Planned investment is a crucial aspect of economic planning, representing the allocation of resources towards future growth and development. It involves strategic decisions on how to utilize funds to generate returns and achieve financial objectives. Interest rates play a significant role in shaping planned investment, as they directly impact the cost of borrowing and the potential returns on investment. When interest rates are low, borrowing becomes cheaper, encouraging businesses and individuals to invest more, as the cost of capital decreases. Conversely, higher interest rates can deter investment as borrowing becomes more expensive, potentially leading to reduced spending and slower economic growth. Understanding the relationship between interest rates and planned investment is essential for making informed financial decisions and managing economic activities effectively.

What You'll Learn

- Investment Planning: Strategies to align investment goals with interest rate changes

- Rate Sensitivity: How interest rates impact the timing and amount of planned investments

- Economic Indicators: Understanding market signals that influence planned investment decisions

- Risk Management: Techniques to mitigate risks associated with interest rate fluctuations in investments

- Policy Impact: The role of monetary policy in shaping planned investment strategies

Investment Planning: Strategies to align investment goals with interest rate changes

Planned investment is a strategic approach to financial planning, where individuals and businesses allocate their resources to achieve specific financial objectives over a defined period. It involves a careful assessment of one's financial situation, risk tolerance, and goals to determine the most suitable investment strategies. When it comes to interest rates, they play a crucial role in shaping the investment landscape and can significantly impact planned investments. Understanding how interest rates affect investment planning is essential for making informed decisions and adapting strategies accordingly.

Interest rates have a direct influence on investment returns and the overall cost of borrowing. When interest rates rise, borrowing becomes more expensive, which can impact investment decisions. For instance, if an individual is considering taking out a loan to invest, higher interest rates may discourage this action as the cost of borrowing increases. On the other hand, rising interest rates can also make savings accounts and fixed-income investments more attractive, as the returns on these instruments tend to increase with higher interest rates. This dynamic highlights the importance of aligning investment goals with interest rate trends.

One strategy for investment planning is to adopt a long-term perspective. Interest rates are subject to market fluctuations and economic policies, which can be unpredictable in the short term. However, over the long term, interest rates tend to follow a general upward or downward trend. By focusing on long-term investment goals, investors can make decisions based on these trends. For example, if an investor aims to retire in 20 years, they might consider investing in a mix of stocks and bonds, adjusting the allocation as interest rates change over time. This approach allows for a more flexible strategy that can adapt to varying interest rate environments.

Another strategy is to diversify investments to manage risk effectively. Interest rates can impact different asset classes differently. For instance, fixed-income securities like bonds are highly sensitive to interest rate changes. When interest rates rise, bond prices typically fall, and vice versa. Therefore, diversifying investments across various asset classes, including stocks, real estate, and commodities, can help mitigate the risks associated with interest rate fluctuations. This diversification ensures that the investment portfolio is not overly exposed to any single interest rate-sensitive asset class.

Additionally, staying informed about economic indicators and central bank policies is crucial for investment planning. Central banks often adjust interest rates to manage economic growth and inflation. By monitoring these policies and their potential impact on interest rates, investors can anticipate changes and adjust their investment strategies accordingly. For instance, if a central bank is expected to raise interest rates, investors might consider reducing their exposure to interest-rate-sensitive assets or exploring alternative investment opportunities that may benefit from higher interest rates.

In conclusion, investment planning requires a thoughtful approach to navigate the impact of interest rates. By understanding the relationship between interest rates and investment returns, individuals and businesses can make informed decisions. Strategies such as adopting a long-term perspective, diversifying investments, and staying informed about economic indicators enable investors to align their goals with interest rate changes. Effective investment planning ensures that financial objectives are met despite the dynamic nature of interest rates, providing a more secure and prosperous financial future.

