Interest rates can have a significant impact on investment spending and the economy as a whole. When interest rates are lowered, it becomes cheaper to borrow money, which can stimulate the economy by encouraging businesses to invest in projects and hire more employees. However, raising interest rates can also have benefits. For example, certain sectors, such as banks and insurance companies, tend to profit from higher interest rates as they can charge more for lending money. Additionally, interest rates can affect bond prices, with an inverse relationship between the two. As interest rates rise, bond prices fall, and vice versa. Therefore, understanding the impact of interest rates is crucial for investors when developing their investment strategies.

| Characteristics | Values |

|---|---|

| Interest rates affect the cost of borrowing | As interest rates increase, the cost of borrowing money increases |

| Interest rates affect how investments perform | As interest rates increase, the return on investment increases |

| Interest rates affect the stock market | As interest rates increase, some stocks will perform better than others |

| Interest rates affect bond prices | As interest rates increase, bond prices decrease |

| Interest rates affect the economy | As interest rates increase, the economy can be destabilised |

What You'll Learn

The financial industry benefits from higher interest rates

Interest rates can have a big impact on investments. When interest rates are low, businesses are incentivised to borrow money to invest in projects and hire more employees, which in turn increases consumer income and spending. However, when interest rates are high, some sectors benefit, including the financial industry. Banks, brokerages, mortgage companies, and insurance companies' earnings often increase as interest rates move higher because they can charge more for lending money.

Investing in a Low-Interest-Rate Environment: Strategies for Success

You may want to see also

Interest rates affect bond prices

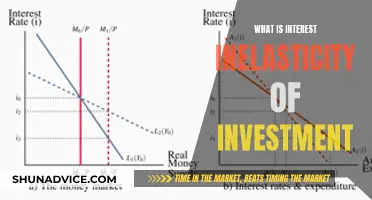

Interest rates can have a big impact on how investments perform. One way in which they do this is by affecting bond prices. There is an inverse relationship between bond prices and interest rates, meaning that as interest rates rise, bond prices fall, and as interest rates fall, bond prices rise.

This is because when interest rates are high, investors are incentivised to invest in stocks and shares, as they can expect to make more money from the interest on their investments. This means that they are less likely to invest in bonds, which drives down the price. Conversely, when interest rates are low, investors are more likely to invest in bonds, as they are a safer option that still offers a reasonable return. This increased demand drives up the price of bonds.

The financial industry tends to benefit the most from interest rate hikes. Banks, brokerages, mortgage companies, and insurance companies' earnings often increase as interest rates move higher because they can charge more for lending money.

However, it is important to note that interest rates are not the only factor that affects investment performance. When developing an investment strategy, investors should also consider other factors such as the health of the economy, the performance of specific sectors, and their own risk tolerance. By taking all of these factors into account, investors can make more informed decisions about where to allocate their capital.

Interest Rate Hike: Boon or Bane for Investors?

You may want to see also

Interest rates can stimulate the economy

Secondly, interest rates can affect the stock market. Some stocks will perform better than others as interest rates increase, with consumer staples like soap and cereal selling as usual, while luxury items like cars may see a decrease in sales.

Thirdly, interest rates can impact bond prices. There is an inverse relationship between bond prices and interest rates, meaning that as interest rates rise, bond prices fall, and vice versa.

Finally, interest rates can influence consumer behaviour. Lower interest rates can make it cheaper for consumers to borrow money, leading to increased borrowing and spending. This, in turn, can justify business expansion and contribute to economic growth.

Understanding Investment Interest Paid: A Guide to Your Finances

You may want to see also

Interest rates affect the cost of borrowing

On the other hand, when interest rates are high, banks, brokerages, mortgage companies and insurance companies can charge more for lending money, which increases their earnings.

Interest rates also affect bond prices. There is an inverse relationship between bond prices and interest rates, meaning that as interest rates rise, bond prices fall, and as interest rates fall, bond prices rise.

Interest rate fluctuations have a substantial effect on the stock market, inflation, and the economy as a whole.

Daily Compound Interest: A Guide to Investing and Earning More

You may want to see also

Interest rates can increase return on investment

However, when interest rates are high, some sectors benefit more than others. The financial industry, for example, tends to see increased earnings as interest rates rise because they can charge more for lending money. Banks, brokerages, mortgage companies, and insurance companies all fall into this category.

Interest rates also affect bond prices. There is an inverse relationship between the two: as interest rates rise, bond prices fall, and vice versa.

As an investor, it is important to consider interest rates when developing an investment strategy. Interest rates can affect the cost of borrowing and impact how investments perform. Taking interest rates into account can help increase the return on investment.

For example, when interest rates are low, consumers may borrow more and buy more, justifying business expansion. This can lead to increased investment spending and potentially higher returns for investors.

Foreign Investments: Interest Rates and Their Intricate Relationship

You may want to see also

Frequently asked questions

Interest rates can have a big impact on how investments perform. They affect the cost of borrowing, which can make investing in stocks seem too risky. However, some sectors benefit from interest rate hikes, such as the financial industry.

Lowering interest rates can stimulate the economy. The Fed can lower interest rates to make it cheaper to borrow money, which encourages businesses to invest in projects and hire more employees.

When prices are rising more quickly than the Fed’s target 2% annual rate of inflation, the spending power of consumers and businesses decreases, which in turn destabilizes the economy.

Interest rate fluctuations have a substantial effect on the stock market. Some stocks will do better than others as interest rates increase. For example, consumer staples like soap and cereal will still sell pretty much as usual, whereas luxury cars may not sell as well.