Vanguard Target Retirement Funds are a way to invest throughout your career and into retirement. Each fund is designed to manage risk while helping to grow your retirement savings. The funds start with an allocation that favours stocks in the early years of an investor's long-term time horizon. As an investor progresses through their career, Vanguard gradually rebalances its target retirement fund's asset allocation in favour of less risky securities, such as bonds and short-term reserves. The funds are designed to be a set it and forget it retirement savings option, removing the headache of deciding on a mix of assets and rebalancing those investments over time.

| Characteristics | Values |

|---|---|

| Minimum Investment | $1,000 |

| Average Expense Ratio | 0.08% |

| Industry Average Expense Ratio | 0.44% - 0.48% |

| Glide Path | The formula determining the fund's asset allocation, which becomes more conservative as the target date approaches |

| "To" Fund | The glide path freezes the asset allocation in the year of retirement |

| "Through" Fund | The glide path continues for 10+ years past retirement |

| Risk Profile | Changes to align with investors' changing tolerance for risk |

| Asset Allocation | 90% stocks and 10% bonds for younger investors; 30% stocks and 70% bonds for retired investors |

What You'll Learn

Vanguard Target Retirement Funds: A one-fund approach

Vanguard Target Retirement Funds are a way to invest throughout your career and into retirement. A single Target Retirement Fund can serve as a complete, diversified retirement portfolio. Each fund is designed to manage risk while helping to grow your retirement savings.

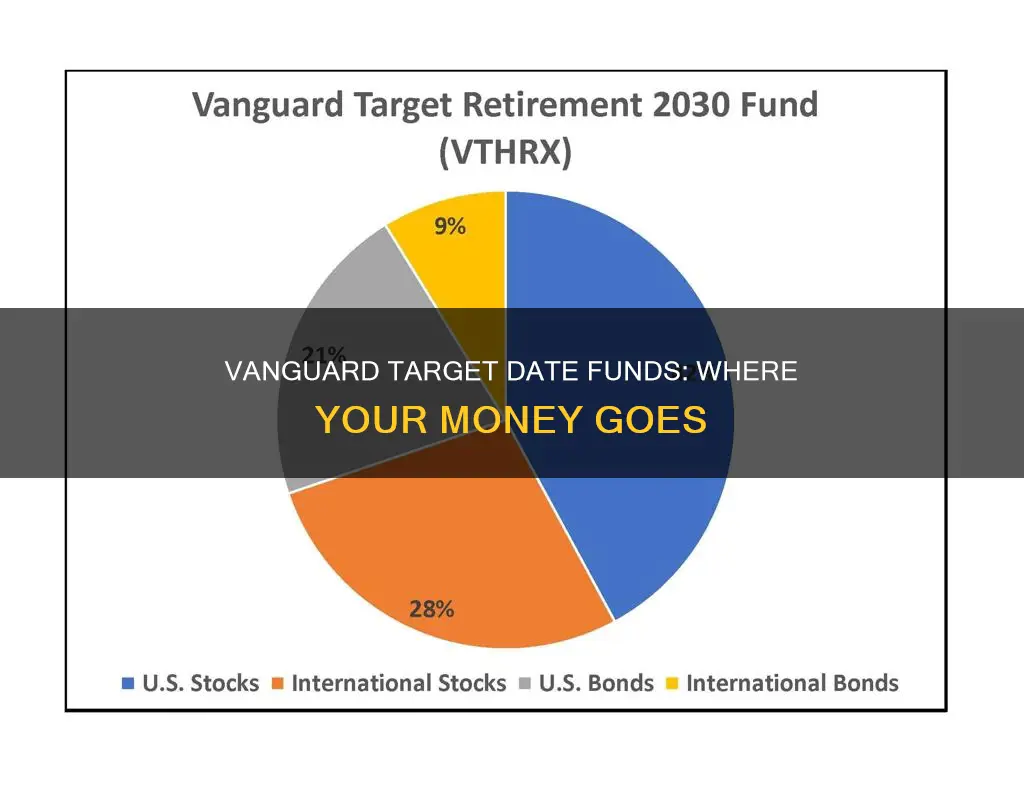

Each Target Retirement Fund invests in several other Vanguard funds to create a broadly diversified mix of stocks, bonds, and, in some cases, short-term reserves. The year in a Target Retirement Fund's name is its target date—the year in which Vanguard expects an investor in the fund will retire and leave the workforce.

A self-adjusting mix

Vanguard's investment professionals manage each fund, gradually adjusting its investment mix to become more conservative as the target date approaches. The funds' managers gradually shift each fund's asset allocation to fewer stocks and more bonds so the fund becomes more conservative as you get closer to retirement. Managers maintain the current target mix, freeing you from the hassle of ongoing rebalancing.

Choosing a Target Retirement Fund

Consider the Target Retirement Fund with the target date closest to the year you plan to retire. If you haven’t planned that far ahead, you can use the year you’ll reach your full Social Security retirement age (65 to 67, depending on when you were born). You’re not required to choose the fund that matches your projected retirement year. Once you review that fund’s mix of stocks and bonds, you could choose a fund with a later target date if you’d prefer a more aggressive investment mix. On the other hand, if you’d prefer a more conservative mix, you could choose a fund with an earlier target date.