Maximizing Tax Benefits: A Guide to Reporting Investment Interest Expenses

You may want to see also

Rate Sensitivity: How interest rates impact the timing and amount of planned investments

Planned investments are strategic financial decisions made by individuals, businesses, or governments to allocate resources towards specific goals. These investments are crucial for economic growth, business expansion, and personal financial planning. However, the effectiveness of these investments can be significantly influenced by interest rates, which introduces a concept known as rate sensitivity.

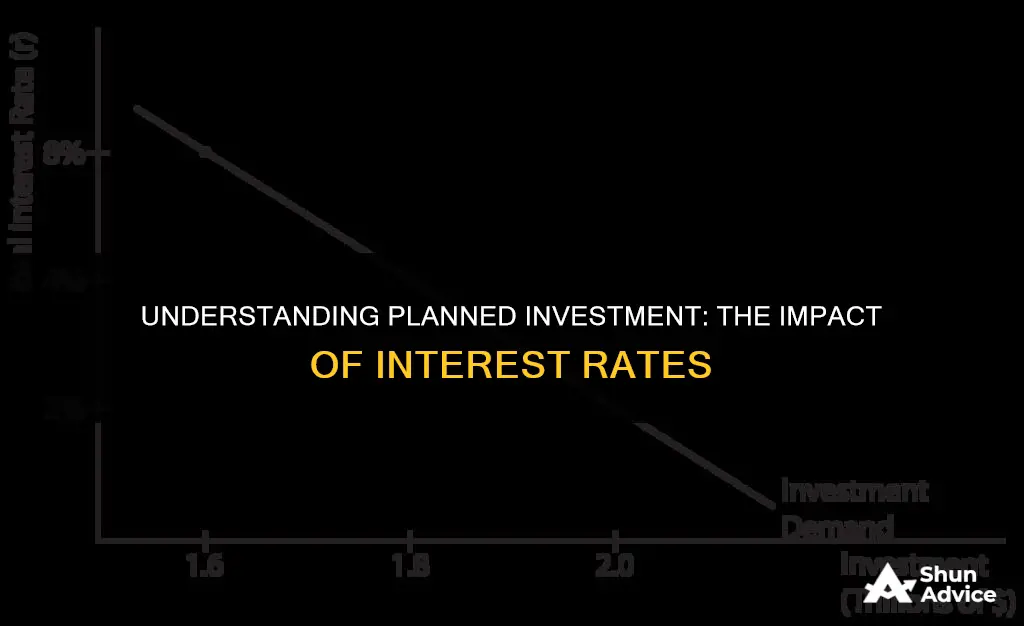

Rate sensitivity refers to the responsiveness of planned investments to changes in interest rates. When interest rates rise, borrowing becomes more expensive, and the cost of capital increases. This directly impacts the decision-making process for planned investments. For businesses, higher interest rates may discourage new projects as the cost of financing these projects becomes more substantial. For instance, a company planning to expand its operations might delay its investment if the interest rate on loans increases, making the project financially less attractive. Similarly, individuals may reconsider their plans to purchase assets like property or stocks when interest rates rise, as borrowing becomes more costly.

On the other hand, lower interest rates can stimulate planned investments. When borrowing is cheaper, it becomes more feasible to finance projects, encouraging businesses to invest in expansion, research, and development. For individuals, lower interest rates can make mortgage payments more affordable, stimulating the housing market and personal investments. This rate sensitivity is a critical factor in economic planning and policy-making. Central banks often use interest rates as a tool to influence economic activity. By adjusting interest rates, they can encourage or discourage investment, thereby managing economic growth and inflation.

The impact of interest rates on planned investments is not limited to the timing of investments but also affects the amount invested. When interest rates are low, investors might be more inclined to borrow and invest, potentially leading to a surge in investment activity. Conversely, high-interest rates may lead to a reduction in investment as the cost of capital increases. This dynamic can have a ripple effect on the overall economy, affecting employment, production, and consumption patterns.

In summary, rate sensitivity highlights the critical role of interest rates in shaping the investment landscape. It influences the timing and magnitude of planned investments, making it a crucial consideration for investors, businesses, and policymakers alike. Understanding this relationship is essential for making informed financial decisions and managing economic strategies effectively.

