Understanding the average annual interest rate for investment is crucial for anyone looking to grow their money. This rate represents the return on investment over a year, indicating how much an investment will earn in interest relative to its principal amount. Knowing this average helps investors make informed decisions about where to allocate their funds, whether it's in stocks, bonds, or other financial instruments. The interest rate can vary widely depending on market conditions, the type of investment, and the investor's risk tolerance. Therefore, it's essential to research and compare different investment options to find the best fit for one's financial goals and risk profile.

What You'll Learn

- Historical Rates: Average interest rates over time for various investment vehicles

- Market Factors: How economic conditions, inflation, and supply/demand affect interest rates

- Risk-Adjusted Rates: Expected returns considering risk levels of different investments

- Tax Implications: How taxes impact the net interest rate earned on investments

- Comparative Analysis: Interest rates compared across different investment options

Historical Rates: Average interest rates over time for various investment vehicles

The average annual interest rate for investments has varied significantly over the years, and understanding these historical rates can provide valuable insights for investors. Here's an overview of the average interest rates for different investment vehicles throughout history:

Treasury Bills and Bonds: Government securities, such as Treasury bills and bonds, have generally offered relatively stable and competitive interest rates. For instance, in the early 20th century, the average annual interest rate for 3-month Treasury bills was around 4-5%. During the post-World War II era, rates increased, reaching approximately 5-6% for short-term bills and 7-8% for long-term bonds. In recent decades, these rates have fluctuated but typically range from 1-3% for short-term bills and 3-5% for long-term bonds.

Savings Accounts and Money Market Funds: Traditional savings accounts and money market funds have often provided lower interest rates compared to riskier investments. In the 1980s, savings accounts offered average annual rates of around 5-6%. However, with the introduction of deregulation, rates have steadily declined, and currently, savings accounts typically yield 1-2% interest. Money market funds, which offer slightly higher rates due to their liquidity, have followed a similar trend, with average rates ranging from 2-3% in recent years.

Certificates of Deposit (CDs): CDs are time deposits that offer higher interest rates for a fixed period. In the 1960s, CDs provided average annual rates of 4-5% for short-term deposits and 6-7% for longer-term CDs. As the financial market evolved, rates increased, reaching 8-9% in the 1980s. However, in recent times, CDs have offered rates ranging from 0.5-2%, depending on the term and financial institution.

Stocks and Equities: Investing in the stock market has historically provided higher average annual returns compared to fixed-income securities. In the late 19th century, stock market returns were around 5-7% annually. This trend continued into the 20th century, with an average annual return of approximately 10-12% for the S&P 500 index. However, the dot-com bubble in the late 1990s and the subsequent market corrections led to lower returns, with the S&P 500 averaging around 7-9% in the early 2000s.

Real Estate: Property investments have historically provided attractive average annual returns, often outpacing other asset classes. In the 1950s, real estate investment trusts (REITs) offered average annual returns of around 8-10%. This trend continued, and in the 1980s, REITs provided returns of 12-15%. In recent years, with the rise of real estate crowdfunding platforms, average annual returns have stabilized at around 7-9%.

Understanding these historical rates can help investors make informed decisions, especially when comparing different investment options. It's important to note that interest rates are influenced by various economic factors and can fluctuate over time, making it essential to stay informed and adapt investment strategies accordingly.

Mortgage or Invest? Weighing the Benefits of Debt Repayment vs. Investment Growth

You may want to see also

Market Factors: How economic conditions, inflation, and supply/demand affect interest rates

Economic conditions, inflation, and supply and demand are key market factors that significantly influence interest rates, which in turn affect investment decisions. Understanding these factors is crucial for investors as they navigate the complex world of financial markets.

Economic Conditions: Interest rates are closely tied to the overall health and performance of the economy. During periods of economic growth, central banks often raise interest rates to control inflation and prevent the economy from overheating. Higher interest rates can attract foreign investment, strengthen the national currency, and encourage savings, which can lead to increased investment in the country's financial markets. Conversely, in a recession or during a period of economic downturn, central banks may lower interest rates to stimulate borrowing, investment, and consumption, aiming to boost economic activity.

Inflation: Inflation, the general rise in the price level of goods and services, is another critical factor. When inflation is high, the purchasing power of money decreases, and lenders demand higher interest rates to compensate for the loss of value of their returns. Central banks often use interest rates as a tool to control inflation. By raising rates, they can reduce the money supply, making borrowing more expensive and potentially slowing down inflation. Conversely, during periods of low inflation or deflation, central banks may lower interest rates to encourage borrowing and spending, which can help stimulate economic growth.

