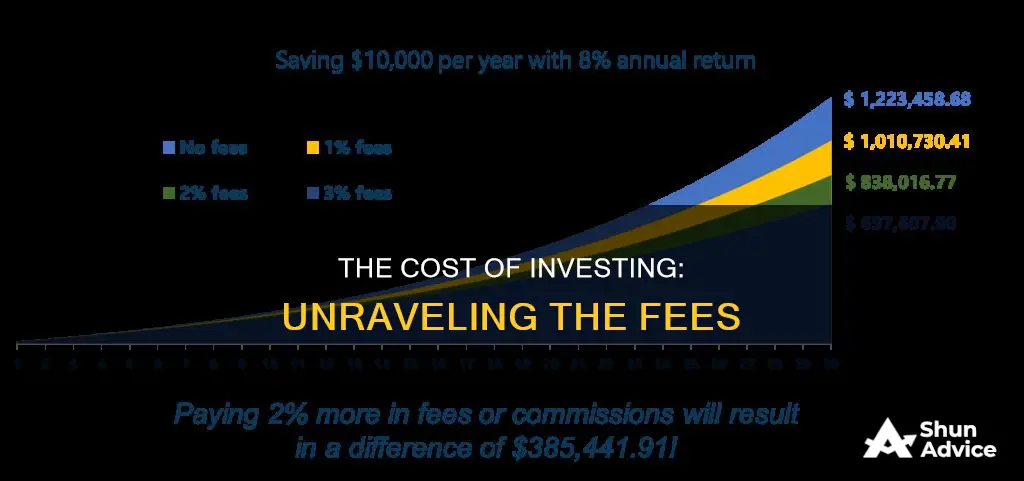

Just like anything else you buy, there are fees and costs associated with investment products and services. These fees, though they may seem small, can have a major impact on your investment portfolio over time. Investment fees are charged to use financial products, such as broker fees, trading fees, and expense ratios. These fees can be tacked on as a small percentage of the funds in your brokerage account, and while they may seem insignificant, they can translate to thousands of dollars over time. Therefore, it is important to understand the fees you are paying to invest wisely.

| Characteristics | Values |

|---|---|

| Why fees are paid on investments | Fees are paid on investments because there are costs associated with investment products and services. |

| Investment fees defined | Investment fees are fees charged to use financial products, such as broker fees, trading fees, and expense ratios. |

| Impact of fees on investment performance | Over time, minimizing fees tends to maximize performance. However, it is important not to let fees dominate your investment decision-making process. |

| Common investment fees | Management or advisory fees, trading fees, expense ratios, sales charge (or load) fees, transfer fees |

| Reducing investment fees | Review your statements, reduce your trading activity, use a robo-advisor |

| Frequency of investment fees | Some fees are ongoing and may be charged monthly or annually. Other fees may only be charged when a transaction takes place or you buy or sell a certain type of asset. |

| Range of management fees | Management fees typically range from 0.20% to 2.00%. |

What You'll Learn

Management or advisory fees

There are two main types of management or advisory fees: asset-based fees and transaction-based fees. Asset-based fees are calculated as a straightforward percentage of assets under management (AUM), typically ranging from 0.25% to 1% per year. Robo-advisors, which provide automated investment advice, usually charge lower asset-based fees compared to traditional financial advisors. Transaction-based fees, on the other hand, involve paying commissions or 'loads' to purchase products or trade in the market. These fees are typically associated with full-service broker-dealer transactions.

It's important to note that management or advisory fees can significantly impact investment returns. Higher fees mean a larger portion of your money goes to the management team instead of you. Additionally, higher fees make it more challenging for the fund to match or beat the market's performance. Therefore, investors should carefully consider the fee structure and potential impact on their investment returns when selecting a financial advisor or investment product.

Microsoft: Invest Now or Miss Out?

You may want to see also

Trading fees

Some brokers may offer discounted trading fees for trading large volumes of stocks. Additionally, some brokers may charge a flat trade fee regardless of the number of shares purchased, while others may charge a commission per share.

It's important to note that trading fees can significantly impact your investment returns. The more frequently you trade, the more you will pay in fees. Therefore, it is crucial to be aware of trading costs and consider them when managing your investment portfolio.

