What if I reinvest my short-term gains? This question is a common dilemma for investors, especially those who are new to the world of finance. Reinvesting short-term gains can be a powerful strategy to grow your wealth over time, but it also comes with certain risks and considerations. In this article, we will explore the benefits and potential pitfalls of reinvesting short-term gains, and provide some practical tips to help you make informed decisions about your investments.

What You'll Learn

- Tax Implications: Understand tax laws to optimize your short-term gains

- Investment Strategies: Diversify and consider long-term growth potential

- Risk Management: Balance risk and reward for sustainable returns

- Market Timing: Learn to recognize optimal moments for reinvestment

- Compound Interest: Reinvesting gains can accelerate wealth accumulation

Tax Implications: Understand tax laws to optimize your short-term gains

Understanding the tax implications of short-term gains is crucial for investors who aim to optimize their returns and make informed decisions. When you reinvest your short-term gains, the tax treatment can significantly impact your overall financial strategy. Here's a detailed guide to help you navigate the tax laws and maximize your gains:

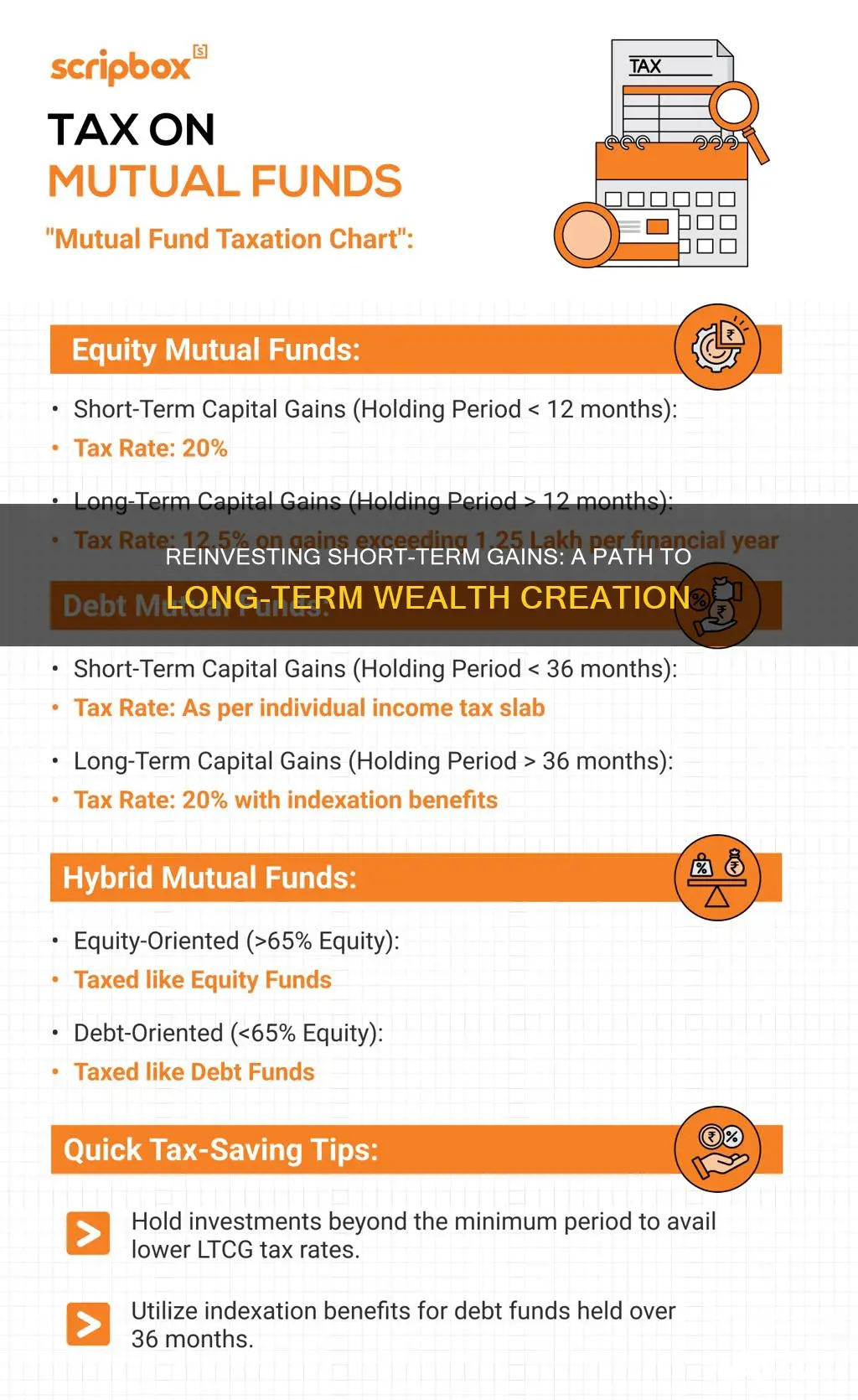

Capital Gains Tax: Short-term capital gains are typically taxed at a higher rate compared to long-term gains. In many jurisdictions, short-term gains are treated as ordinary income, which means they are taxed at your regular income tax rate. This can be a significant consideration, especially if you are in a higher tax bracket. For example, if you sell an asset for a short-term gain and reinvest the proceeds, you might want to evaluate the tax consequences. Understanding the tax brackets and rates applicable to your jurisdiction is essential to estimate the tax liability on the reinvested gains.

