The capital asset pricing model (CAPM) is a financial model used to determine a security's expected return, given its associated risk. It is a linear relationship between the required return on an investment and its systematic risk. The CAPM formula includes the risk-free rate, investment beta, and market return. The model is based on the relationship between an asset's beta, the risk-free rate, and the equity risk premium. CAPM is widely used in finance for pricing risky securities and generating expected returns for assets. It is also used in conjunction with modern portfolio theory (MPT) to understand portfolio risk and expected return. Despite its limitations and unrealistic assumptions, the CAPM is still valuable for evaluating the reasonableness of future expectations and conducting investment comparisons.

What You'll Learn

Calculating the expected return of an investment

The Capital Asset Pricing Model (CAPM) is a financial model that calculates the expected rate of return for an investment or asset. It establishes a linear relationship between the required return on an investment and risk.

The formula for calculating the expected return of an investment using CAPM is:

Expected return of investment = Risk-free rate + Beta of the investment x (Expected return of the market - Risk-free rate)

Where:

- Expected return of investment is the expected return of the investment you are calculating

- Risk-free rate is the interest rate of an investment with little to no risk (usually a short-term government bond)

- Beta of the investment is a measure of the investment's volatility compared to the wider market (a score above 1 indicates higher risk and volatility, and a score below 1 indicates lower risk and volatility)

- Expected return of the market is the estimated return rate of the overall market or a diversified portfolio

For example, let's say you are considering investing in Stock A. The risk-free rate is 3%, Stock A has a beta of 1.2, and the expected return of the market is 8%.

Plugging these values into the formula, we get:

Expected return of Stock A = 3% + 1.2 x (8% - 3%) = 9.5%

So, the expected return of Stock A is 9.5%.

It's important to note that CAPM has some limitations, such as making unrealistic assumptions and relying on a linear interpretation of risk vs. return. The values used in the formula are also dynamic and subject to change, so it's important to update the calculation periodically.

Robinhood Investing: A Beginner's Guide to Getting Started

You may want to see also

Using CAPM for investment appraisal

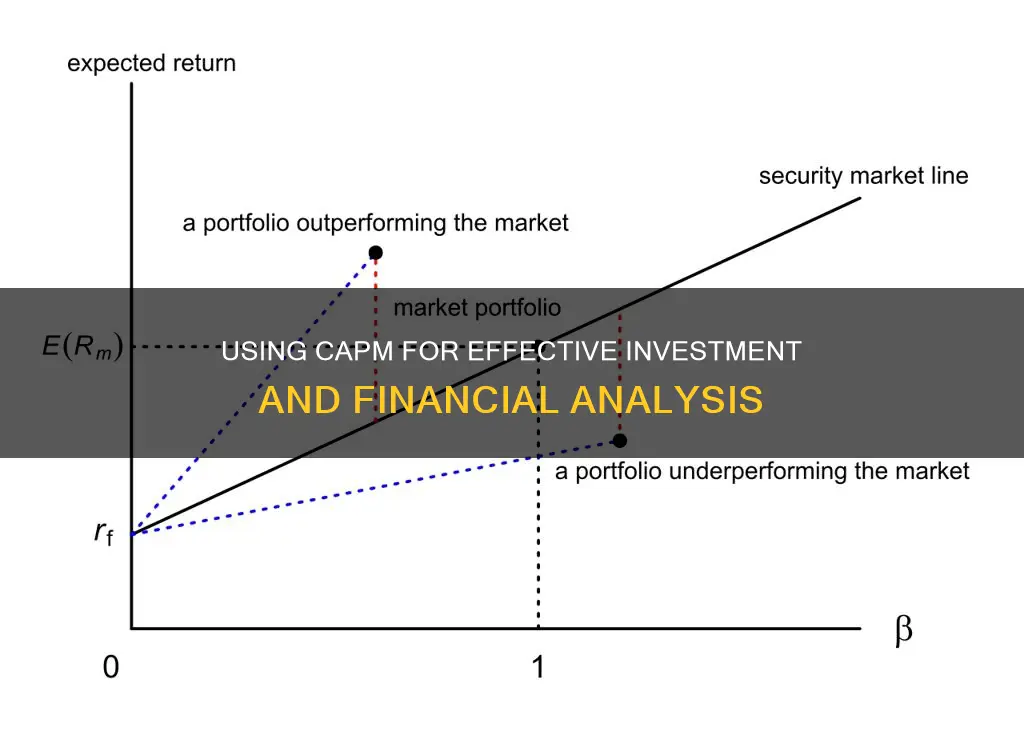

The Capital Asset Pricing Model (CAPM) is a useful tool for investment appraisal, helping to estimate the equity cost in the cost of capital computation. It establishes a linear relationship between the required return on an investment and the risk involved.

