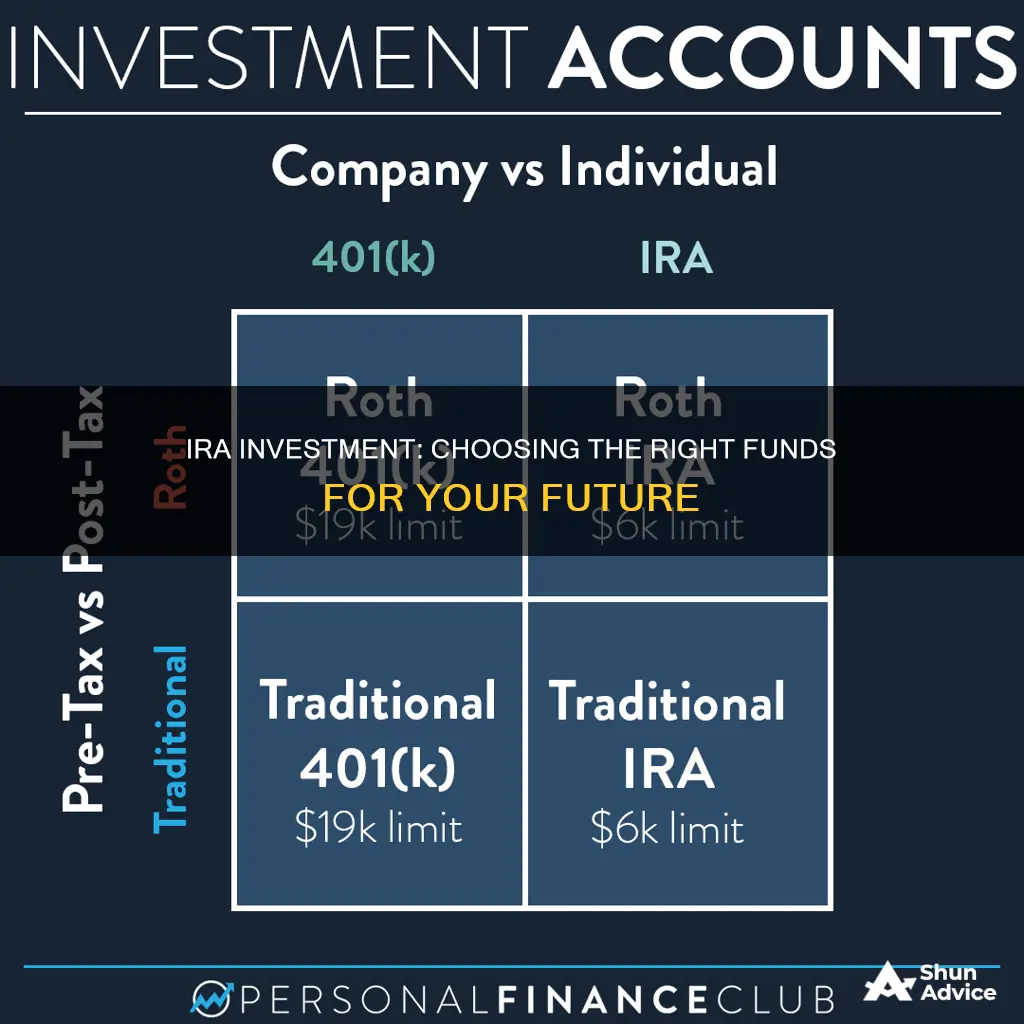

When it comes to investing your IRA, there are a variety of options to choose from. The best choice for you will depend on your personal circumstances, including your age, risk tolerance, and financial goals.

IRAs offer a wider range of investment options than employer-sponsored plans such as 401(k)s. You can choose to invest in individual stocks or a long list of mutual funds. You can also leave these decisions to an expert by choosing a low-cost robo-advisor.

Some of the most common IRA investments include:

- U.S. stock index funds

- U.S. bond index funds

- Global stock index funds

- Dividend stock funds

- Value stock funds

- Nasdaq-100 index funds

- Small-cap stock funds

- Real estate investment trusts (REITs)

- Target-date funds

| Characteristics | Values |

|---|---|

| Investment options | Stocks, bonds, mutual funds, annuities, unit investment trusts (UITs), exchange-traded funds (ETFs), real estate |

| Considerations | Time until retirement, risk tolerance, age, financial situation, investment horizon, financial goals |

| Investment types | Broad-based stock and bond index funds, global stock index funds, dividend stock funds, value stock funds, Nasdaq-100 index funds, small-cap stock funds, target-date funds, robo-advisors |

What You'll Learn

Stocks, bonds, mutual funds, annuities, and ETFs

Stocks

Stocks are a popular investment option for IRAs, particularly for those with a long investment horizon and a higher risk tolerance. Stocks can provide higher returns over time, making them attractive for tax-advantaged accounts like Roth IRAs. Additionally, stocks can be a good choice for younger investors as they offer greater saving potential due to tax-free compounding. When investing in stocks through an IRA, it's important to consider the tax implications, as dividends and capital gains may be taxed differently depending on the type of IRA.

Bonds

Bonds are another investment option for IRAs, offering a more conservative approach compared to stocks. Bonds are often less volatile and generate interest income. When choosing bonds for an IRA, it's important to consider the tax treatment of the account. For example, municipal bonds are typically held in regular accounts as they offer tax-exempt interest, while high-yield bonds, also known as junk bonds, are suitable for IRAs due to their higher risk and potential for greater returns.

Mutual Funds

Mutual funds are a common way to diversify an investment portfolio and can be used in IRAs. They pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Mutual funds are actively managed by professional portfolio managers, who make investment decisions on behalf of the investors. While mutual funds offer convenience and diversification, they may have higher fees and expense ratios compared to other investment options.

