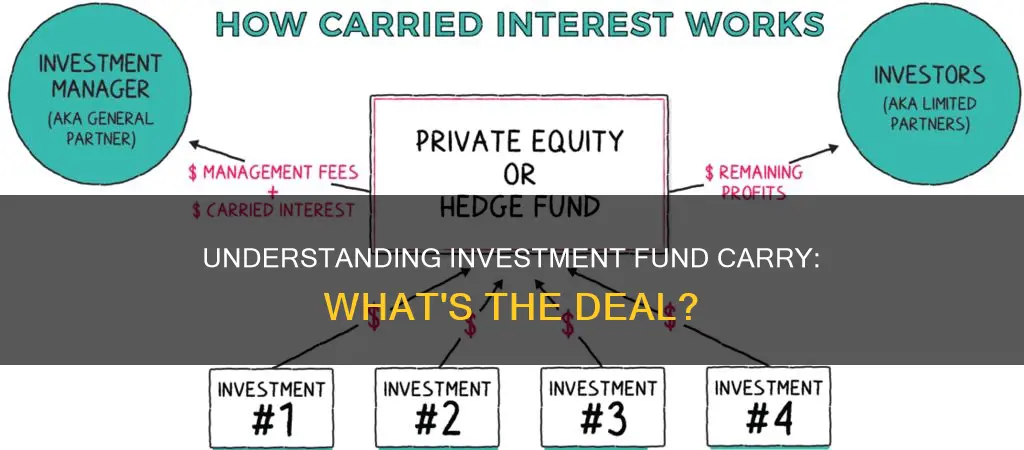

Carried interest, or carry, is a share of the profits of an investment fund paid to the fund's general partners or managers. It is a performance or incentive fee that rewards the manager for enhancing performance and serves as an assurance to investors that the general partner's interests are aligned with theirs. Carry is typically structured as a percentage of the fund's profits, usually 20%, once investors have received their original investment plus an additional return, known as the hurdle rate. While carry is a common practice in private equity and hedge funds, it has been criticised for allowing fund managers to secure reduced tax rates.

| Characteristics | Values |

|---|---|

| What is it? | A share of the profits of an investment fund paid to the fund managers |

| Type of funds | Private equity, venture capital, and hedge funds |

| Who is it paid to? | General partners of the fund |

| Why is it paid? | As a performance fee, rewarding the manager for enhancing performance |

| When is it paid? | Once the fund achieves a specified minimum return, also known as the hurdle rate |

| How much is paid? | Typically 20% of the fund's profits, but can vary |

| Taxation | Treated as a long-term capital gain and taxed at a lower rate than ordinary income |

| Controversy | Critics argue that it allows fund managers to secure a reduced tax rate and creates inequality in taxation |

| Other names | Carry |

What You'll Learn

What is 'carry' in an investment fund?

"Carry" or "carried interest" is a share of the profits of an investment fund paid to the fund's managers. It is a performance or incentive fee, rewarding managers for enhancing performance. Carry is usually structured as a percentage of the fund's profits, typically 20%, once investors have received back their original investment plus an additional return (known as the "hurdle rate" or "hurdle").

Carry is popular with investors because it incentivises fund managers to ensure the fund is a success, creating greater alignment between the fund managers and investors. Carry is also a significant component of private equity compensation. It is a way to ensure that fund managers have "skin in the game", as their interests are aligned with those of the investors.

The origins of carried interest can be traced to the 16th century when European ships were crossing to Asia and the Americas. The captain of the ship would take a 20% share of the profit from the carried goods to pay for the transport and the risk of sailing over oceans.

In most cases, carry is considered a return on investment and is taxed as a capital gain rather than ordinary income, usually at a lower rate. This has been criticised as a "loophole" that allows fund managers to secure a reduced tax rate.

Investment Advisor or Hedge Fund: What's the Difference?

You may want to see also

How is carry calculated?

Carry, or carried interest, is the percentage of a private fund's profits that are paid to the fund manager as compensation. This is usually paid to the general partner (GP) of the fund, who is responsible for managing the fund and its investments. The GP is compensated for their operational role by a management fee, charged as a percentage of the fund's assets, and for their investment management role by a performance fee, charged as a percentage of the fund's profits above a certain amount.

The performance fee incentivises the GP to maximise returns to investors, as the GP now has "skin in the game" in the form of an interest in the fund's performance. The performance fee is usually 20% of the profits on the investments, although this can vary depending on the type of investment fund and investor demand.

Carry is calculated as:

Total fund profits = Final Value – Total investment

Carry = Total profit * Performance fee

Carry is usually only paid out once investors have received their investments back, plus a minimum expected return, known as the 'hurdle rate'. The hurdle rate is typically 7-9% per annum.

A Guide to Investing in BDO Mutual Funds

You may want to see also

How is carry taxed?

