Investing is a fascinating topic for many reasons. It can be a way to build wealth and secure your financial future, but it's also a complex and sometimes risky endeavour that requires careful research and planning. There are many different types of investments, from stocks and bonds to property and commodities, each with its own unique set of risks and rewards. Successful investing requires a deep understanding of financial markets and the ability to make informed decisions, and it can be a rewarding pursuit for those who are willing to put in the time and effort to learn the ropes.

| Characteristics | Values |

|---|---|

| Limitless returns | $500 investment |

| Understanding the economy and the market | Interest in economics and finance |

| Many ways to succeed | Buy and hold method |

What You'll Learn

The history of the markets

One of the earliest forms of investing can be traced back to ancient times, when people would barter and trade goods and services. This simple exchange of value laid the foundation for the markets as we know them today. As societies became more complex and specialised, money was introduced as a standardised medium of exchange, allowing for more efficient and widespread trade.

The concept of investing as we know it today began to take shape in the 17th and 18th centuries, with the rise of merchant capitalism and the establishment of stock markets. People began to invest in companies and ventures, hoping to profit from their success. This was also a time of great exploration and expansion, with new trade routes opening up and creating new opportunities for investors.

The industrial revolution of the 19th century brought even more dramatic changes to the markets. The rapid development of new technologies and industries created a host of new investment opportunities. It was also during this time that the first modern stock exchanges were established, providing a more organised and regulated environment for trading and investing.

The 20th century saw the globalisation of the markets, with the rise of multinational corporations and the integration of financial systems worldwide. This period also witnessed the emergence of new types of investing, such as mutual funds and derivatives, which offered even more opportunities for investors to diversify their portfolios and manage risk.

Today, the markets are more accessible than ever before, with online trading platforms and a wide range of investment options available to individuals around the world. Despite the many changes and advancements, the fundamental principles of investing remain the same: identifying opportunities, managing risk, and building wealth over time.

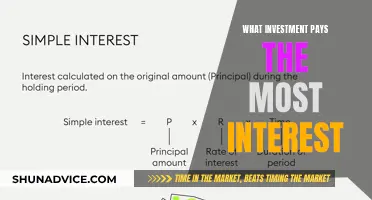

Investment Interest: Carrying Over for Maximum Returns?

You may want to see also

Retirement planning

Investing is an appealing prospect for many people, and there are several reasons why it might interest you. One of the key attractions is the potential for high returns. For example, an instructor at a training course once commented that with a $500 investment, your returns could be limitless. This idea of limitless returns is an enticing prospect for many, and it can spark a quest for financial success.

One of the benefits of investing for retirement is the ability to take advantage of compound interest. Compound interest allows your investments to grow exponentially over time, which can significantly increase your retirement savings. For example, if you start investing at a young age, even with a small initial investment, the power of compound interest can turn it into a substantial sum by the time you retire.

Additionally, investing for retirement provides the opportunity to diversify your portfolio and reduce risk. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can minimise the impact of market volatility and protect your retirement savings. It's important to remember that investing carries inherent risks, and there are no guarantees. However, by carefully researching and understanding the market, you can make informed decisions that align with your risk tolerance and financial goals.

Finally, when investing for retirement, it's essential to consider the tax implications and take advantage of any available tax benefits. Many countries offer tax incentives for retirement savings, such as tax-deferred or tax-free investment accounts. By utilising these tax benefits, you can maximise your retirement savings and minimise the impact of taxes on your investments. In conclusion, investing for retirement requires a careful and disciplined approach, but it can be a powerful tool for securing your financial future. By understanding the market, managing risk, and taking advantage of compound interest and tax benefits, you can build a substantial retirement nest egg and enjoy a comfortable retirement.

Venture Capitalists: Interest Rates, Loans, and Investment Bankers Compared

You may want to see also

Investment strategies

One popular strategy is the "buy and hold" method, which involves buying an asset and holding onto it for the long term, regardless of market fluctuations. This strategy can be particularly effective for investors who are able to ride out short-term losses in the hope of long-term gains.