Understanding Cash Investment Interest Rates: A Comprehensive Guide

You may want to see also

Economic Indicators: Understanding market signals that influence planned investment decisions

Planned investment is a crucial aspect of economic activity, representing the decisions made by businesses and individuals regarding future expenditures. It is influenced by various economic indicators and market signals that provide valuable insights into the overall health and direction of an economy. Understanding these indicators is essential for making informed investment choices and predicting future economic trends.

One of the most significant factors affecting planned investment is the interest rate. When interest rates are low, borrowing becomes cheaper, encouraging businesses to invest in new projects, expand operations, or purchase assets. Lower interest rates stimulate economic growth as businesses can access capital more easily, leading to increased production, job creation, and overall economic expansion. This is particularly beneficial for industries such as construction, manufacturing, and technology, which often require substantial capital investment.

Conversely, when interest rates rise, borrowing becomes more expensive, and the cost of capital increases. This can lead to a decrease in planned investment as businesses may become more cautious about taking on new projects or expanding their operations. Higher interest rates may also discourage consumers from making significant purchases, such as houses or durable goods, as the cost of borrowing rises. As a result, economic activity may slow down, and businesses might postpone investments until interest rates become more favorable.

Economic indicators play a vital role in signaling the potential direction of interest rates and, consequently, planned investment. One such indicator is the inflation rate. When inflation is high, central banks often raise interest rates to control spending and borrowing. Higher interest rates can then reduce planned investment as the cost of capital increases. On the other hand, low inflation or deflationary pressures may prompt central banks to lower interest rates, stimulating investment by making borrowing more attractive.

Another critical economic indicator is the unemployment rate. A low unemployment rate suggests a strong labor market, which can encourage businesses to invest in new projects and hire additional workers. This positive economic environment may lead to increased planned investment. Conversely, high unemployment rates can signal economic weakness, causing businesses to be more cautious about investing, as consumer spending and demand may be uncertain.

Additionally, market sentiment and investor confidence are essential market signals that influence planned investment decisions. Positive economic news, such as strong corporate earnings reports or favorable government policies, can boost investor confidence and encourage investment. Conversely, negative news or economic uncertainties may lead to reduced investment as market participants become more risk-averse.

In summary, understanding economic indicators is crucial for deciphering market signals that impact planned investment. Interest rates, inflation, unemployment, and market sentiment are key factors that businesses and investors consider when making investment choices. By analyzing these indicators, market participants can make more informed decisions, adapt to changing economic conditions, and contribute to the overall growth and stability of the economy.

Understanding the Role of Interest in Cash Flow from Investing

You may want to see also

Risk Management: Techniques to mitigate risks associated with interest rate fluctuations in investments

Interest rate fluctuations can significantly impact planned investments, often posing risks to the financial health of investors. When interest rates rise, the value of existing investments, particularly fixed-income securities, can decline. This is because higher interest rates make new investments more attractive, causing investors to sell off existing bonds or securities at a loss to capitalize on the higher returns. Conversely, during periods of falling interest rates, the value of these investments can increase as they become more appealing to investors.

To mitigate these risks, investors can employ various risk management techniques. One common strategy is to diversify the investment portfolio. By allocating assets across different sectors, industries, and asset classes, investors can reduce the impact of interest rate changes on any single holding. For instance, a well-diversified portfolio might include a mix of stocks, bonds, and alternative investments, ensuring that the overall performance is not overly sensitive to interest rate shifts.

Another effective approach is to use financial derivatives, such as interest rate swaps or futures contracts. These instruments allow investors to hedge against interest rate risk by locking in future interest rates or managing the exposure to rate changes. For example, an investor holding a bond portfolio might enter into an interest rate swap to protect against rising rates, thus ensuring a more stable return over time.

Additionally, investors can consider adjusting the timing of their investments. This involves making strategic decisions about when to buy or sell assets based on interest rate forecasts. For instance, if interest rates are expected to rise, investors might choose to delay bond purchases, anticipating that the value of existing bonds will increase as rates rise. Alternatively, they could consider investing in floating-rate securities, which adjust their returns based on market interest rates, providing a degree of protection against rate fluctuations.