The target date is not the end

Nothing special happens with a Target Retirement Fund when it reaches its target date. The fund doesn’t stop investing, and you don’t need to take your money out of the fund. The gradual move from stocks to bonds simply continues. Target Retirement Funds are designed to keep your money invested appropriately throughout your retirement years. About seven years after a fund reaches its target date, its investment mix is expected to match that of the Vanguard Target Retirement Income Fund. That fund is designed to provide income to retirees while seeking to preserve the original investment.

Mutual Funds: Financial Aid Investment Strategy

You may want to see also

How Vanguard's funds differ from the competition

Vanguard's Target Retirement Funds are designed to be a straightforward approach to a complex problem: how to invest successfully for retirement. Each fund is tailored to the individual, taking into account their risk tolerance, retirement timeline, and financial goals.

- Investor-owned: Vanguard is owned by its funds, which are in turn owned by Vanguard's fund shareholders. This means that the company returns value to its investors, not an outside firm. This structure helps Vanguard prioritise the financial well-being of its participants.

- Performance: Vanguard's Target Retirement Funds have historically provided higher returns with less volatility than their peer averages. The funds have performed in the top quartile among their peer groups for 10-year returns. This strong performance, combined with lower volatility, gives participants greater confidence in their retirement plans.

- Cost: Vanguard's average expense ratio for its Target Retirement Funds is 82% less than the industry average. Lower fees mean more money stays in the investor's account, working for them.

- Glide path: Vanguard's glide path, or the formula that determines the fund's asset allocation over time, is designed to optimise asset allocation and balance risk and reward. This is backed by decades of research and behavioural insights, helping participants retire when they want, with enough money to live comfortably.

- Automatic rebalancing: Vanguard's Target Retirement Funds are self-adjusting. The funds' managers gradually shift each fund's asset allocation to fewer stocks and more bonds as the target date approaches. This frees investors from the hassle of ongoing rebalancing, ensuring their portfolio remains aligned with their goals.

- Flexibility: Vanguard's Target Retirement Funds offer flexibility in terms of the target date. Investors are not required to choose the fund that matches their projected retirement year. They can opt for a fund with an earlier or later target date, depending on their risk tolerance and investment preferences.

- Broad diversification: Each Target Retirement Fund invests in several other Vanguard funds, creating a diverse mix of stocks, bonds, and, in some cases, short-term reserves. This diversification helps to manage risk while aiming for growth.

- Research and expertise: Vanguard's Target Retirement Funds are designed based on the company's decades of portfolio management expertise and time-tested investment techniques. This includes Vanguard's Life-Cycle Investing Model, which adds value through a strategic approach.

- Education and support: Vanguard provides educational resources and support to help investors make informed decisions. This includes retirement calculators, investment guides, and other tools to navigate the complex world of retirement planning.

In summary, Vanguard's Target Retirement Funds stand out from the competition by offering strong historical performance, low costs, a thoughtful glide path, automatic rebalancing, flexibility, broad diversification, and a wealth of educational resources. These features combine to provide a comprehensive solution for individuals seeking to successfully invest for retirement while managing risk and optimising returns.

Protecting Investments: Safe Funds for Volatile Markets

You may want to see also

The benefits of diversification

Vanguard Target Retirement Funds are a great way to invest throughout your career and into retirement. One of the key advantages of these funds is the benefit of diversification. By investing in a range of different assets, such as stocks, bonds, and short-term reserves, these funds provide investors with a well-diversified portfolio that helps to manage risk while growing retirement savings. Here are some of the key benefits of diversification:

Risk Management

Diversification is a risk management technique. By spreading your investments across various assets, you reduce the risk of losing all your money if one particular investment performs poorly. This is because the performance of different assets is often uncorrelated, meaning that if one type of asset is doing well, another might be doing poorly, and vice versa. As a result, a diversified portfolio can help smooth out the ups and downs of the market and provide more consistent returns over time.

Access to a Wide Range of Investments

Vanguard Target Retirement Funds invest in thousands of U.S. and international stocks and bonds. This gives investors access to a broad range of investments that they might not be able to access individually. By pooling their money with other investors, individuals can gain exposure to a diverse set of companies and industries, both domestically and globally. This diversification across different markets and asset classes helps to further reduce risk and improve long-term returns.

Automatic Rebalancing

Vanguard Target Retirement Funds are self-adjusting and are professionally managed by investment experts. As the target retirement date approaches, the fund managers gradually adjust the investment mix to become more conservative. This means that the fund automatically rebalances your portfolio for you, freeing you from the hassle of ongoing rebalancing. This ensures that your asset allocation stays in line with your risk tolerance and investment goals as you progress through your career and into retirement.

