Mutual fund distributors are licensed individuals or entities that sell mutual fund products to investors on behalf of asset management companies (AMCs). They help investors navigate their options, choose the right funds, and manage the investment process. In return for their services, mutual fund distributors earn commissions from AMCs, which typically range from 0.1% to 2% of the investment amount. This commission is influenced by factors such as the type of mutual fund, the distributor's relationship with the company, their experience, and the size of the investment. While mutual fund distributors provide valuable guidance, they are not financial advisors and may not offer personalised investment advice. Understanding the commission structure is important for both aspiring distributors and informed investors.

| Characteristics | Values |

|---|---|

| Commission structure | 0.1% to 2% of the number of units purchased by investors |

| Commission factors | Mutual fund type, distributor's relationship with the company, distributor's experience, investment size |

| Sources of commission | Upfront commission, trailing commission |

| Upfront commission | Paid at the time of investment, typically 0.5% to 1.5% of the amount invested |

| Trailing commission | Compensates distributors for attracting investors from outside the top 30 cities |

| Commission payment | Monthly, with quarterly updates to the brokerage structure |

What You'll Learn

- Mutual fund distributors earn a commission from Asset Management Companies (AMCs)

- Commission is typically a percentage of the amount invested

- Commission rates vary depending on the type of mutual fund

- Distributors with more experience and a larger client base may receive higher commission rates

- There are two main types of commission: upfront and trailing

Mutual fund distributors earn a commission from Asset Management Companies (AMCs)

Mutual fund distributors are individuals or entities that sell mutual fund products to investors on behalf of Asset Management Companies (AMCs). They are licensed and regulated by the Securities and Exchange Board of India (SEBI) and the Association of Mutual Funds in India (AMFI). Mutual fund distributors help investors navigate the complex world of mutual funds, guiding them to make informed investment decisions. They assist in choosing the right mutual fund based on the investor's goals, risk appetite, and financial circumstances. Additionally, they streamline the paperwork and investment process, making it more accessible and convenient for the investor.

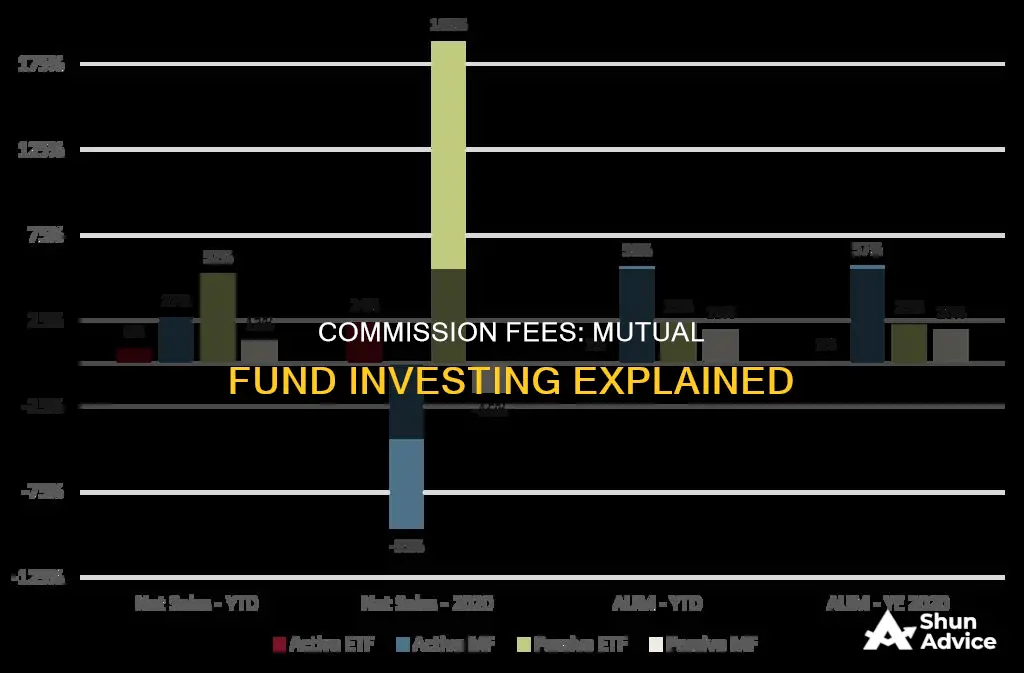

In recognition of their role, mutual fund distributors earn a commission from the AMCs. This commission is typically structured as a percentage of the amount invested by the investor, ranging from 0.1% to 2% of the number of units purchased. The specific rate depends on various factors, including the type of mutual fund, the distributor's relationship with the mutual fund company, their experience and client base, and the size of the investment.

The commission structure for mutual fund distributors consists of two main components: upfront commission and trailing commission. The upfront commission is a one-time payment made at the time of investment, usually ranging from 0.5% to 1.5% of the investment amount. On the other hand, trailing commissions are designed to incentivize distributors for attracting investors from cities outside the top 30 urban centres. In the top 30 cities, the commission rate is standardized, varying between 0.1% and 2%sourcing clients from smaller cities and rural areas (referred to as B-30 cities) receive additional incentives, including special commissions during the first year of investment.

It is important to note that mutual fund distributors are not financial advisors and may not provide personalized investment advice. Their role is to facilitate the mutual fund investment process and bridge the gap between mutual fund companies and individual investors. The commissions earned by distributors contribute to the expense ratio of the mutual fund scheme, which ultimately impacts the overall returns realized by investors.

