Owner's equity is a term used to describe the net worth of a company, or the value of a company's assets minus its liabilities. It is an important measure for owners to understand the value of their stake in their business, and it is often used to demonstrate a company's value to lenders and outside investors. Owner's equity is listed on a company's balance sheet and can be used to indicate a business's financial health, as well as whether the company is gaining or losing value over time. A company's owner's equity can be calculated by subtracting the company's liabilities from its assets.

| Characteristics | Values |

|---|---|

| Definition | The proportion of the total value of a company’s assets that can be claimed by its owners (sole proprietorship or partnership) and by its shareholders (if it is a corporation) |

| Calculation | Total assets – Total liabilities |

| Accounting Equation | Assets = Liabilities + Owner’s equity |

| Balance Sheet | Owner’s equity is listed on a company’s balance sheet |

| Business Health | Positive and increasing equity indicates a healthy, growing company |

| Business Health | Negative owner’s equity often shows that a company has more liabilities than assets and can signify trouble for a business |

| Components | Capital investments from the owner, retained earnings generated by the business, money withdrawn by the owner, and losses generated by the business |

| Components (Publicly Traded Companies) | Dividends and distributions, outstanding shares, other capital, and treasury stocks |

What You'll Learn

Owner's equity is the net worth of a company

Owners' equity is the net worth of a company. It is the amount of a company's assets that can be claimed by the owners and shareholders after all liabilities have been subtracted. This can be calculated by using the formula:

> Owners' Equity = Total Assets – Total Liabilities

Owners' equity is listed on a company's balance sheet and is considered an important measure for owners to understand the value of their stake in the business. It is also used by analysts to assess a company's financial health.

Owners' equity can be increased by investing more money in the business, bringing on additional equity partners, or authorising more shares of stock for sale. It can also be increased by decreasing a company's liabilities or increasing profits.

A positive owners' equity indicates a healthy, growing company, whereas negative owners' equity may indicate that a company has more liabilities than assets, which can signify trouble for the business.

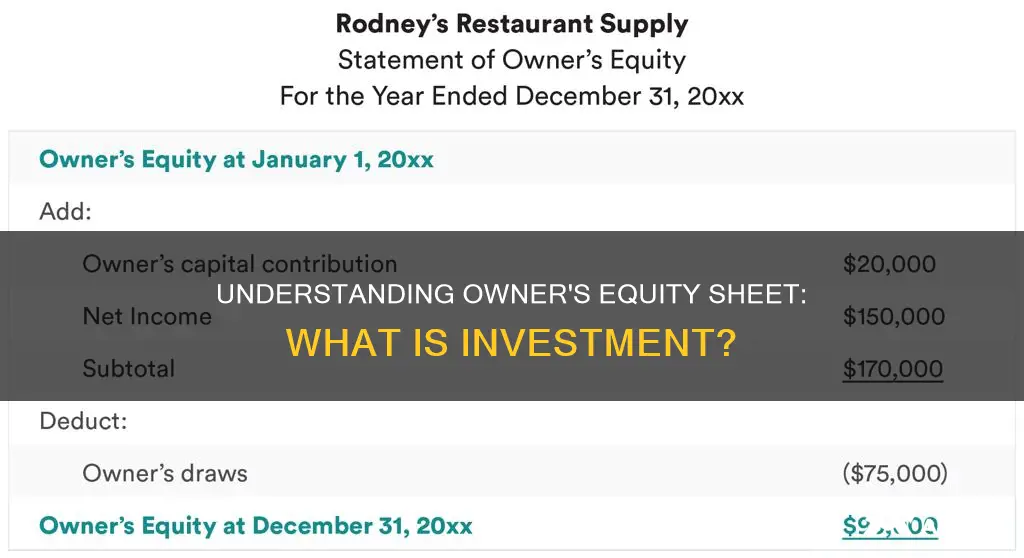

Understanding Investment's Role in Owner's Equity

You may want to see also

It is calculated by subtracting liabilities from assets

Owner's equity is a critical metric for understanding a company's financial health and represents the net worth of a company. It is calculated by subtracting total liabilities from total assets, indicating how much of the company's assets are claimed by owners or shareholders.

The formula for calculating owner's equity is:

> Owner's Equity = Total Assets - Total Liabilities

This formula is derived from the fundamental accounting equation: Assets = Liabilities + Owner's Equity. By rearranging this equation, we can solve for owner's equity.

When calculating owner's equity, it is important to note that liabilities must be subtracted first because, in the event of a sale or liquidation, these must be paid before the owner can collect any remaining funds.

Owner's equity can be found on a company's balance sheet and is an essential tool for owners to understand the value of their stake in the business. It is also used by analysts to assess the financial health of a company and determine its valuation.

For example, let's consider a company with total assets of $3.2 million and total liabilities of $2.1 million. By subtracting the liabilities from the assets, we find that the owner's equity is $1.1 million. This indicates that the owner has a substantial stake in the company and that the company is in good financial health.

