When a company purchases equity securities or invests in another company, there are three ways the investment can be reported: 1) Fair value option, 2) Equity method, and 3) Consolidation method. The fair value option is the alternative for a business to record its financial instruments at their fair values. GAAP allows this treatment for financial assets or financial liabilities, firm commitments that only involve financial instruments, and insurance or warranty contracts where the insurer can pay a third party to provide goods or services in settlement. The fair value option is elected when a company owns less than 20% of another company's outstanding shares and does not have significant influence over the company it is investing in.

What You'll Learn

Fair value option vs. equity method

When a company purchases equity securities or invests in another company, there are three ways the investment can be reported: the fair-value option, the equity method, and the consolidation method.

The fair-value option is the alternative for a business to record its financial instruments at their fair values. GAAP allows this treatment for the following items:

- A financial asset or financial liability

- A firm commitment that only involves financial instruments

- An insurance contract where the insurer can pay a third party to provide goods or services in settlement, and where the contract is not a financial instrument

- A warranty in which the warrantor can pay a third party to provide goods or services in settlement, and where the contract is not a financial instrument

The fair-value option cannot be applied to the following items:

- An investment in a subsidiary or variable interest entity that will be consolidated

- Deposit liabilities of depository institutions

- Financial assets or financial leases recognized under lease arrangements

- Financial instruments classified as an element of shareholders’ equity

- Obligations or assets related to pension plans, post-employment benefits, stock option plans, and other types of deferred compensation

The fair value option is used when ownership is less than 20% of the company’s outstanding shares and the investor does not have significant influence. When the fair value method is used, the company would classify the investment as “trading” or “available-for-sale”.

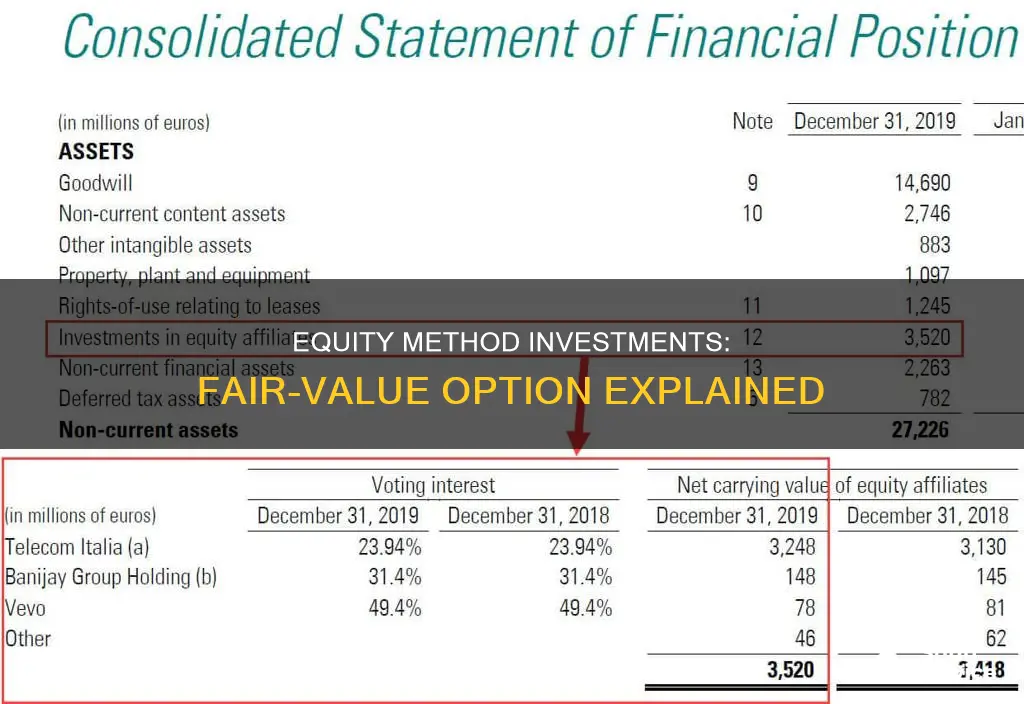

The equity method is an accounting technique used to record the profits earned by a company through its investment in another company. Under the equity method of accounting, the investor company reports the revenue earned by the other company on its income statement. This amount is proportional to the percentage of its equity investment in the other company. The equity method is generally used when a company holds significant influence over the company it is investing in.

The investment is initially recorded at historical cost, and adjustments are made to the value based on the investor’s percentage ownership in net income, loss, and dividend payouts. Net income of the investee company increases the investor’s asset value on their balance sheet, while the investee’s loss or dividend payout decreases it. The investor also records the percentage of the investee’s net income or loss on their income statement.

Savings or Investment Plans: Where Should Your Money Go?

You may want to see also

When to use the fair value option

When to use the fair-value option

The fair-value option is a method for a business to record its financial instruments at their fair values. This option is available for the following items:

- A financial asset or financial liability

- A firm commitment that only involves financial instruments

- An insurance contract where the insurer can pay a third party to provide goods or services in settlement, and where the contract is not a financial instrument (i.e., requires payment in goods or services)

- A warranty in which the warrantor can pay a third party to provide goods or services in settlement, and where the contract is not a financial instrument (i.e., requires payment in goods or services)

The fair-value option cannot be applied to the following items:

- An investment in a subsidiary or variable interest entity that will be consolidated

- Deposit liabilities of depository institutions

- Financial assets or financial leases recognized under lease arrangements

- Financial instruments classified as an element of shareholders’ equity

- Obligations or assets related to pension plans, post-employment benefits, stock option plans, and other types of deferred compensation

The fair-value option can be used when a company purchases equity securities or invests in another company and has ownership of less than 20% of the company's outstanding shares and the investor does not have significant influence. In this case, the company would classify the investment as "trading" or "available-for-sale".