CAPM is based on the relationship between an asset's beta, the risk-free rate, and the equity risk premium. The risk-free rate is usually the Treasury bill rate, while the equity risk premium is the expected return on the market minus the risk-free rate. The beta value of an asset compares its volatility or systematic risk to the market. If a stock is riskier than the market, its beta will be greater than one.

The CAPM formula is:

Expected return of investment = Risk-free rate + Beta of the investment x (Expected return of market - Risk-free rate)

The CAPM formula can be used to determine whether an investment's returns are commensurate with its risks. It is a relatively simple method that is widely used and can be easily stress-tested to derive a range of outcomes. However, it is based on several assumptions that may not hold true in reality, such as the assumption that investors can borrow and lend at the risk-free rate.

When using CAPM for investment appraisal, it is important to consider the limitations of the model. For example, finding suitable proxy betas can be challenging, as proxy companies rarely undertake only one business activity. Additionally, the CAPM assumes a single-period time horizon, which may not align with the multi-period nature of investment appraisal. Despite these limitations, CAPM remains a valuable tool for financial management and investment decisions.

Tracking Investments: Using Computers for Financial Management

You may want to see also

CAPM's advantages and disadvantages

The Capital Asset Pricing Model (CAPM) is a widely used finance theory that establishes a linear relationship between the required return on an investment and risk. It is a simple calculation that can be easily stress-tested to derive a range of outcomes. However, it is based on certain assumptions that may not hold in the real world. Here are some advantages and disadvantages of the CAPM:

Advantages

- CAPM is a simple and intuitive model that only requires three inputs: the risk-free rate, the market risk premium, and the beta of the asset.

- It provides a consistent and objective way to compare the cost of equity across different businesses, industries, or countries.

- It captures the effect of systematic risk, which is relevant for investors with well-diversified portfolios.

- It is a widely used model that is easily calculated and can be used to evaluate investment risk and return.

- It takes into account systematic risk (beta), which is left out of other return models such as the dividend discount model (DDM).

- It can be used in conjunction with other aspects of an investment mosaic to provide unparalleled yield data and support investment decisions.

- It is most accurate for short-term investing.

- It uses an investment beta to help predict how an investment might move relative to market fluctuations.

- It is widely used and allows for easy comparisons of investment alternatives.

Disadvantages

- CAPM relies on several unrealistic assumptions, such as perfect and efficient markets, homogeneous expectations, no taxes, no transaction costs, and no arbitrage opportunities.

- It ignores the effect of unsystematic risk on the expected return of an asset, which may be relevant for investors with concentrated or illiquid portfolios.

- It assumes that the beta of an asset is constant and stable over time, which may not be the case for businesses facing dynamic and changing market conditions.

- It assumes that investors can borrow and lend at a risk-free rate, which is not attainable in reality.

- It assumes a single-period transaction horizon, which may not align with the multi-period nature of investment appraisal.

- It assumes a stable risk-free rate, but in reality, this rate can change over time, affecting the valuation results.

- It may not capture all dimensions of risk and return for a business, and alternative models such as the arbitrage pricing theory (APT) or the Fama-French three-factor model may provide a more comprehensive analysis.

- It does not address the underlying company's strengths and weaknesses.

- It does not factor in unsystematic risk from catalysts such as industry regulations, competition, and capital structure of a business.

- It assumes that investors are focused solely on wealth accumulation and risk minimization, which may not be true for investors prioritizing impact investing or other factors.

Understanding Total Cash and ST Investments: A Comprehensive Guide

You may want to see also

CAPM's assumptions

The Capital Asset Pricing Model (CAPM) is a finance theory that establishes a linear relationship between the required return on an investment and risk. It is based on the relationship between an asset's beta, the risk-free rate, and the equity risk premium. While the model is widely used, it is often criticised for its assumptions, which are considered unrealistic. Here are the key assumptions of CAPM:

Investors Hold Diversified Portfolios

This assumption implies that investors will only demand a return for the systematic risk in their portfolios since unsystematic risk has been diversified and can be disregarded. This assumption is important as it allows CAPM to focus on the relationship between return and systematic risk.