In summary, owner's equity is a critical metric that provides insight into a company's financial health and the value of an owner's stake in the business. It is calculated by subtracting total liabilities from total assets and can be found on a company's balance sheet.

Enhancing Investment Management Savvy: Strategies for Success

You may want to see also

It is an indicator of a company's financial health

Investment in an owner's equity sheet is an important indicator of a company's financial health. Owner's equity is the proportion of a company's total assets that can be claimed by its owners or shareholders. It is calculated by subtracting all liabilities from the total value of an asset.

For normal day-to-day business analysis, owner's equity is a valuable indication of a business's financial health and a way to track whether the company is gaining or losing value over time. Owner's equity is listed on a company's balance sheet and can be used to demonstrate a company's value to lenders and outside investors.

A positive owner's equity indicates that a company has enough assets to cover its liabilities. A negative owner's equity means that a company's liabilities exceed its assets, which can be considered balance sheet insolvency. Negative owner's equity can create long-term problems for a business as it indicates that the company does not have enough capital to support its operations.

Owner's equity is calculated by summing up all business assets (property, equipment, inventory, retained earnings, and capital goods) and then deducting all liabilities (debts, wages, salaries, loans, and creditors).

Owner's equity is an important measure to help owners understand the value of their stake in the business. It is also used by analysts to assess a company's financial health and determine a firm's valuation.

Silver Investment Guide: Buying Silver in India

You may want to see also

It is not considered an asset of the business

Owner's equity is the amount of money invested by the owner in the business minus any money taken out by the owner of the business. It is not considered an asset of the business. Owner's equity is calculated by summing all the business assets (property, plant, equipment, inventory, retained earnings, and capital goods) and deducting all the liabilities (debts, wages, salaries, loans, and creditors). The resulting figure represents the owner's stake in the business and is listed on the company's balance sheet.

While owner's equity is derived in part from a company's assets, it is not itself an asset. This is because owner's equity is calculated as the total value of a company's assets minus the company's liabilities. Owner's equity functions as a liability owed to the owner by the business.

The balance sheet is a financial statement based on the equation that the total assets of a company are equal to the total of its liabilities and owner's equity. The company's assets are entered on one side of the sheet, while the liabilities and owner's equity are entered on the other. Owner's equity is the number that remains when liabilities are subtracted from assets.

The dynamics of increasing and decreasing owner's equity are similar to that of a bank account balance. Owner's equity grows when the business makes money, the owner puts more money into the business, or the business assets increase in value. Conversely, owner's equity decreases when the business loses money, the owner takes money out of the business, or the business assets decrease in value.

In summary, owner's equity is not considered an asset of the business. It is a calculation of the owner's stake in the business, derived from the difference between the total assets and total liabilities of the company.

Investing: A Smarter Option Than Saving for Your Future

You may want to see also

It can be increased by owner investment or business profits

Owner's equity is a crucial metric for understanding the financial health of a business and can be increased by owner investment or business profits. It is the difference between the value of a company's assets and its liabilities. A simple formula to calculate owner's equity is:

> Owner's Equity = Total Assets - Total Liabilities

This figure represents the net worth of the company, and it is important to note that owner's equity is not considered an asset of the business. Instead, it functions as a liability owed to the owner by the business.

Owner's equity can be increased by owner investment, which may come in the form of capital investments such as land, vehicles, or equipment. These capital investments are part of the business's equity and are included on the asset side of the balance sheet. When an owner invests more money into the business, owner's equity increases.

Additionally, owner's equity can be increased by business profits. Higher profits through increased sales or decreased expenses will increase the amount of owner's equity. Retained earnings, which are profits reinvested into the business, contribute to positive equity growth and increase the overall value of the company.

It is worth noting that owner's equity can also be decreased by owner withdrawals, business losses, or a decrease in the value of business assets. Therefore, while increasing owner's equity through investment and profits is beneficial, it is important to monitor and manage owner withdrawals and business expenses to maintain a healthy equity position.

India's Future: Defense, Agriculture, or Education?

You may want to see also

Frequently asked questions

Owner's equity is the proportion of a company's assets that can be claimed by its owners after all liabilities have been accounted for. It is the amount that remains for the owner once all the business's debts have been paid off.

Owner's equity is calculated by subtracting the company's liabilities from its assets: Owner's Equity = Assets – Liabilities.

Owner's equity is listed on a company's balance sheet. It is not an asset of the business, but it functions as a liability owed to the owner by the business.

Yes, owner's equity can be negative. This occurs when a company's liabilities exceed its assets, which can be caused by the owner withdrawing too much money from the company.

The only difference between owner's equity and shareholder's equity is the type of business. Owner's equity refers to tightly held businesses, while shareholder's equity refers to widely held businesses.