Retirement investments are a popular way to save for the future, but what is a realistic interest rate to expect? The average savings account rate is a benchmark for the overall interest-rate environment, but it's not a rate you should settle for. The national average savings account yield is 0.6% APY, but many online banks offer higher savings interest rates. When it comes to retirement investments, a 12% return is often used as a benchmark, but experts say this is absolutely nuts. A more reasonable return assumption is 5% for a balanced portfolio of stocks and bonds, or 7% for a more aggressive exposure to stocks.

| Characteristics | Values |

|---|---|

| Average rate of return | 12% |

| Conservative estimate | 5% |

| Fidelity NetBenefits account projection | 3.5% |

| National average savings account yield | 0.6% |

What You'll Learn

How much can you expect to earn on retirement investments?

The average interest rate for retirement investments is a subject of debate. A 12% retirement return assumption is often used as a benchmark, and this is based on the average historical return from 1926 to 2023. However, experts have called this "absolutely nuts", as it doesn't take into account volatility or inflation. A more realistic average interest rate for retirement investments is between 5% and 7%. This is based on a balanced portfolio of stocks and bonds, with a higher rate for a more aggressive exposure to stocks.

It's important to note that the average savings account rate is not a good indicator of the interest rate you should expect on your retirement investments. The national average savings account yield is much lower, at 0.6% APY.

When investing for retirement, it's recommended to aim for an annual percentage yield (APY) that is many times the national average. This can be achieved through high-yield savings accounts, which often have no or low minimum balance requirements.

Additionally, investing through a post-tax Roth IRA account may help boost your returns, as tax rates may increase in the future.

Interest Rates Rise: How Does This Affect Your Investments?

You may want to see also

What is a conservative return?

There is no definitive answer to the question of what a conservative return is, as it depends on a variety of factors, including the type of investment and the economic climate. However, a conservative return is generally considered to be a lower rate of return than an aggressive or high-risk investment.

A conservative return is often associated with lower-risk investments, such as savings accounts, bonds, and certain types of stocks. These types of investments typically offer a lower potential return than more aggressive investments, but they are also less likely to lose value. For example, a savings account with a high-yield savings account may offer a competitive return with a no or low minimum balance requirement.

When considering retirement investments, it is important to remember that the annual rate of return is an estimate of the gains you may earn over time. The rate of return can vary depending on the specific investment and the overall market conditions. For example, a 25-year-old who invests $100 per month in an S&P 500 index fund in a Roth individual retirement account until they are 65 may see a 12% annual rate of return over 40 years. However, this is considered an aggressive assumption by some experts, who argue that a more reasonable return assumption is 5% for a balanced portfolio of stocks and bonds.

It's important to be mindful of how those anticipated rates of return are determined. For instance, tools that provide return projections, such as Fidelity's balance projection for a NetBenefits account holder's next milestone age, may anticipate a lower return, such as 3.5%. This more conservative estimate takes into account the potential for volatility and inflation, which can impact the overall return on investment.

Investments to Hedge Against Rising Interest Rates

You may want to see also

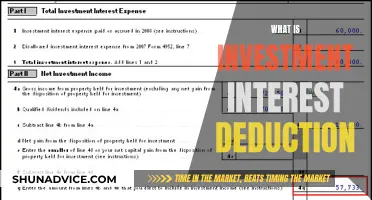

How do you calculate the annual rate of return?

There is no single average interest rate for retirement investments. The rate of return depends on the type of investment and the length of time you invest for. For example, a 25-year-old who invests $100 per month in an S&P 500 index fund in a Roth individual retirement account until they are 65 may see a 12% annual rate of return over 40 years. However, this rate of return is considered "absolutely nuts" by some experts, who argue that a more realistic rate of return is 5% for a balanced portfolio of stocks and bonds or 7% for a more aggressive exposure to stocks.

To calculate the annual rate of return, you can use the following formula:

ROR = [(EV – BV) / BV] x 100

Where:

- ROR is the rate of return

- EV is the ending value of the investment

- BV is the beginning value of the investment

This formula can be used to calculate the rate of return for a single year or for multiple years. If you are calculating the rate of return for multiple years, you may need to first calculate the amount you received in dividends over time. The amount received in dividends can be calculated using the following formula:

Amount Received in Dividends = Number of Shares x (Dividend Price x Number of Years)

The annual rate of return is a way of calculating investment returns on an annual basis. It allows investors to compare different types of investments over the same time frame, making it easy to see which investments are most profitable. It is important to note that the annual rate of return is an estimate of the gains you may earn over time and does not incorporate volatility or inflation.