Single-Period Transaction Horizon

CAPM assumes a standardised holding period to make returns on different securities comparable. Typically, a one-year holding period is used, which is considered reasonable as returns on securities are usually quoted annually, even if investors hold them for longer.

Investors Can Borrow and Lend at the Risk-Free Rate of Return

This assumption, derived from portfolio theory, provides a minimum level of return required by investors. It corresponds to the point where the security market line (SML) and the y-axis intersect. While this assumption is useful for the model, it is not reflective of the real world, as individual investors cannot borrow at the same rate as governments due to higher associated risk.

Perfect Capital Market

This assumption suggests that all securities are accurately valued and their returns will plot on the SML. A perfect capital market assumes no taxes or transaction costs, perfect information available to all investors, and that all investors are risk-averse, rational, and aim to maximise their utility. While this assumption simplifies the model, it does not reflect the complexities of real-world capital markets, which are not perfectly efficient and can misprice securities.

No Transactions Costs

CAPM assumes no transaction costs, which is unrealistic as taxes, fees, and other costs are typically involved in buying and selling assets.

Assets Are Infinitely Divisible

This assumption implies that investments can be divided into unlimited pieces and sizes, which may not hold true in all real-world scenarios.

No Personal Income Taxes

CAPM assumes no personal income taxes, which is another idealised assumption that does not reflect the reality of investing.

Perfect Competition

The model assumes perfect competition, where an individual's buying or selling decisions do not impact the asset's price.

All Assets, Including Human Capital, Are Marketable

This assumption implies that all assets can be easily bought and sold in the market, which may not be true for certain types of assets.

All Investors Have the Same Information

CAPM assumes that all investors have equal and simultaneous access to information, which is not always the case in practice.

Investors Make Decisions Based Solely on Expected Returns and Portfolio Return Variances

This assumption implies that investors are solely focused on maximising wealth accumulation while minimising risk. However, in reality, investors may have other objectives, such as impact investing, which prioritises supporting socially conscious organisations.

In summary, while these assumptions form the foundation of CAPM, they have been criticised for being unrealistic and not reflecting the complexities of real-world investment decisions. Despite this, CAPM remains a widely used tool in financial management and investment analysis due to its simplicity and ability to provide a quantitative framework for evaluating investments.

Cash is King: Investing with Cold, Hard Cash

You may want to see also

CAPM's problems

The Capital Asset Pricing Model (CAPM) is a widely used model that establishes a linear relationship between the required return on an investment and risk. However, it is not without its problems.

Unrealistic Assumptions

The CAPM makes several assumptions that have been criticised as being unrealistic. These include:

- Investors are focused on wealth accumulation: CAPM assumes that investors are solely interested in maximising wealth accumulation while minimising risk. However, with the rise of impact investing, this assumption may no longer hold true.

- The market is frictionless: CAPM ignores transaction costs, taxes, and inflation, which are important considerations for investors.

- Equally informed investors: CAPM assumes that all investors have equal access to information, which is not always the case in practice.

- A stable risk-free rate: CAPM assumes that the risk-free rate will remain constant over the investment period, which may not be accurate.

- No unsystematic risk: CAPM focuses on systematic risk and assumes that investors can diversify their portfolios to eliminate unsystematic risk.

Volatility of Risk-Free Rate

The commonly accepted rate used as the risk-free rate (Rf) is the yield on short-term government securities. However, this yield changes daily, creating volatility and affecting the reliability of the outcome.

Difficulty in Determining Project Proxy Beta

Businesses using CAPM to assess an investment need to find a beta value that reflects the project or investment. Often, a proxy beta is required, and accurately determining this can be challenging, impacting the reliability of the outcome.

Inaccurate Reflection of Market Returns

The return on the market (Rm) can be negative at any given time, and long-term market returns are used to smooth this out. However, these returns are historical and may not accurately represent future market returns.

Inability to Borrow at a Risk-Free Rate

CAPM assumes that investors can borrow and lend at a risk-free rate, which is unrealistic. Individual investors cannot borrow or lend at the same rate as the government, and the minimum required return line may be lower than the model calculates.

Dividends: Cash Flow from Investing?

You may want to see also