Lastly, regular review and rebalancing of the investment portfolio are essential. Market conditions and interest rate environments can change rapidly, so investors should periodically assess their holdings and make adjustments as necessary. This may involve selling underperforming assets and reallocating funds to take advantage of new opportunities presented by shifting interest rates. By staying proactive and responsive to market dynamics, investors can effectively manage the risks associated with interest rate fluctuations.

Unlock Investment Returns: Master the Art of Interest Rate Calculation

You may want to see also

Policy Impact: The role of monetary policy in shaping planned investment strategies

The relationship between monetary policy and planned investment is a critical aspect of economic strategy, especially in the context of interest rates. When central banks adjust interest rates, they initiate a chain reaction that influences various economic activities, including planned investment. Planned investment refers to the decisions made by businesses and individuals regarding future capital expenditures, which are crucial for economic growth and development.

Monetary policy, primarily through changes in interest rates, can significantly impact these investment decisions. Lower interest rates often encourage planned investment by reducing the cost of borrowing. When interest rates are low, businesses may find it more attractive to take out loans for new projects, expansion, or equipment purchases. This is because the interest expense on these loans is relatively lower, allowing companies to allocate more funds towards their investment goals. As a result, planned investment increases, leading to higher capital spending and potential economic growth.

Conversely, higher interest rates can have a deterrent effect on planned investment. When borrowing becomes more expensive due to increased interest rates, businesses might reconsider their investment plans. The higher cost of capital may discourage new projects, especially those with longer payback periods. This can lead to a decrease in planned investment, potentially slowing down economic activity and growth. For instance, during periods of tight monetary policy, where central banks raise interest rates to control inflation, businesses might postpone non-essential investments, focusing instead on cost-cutting measures.

The impact of monetary policy on planned investment is a delicate balance. Central banks must carefully consider the effects of their interest rate decisions. While lower interest rates can stimulate investment and economic activity, prolonged or excessive lowering of rates may lead to inflationary pressures. On the other hand, raising interest rates too quickly or to high levels can stifle investment and economic growth. Therefore, central banks often use monetary policy as a tool to guide the economy towards a stable and sustainable growth path.

In summary, monetary policy, particularly changes in interest rates, plays a pivotal role in shaping planned investment strategies. Businesses and investors closely monitor these policy shifts, as they directly influence the cost of capital and the overall economic environment. Effective monetary policy can encourage or discourage investment, thereby impacting economic growth and development. Understanding this relationship is essential for policymakers and businesses alike to make informed decisions and navigate the complexities of the modern economy.

Unlocking Investment Returns: A Guide to Calculating Simple Interest

You may want to see also

Frequently asked questions

Planned investment refers to the deliberate and strategic allocation of financial resources with the primary goal of generating future income or capital appreciation. It involves making informed decisions about where and how to invest money, often with a long-term perspective. This type of investment is typically well-researched and aligned with an individual's or organization's financial objectives and risk tolerance.

Interest rates play a significant role in influencing planned investment decisions. When interest rates are low, borrowing becomes cheaper, which can encourage businesses to invest in expansion projects, equipment, or research and development. Lower interest rates may also prompt individuals to consider investments in stocks or bonds, as the potential returns can be more attractive compared to the cost of borrowing. Conversely, during periods of high-interest rates, borrowing becomes more expensive, potentially discouraging investment and leading to a more cautious approach.

Changes in interest rates can have a ripple effect on various investment strategies. Rising interest rates might lead to a shift in investment preferences towards fixed-income securities like bonds, as they offer more attractive yields. This can impact the stock market, causing a potential decline in share prices, especially for growth-oriented companies. On the other hand, falling interest rates may encourage investors to take on more risk, potentially favoring equity investments. Understanding these dynamics is crucial for investors to adjust their portfolios accordingly and make informed decisions.