Understanding Qualified Investment Funds: Definition and Benefits

You may want to see also

Commission is typically a percentage of the amount invested

Commissions are a common feature of mutual fund investing. Mutual fund distributors are individuals or entities that sell mutual fund products to investors on behalf of asset management companies (AMCs). They are licensed and regulated by the Securities and Exchange Board of India (SEBI) and the Association of Mutual Funds in India (AMFI).

The commission structure for mutual fund distributors typically operates within a range of 0.1% to 2% of the number of units purchased by investors. This means that the commission paid to the distributor is usually calculated as a percentage of the amount invested by the investor. For example, if the commission rate is 1% and an investor puts Rs. 10,000 into a mutual fund, the distributor would earn Rs. 100 as a commission. Thus, the larger the investment, the higher the commission paid to the distributor.

It is important to note that the commission rates may vary depending on several factors. Firstly, different types of mutual funds offer different commission rates. For instance, equity mutual funds often provide higher commissions compared to debt mutual funds due to their higher potential for returns and riskier nature. Secondly, the distributor's relationship with the mutual fund company can influence the commission rate. Distributors who bring substantial business to the company or have a strong reputation in the industry may be offered higher commission rates. Thirdly, the distributor's experience and client base can also be a factor, with more experienced distributors who have a larger client base often receiving higher commission rates.

Mutual fund distributors play a crucial role in the investment process, especially for the average investor. They assist investors in choosing the right mutual fund based on their investment goals, risk profile, and other factors. Additionally, they help with the paperwork and investment process, making it smoother and more accessible. While they provide valuable guidance, it is important to remember that mutual fund distributors are not financial advisors and may not offer personalised investment advice.

Smaller Companies, Bigger Returns: Investing in Franklin India's Future

You may want to see also

Commission rates vary depending on the type of mutual fund

Equity mutual funds, for example, may offer higher commissions compared to debt mutual funds due to their higher potential for returns and increased risk. The distributor's relationship with the mutual fund company can also impact the commission rate. Distributors who bring substantial business to the company or have a strong reputation in the industry may be offered higher commission rates.

Additionally, mutual fund companies tend to offer enhanced commission rates to distributors with extensive experience and a larger client base, as they are often more successful in attracting new clients. The size of the investment also matters, as the commission paid is usually a percentage of the amount invested.

It is important to note that mutual fund distributors are compensated by the Asset Management Companies (AMCs) and not directly by the investors. The commission structure is designed to reward distributors for their role in distributing and selling mutual fund products, as well as providing guidance and support to investors.

Low-Cost Trading Funds: Smart Investment, Smart Returns

You may want to see also

Distributors with more experience and a larger client base may receive higher commission rates

Mutual fund companies recognise the value that these experienced distributors bring to the table and are willing to compensate them accordingly. The commission structure for mutual fund distributors is designed to incentivise and reward those who consistently deliver strong results.

The experience of these distributors also comes into play when negotiating commission rates. With a larger client base, they have more leverage to negotiate higher rates, as the mutual fund company recognises the potential value they can bring. Additionally, these distributors may have strong relationships with the mutual fund company, further increasing their influence in commission negotiations.

The commission rates for these experienced distributors can vary depending on the mutual fund company and the specific fund being offered. However, it typically ranges from 0.1% to 2% of the number of units purchased by investors. This commission is usually a percentage of the amount invested by the investor, so the larger the investment, the higher the commission.

These distributors play a crucial role in the mutual fund industry, acting as intermediaries between the fund companies and individual investors. Their extensive knowledge, networks, and sales skills are highly valued, and mutual fund companies are willing to offer competitive commission rates to secure their services.

Corporations' Hesitance Towards Mutual Funds: Exploring the Why

You may want to see also

There are two main types of commission: upfront and trailing

Commissions are a common feature of mutual fund investing. Mutual fund distributors are individuals or entities that sell mutual fund products to investors on behalf of asset management companies (AMCs). They are licensed and regulated by the Securities and Exchange Board of India (SEBI) and AMFI. For their services, they earn commissions from the AMCs, which are typically a percentage of the amount invested by the investor.

Trailing commissions, on the other hand, are designed to compensate mutual fund distributors for attracting investors from cities outside the top 30 urban areas. In the top 30 cities, the commission rate is standardised, ranging from 0.1% to 2%, depending on the fund house and the type of mutual fund. Distributors in these areas do not receive additional benefits or bonuses for attracting clients.

Cities outside the top 30 are known as B-30 cities. Distributors sourcing clients from these locations receive extra incentives, including special commissions on each investment made during the first year, in addition to the standard commission rate. The standard commission rate for B-30 cities also ranges between 0.1% and 2%.

The upfront and trailing commission structure for mutual fund distributors is unique to each AMC and is based on their internal guidelines and incentive structures. These structures aim to ensure the maximum reach of the AMC while also providing benefits to investors.

Quant Funds: Worth the Investment Risk?

You may want to see also

Frequently asked questions

Commissions are the fees that mutual fund distributors earn for their services. These intermediaries are compensated by the mutual fund houses, or asset management companies (AMCs), through commissions.

Mutual fund commissions typically range from 0.1% to 2% of the units purchased by investors. This rate varies depending on the mutual fund type, the AMC, and other factors like the distribution channel used to acquire customers.

The commission structure for mutual fund distributors is based on a percentage of the total assets under management (AUM). The AUM of a mutual fund distributor is dynamic and can change due to new investments or redemptions, and market value fluctuations.