Annuities

Annuities are insurance products that provide guaranteed payments during retirement. They are often used in addition to IRAs or other retirement savings accounts. Annuities can be immediate or deferred, offering payouts right away or allowing for contributions to grow over time. It's important to note that annuities are not the same as IRAs. Annuities are insurance products, while IRAs are tax-advantaged retirement savings accounts. However, it is possible to hold an annuity within an IRA.

ETFs

Exchange-Traded Funds (ETFs) are investment vehicles that combine features of both stocks and mutual funds. They are traded on stock exchanges and provide investors with a simple and flexible way to gain exposure to a diverse range of assets. ETFs are known for their low expense ratios and tax efficiency, making them well-suited for IRAs, especially for tax-conscious investors. ETFs offer intraday trading flexibility and are easily accessible to investors with limited capital due to their low minimum investment requirements.

Diversifying Mutual Fund Investments: A Smart Strategy?

You may want to see also

Target-date funds

With a target-date fund, you choose the year when you want to access the money, and the fund will automatically shift from riskier, high-return assets (stocks) to safer, low-return assets (bonds) as you approach your target date. This is called an "asset mix". The fund will also rebalance itself and the appropriate amount of risk will be taken as you age.

TSP F Fund: Best Times to Invest and Why

You may want to see also

Real estate

However, there are many rules to navigate. Firstly, you will need a self-directed IRA, which is independent of any brokerage, bank, or investment company. You will also need a custodian, an entity that specializes in self-directed accounts that will manage the transaction, associated paperwork, and financial reporting.

Any real estate property you buy must be strictly for investment purposes. You, your family, or anyone the IRS deems "disqualified" cannot use it. This includes your parents, grandparents, children, grandchildren, great-grandchildren, and service providers of your IRA.

Purchasing real estate within an IRA usually requires paying in cash, and the IRA must pay all ownership expenses. The property can be financed with an investment property-specific mortgage, but this will be subject to unrelated business income tax (UBIT).

Offshore Investment Fund Setup: A Comprehensive Guide

You may want to see also

Risk tolerance

Time Horizon:

The amount of time you plan to invest for is an important factor in determining your risk tolerance. If you have a long investment horizon, you may be able to tolerate more risk since you have more time to recover from potential losses. On the other hand, if you're closer to retirement or need access to your funds sooner, you may want to take on less risk to protect your capital.

Ability to Tolerate Risk:

Consider your emotional and financial ability to handle market volatility and potential losses. If the idea of your investments fluctuating in value makes you uncomfortable, you may have a lower risk tolerance. Additionally, if you rely solely on your investments for income, you may want to take on less risk to avoid significant losses that could impact your financial stability.

Rules of Thumb:

There are some rules of thumb that can help guide your asset allocation based on risk tolerance. One common rule is to subtract your age from 100 (or 110 for a more aggressive approach) to determine the percentage of your portfolio that should be allocated to stocks. For example, if you're 30 years old, you would allocate 70% to 80% of your portfolio to stocks. However, you can adjust this based on your personal preferences and risk tolerance.

Age Considerations:

Your age can also impact your risk tolerance. Generally, younger investors can afford to take on more risk since they have a longer time horizon. As you get closer to retirement, you may want to gradually reduce the percentage of stocks in your portfolio and increase investments in bonds and less risky assets. This helps balance the need for growth with the need to protect your savings.

Financial Situation:

Your financial situation and goals can also influence your risk tolerance. If you're investing for retirement, you may have a higher risk tolerance compared to an account you use for paying monthly bills. Additionally, if your financial outlook seems uncertain, you may want to have a relatively lower allocation to risky assets.

When deciding how to allocate your IRA investments, it's crucial to assess your risk tolerance honestly and choose investments that align with your comfort level and financial goals. Remember that investing involves risk, and there are no guarantees of returns. Diversification and asset allocation can help manage risk, but they do not ensure a profit or protect against losses.

Fidelity Blue Chip Growth Fund: A Smart Investment Strategy

You may want to see also

Time horizon

When it comes to investing your IRA, time horizon is a critical factor to consider. It refers to the period you expect to hold an investment before needing the money. This could be a short-term horizon of fewer than five years, a medium-term horizon of three to ten years, or a long-term horizon of ten years or more.

If you have a short-term investment horizon, you'll want to choose conservative investment options to preserve your principal and ensure liquidity. Examples include money market funds, savings accounts, short-term certificates of deposit, and short-term bonds. These investments are suitable if you're nearing retirement or need access to a large sum of cash soon.

For those with a medium-term horizon, a balanced approach is necessary. You can invest in a mix of stocks and bonds, allowing for asset appreciation while managing risk. This strategy is often used for goals like saving for a child's college education or a first home. As the time horizon approaches its end, you can shift more assets into short-term options to reduce risk.

Long-term investment horizons, typically associated with retirement savings, offer the most flexibility in terms of risk tolerance. You can invest heavily in equities and take advantage of the potential for higher returns over the long run. As you get closer to retirement, you can gradually shift towards more conservative investments to protect your gains.

It's important to note that your risk tolerance and financial goals also play a role in determining your investment choices. Generally, the longer the time horizon, the more aggressive your investments can be. However, if you are risk-averse, you may opt for safer assets, even for long-term goals.

Additionally, consider the impact of inflation on your investments. While savings accounts and CDs offer stability, they may lose value over time due to inflation. On the other hand, stocks and stock funds are designed to outperform inflation but come with higher volatility.

Understanding your time horizon is crucial for making informed investment decisions and ensuring your IRA aligns with your financial goals.

Unlock Real Estate Funding: Strategies for Investors

You may want to see also