To minimize the impact of trading fees, you can consider working with a financial advisor to find a balance between the right brokerage firm and the fees charged. Additionally, more online brokerage firms are now offering commission-free trading for certain types of investments, such as stocks, ETFs, and mutual funds. However, it's important to read the fine print and understand the limitations and applicable securities for commission-free trading.

Smart Ways to Invest $25,000

You may want to see also

Expense ratios

An expense ratio is a fee that investors pay for the management of a fund, including administrative, marketing, and management costs. It is calculated by dividing a fund's operating expenses by its net assets. The expense ratio is important because it lets an investor know how much they are paying to invest in a specific fund and how much their returns will be reduced. The expense ratio is typically represented as a percentage. For example, an expense ratio of 0.2% means that for every $1,000 invested in a fund, the investor will pay $2 annually in operating expenses.

The expense ratio of a fund is important because it directly reduces an investor's returns. Investors have to consider the impact of high fees and the impact of compounding. When charged as a percentage, fees eat up a larger amount of money as the portfolio balance grows.

Over the past 20 years, expense ratios among all funds have been trending downward. According to Morningstar's 2020 US Fund Fee Study, the asset-weighted average expense ratio fell to 0.41% in 2020 from 0.93% in 2000. The asset-weighted average expense ratio for actively managed funds was 0.62% in 2020, while for passively managed funds, it was only 0.12%.

It is worth noting that while mutual funds overall had higher expense ratios, a subset of them – stock index funds – had markedly lower fees. The asset-weighted average on stock index mutual funds, which are passively managed, fell from 0.27% in 2000 to just 0.05% in 2022.

When it comes to investing, it is important to understand the different types of costs and fees associated with financial products. While minimizing fees tends to maximize performance over time, it is also important not to let fees dominate the investment decision-making process.

Raisin in the Sun" Investors Reveale

You may want to see also

Sales charge fees

Sales charges are fees paid by investors to financial intermediaries such as brokers, financial planners, or investment advisors. They are additional fees that serve as compensation for the salesperson and are expressed as a percentage of the investment value.

In mutual funds, a sales charge is typically called a 'load', which may be charged upfront at the time of investment, at the time of sale, or through some other arrangement. These charges are usually a fixed percentage of the trade's value and can be minimized or avoided by seeking out no-load funds or ETFs.

The level of sales charge incurred by an investor often depends on the specific share classes of a fund, and they can vary across different fund and share types. By regulation, the maximum permitted sales charge is 8.5%, but most loads fall within a 3% to 6% range.

There are three common types of sales charges: front-end, back-end, and deferred sales charges. Front-end sales charges are paid as a percentage of the purchase price at the time of investment, while back-end sales charges are paid as a percentage of the selling price at the time of sale. Deferred sales charges are back-end sales charges that decline over time, often reaching zero, and are contingent on the holding period.

Sales charges are criticized by investor advocates and educators, who argue that they are unnecessary for most investments today. These charges reduce investor returns and can be difficult to spot, especially when associated with B-shares.

To avoid sales charges, investors can opt for no-load mutual funds or exchange-traded funds (ETFs). However, it's important to be aware of the bid-ask spread on ETFs, as a high bid-ask spread can be just as detrimental as a sales charge.

Oil Investing: Smart Move?

You may want to see also

Transfer fees

It is also worth noting that some brokerages may charge account closure fees when transferring an account to another firm. These fees typically range from $50 to $200.

Solar Energy: The Rapid Return on Investment

You may want to see also

Frequently asked questions

Investment fees are charged for the use of financial products and services. These fees are similar to the costs consumers face when shopping for a car.

Common investment fees include management or advisory fees, trading or commission fees, expense ratios, and sales charge (or load) fees.

Investment fees reduce any returns you make on your investments. Over time, these fees can significantly eat away at your overall returns and reduce your wealth.

You can use no-fee brokers, low-cost index funds with low expense ratios, and no-load mutual funds. You can also use a robo-advisor, which tends to be less costly than a human investment advisor. Additionally, understanding the different types of costs and doing careful research can help you minimise fees.

While higher fees do not guarantee better performance, they may be worth it in certain cases. For example, actively managed funds charge higher fees but aim to outperform the market. However, studies have shown that investments with higher fees frequently underperform those with lower fees.