Standard deviation is a statistical measure used to gauge the riskiness of an investment portfolio. It is a quantification of how much a series of numbers, such as fund returns, varies from its mean or average. In other words, it measures the income variations in investments and the consistency of their returns. A high standard deviation indicates high risk because it shows that the earnings are highly unstable and volatile. Conversely, a low standard deviation indicates low risk and more stable earnings.

| Characteristics | Values |

|---|---|

| Definition | The portfolio standard deviation is the financial measure of investment risk and consistency in investment earnings. |

| What it indicates | An investment's risk because it shows how stable its earnings are. |

| Calculation | The square root of the portfolio variance. |

| Coefficient of variance | The degree of variation of returns. |

| Use | To compare with other portfolios to see if it is performing consistently. |

| Factors affecting portfolio risk | Change in interest rates, inflation rate, unemployment rate, and exchange rates. |

| Factors controlled by the firm | Bargaining power of suppliers, research and development, and competition. |

| Time period | Standard deviation is calculated using monthly returns for the past 36 months. |

| Formula | Ri – the return observed in one period (one observation in the data set) |

| Ravg – the arithmetic mean of the returns observed | |

| n – the number of observations in the dataset |

What You'll Learn

Calculating standard deviation

Standard deviation is a statistical measure of the diversity or variability in a data set. It is calculated by taking the square root of the variance, which is itself the average of the squared differences of the mean. In other words, standard deviation is the square root of the calculated variance of a set of data.

The formula for variance of a population is:

Variance = \( \sigma^2 = \frac{\Sigma (x_{i} - \mu)^2}{n} \)

The formula for variance for a sample set of data is:

Variance = \( s^2 = \frac{\Sigma (x_{i} - \overline{x})^2}{n-1} \)

To calculate the standard deviation, take the square root of the population or sample variance.

Population standard deviation = \( \sqrt {\sigma^2} \)

Standard deviation of a sample = \( \sqrt {s^2} \)

For example, suppose a mutual fund achieves the following annual rates of return over five years: 4%, 6%, 8.5%, 2%, and 4%. The mean value, or average, is 4.9%. To calculate the variance, we first subtract the mean from each data point and square the result:

- 4%-4.9%)^2 = (-0.9%)^2 = 0.81%

- 6%-4.9%)^2 = (1.1%)^2 = 1.21%

- 8.5%-4.9%)^2 = (3.6%)^2 = 12.96%

- 2%-4.9%)^2 = (-2.9%)^2 = 8.41%

- 4%-4.9%)^2 = (-0.9%)^2 = 0.81%

Next, we sum these squared differences: 0.81% + 1.21% + 12.96% + 8.41% + 0.81% = 24.19%.

Then, we divide the sum by the number of data points in the set, which in this case is five: 24.19% / 5 = 4.84%. This gives us the variance.

Finally, we take the square root of the variance to get the standard deviation: √4.84% = 2.46%.

Standard deviation can also be calculated using a calculator or spreadsheet software, which can simplify the process, especially for larger data sets.

Portfolio Diversification: An Investment Strategy Guide

You may want to see also

Standard deviation and volatility

Standard deviation is a statistical measure used to gauge the risk associated with an investment portfolio. It quantifies the volatility of returns, indicating how stable or unstable they are. A high standard deviation means higher risk, as it shows that the earnings are highly volatile, while a low standard deviation indicates lower risk and more predictable returns.

Standard deviation is calculated by measuring the average variance of a given dataset. In the context of investment portfolios, it measures how much a series of fund returns deviate from the mean or average. This helps investors understand how varied a fund's returns have been over a specific period, both in terms of gains and losses. For example, a mutual fund that consistently gained or lost 1% each month for 36 months would have a standard deviation of zero since there is no variation in returns. On the other hand, a fund with significant fluctuations in returns over the same period would have a much higher standard deviation.

By understanding the standard deviation of a portfolio's annual rate of return, analysts and investors can assess the consistency of returns over time. A portfolio with a long history of stable returns will have a low standard deviation, while a growth-oriented or emerging market fund with higher volatility will have a higher standard deviation, indicating a riskier investment.

