There are a variety of investment options that pay out monthly income, including savings accounts, certificates of deposit, dividend-paying stocks, bonds, annuities, rental real estate, and business ownership. These options offer varying levels of risk, liquidity, and potential returns, so it's important for investors to carefully consider their financial goals, risk tolerance, and time horizon before committing to any investment. Working with a financial advisor can help individuals build a portfolio of income-generating investments that aligns with their overall financial plan.

What You'll Learn

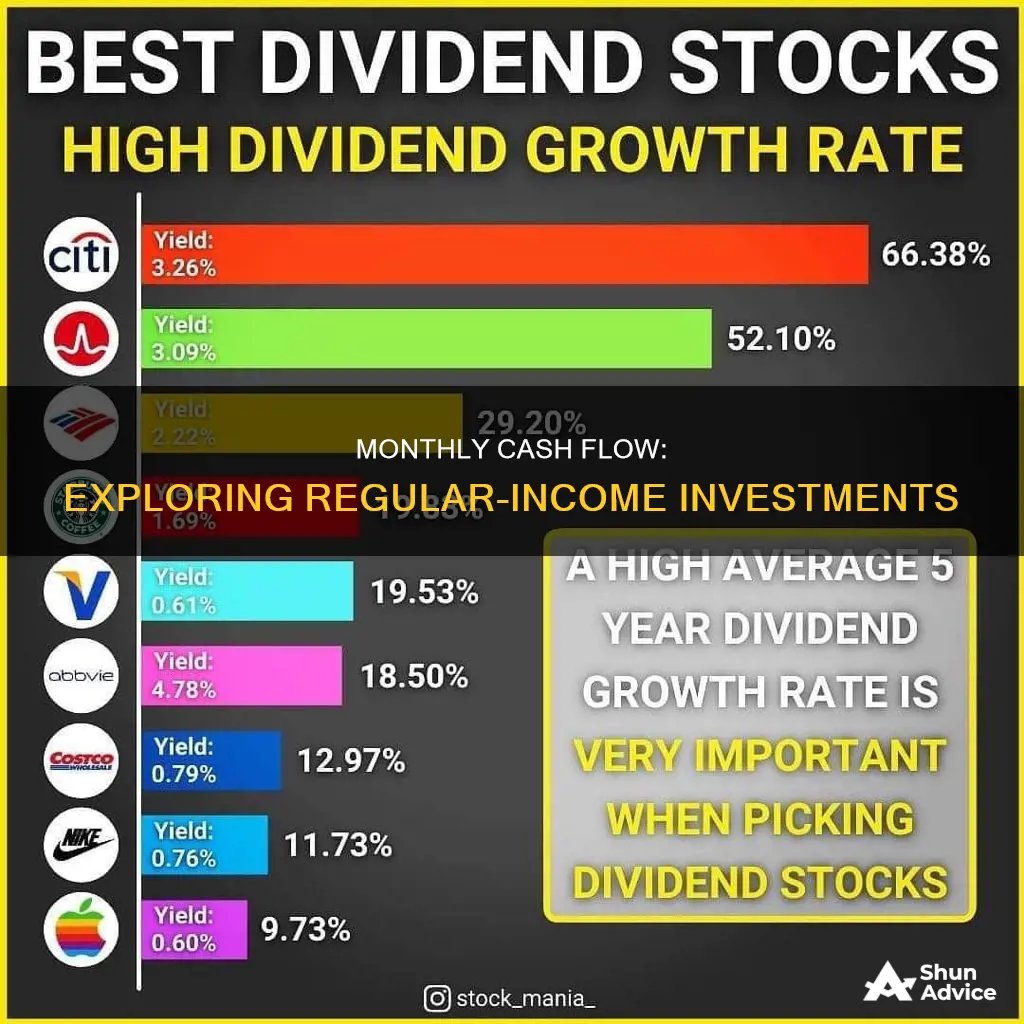

Dividend-paying stocks

Dividends are usually paid in cash, but they can also be issued as shares of stock. The amount is decided by the board of directors and is based on the company's most recent earnings. Dividends are a good way to give an investment portfolio additional stability, as the periodical cash payments are likely to continue long-term.

Some stocks pay higher dividend yields than others. For example, one stock may pay an annual yield of 1% of its share price, while another pays 5%. To reduce the risk in your stock portfolio, buy exchange-traded funds with a wide range of dividend-paying stocks so you don't overinvest in any one company.

Hundreds of ETFs specialize in high-dividend stocks, though they can be a bit pricey. Dividend-paying stocks are a good starting point for investors, and a financial advisor can help you build a portfolio of income-generating investments.

Home Loan vs. Investing: Where Should Your Money Go?

You may want to see also

Savings accounts

There are several types of savings accounts to consider:

- Instant access savings accounts: These accounts allow you to earn interest while still providing quick access to your money. Some instant access accounts offer competitive rates for the initial 12 months, after which the rate reverts to the underlying interest rate. For example, the Post Office in the UK offers 1.29% monthly interest for the first year, then drops to 0.25%.