Tax Deductions and Credits: Tax laws often provide deductions and credits to encourage certain behaviors. For instance, some countries offer tax benefits for reinvesting gains in specific industries or sectors. Research and identify any available deductions or credits that can be applied to your reinvested short-term gains. These incentives can help reduce your taxable income and, consequently, the tax amount owed. For instance, if you reinvest your gains in a qualified retirement plan, you may be eligible for tax advantages associated with those plans.

Tax-Efficient Reinvestment Strategies: To optimize your short-term gains, consider implementing tax-efficient reinvestment strategies. One approach is to reinvest the gains in tax-advantaged accounts, such as retirement accounts or tax-efficient mutual funds. These accounts often offer tax deferral or tax-free growth, allowing your reinvested gains to compound over time. Additionally, you can explore tax-efficient exchange-traded funds (ETFs) or index funds, which may provide diversification and potential tax benefits.

Long-Term Holding and Tax Deferral: If you plan to reinvest your short-term gains in a long-term investment, you can take advantage of tax deferral. Long-term capital gains are generally taxed at a lower rate than short-term gains. By holding the reinvested assets for an extended period, you may qualify for the reduced tax rate when you eventually sell them. This strategy can be particularly beneficial for investors who believe in the long-term growth potential of their chosen assets.

Consultation with a Tax Professional: Tax laws can be complex, and each jurisdiction has its own set of rules. It is advisable to consult a qualified tax professional or accountant who can provide personalized advice based on your specific circumstances. They can help you navigate the tax implications, identify potential savings, and ensure compliance with the law. A tax expert can also assist in structuring your reinvestment strategy to minimize tax liabilities and maximize your financial gains.

Solana's Future: A Long-Term Investment Strategy

You may want to see also

Investment Strategies: Diversify and consider long-term growth potential

When considering how to reinvest short-term gains, it's crucial to adopt a strategic approach that emphasizes diversification and long-term growth potential. This strategy is particularly important in today's dynamic and often volatile financial markets. Here's a detailed guide on how to navigate this process effectively:

Diversification: The Cornerstone of Strategy

Diversification is a fundamental principle in investing, and it becomes even more critical when you're dealing with short-term gains. This strategy involves spreading your investments across various asset classes, sectors, and geographic regions. By doing so, you reduce the risk associated with any single investment and create a more resilient portfolio. For instance, if you've made a short-term profit in stocks, consider allocating a portion of that gain to other asset classes like real estate, bonds, or even alternative investments like commodities or cryptocurrencies. This approach ensures that your portfolio is not overly exposed to any one market or sector, providing a more stable foundation for long-term growth.

Long-Term Growth Potential: A Focused Approach

While diversification is essential, it's equally important to consider the long-term growth potential of your investments. Short-term gains can be reinvested with a view to capitalize on the following:

- Compounding Returns: Reinvesting short-term gains can lead to compounding returns, where your earnings generate additional earnings over time. This effect can significantly boost your long-term wealth accumulation. For example, if you reinvest dividends from a stock into the same or similar stocks, the dividends earned on the reinvested amount will also generate dividends, creating a snowball effect.

- Market Trends: Analyzing market trends and identifying sectors or industries with strong growth potential can be a strategic move. Reinvesting in these areas can lead to substantial long-term gains. However, it's crucial to conduct thorough research or consult financial advisors to make informed decisions.

- Reinvestment Strategies: Consider implementing strategies like dollar-cost averaging, where you invest a fixed amount regularly, regardless of the market price. This approach can help smooth out market volatility and provide a steady growth path.

Risk Management and Regular Review

Reinvesting short-term gains also requires a thoughtful approach to risk management. Here are some key considerations:

- Risk Assessment: Evaluate the risk associated with each investment. Diversification helps mitigate risk, but it's essential to understand the potential pitfalls of each asset class.

- Regular Portfolio Review: Periodically review your investment portfolio to ensure it aligns with your financial goals and risk tolerance. Market conditions and personal circumstances can change, so a review is necessary to make adjustments.

- Tax Implications: Be mindful of tax consequences when reinvesting gains. Different jurisdictions have varying tax rules, so understanding these implications is vital to optimize your investment strategy.

