An initial cash investment is the amount of money available or required to start a project or business. It is usually a negative figure as it represents the upfront costs or initial cash outlay, and there are no returns at the beginning of a project or business. Fixed capital, working capital, salvage value, tax rate, and book value are considered when calculating the initial cash investment. It is also called the initial investment outlay or initial outlay.

What You'll Learn

- Initial cash flow is the total money available when a project or business is in the planning stages

- It is usually a negative figure as launching a business requires capital investment

- Initial cash flow is factored into the discounted cash flow analysis used to evaluate the feasibility of a project

- Initial cash flow can be calculated by netting all incremental cash flows that occur at time zero

- Initial investment equals the amount needed for capital expenditures plus any increase in working capital

Initial cash flow is the total money available when a project or business is in the planning stages

The initial cash flow includes all operating and equipment costs for the planning stage. It is calculated by netting all of the incremental cash flows that occur at time zero, subtracting all the cash outflows from all the cash inflows at that time. Fixed capital, working capital, salvage value, tax rate, and book value are considered when calculating the initial cash flow.

For example, if a company is considering retooling a plant for a new product, the initial cash flow would include the cost of any new equipment. The total may be offset by the salvage value of any old equipment that is sold, with the capital gains tax or loss on the sale also factored in.

The initial cash flow is a crucial figure in the discounted cash flow analysis used to evaluate the feasibility of a project. It represents the upfront costs or initial cash outlay involved in starting a new project or purchasing an asset. This analysis is important to ensure that a company does not undertake an unprofitable project.

Understanding Cash Flow from Sales of Investments

You may want to see also

It is usually a negative figure as launching a business requires capital investment

Initial cash flow is the total money available when a project or business is in the planning stages. It is usually a negative figure as launching a business requires a capital investment to generate future income. This figure includes any loans or investments made in the project.

Initial cash flow is factored into the discounted cash flow analysis used to evaluate the feasibility of a project. This analysis is crucial, as an error in the cash flow or discount rate estimation can lead a company to undertake an unprofitable project. The initial cash flow represents the upfront costs or initial cash outlay involved in starting a new project or purchasing an asset. It includes all operating and equipment costs for the planning stage.

Due to the high cost of startups, initial cash flow is typically a negative number. This is because the costs of production can exceed total sales, which can be indicative of a company's inability to control costs or can be the result of difficulties beyond the company's control. Negative net income, where a company's expenses are larger than their revenues, can be a red flag for potential bankruptcy.

The internal rate of return (IRR) is used to determine whether an investment is worth pursuing. It is the discount rate that makes the net present value (NPV) of a project zero, or the expected compound annual rate of return. If the IRR is greater than or equal to the cost of capital, the company would accept the project as a good investment.

Fidelity Branches: Can You Deposit Cash?

You may want to see also

Initial cash flow is factored into the discounted cash flow analysis used to evaluate the feasibility of a project

Initial cash flow is the total money available when a project or business is in the planning stages. This figure includes any loans or investments made in the project and is usually a negative number because launching a business requires capital investment to generate future income.

Initial cash flow is factored into the discounted cash flow (DCF) analysis, which is used to evaluate the feasibility of a project. DCF analysis is a method used to value an investment by discounting its estimated future cash flows. It can be applied to value a stock, company, project, or other assets.

DCF analysis estimates the value of return that an investment generates after adjusting for the time value of money. The time value of money assumes that a dollar today is worth more than a dollar tomorrow because it can be invested. DCF analysis can be useful in any situation where money is paid upfront with the expectation of receiving more money in the future.

The first step in conducting a DCF analysis is to estimate the future cash flows for a specific time period and the terminal value of the investment. The second step is to determine the appropriate rate to discount the cash flows to the present value. The cost of capital is usually used as the discount rate, which can vary depending on the project or investment.

By comparing the DCF to the initial investment, investors can determine if a project is worth pursuing. If the DCF is greater than the present cost, the investment is profitable. If the DCF is lower than the present cost, investors may be better off holding onto their cash.

OPay Cash Investment: Legit or Scam?

You may want to see also

Initial cash flow can be calculated by netting all incremental cash flows that occur at time zero

An initial cash investment is the total money available when a project or business is in the planning stages. This figure includes any loans or investments made in the project and is usually a negative figure, as launching a business requires capital investment.

A simple formula for incremental cash flow is:

Incremental Cash Flow = Revenue – Expenses – Initial Cost

To calculate initial cash flow, the first step is to identify the initial investment costs, including any upfront payments for assets or technology. Next, estimate the additional revenue the project will generate, accounting for any increase in operating expenses. Subtract these expenses from the revenue to find the net income. Finally, calculate the net cash flow by adding non-cash expenses like depreciation back into the net income.

For example, a restaurant introducing a new menu item might have an initial investment of $10,000 for development and marketing. With a projected additional annual revenue of $60,000, and additional annual operating expenses of $24,000 for ingredients and staff, the incremental cash flow can be calculated as follows:

- Additional Revenue: $60,000

- Less: Additional Operating Expenses: -$24,000

- Pre-tax Income: $36,000

- Tax Impact (at 30%): -$10,800

- After-tax Income: $25,200

- Total Incremental Cash Flows: $15,200 (Annual Cash Flow)

Therefore, the new menu item is projected to generate an annual incremental cash flow of $25,200 after covering the initial costs. This makes the project financially attractive.