Long-Term Investment Strategy

Diversification is a long-term investment strategy. By investing in a range of assets with different risk and return characteristics, you are positioning your portfolio to perform well in various market conditions. While some investments may perform better than others at different times, having a diversified portfolio ensures that you are not overly exposed to any one particular asset or market. This helps to smooth out the impact of market volatility and can lead to more consistent, long-term returns.

Peace of Mind

Diversification can provide investors with peace of mind. Knowing that your investments are spread across a variety of assets can help reduce the stress and anxiety associated with investing. It allows you to focus on your long-term investment goals without worrying about the day-to-day fluctuations of the market. A well-diversified portfolio can give you confidence that your investments are managed in a way that balances risk and return effectively.

Lending Club: Funds Investing in Peer-to-Peer Loans

You may want to see also

Vanguard's fees compared to the industry average

Vanguard is known for its low-cost investment funds, which have expense ratios that are significantly lower than the industry average.

Vanguard's average ETF and mutual fund expense ratio is 0.08%, compared to the industry average of 0.44% (excluding Vanguard). This means that Vanguard's expense ratio is 82% less than the industry average.

Vanguard's low-cost approach is a result of its unique investor-centric structure, where the company is owned by its funds, which are in turn owned by Vanguard's fund shareholder clients. This structure has allowed Vanguard to gain tremendous scale, with more than 15 million investors and over $1 trillion in target-date fund assets. As a result, the company has been able to drive down costs for its investors.

In addition to its low expense ratios, Vanguard also offers no-transaction-fee mutual funds and ETFs, as well as low or no account fees, depending on the account type and balance. For example, Vanguard's standard brokerage and IRA accounts have a $20 annual fee, which is waived if the client signs up for e-delivery of statements.

Vanguard's low fees make it a good choice for long-term investors seeking a low-cost investment option. However, it is important to note that Vanguard's investment funds may have minimum investment requirements, which can range from $1,000 to $3,000 or more.

Overall, Vanguard's fees are significantly lower than the industry average, making it an attractive option for cost-conscious investors.

Mutual Funds vs. ETFs: Which is Better for Long-Term Investing?

You may want to see also

How to choose a Vanguard Target Retirement Fund

Choosing a Vanguard Target Retirement Fund is an important decision that can help bring financial well-being. Here are some key considerations on how to choose the right fund for your needs:

Understanding Target Retirement Funds

Target Retirement Funds, also known as life-cycle funds or target-date funds, are designed to simplify retirement investing. These funds automatically adjust their investment mix over time, becoming more conservative as you approach retirement. The year in the fund's name is typically the target retirement date, and the investment mix is adjusted accordingly. For example, a Vanguard Target Retirement 2055 Fund is designed for investors expecting to retire around the year 2055.

Factors to Consider

When choosing a Vanguard Target Retirement Fund, here are some key factors to keep in mind:

- Risk and Return: The closer you are to retirement, the more conservative the fund's investment mix will be. If you are further away from retirement, the fund's investment mix will be more aggressive, seeking higher returns.

- Glide Path: This refers to how the fund adjusts its investment mix over time. Consider whether you prefer a "to" glide path, where the adjustment freezes once the target date is reached, or a "through" glide path, which continues adjusting for a period after retirement.

- Fees and Expenses: Target Retirement Funds can have varying expense ratios and fees. Vanguard is known for its low expense ratios, but it's important to compare these costs across different funds to ensure you're getting a good value.

- Asset Allocation: Different funds with the same target date can have varying allocations in stocks and bonds. Choose a fund that aligns with your risk tolerance and need for growth. If you prefer a more aggressive approach, consider a fund with a later target date. If you want a more conservative mix, choose a fund with an earlier target date.

- Performance and Reviews: While past performance doesn't guarantee future results, it's worth considering the historical returns and ratings of the funds. Look for independent ratings from sources like Morningstar to get an unbiased evaluation.

- Your Retirement Goals: Consider your overall retirement goals and how the fund fits into your broader financial plan. Think about your expected retirement age, risk tolerance, and income needs during retirement.

Final Thoughts

Remember to review your asset mix periodically to ensure it aligns with your goals and risk tolerance. Additionally, consider seeking advice from a financial professional to help you make an informed decision about choosing the right Vanguard Target Retirement Fund for your needs.

A Guide to Investing in Paytm Mutual Funds

You may want to see also

Frequently asked questions

Target-date funds, also known as life-cycle funds or target-retirement funds, aim to continually strike the right balance between the risk necessary to build wealth and safer bets to protect a growing nest egg. The fund automatically rebalances your portfolio with the right mix of stocks, bonds and money market accounts as you age.

You should generally choose a fund whose date most closely aligns with the year you plan to retire or start using the money.

There are three ways to invest in a target-date fund. Target-date funds are a common preset choice for a 401(k). You can also open a brokerage account with a fund manager or online broker to shop for target-date funds. Or you can purchase one directly from a fund provider like Vanguard, Fidelity or T. Rowe Price.

The chief appeal of target-date funds is their simplicity. They are a "set it and forget it" retirement savings option that removes two headaches for investors: deciding on a mix of assets and rebalancing those investments over time.