In summary, reinvesting short-term gains is a powerful tool for building wealth over the long term. By diversifying your portfolio and focusing on investments with strong growth potential, you can navigate the complexities of the financial markets effectively. Remember, a well-diversified portfolio, combined with a long-term perspective, is a key ingredient for successful investing.

Egypt-China Investment Deal: Unlocking Africa's Future

You may want to see also

Risk Management: Balance risk and reward for sustainable returns

When considering the reinvestment of short-term gains, it's crucial to approach it with a strategic mindset, especially in the context of risk management. The goal is to balance the potential for higher returns with the need to preserve capital and maintain financial stability. Here's a detailed guide on how to navigate this strategy effectively:

Understanding Risk and Reward: Reinvesting short-term gains often involves taking on additional risk to potentially increase returns. This could mean investing in more volatile assets or expanding your portfolio's exposure to different markets. For instance, if you've made a profit from a short-term trade, reinvesting those gains might involve purchasing stocks or funds with a higher risk profile. However, it's essential to understand that higher risk doesn't always equate to higher rewards; it's about managing the risk-reward ratio effectively.

Risk Assessment: Before reinvesting, conduct a thorough risk assessment. Evaluate your current investment portfolio and identify the level of risk it entails. Consider factors such as asset allocation, diversification, and the historical volatility of your investments. By understanding your current risk exposure, you can make informed decisions about where and how much to reinvest. Diversification is key; ensure that your reinvested funds are spread across various asset classes to mitigate potential losses.

Risk Mitigation Strategies: To balance risk and reward, employ several risk management techniques. Firstly, consider using stop-loss orders to limit potential losses. This strategy involves setting a predetermined price at which you will sell an asset if it moves against your position. Secondly, regularly review and rebalance your portfolio. Market conditions change, and over time, certain investments may become over- or under-weighted. Rebalancing helps maintain your desired asset allocation and risk exposure. Additionally, consider implementing risk-control tools like options or futures contracts to hedge against potential market downturns.

Long-Term Perspective: Adopting a long-term investment perspective is vital when reinvesting short-term gains. Short-term market fluctuations should not deter you from your investment goals. Focus on the underlying value of your investments and the potential for long-term growth. By maintaining a long-term outlook, you can make more rational decisions, avoiding impulsive reactions to short-term market volatility. This approach also allows you to benefit from compound interest, where reinvested earnings generate returns, further growing your wealth over time.

Regular Monitoring and Adjustment: Risk management is an ongoing process. Continuously monitor your investments and stay updated on market trends and news that may impact your holdings. Regularly review your risk assessment and make adjustments as necessary. Market conditions, economic factors, and global events can influence risk profiles, so staying informed is crucial. Additionally, consider seeking advice from financial advisors who can provide personalized guidance based on your risk tolerance and investment objectives.

In summary, reinvesting short-term gains requires a thoughtful approach to risk management. By understanding the risk-reward relationship, assessing your current risk exposure, and employing various risk mitigation strategies, you can make informed decisions. Adopting a long-term perspective and staying committed to your investment strategy will help you navigate the potential pitfalls of short-term market volatility and work towards sustainable returns.

Unveiling the World of Short-Term Investment Options

You may want to see also

Market Timing: Learn to recognize optimal moments for reinvestment

Market timing is an essential skill for investors who aim to maximize their returns and make the most of their short-term gains. It involves recognizing the right moments to reinvest your profits, allowing your investments to grow exponentially over time. While it may seem like a simple concept, mastering market timing can be challenging and requires a deep understanding of market dynamics and trends. Here's a guide to help you navigate this process:

Understanding Market Trends: The first step towards successful market timing is developing a keen understanding of market trends. Study historical data and identify patterns in the market's behavior. Look for indicators such as price movements, volume trends, and technical chart patterns that can signal potential turning points. For example, a sudden surge in stock prices might indicate an overbought market, suggesting a potential downturn. Conversely, a prolonged period of price consolidation could be a sign of accumulation, hinting at an upcoming upward trend. By recognizing these patterns, you can make informed decisions about when to reinvest.

Risk Assessment and Diversification: Reinvesting short-term gains carries inherent risks, especially during volatile market conditions. It's crucial to assess your risk tolerance and diversify your investments accordingly. Consider allocating your reinvested funds across various asset classes, sectors, or industries to mitigate potential losses. Diversification ensures that your portfolio is not overly exposed to any single market event or sector downturn. Regularly review and adjust your investment strategy to align with your risk profile and market conditions.

Technical Analysis Tools: Technical analysis is a powerful approach to market timing. Utilize various technical indicators and charting tools to identify potential entry and exit points. Moving averages, relative strength index (RSI), and exponential moving averages are commonly used tools. For instance, crossing a short-term moving average with a long-term one can signal a potential trend change, providing an optimal moment to reinvest. These tools help investors make data-driven decisions, reducing the influence of emotional impulses.