Zinser Investment: Relevant Cash Flows and Their Impact

You may want to see also

Initial investment equals the amount needed for capital expenditures plus any increase in working capital

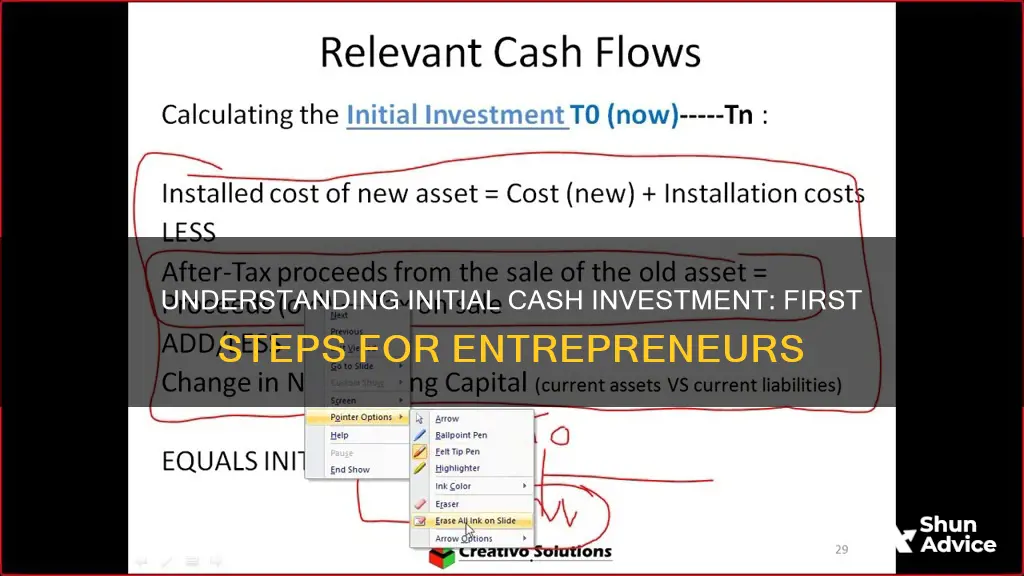

An initial cash investment is the total money available when a project or business is in the planning stages. This includes any loans or investments made in the project. The initial investment formula is: Initial Investment = CapEx + ΔWC + D, where CapEx is capital expenditure, ΔWC is the change in working capital and D is the net cash flow from disposed assets.

An initial cash investment is also referred to as an initial investment outlay or initial cash flow. It is usually a negative figure, as launching a business requires capital investment in the hopes of generating future income. This figure includes all operating and equipment costs for the planning stage.

Capital expenditures refer to the acquisition of physical assets by a company for use in furthering its long-term business goals and objectives. Real estate, manufacturing plants, and machinery are among the assets that are purchased as capital investments. The capital used may come from a wide range of sources, from traditional bank loans to venture capital deals.

Working capital is the difference between a company's current assets (including cash and other assets that can be converted into cash within a year) and its current liabilities, such as payroll, accounts payable, and accrued expenses. A business that maintains positive working capital will likely have a greater ability to withstand financial challenges and the flexibility to invest in growth.

The initial investment formula can be used to determine the amount of money required to start a business or project. This includes the cost of capital expenditures, such as machinery, tools, shipment, and installation, as well as any increase in working capital. For example, a company may need to purchase new equipment, which would be considered a capital expenditure. Additionally, the company may need to increase its current assets, such as cash or inventory, which would be reflected in the change in working capital.

In summary, the initial investment formula of Initial Investment = CapEx + ΔWC + D provides a framework for understanding the financial requirements of starting a business or project. It takes into account the cost of capital expenditures, changes in working capital, and the net cash flow from disposed assets. By considering these factors, businesses can make informed decisions about their financial needs and goals.

Cash Investment Strategies: Your Guide to Profitable Opportunities

You may want to see also

Frequently asked questions

An initial cash investment is the total money that is available when a project or business is in the planning stages. It is also referred to as the initial investment outlay or initial cash flow.

An initial cash investment includes all operating and equipment costs for the planning stage. It is the sum of capital expenditures, working capital requirements, and after-tax proceeds from assets disposed of or available for use elsewhere.

An initial cash investment is calculated by netting all of the incremental cash flows that occur at time zero, which is when a firm makes the capital expenditure. This is done by subtracting all the cash outflows occurring at time zero from all the cash inflows that occur at that time.

An initial cash investment is important because it helps evaluate the feasibility of a project or business venture. It is used in capital budgeting to determine the attractiveness of a project by comparing the initial cash investment to the expected future cash flows generated by the project.

An example of an initial cash investment is a company deciding to purchase new equipment. The initial investment would include the cost of the equipment, installation, and any other related expenses. This initial investment would then be compared to the expected future cash flows generated by the new equipment to determine if it is a good investment decision.