A negative cash balance in a trading account can be caused by a number of factors, including rejected deposits, unsettled funds, or unexpected fees. It is important to review recent transactions and account details to identify the cause of the negative balance. In some cases, it may be necessary to contact the bank or investment platform's customer support for clarification.

What You'll Learn

- Potential causes: rejected deposits, margin interest, or hidden fees

- Potential solutions: sell investments, resolve the issue with your bank, or submit a new deposit

- Impact on total value: distorts the total value of securities in the account

- Customer service: call, email, or live chat

- Alternatives: check transaction history, or wait a few days to see if the balance returns to $0

Potential causes: rejected deposits, margin interest, or hidden fees

There are several potential reasons for a negative cash balance in a trading account. One common cause is rejected deposits. If your banking institution rejects a deposit and pulls back the funds, it can take up to seven business days for you to be notified, during which time you may have already invested the funds in your account. Another potential cause is margin interest. If you have borrowed money to trade on margin, you will be charged interest on the loan, which can result in a negative cash balance if the interest amount is higher than your available cash. Additionally, there may be hidden fees or unexpected charges that you were not aware of, such as monthly margin fees, which can also contribute to a negative cash balance. It is important to review your transactions and reach out to your bank or financial institution for clarification on any unclear charges or negative balances.

Investing Excess Cash: Strategies for Smart Financial Planning

You may want to see also

Potential solutions: sell investments, resolve the issue with your bank, or submit a new deposit

If you have a negative cash balance in your Schwab account, there are a few potential solutions: sell investments, resolve the issue with your bank, or submit a new deposit.

Firstly, you could sell enough of your investments to cover the negative cash balance. This is a quick way to resolve the issue, but it may not be ideal if you did not want to sell your investments.

Another option is to resolve the issue with your bank and resubmit your deposit. This may be suitable if your bank rejected your deposit, which can happen if there were not enough funds in your account or if the funds were under a clearing period. Contact your bank to understand the reason for the rejection and try to submit the deposit again.

Finally, you could submit a new deposit from a different bank account to cover the negative cash balance. This approach ensures you can hold onto your investments, but you will need to provide the funds from an alternative source.

It is important to address a negative cash balance in your trading account promptly to avoid further complications or potential liquidation of your holdings. Review your transactions and account details to understand the cause of the negative balance, and consider contacting Schwab directly for assistance if needed.