Long-Term Perspective: While market timing is about recognizing short-term opportunities, it's essential to maintain a long-term investment perspective. Short-term gains should be viewed as a means to fuel further growth rather than a final destination. Reinvesting these gains allows your wealth to compound over time, benefiting from the power of compounding returns. Focus on building a robust investment strategy that aligns with your financial goals, and use short-term gains as a catalyst to accelerate your progress.

Stay Informed and Adapt: Markets are dynamic, and successful market timing requires constant learning and adaptation. Stay updated on economic news, global events, and industry-specific developments that could impact your investments. Be prepared to adjust your reinvestment strategy based on changing market conditions. Regularly review your portfolio performance and make necessary adjustments to stay on track. Market timing is an art that improves with experience, so keep refining your skills and strategies.

Understanding Long-Term and Short-Term Investing: A Comprehensive Guide

You may want to see also

Compound Interest: Reinvesting gains can accelerate wealth accumulation

Reinvesting your short-term gains is a powerful strategy to harness the potential of compound interest and significantly accelerate your wealth accumulation journey. This concept is particularly beneficial for investors who aim to build substantial financial growth over time. When you reinvest your short-term profits, you essentially allow your money to work harder for you by putting it back into the same or similar investments. This practice is the cornerstone of compound interest, a phenomenon where your earnings generate additional earnings, and these new earnings, in turn, produce even more earnings over time.

The beauty of compound interest lies in its ability to create a snowball effect. As you consistently reinvest your short-term gains, the initial amount grows exponentially. For instance, if you invest $1,000 and earn a 10% return, reinvesting that $100 gain means your next investment is now $1,100. The following year, you'll earn 10% on this new total, resulting in a $110 profit. Over time, this process compounds, leading to substantial growth. This strategy is especially advantageous for long-term investors, as it allows them to benefit from the power of compounding over an extended period.

To maximize the benefits of reinvesting short-term gains, consider the following: Firstly, ensure that your initial investments are well-diversified to minimize risk. This way, even if one investment underperforms, others can compensate for potential losses. Secondly, research and choose investments with a history of consistent growth and strong fundamentals. This increases the likelihood of generating positive short-term returns. Lastly, regularly review and adjust your investment portfolio to align with your financial goals and risk tolerance.

Additionally, it's essential to understand the tax implications of reinvesting gains. In many jurisdictions, reinvesting dividends or capital gains may be tax-efficient, especially if held in a tax-advantaged account like a retirement fund. However, it's crucial to consult with a financial advisor to navigate the tax laws in your region and ensure compliance with regulations. They can provide tailored advice on how to optimize your reinvestment strategy while minimizing tax liabilities.

In summary, reinvesting short-term gains is a strategic approach to wealth accumulation, leveraging the power of compound interest. By consistently putting your earnings back into the market, you can watch your wealth grow exponentially over time. This method is a fundamental principle of successful long-term investing, allowing individuals to build substantial financial portfolios with relative ease. Remember, the key to success is discipline, diversification, and a well-informed approach to investing.

Master Short-Term Investments: A Comprehensive Audit Guide

You may want to see also

Frequently asked questions

Reinvesting short-term gains can be a strategic move, especially if you have a long-term investment horizon. By reinvesting, you can compound your returns over time, potentially growing your wealth faster. However, it's important to consider the tax implications, as short-term capital gains are typically taxed at a higher rate than long-term gains. Consult a tax advisor to understand the best approach for your situation.

Yes, there are risks to consider. Reinvesting without proper research or diversification may lead to higher volatility in your portfolio. If the market takes a downturn, your reinvested gains could be eroded. It's crucial to assess your risk tolerance and ensure that your reinvestment strategy aligns with your investment goals and time frame.

Diversification is key. Instead of reinvesting all your short-term gains in a single asset, consider spreading them across different investments. This could include a mix of stocks, bonds, mutual funds, or exchange-traded funds (ETFs). Regularly reviewing and rebalancing your portfolio can help manage risk and ensure it stays aligned with your investment objectives.

Reinvesting in a different asset class can be a smart move to balance risk and reward. For example, if you've made short-term gains in stocks, you might consider reinvesting some of those gains in bonds or real estate, which can provide a more stable return. Diversifying across asset classes can help smooth out market fluctuations and protect your capital.

Absolutely! Consulting a financial advisor is highly recommended before making significant reinvestment decisions. They can provide personalized advice based on your financial goals, risk profile, and time horizon. A financial advisor can help you navigate the complexities of reinvesting short-term gains and ensure that your strategy is tailored to your specific needs and circumstances.