- Easy access savings accounts: Similar to instant access accounts, but withdrawals may take a few days to process.

- Notice savings accounts: These accounts require you to give advance notice, typically between 40-95 days, before removing funds. Longer notice periods usually earn higher interest rates.

- Regular savings accounts: These accounts are suitable for those who want to put away a fixed amount of money each month over a longer period. They often offer attractive interest rates, but initial yearly returns may be modest, making them better suited for long-term savings.

- Cash ISAs: These are tax-free savings accounts with two main types: instant access and fixed-term. Instant access cash ISAs allow penalty-free withdrawals, while fixed-term cash ISAs have restrictions on withdrawals like fixed-rate bonds.

When choosing a savings account, it's important to compare interest rates, account fees, minimum balance requirements, accessibility, and other features to find the best option for your financial goals.

Young People: Invest Now, Gain Later

You may want to see also

Rental properties

Location

When choosing a rental property, look for a location with low property taxes, good schools, and amenities like restaurants and parks within walking distance. A safe neighbourhood with access to public transportation and a growing job market is also a good indicator of a high demand for rentals.

Financing

Financing a rental property is typically more difficult than financing a primary residence. Lenders usually charge higher interest rates on rental properties and require a larger down payment, often between 15% and 25%. It is important to consider the various expenses that come with owning a rental property, such as maintenance and upkeep costs, property management fees, and landlord insurance.

Time Commitment

Investing in rental properties is a time-consuming process. It requires choosing the right property, preparing the unit, finding reliable tenants, and ongoing maintenance. If you are not able to commit the necessary time, consider hiring a property manager, who typically charges between 8% and 12% of the collected rents.

Legal Considerations

It is essential to familiarise yourself with the landlord-tenant laws in your state and local area. Both tenants and landlords have rights and obligations regarding security deposits, lease requirements, eviction rules, and fair housing laws.

Pros and Cons

Young Investors: Why the Hesitation?

You may want to see also

Government bonds

However, it's important to note that government bonds do carry the risk of inflation and interest rates. If inflation is high, the real value of the income from the bonds will be reduced. Similarly, if interest rates rise, the price of the bonds will decline.

Most bonds pay interest annually, semi-annually, or at the end of their term, but some pay interest monthly. For example, US government bonds (T-bills) pay interest monthly.

Treasury bonds, in particular, are government securities that have a 20-year or 30-year term and pay a fixed interest rate on a semi-annual basis. They earn interest until maturity, and the owner is paid the par amount or principal when the bond matures. This interest is exempt from state and local taxes but is subject to federal income tax.

When considering investing in government bonds, it's important to keep in mind that they may not provide a high enough return to meet long-term investment goals or outpace inflation. For those seeking higher long-term returns, stocks or stock funds may be a better option.

Early Education: Worth the Investment?

You may want to see also

High-yield savings accounts

By depositing money into a savings account, individuals can earn interest on their balance, with the interest rate determined by the financial institution. Savings accounts are safe, reliable, highly liquid and easy to open, with small or no minimum initial investment requirements. The interest earned is typically compounded regularly, potentially accumulating wealth without active involvement.

While the returns may be modest compared to riskier investments, the security and predictability of a savings account make it an easy choice for individuals looking to build a stable monthly income foundation. Here are some examples of high-yield savings accounts:

- Peak Bank: 5.30% APY, no minimum deposit requirements, and a $0 monthly service charge.

- Forbright Bank: 5.30% APY, no minimum deposit requirements, and a $0 monthly service charge.

- North American Savings Bank: 5.30% APY, no minimum deposit requirements, and a maximum deposit amount of $2 million.

- Evergreen Bank Group: 5.25% APY, no minimum deposit requirements, and a $0 monthly service charge.

- UFB Direct: 5.25% APY, no minimum deposit requirements, and a $0 monthly service charge.

- Newtek Bank: 5.25% APY, no minimum deposit requirements, and a $0 monthly service charge.

- Jenius Bank: 5.25% APY, no minimum deposit requirements, and no maximum deposit amount.

It's important to note that, while high-yield savings accounts offer higher interest rates than traditional savings accounts, they still may not keep up with inflation. Therefore, it's essential to consider your financial goals and conduct thorough research before choosing a savings account.

Savings Woes: Firms' Investment Blues

You may want to see also

Frequently asked questions

Examples of investments that pay monthly include savings accounts, certificates of deposit, dividend stocks, rental real estate, and annuities.

Dividend stocks are stocks of public companies that share profits with shareholders as dividends, offering regular income and the potential for price appreciation.

You can invest in dividend-paying stocks by opening a brokerage account and purchasing individual stocks or exchange-traded funds (ETFs) that focus on dividend-paying companies.

Dividend stocks offer a steady income stream and the potential for capital appreciation. They are also generally less volatile than growth stocks, making them a good choice for investors seeking a more stable investment option.

As with any investment, there are risks associated with dividend stocks. The company may not perform as expected, or the stock price may fluctuate. Additionally, dividend payments are not guaranteed and can be cut or suspended at any time.