Understanding Long-Term Investment Interest Rates

You may want to see also

What is a high-yield savings account?

There is no definitive answer to the average interest rate for retirement investments. While the average historical return from 1926 to 2023 is 12.2%, according to a monthly data set called stocks, bonds, bills and inflation, or SBBI, this is based on a simple arithmetic return, which may not accurately reflect all fluctuations. Experts have said that a 12% retirement return assumption is "absolutely nuts". They suggest that a more reasonable return assumption is 5% for a balanced portfolio of stocks and bonds or 7% for a more aggressive exposure to stocks.

A high-yield savings account (HYSA) is a savings account that earns a higher-than-average interest rate. While the average return on a traditional savings account is just 0.43%, some HYSAs offer rates over 4%. The interest rate that these accounts offer is known as the annual percentage yield (APY). Most HYSAs are offered by online banks, fintechs or credit unions, but some brick-and-mortar banks have gotten into the game, too. These accounts offer a lot of incentives for savers, but there are some tradeoffs. For example, while online banks can offer a higher APY, they may come with deposit and balance minimums, monthly fees or other limitations.

The national average savings account yield is 0.6 percent APY, according to Bankrate’s survey of institutions as of the week of March 10, 2025. Bankrate surveys more than 500 banks and credit unions weekly to generate the national averages.

The Ally Bank Savings Account is a high-yield savings option with no minimum deposit required to open and zero monthly fees. At 3.70% APY, this account’s interest rate is more than eight times the national average. Account holders can maximise their savings potential through round-ups, recurring transfers to their savings account, and surprise savings through tools that analyse your checking account spending and transfer “safe-to-save” money to your savings account.

The American Express High-Yield Savings Account also offers a competitive 3.70% APY and lacks a minimum opening deposit or minimum balance requirements. Interest on your account balance is compounded daily and deposited into your account on a monthly basis.

Exploring Surplus Impact on Interest Rates and Investments

You may want to see also

How does tax impact retirement investments?

Retirement investments are impacted by tax in a number of ways. Firstly, the type of retirement plan you choose will determine how much tax you pay. For example, a post-tax Roth IRA account may boost your returns as tax rates may increase in the future. In 2024 and 2025, you can deduct contributions of up to $7,000 to a traditional IRA ($8,000 if you are age 50 or older by the end of the tax year).

The year in which you make deductible contributions to a retirement plan will also impact the amount of tax you pay. Experts recommend choosing the year when you are in the highest tax bracket, as you will get the most benefit from your deduction.

The type of investment vehicle you choose will also impact the amount of tax you pay. For example, stocks, bonds, and mutual funds are taxed the same whether you are retired or still employed.

It is important to consider the impact of taxes on your investment returns. Tax rates may increase in the future, which could affect your overall returns. Additionally, the cash surrender values of your life insurance policy can generally be accessed tax-free by first withdrawing the premiums you paid. However, tapping into a policy's cash value may reduce the available death benefit and could result in an income tax surprise if the policy loan plus cumulative loan interest ever exceeds the remaining policy cash value.

When it comes to retirement investments, the average rate of return has been the subject of debate. Some experts argue for a conservative estimate of around 5%, while others suggest a more aggressive exposure to stocks could result in a 7% return. It is important to be mindful of how those anticipated rates of return are determined.

Shareholder Loans: Is Interest Paid Considered Investment Interest?

You may want to see also

Frequently asked questions

The average interest rate for retirement investments is a subject of debate. Experts have said that a 12% retirement return assumption is "absolutely nuts" and that a more realistic rate is 5% for a balanced portfolio of stocks and bonds or 7% for a more aggressive exposure to stocks.

A good interest rate for retirement investments is one that is higher than the national average savings account interest rate, which is currently 0.6% APY. Aim for an annual percentage yield (APY) that is many times the national average, such as those offered by high-yield savings accounts.

To get a good interest rate for your retirement investments, consider investing through a post-tax Roth IRA account versus a pretax traditional retirement account, as tax rates may increase in the future.

The interest rate of your retirement investments can be affected by volatility and inflation.

The annual rate of return, or the percentage change in an investment's value, is an estimate of the gains you may earn over time.