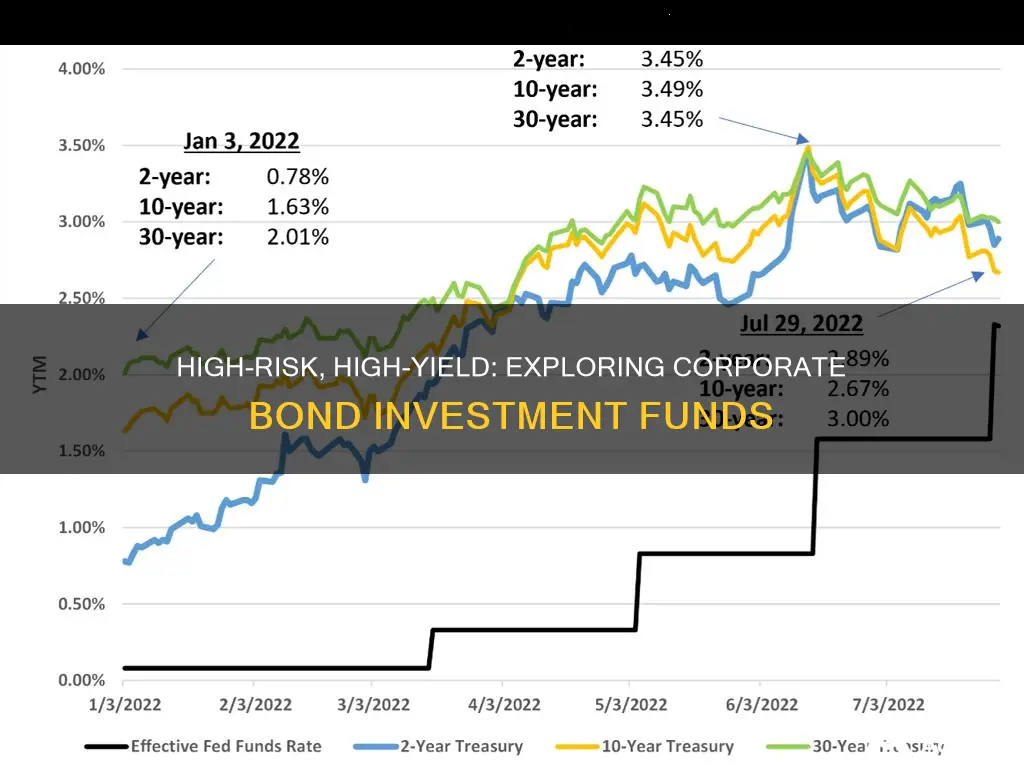

Interest rate risk

High-yield bonds tend to have shorter maturities, usually 10 years or less, and are often callable after four or five years. This relatively low duration makes them less sensitive to interest rate changes than long-term bonds. However, the longer the term of a bond, the higher the interest rate risk, as there is more time for interest rates to change.

It's important to note that while rising interest rates can negatively impact the market value of high-yield bonds, they can also have a positive effect. Interest rates often increase during periods of economic expansion, which can benefit the corporations issuing the bonds. This means that high-yield bonds may have a lower risk of default during these periods.

To manage interest rate risk, investors can consider diversifying their bond holdings by including bonds with different maturities and by investing in a mix of high-yield and investment-grade bonds. Additionally, investors can consider using bond ladders, which involve purchasing bonds with staggered maturity dates, to reduce the impact of interest rate changes.

Bond Index Funds: Safe Investment Havens?

You may want to see also

Frequently asked questions

High-yield corporate bonds are a type of bond issued by companies with a higher risk of default. They offer higher interest rates to compensate for the increased risk. These bonds are also known as "junk bonds" due to their lower credit quality.

High-yield corporate bonds offer the potential for higher returns compared to investment-grade bonds. The bonds with the highest risks typically offer the highest yields.

While high-yield corporate bonds offer the potential for higher returns, they also carry significant risks. These include default risk, higher volatility, interest rate risk, liquidity risk, and higher transaction costs.

There are several ways to invest in high-yield corporate bonds: you can buy them directly from broker-dealers, or you can buy into a mutual fund or ETF that holds high-yield corporate bonds. It is recommended that small investors avoid buying individual high-yield corporate bonds directly due to the high default risk.