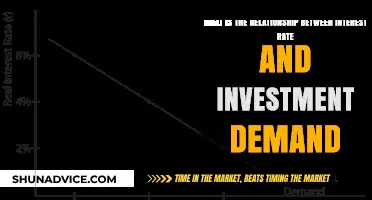

Supply and Demand: The principles of supply and demand also play a significant role in interest rate determination. When the demand for loans exceeds the supply, interest rates tend to rise. This often occurs during periods of strong economic growth when businesses and individuals are more active in borrowing for investments or consumption. Conversely, when the supply of loans exceeds the demand, interest rates may fall. This situation can arise during economic downturns or when central banks inject more money into the economy to encourage borrowing and spending.

In summary, market factors such as economic conditions, inflation, and supply and demand are interconnected and have a profound impact on interest rates. Investors should closely monitor these factors to make informed decisions about investments. Understanding how these variables interact can help investors anticipate changes in interest rates, which is essential for managing investment portfolios effectively.

Unlocking the Power of Interest-Only Investment Loans

You may want to see also

Risk-Adjusted Rates: Expected returns considering risk levels of different investments

When evaluating investment opportunities, it's crucial to understand the concept of risk-adjusted rates, which provide a more comprehensive view of expected returns by taking into account the varying risk levels associated with different investments. This approach allows investors to make more informed decisions by comparing the potential gains against the risks involved.

Risk-adjusted rates, often referred to as risk-adjusted returns, are calculated by adjusting the nominal or stated returns of an investment to account for the risk taken. This adjustment is typically done using various risk metrics, such as the Sharpe ratio, which measures the excess return per unit of volatility, or the Sortino ratio, which focuses on returns relative to downside volatility. By employing these metrics, investors can assess how much extra return they are getting for the risk they are taking.

For instance, consider two investment options: a high-risk, high-reward stock and a low-risk, stable bond. The stock might offer a higher nominal return, but it also carries a greater risk of loss. In contrast, the bond provides a more stable return but with lower volatility. By applying risk-adjusted rate analysis, investors can determine which option aligns better with their risk tolerance and investment goals.

The process involves comparing the risk-adjusted rates of different investments to identify the most attractive opportunities. This comparison is particularly useful when evaluating investments with different risk profiles, as it provides a more accurate representation of the expected returns relative to the risk taken. For example, a risk-averse investor might prefer a lower-risk investment with a slightly lower return, while a risk-tolerant investor may be willing to accept higher volatility for potentially higher gains.

Understanding risk-adjusted rates is essential for investors to make strategic decisions, especially when building a diversified portfolio. It enables them to balance risk and return, ensuring that their investments are aligned with their financial objectives and risk preferences. This approach empowers investors to navigate the complex world of investments with greater confidence and a more nuanced understanding of the potential outcomes.

Interest Rates: The Key to Unlocking Investment Potential

You may want to see also

Tax Implications: How taxes impact the net interest rate earned on investments

Understanding the tax implications is crucial when evaluating the net interest rate earned on investments, as taxes can significantly impact the overall return on investment. The tax treatment of investment income varies depending on the type of investment and the jurisdiction. Here's an overview of how taxes affect the net interest rate:

Taxable Income: Interest earned from investments is generally taxable income. When you receive interest payments, they are typically reported as income in the year they are received. This means that the interest earned is subject to income tax, which can reduce the net interest rate. For example, if you invest $1,000 and earn $50 in interest, but you are in a 30% tax bracket, you would only net $35 after taxes.

Tax Deductions and Credits: In some cases, certain investment-related expenses can be deducted, which indirectly affects the net interest rate. For instance, if you incur expenses like investment management fees or interest on a margin loan, these costs can be deducted from your taxable income. This reduction in taxable income can result in a lower tax liability, thus increasing the net interest rate earned. Additionally, specific tax credits or incentives might be available for certain types of investments, further enhancing the after-tax return.

Capital Gains Taxes: When you sell an investment for a profit, you may be subject to capital gains taxes. The tax rate on capital gains can vary depending on the holding period and your income level. Long-term capital gains are often taxed at a lower rate than ordinary income. If you invest in assets for the long term and sell them at a profit, the tax impact can be more favorable, potentially increasing the net interest rate over time.

Tax-Efficient Investing: To maximize the net interest rate, investors can employ tax-efficient strategies. One approach is to invest in tax-advantaged accounts, such as retirement accounts (e.g., 401(k) or IRA), where contributions are often tax-deductible, and earnings grow tax-free until withdrawal. Another strategy is to consider tax-efficient investments, such as municipal bonds, which offer tax-free interest income, or investing in tax-loss-harvesting strategies to offset capital gains taxes.