The taxation of carried interest has been a controversial issue in the United States, with critics arguing that it allows some of the country's richest people to defer and lower their taxes. Carried interest is typically taxed as a long-term capital gain, rather than as ordinary income, which attracts a lower tax rate. This preferential tax treatment is comparable to that of other investments like stocks or real estate.

In the US, the maximum long-term capital gains rate, including the net investment income tax, is 23.8%, compared to the maximum 37% ordinary income rate. This disparity has led to criticism, with some arguing that taxing carry as regular income would eliminate the loophole that allows private equity managers to secure reduced tax rates.

The taxation of carried interest varies across different jurisdictions. For example, in Canada, the tax rate depends on the nature of the return and the holder's province of residence. In Ontario, the highest marginal tax rates for capital gains, including share buybacks, disposal proceeds, or repayment of loan principal, are 26.76%. For interest income and dividends, the rates are 53.53% and 39.34% respectively.

In the UK, there is a safe harbour test that can mitigate employment tax liability on the grant of carry, subject to certain conditions. These conditions include a capital contribution made by all UK carry holders and the timing of the grant of carry in relation to the fund's investments. The UK tax rate for capital gains, including share buybacks, disposal proceeds, or repayment of loan principal, is 28%, which is higher than the ordinary 20% capital gains tax rate.

In France, there is a bespoke carry regime, the Statutory Regime, which taxes carried interest proceeds received by French individuals at a flat rate of 30%, comprising income tax and social security taxes. In Germany, there is a special carried interest tax regime, the CI Regime, which stipulates that 40% of the carried interest payment is tax-exempt if certain conditions are met.

In summary, the taxation of carried interest varies across jurisdictions, but it is generally treated as a long-term capital gain, attracting a lower tax rate than ordinary income. This preferential treatment has been a source of controversy, particularly in the United States, where it has been criticised as a loophole that benefits high-income individuals.

BlackRock Liquidity Fed Fund Insti: Worth the Investment?

You may want to see also

Why is carry controversial?

Carry, or carried interest, is a share of the profits of an investment fund paid to the fund's general partners as a performance fee. It is often structured as 2% of fund assets and 20% of fund profits. Carry is controversial because it is taxed as a capital gain rather than as income. This means that partners earning carry may be paying less in taxes than regular employees while earning a higher salary. This creates a system of inequality in taxation, where higher earners pay a lower tax rate than lower earners.

In the United States, the tax rate for long-term capital gains is 20%, while the top rate for ordinary income is 37%. Critics argue that this allows some of the richest Americans to unfairly defer and lower taxes on the majority of their income. Defenders of the status quo say that the tax code's treatment of carry is comparable to its handling of "sweat equity" business investments.

The controversy over carry has resulted in several regulatory attempts to change how it is taxed. In 2007, US Representative Sander M. Levin introduced a bill that would have eliminated the ability of managers to receive capital-gains tax treatment on their income. In 2018, under the Trump administration, tax legislation passed that increased the length of time assets must be held to qualify for long-term capital gains treatment from one to three years. However, this legislation did not completely close the loophole that allows private equity managers to secure reduced tax rates.

American Funds New Perspective Fund A: Worth the Investment?

You may want to see also

How does carry incentivise fund managers?

Carry incentivises fund managers by offering them a share of the fund's profits, usually 20%, as a performance fee. This incentivises fund managers to maximise the fund's profits and ensures their interests are aligned with those of the investors. The performance fee is often the primary source of compensation for fund managers, and it is only earned if the fund achieves a pre-agreed minimum return, known as the hurdle rate. This hurdle rate is an incentive for fund managers to focus on long-term profitability.

The carry is a significant component of private equity compensation and can range from as high as 50% in exceptional cases to as low as single digits. It is a way to reward fund managers for their hard work and due diligence in generating profits. Fund managers are heavily involved in strategy, business development, financial management, and operational details, and carry provides them with additional income on top of their management fees.

The structure of carry also incentivises fund managers. It is often held through a separate carry vehicle, providing privacy and flexibility. The carry vehicle can admit new joiners, reward high performers, and deal with bad leavers forfeiting carry. This flexibility allows fund managers to be motivated by the potential for additional carry.

Additionally, investors often require that fund managers invest their own money in the fund, ensuring they have "skin in the game". This further aligns the interests of fund managers with those of the investors and provides an extra incentive to ensure the fund's success.

Launching an Investment Fund: A Guide for South Africa

You may want to see also

Frequently asked questions

Carry, or carried interest, in an investment fund is a share of the profits of an investment paid to the investment manager. It is a performance fee, rewarding the manager for enhancing performance.

Carry typically averages about 20% of the fund's profits but can range from as high as 50% to as low as single digits.

The name is derived from the 16th century when European ships were crossing to Asia and the Americas. The captain of the ship would take a 20% share of the profit from the carried goods to pay for the transport and the risk of sailing over oceans.

The manager's carried interest allocation varies depending on the type of investment fund and the demand for the fund from investors. In private equity, the standard carried interest allocation historically has been 20% for funds making buyout and venture investments.