Another strategy is to focus on options, which can provide the opportunity to take profits and run. This may involve taking advantage of long call positions, which can offer the potential for significant returns with limited risk.

For some, investing is about more than just financial gain. The psychological and philosophical aspects of economic decisions can be fascinating, and the ever-changing nature of the economy and world markets provides an endless opportunity to build understanding and knowledge.

Ultimately, the right investment strategy will depend on an individual's goals, risk tolerance, and investing behaviour. By understanding the various strategies available and aligning them with personal preferences, investors can increase their chances of success.

Interest Payable: Operating, Investing, or Financing Activity?

You may want to see also

Stock market indicators

One of the most fascinating aspects of stock market indicators is the way they reflect the psychological and philosophical dimensions of economic decision-making. People's choices about where and how to invest their money are driven by a range of factors, from personal values and beliefs to emotional responses to market trends.

For example, a common indicator used in stock market analysis is the price-to-earnings (P/E) ratio, which compares a company's stock price to its earnings per share. A high P/E ratio can indicate that investors are optimistic about the company's future prospects, expecting earnings growth that will justify the higher stock price. This optimism could be driven by a range of factors, from faith in a company's leadership to positive market sentiment more broadly.

Another interesting aspect of stock market indicators is the way they can be used to identify potential investment opportunities. For instance, some investors might look for stocks with low P/E ratios, indicating that they may be undervalued by the market. By buying these stocks, investors are essentially betting on their potential for future growth, hoping to achieve significant returns if the company's performance improves.

Additionally, stock market indicators can also provide insights into broader economic trends and market sentiment. For example, a rising stock market could indicate increased investor confidence in the overall economy, while a declining market might signal concerns about an economic downturn.

Overall, stock market indicators offer a fascinating glimpse into the complex world of investing, where decisions are driven by a combination of data, analysis, and human psychology. By understanding and interpreting these indicators, investors can make more informed choices about where to allocate their capital, and potentially achieve significant returns on their investments.

Paying Off Debt or Investing: Which Should You Choose?

You may want to see also

International stocks

One of the key attractions of investing in international stocks is the potential for higher returns. By investing in countries with strong economic growth and favourable market conditions, investors can seek opportunities that may offer greater profitability than their home markets. This was the experience of one investor who, after learning about futures and options, was intrigued by the idea of limitless returns.

Additionally, investing in international stocks offers a valuable learning experience. By exploring different markets, investors can develop a deeper understanding of global economics and market dynamics. This knowledge can be applied to future investment decisions, helping investors make more informed choices and potentially improving their long-term investment performance.

Overall, international stocks present a compelling opportunity for investors seeking diversification, higher returns, and a broader understanding of global markets. By embracing the challenges and rewards of investing in international stocks, investors can expand their investment horizons and potentially achieve their financial goals.

Understanding Taxable Interest Income from Investments

You may want to see also

Frequently asked questions

I am interested in investing because I want to grow my wealth over time and achieve financial freedom. I believe that investing is a great way to build my financial future and reach my long-term goals.

I find the potential for long-term capital growth and compound interest appealing. I also like the idea of diversifying my portfolio across different asset classes and sectors to manage risk and potentially enhance returns.

By investing wisely and consistently, I believe I can build a substantial nest egg over time. I can use this to achieve financial milestones such as buying a home, saving for retirement, or funding my children's education.

I am particularly interested in stocks and shares because I like the idea of owning a piece of a company and potentially benefiting from its success. I am also intrigued by the potential of alternative investments like property, commodities, and private equity, which can offer diversification and potentially higher returns.

I understand that investing involves risk, and I am prepared to accept a certain level of volatility. To manage risk, I plan to adopt a long-term investment horizon, diversify my portfolio, and conduct thorough research before making any investment decisions. I will also regularly review and rebalance my portfolio to ensure it remains aligned with my risk tolerance and investment goals.