It is important to note that standard deviation is just one aspect of investment risk analysis and should not be the sole factor in making investment decisions. Other factors, such as interest rate changes, inflation, unemployment, and exchange rates, can also impact portfolio risk. Additionally, standard deviation assumes a normal distribution of data, which may not always be the case for investment portfolios.

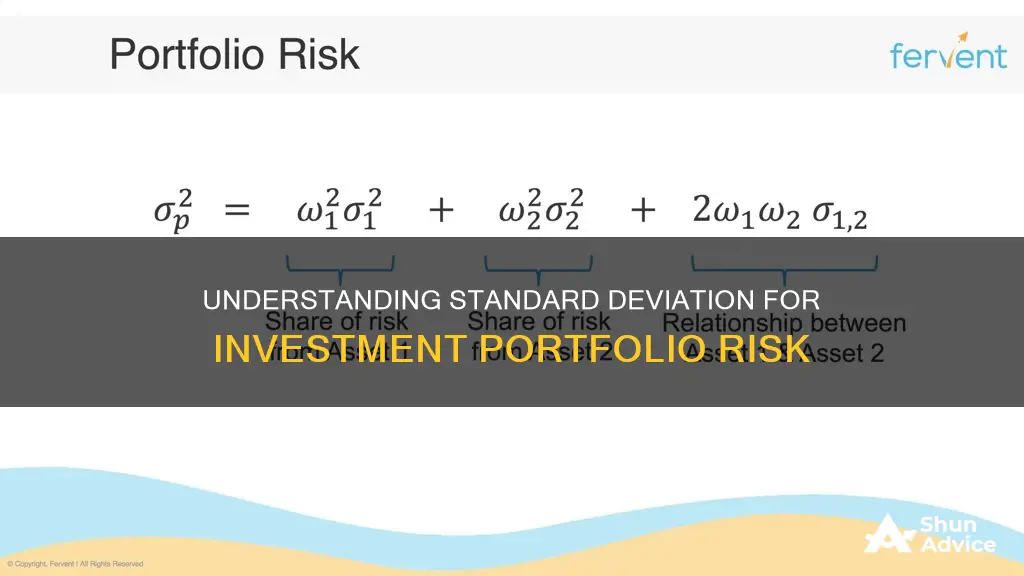

To calculate the standard deviation of a portfolio, one must first calculate the standard deviation of each security in the portfolio. Then, determine the weights of each security, find the correlation between the securities, calculate the variance, and finally compute the portfolio's standard deviation using the square root of the variance.

Investing While Saving for a Home: Wise or Risky?

You may want to see also

Using standard deviation to assess risk

Standard deviation is a widely used metric for assessing the risk of an investment fund. It quantifies how much a series of numbers, such as fund returns, varies from its mean or average. This provides investors with a precise measure of how varied a fund's returns have been over a given period, both positively and negatively.

Standard deviation is calculated by first determining the mean of all data points, then calculating the variance for each data point by subtracting the mean. The variances are then squared, summed, and divided by the number of data points in the set minus one. The square root of this quotient is the standard deviation.

A high standard deviation indicates that prices are moving wildly and that an investment is risky. Conversely, a low standard deviation suggests that prices are calm and stable, implying lower risk. For example, a mutual fund with consistent returns over time will have a low standard deviation, while a growth-oriented or emerging market fund with greater volatility will have a higher standard deviation and be riskier.

It is important to note that standard deviation is not the only measure of investment risk. Other factors, such as interest rate changes and economic conditions, can also impact the performance of a fund. Additionally, standard deviation assumes a normal distribution of data, which may not always be the case, especially for hedge funds.

When using standard deviation to assess risk, investors also consider the potential for higher returns. A high standard deviation may indicate higher potential rewards, while a low standard deviation suggests more modest gains. Ultimately, investors must balance risk and potential returns based on their risk appetite and investment objectives.

Diversification: Managing Risk in Your Investment Portfolio

You may want to see also

The drawbacks of standard deviation

Standard deviation is a statistical measure used to assess the risk of an investment portfolio. It indicates how stable or volatile a fund's returns are, providing a quantitative measure of how varied a fund's returns have been over a particular time frame. A fund with a high standard deviation is considered riskier as it indicates higher volatility and inconsistent returns.