Jurisdictional Differences: Tax laws and rates vary across different countries and regions. Investors should be aware of the tax regulations in their jurisdiction to accurately calculate the net interest rate. Some countries offer favorable tax treatments for specific types of investments, which can significantly impact the overall return. Understanding these nuances is essential for making informed investment decisions.

Interest Rate Hikes: Unlocking Investment Potential

You may want to see also

Comparative Analysis: Interest rates compared across different investment options

When considering investment options, understanding the average annual interest rates associated with each can significantly impact your financial decisions. The interest rate is a critical factor in determining the growth and profitability of your investments over time. Here's a comparative analysis of interest rates across various investment avenues:

Bank Savings Accounts: Traditional savings accounts offered by banks are often considered a safe and accessible investment option. The average annual interest rate for savings accounts varies depending on the bank and the type of account. Typically, high-yield savings accounts offer higher interest rates compared to standard savings accounts. As of my knowledge cutoff in January 2023, the average annual interest rate for savings accounts in the United States ranges from 0.01% to 0.50%, with some online banks offering slightly higher rates. While this option provides liquidity and security, the interest earned may not keep pace with inflation over the long term.

Certificates of Deposit (CDs): CDs are time-bound deposits offered by banks, typically providing higher interest rates than savings accounts. The interest rate on CDs is determined by the term length, with longer-term CDs generally offering higher rates. For instance, a 1-year CD might offer an average interest rate of 0.50%, while a 5-year CD could provide 1.20% or more. CDs are ideal for investors seeking a fixed return over a specific period, but early withdrawals may incur penalties.

Bonds: Government and corporate bonds are fixed-income securities that offer interest payments to investors. The average annual interest rate on bonds depends on the type and creditworthiness of the issuer. Government bonds, considered low-risk, often have lower interest rates compared to corporate bonds. For instance, a 10-year US Treasury bond might yield around 2-3%, while corporate bonds could offer 4-5% or more. Bond interest rates are influenced by market conditions and the issuer's credit rating.

Dividend-Paying Stocks: Investing in individual stocks that consistently pay dividends can provide an average annual interest-like return. Dividend yields vary widely depending on the company and industry. High-yielding stocks may offer an attractive interest rate, but they also carry higher risks. For example, a well-established utility company might provide a 3-4% dividend yield, while a tech startup could offer a much higher yield but with greater uncertainty.

Peer-to-Peer Lending: P2P lending platforms enable individuals to lend money directly to borrowers, often at higher interest rates than traditional savings accounts. The average interest rate on P2P loans can range from 5% to 12% or more, depending on the borrower's creditworthiness and the platform. This investment option offers the potential for higher returns but also carries credit risk.

In summary, the average annual interest rate for investments varies widely across different options. While savings accounts and CDs offer relatively low rates, bonds and dividend-paying stocks provide moderate returns. P2P lending can be an attractive high-yield option, but it comes with increased risk. Investors should carefully consider their risk tolerance, investment horizon, and financial goals when choosing investment vehicles to maximize their interest earnings.

Unraveling the Mortgage Interest Conundrum: Is It an Investment?

You may want to see also

Frequently asked questions

The average annual interest rate for investment can vary significantly depending on various factors such as the type of investment, market conditions, and individual financial goals. Generally, it ranges from 3% to 10% or more. For example, a high-yield savings account might offer around 2-3%, while a stock market investment could yield 5-10% or higher in a strong market. It's important to research and compare different investment options to find the best fit for your financial strategy.

Interest rates play a crucial role in determining the returns on your investments. Higher interest rates often lead to increased investment returns, especially for fixed-income securities like bonds. When interest rates rise, the value of existing bonds may decrease, but new investments at higher rates can provide more attractive returns. Conversely, lower interest rates might result in less appealing returns, especially for long-term investments. Understanding the relationship between interest rates and investment performance is key to making informed financial decisions.

Yes, investing in high-interest rates does come with certain risks. One significant risk is the possibility of principal loss, especially in volatile markets. If interest rates fall, the value of your investments could decrease, potentially resulting in losses. Additionally, high-interest investments might require a longer investment horizon to achieve substantial returns, and there's a chance of market fluctuations affecting your overall portfolio. It's essential to diversify your investments and carefully consider your risk tolerance before committing to any high-interest investment strategy.

Estimating potential returns is possible but challenging due to the dynamic nature of financial markets. You can use historical data and current interest rates as a starting point for calculations. For instance, if you invest in a bond with a fixed interest rate, you can estimate the annual return by multiplying the interest rate by the investment amount. However, market conditions, economic factors, and individual investment performance can significantly impact actual returns. It's advisable to consult financial advisors for personalized estimates and to regularly review and adjust your investment strategy.