Maximizing Cash Value Life Insurance: A Smart Investment Guide

You may want to see also

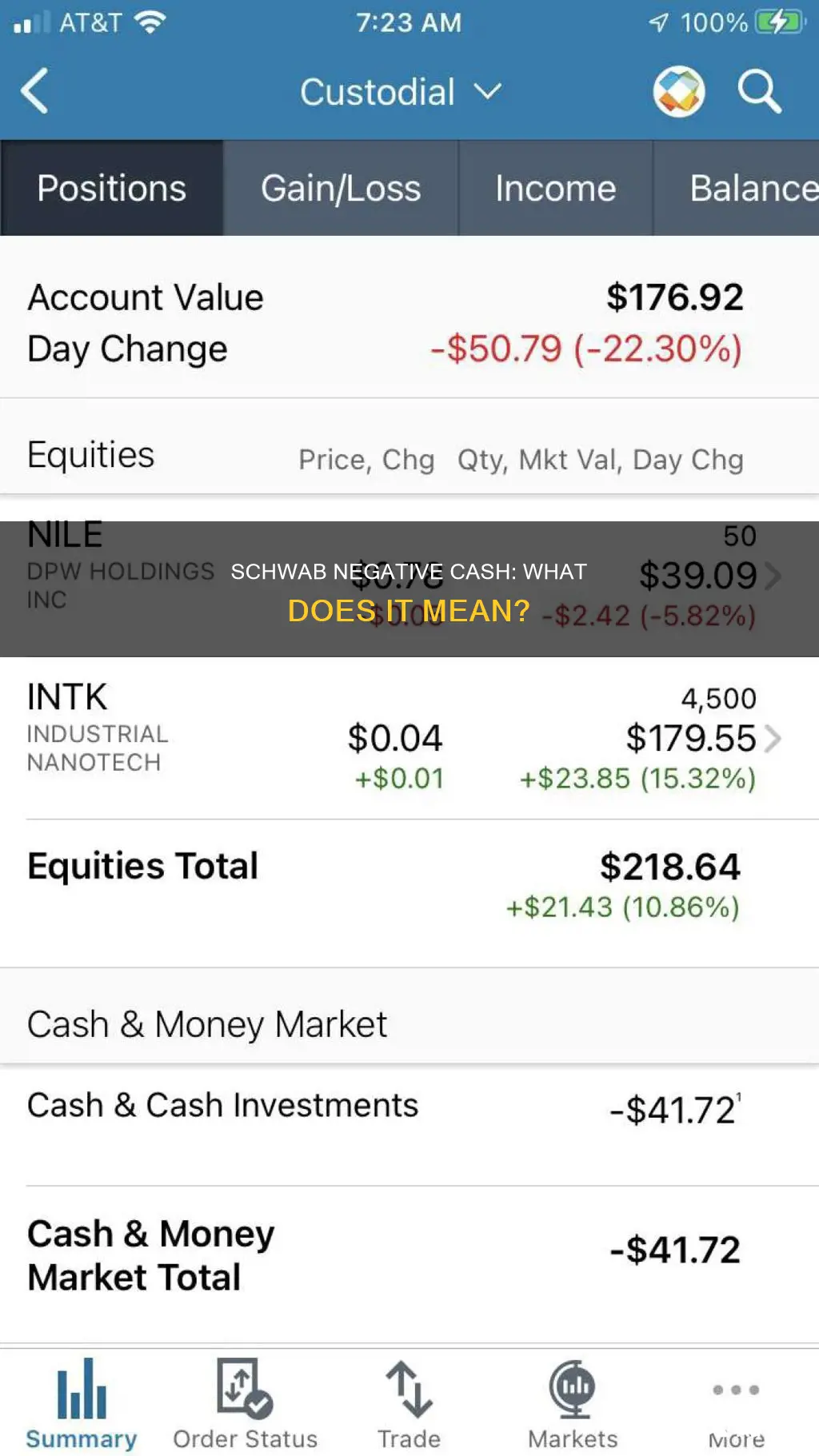

Impact on total value: distorts the total value of securities in the account

A negative cash balance in an investment account can distort the total value of securities in that account. This can occur when a security is bought, and the cash balance decreases, or when a security is sold, and the cash balance increases.

For example, if you have a negative cash balance of -$100 and you have purchased securities worth $150, the total value of securities in your account will be distorted by the negative cash balance, appearing as $50 instead of $150.

In this case, it is important to review your transactions and ensure that all trades are accounted for correctly. You may need to enter a one-time balance adjustment to rectify the issue. This can be done by reviewing the transactions register for any placeholder entries, which are usually shown in light grey at the start of the register.

Additionally, it is worth noting that some brokerages show the cash invested in the "core account" as the cash balance in the account, without reflecting individual trades in and out of the core. This can also lead to a distorted total value of securities in the account.

Wells Fargo's Cash Investment Options: What You Need to Know

You may want to see also

Customer service: call, email, or live chat

If you have noticed a negative cash balance in your Schwab account, there are a few things you can do to resolve the issue. Firstly, check your transactions over the last few days to see if there are any unexpected fees or margin interests that may have caused the negative balance. You can do this by going to the "Dashboard" in your account and selecting "View Balance Details" and then "History". If you notice any unexpected transactions, you can contact Schwab's customer service team by calling them, emailing them, or using their live chat feature.

When you call Schwab's customer service team, they will be able to tell you if you have any pending trades or other issues that may have caused the negative cash balance. You can also ask them to turn off the margin feature if you do not wish to use it. If you have multiple accounts, make sure to select the correct account from the dropdown menu when checking your order status.

If you prefer to use email or live chat, you can explain your issue and provide as many details as possible about your transactions and account history. The customer service team will then investigate the issue and get back to you with a solution.

It is important to address a negative cash balance as soon as possible to avoid any further issues or complications with your investments. Schwab's customer service team is available 24/7 and is known for being friendly and helpful, so don't hesitate to reach out to them for assistance.

Gross PPE Cash Flow: Investing Strategies for Success

You may want to see also

Alternatives: check transaction history, or wait a few days to see if the balance returns to $0

If you have a negative cash balance in your Schwab account, there are a few alternatives to consider before contacting Schwab directly. Firstly, check your transaction history for any unexpected fees or margin interests that may have been charged to your account. These charges can affect your cash balance and result in a negative amount. For example, if you have a margin account and borrow money to buy stocks, you will be charged interest on that loan. This interest can accumulate and result in a negative cash balance.

Additionally, review your transaction history for any recent trades or purchases that may have exceeded your settled funds. If you have made purchases that exceed the value of your settled funds, this can also result in a negative cash balance.

If you have reviewed your transaction history and cannot identify any obvious reasons for the negative balance, you may consider waiting a few days to see if the balance returns to $0. Sometimes, negative cash balances can occur due to temporary issues or delays in transaction processing. By waiting a few days, you allow time for any pending transactions to clear and for your balance to adjust accordingly.

It is important to regularly review your transaction history and monitor your cash balance to identify and address any discrepancies promptly. This will help you make informed decisions about your investments and ensure the accurate management of your finances.

If, after checking your transaction history and waiting a few days, the negative cash balance persists, you may need to contact Schwab directly for further assistance in resolving the issue. Their customer support team can provide you with account-specific information and help you understand the reason for the negative cash balance.

Investments, Cash Flows, and the Impact of Gains

You may want to see also

Frequently asked questions

A negative cash balance in your Schwab account could be due to a rejected deposit, where the banking institution pulls back the funds. It could also be that you bought things that exceed the value of your settled funds.

There are a few ways to fix a negative cash balance in your Schwab account:

- Sell enough of your investments to cover the cash balance that you owe.

- Resolve the issue with your bank and resubmit your deposit.

- Submit a new deposit from a different bank account.

If you still have a negative cash balance, Schwab may need to liquidate your holdings to cover the amount owing. They will start by selling the most recent whole shares you've purchased at the current market price.