Despite its popularity, standard deviation has several drawbacks:

Not a Standalone Risk Assessment Tool

Standard deviation is not a standalone tool for assessing the risks associated with a mutual fund. While it indicates the consistency or inconsistency of a fund's returns, it does not reflect the fund's performance relative to its benchmark. This benchmark performance is measured using beta, which indicates how well a fund performs against its reference point. Therefore, standard deviation should be used in conjunction with other risk management measures, such as beta and alpha, to understand the full risk profile of an investment.

Assumes Bell-Shaped Distribution

The standard deviation equation assumes a normal distribution, or bell curve, of data values. This assumption implies that there is an equal probability of achieving values above or below the mean. However, many portfolios, especially hedge funds, do not follow this pattern and tend to be skewed in one direction. This limitation means that the standard deviation may not accurately represent the risk profile of these portfolios.

Individual Securities Matter Less in Larger, More Diverse Portfolios

When a portfolio contains a large number of securities and a diverse range of security types, the standard deviation of individual securities becomes less significant to the overall portfolio. In such cases, the impact of any one security on the portfolio's overall risk profile is diminished, and other factors may come into play.

Larger Data Sets Are More Reliable

As with any statistical model, the reliability of standard deviation calculations increases with larger data sets. A standard deviation calculated from a small number of data points may not be as accurate as one derived from a larger sample size. Therefore, it is important to consider the size of the data set when interpreting standard deviation results.

Context is Needed for Interpretation

Standard deviation on its own does not provide much context for interpreting the risk level of a fund. It is essential to compare the standard deviation of a fund with those of similar funds or relevant indexes to determine whether it is high or low relative to its peers. This comparison provides a more meaningful assessment of the fund's risk profile.

Investing More, Saving Less: Surplus Secrets

You may want to see also

Standard deviation and portfolio diversification

Standard deviation is a statistical measure used to gauge the riskiness of an investment. It is a measure of the magnitude of deviations between the values of the observations contained in a dataset. In the context of investment portfolios, standard deviation measures the variability of returns. It is calculated by first determining the arithmetic mean of returns and then using a formula that accounts for the number of observations in the dataset.

A high standard deviation indicates a higher risk because it shows that the earnings are highly unstable and volatile. Conversely, a low standard deviation indicates lower risk and more stable returns. Standard deviation is often used by investment analysts to understand the risks associated with mutual funds or hedge funds. It is also used by individual investors to assess the risk of their investment portfolios and make adjustments according to their risk tolerance.

Portfolio diversification is a strategy used to manage investment risk. By investing in a variety of different assets, such as stocks, bonds, commodities, mutual funds, and exchange-traded funds, investors can protect themselves from temporary losses in any one asset class. Diversification ensures that an investor's portfolio is not overly exposed to the risks of any single asset or group of assets.

When calculating the standard deviation of a portfolio, it is important to consider the standard deviation of each security within the portfolio, the weights of each security, and the correlation between the securities. The standard deviation of a portfolio will be lower than the standard deviation of its individual securities due to the diversification of assets.

While standard deviation is a useful tool, it has some drawbacks. It assumes a normal distribution of data, which may not be the case for many portfolios, especially hedge funds. Additionally, standard deviation does not consider how well a fund performs against its benchmark. It is important to consider other factors and not rely solely on standard deviation when making investment decisions.

Marie Curie's Family Savings: Lost Investment, Found Legacy

You may want to see also

Frequently asked questions

Standard deviation is a statistical measure of the magnitude of deviations between the values of the observations contained in a dataset. In finance, it is used to quantify how risky an investment is and to determine the minimum required return on an investment.

The standard deviation of a set of data can be found using the following formula:

Ri = the return observed in one period (one observation in the dataset)

Ravg = the arithmetic mean of the returns observed

n = the number of observations in the dataset

Standard deviation is important for investors as it provides a precise measure of how varied a fund's returns have been over a particular time frame, both on the upside and the downside. This information can then be used to judge the range of returns a fund is likely to generate in the future.