The fair-value option can also be used when a company has ownership of 20% to 50% of the company's shares. In this case, the company has significant influence and can use the fair-value method or the equity method. The fair-value option may be preferable to avoid the complexity of the equity method.

The fair-value option can be elected when an investment becomes subject to the equity method of accounting for the first time, such as when an investor obtains significant influence by acquiring an additional investment in the company. The election of the fair-value option is irrevocable, so it is important to carefully consider when to use this option.

It is important to note that the fair-value option is not a requirement, and its election may result in reduced comparability of financial reporting. The fair-value option may be preferable in certain situations, such as when a company wants to present a more complete and accurate picture of its economic interest in another company.

Crafting an Investment Offer: A Guide to Writing Portfolio Proposals

You may want to see also

Reporting requirements

When a company purchases equity securities or invests in another company, there are three ways the investment can be reported: 1) Fair value option, 2) Equity method, and 3) Consolidation method.

The fair value method is used when ownership is less than 20% of the company's outstanding shares and the investor does not have significant influence. When the fair value method is used, the company would classify the investment as "trading" or "available-for-sale".

ASC 825 permits reporting entities to choose to elect the fair value option at specified election dates and measure eligible items at fair value. All entities may elect the fair value option for any of the following eligible items:

- A recognised financial asset and financial liability

- A firm commitment that only involves financial instruments

- An insurance contract where the insurer can pay a third party to provide goods or services in settlement, and where the contract is not a financial instrument

- A warranty in which the warrantor can pay a third party to provide goods or services in settlement, and where the contract is not a financial instrument

The fair value option cannot be applied to the following items:

- An investment in a subsidiary or variable interest entity that will be consolidated

- Deposit liabilities of depository institutions

- Financial assets or financial leases recognised under lease arrangements

- Financial instruments classified as an element of shareholders' equity

- Obligations or assets related to pension plans, post-employment benefits, stock option plans, and other types of deferred compensation

An investor electing to adopt the fair value option for any of its equity method investments is required to present those equity method investments at fair value at each reporting period, with changes in fair value reported in the income statement. In addition, certain disclosures are required in the investor's financial statements when it has elected the fair value option for an investment that otherwise would be accounted for under the equity method of accounting.

ASC 825-10 permits reporting entities to apply the FVO on an instrument-by-instrument basis. Therefore, a reporting entity can elect the FVO for certain instruments, but not others, within a group of similar instruments.

ASC 825-10-45-2 permits reporting entities to present the fair value and non-fair-value amounts:

- Aggregated in the same balance sheet line item (parenthetically disclosing the amount measured at fair value included in the aggregate amount), or

- In two separate line items

Securities for which the reporting entity elects the FVO are presented in the same category as other securities required to be measured at fair value, with changes in fair value recorded in income. If a reporting entity elects the FVO for one or more investments, it may use terminology such as "securities carried at fair value" in describing these securities, instead of the "trading" terminology in ASC 320.

ASC 825-10 does not include guidance on geography for items measured at fair value under the FVO, nor does it address how to present dividend income, interest income, or interest expense. However, for instruments within the scope of ASC 320-10, even if measured at fair value under the FVO, there is a prescribed method of calculating interest income that must be applied to those instruments. For all other instruments carried at fair value under the FVO for which GAAP does not prescribe a particular method of interest recognition, a reporting entity may apply one (or some variation) of the following models for reporting interest income and expense, and should disclose its policy for recognition.

- Present the entire change in fair value of the FVO item, including the component related to accrued interest, in a single line item in the income statement.

- Separate the interest income or expense from the full change in fair value of the FVO item and present that amount in interest income/expense. Present the remainder of the change in fair value in a separate line item in the income statement. Allocation of the change in fair value to interest income/expense should use an appropriate and acceptable method under GAAP.

Each presentation reflects the same net change in fair value, but the impact on individual line items in the income statement may differ significantly. When there is no method prescribed by other GAAP, reporting entities are encouraged to use the single line presentation because the total change in fair value is a more meaningful number.

FVO disclosures help financial statement readers understand the extent to which the reporting entity uses the FVO, management's reasons for electing the FVO, and how changes in fair values affect net income for the period.

Equity Investments: Current Assets or Not?

You may want to see also

Exemptions from the equity method

When a company purchases equity securities or invests in another company, there are three ways the investment can be reported: the fair value option, the equity method, and the consolidation method. The equity method is used when a company holds significant influence over the company it is investing in.

The equity method of accounting does not apply to certain investments as detailed in ASC 323. The guidance in this Topic does not apply to the following:

- An investment accounted for in accordance with Subtopic 815-10

- An investment in common stock held by a nonbusiness entity, such as an estate, trust, or individual

- An investment in common stock within the scope of Topic 810

- An investment held by an investment company within the scope of Topic 946

- Investments in limited liability companies (LLCs) that are required to be accounted for as debt securities

Nonbusiness entities, such as an estate, trust, or an individual, are not required to account for their investments in common stock under the equity method of accounting even if they are able to exercise significant influence over the financial and operating policies of the investee. This exemption recognises the diverse nature of nonbusiness entities and that the use of fair value or the measurement alternative may better present the financial position of such entities.

Real estate investment trusts (REITs) are considered to have business activities, typically by earning income through real estate loans and investments, and therefore do not qualify for the nonbusiness entity exception. As a result, investments held by REITs should be analysed to determine if the equity method of accounting should be applied.

An investment in common stock that represents a controlling financial interest should be consolidated pursuant to ASC 810, Consolidation. It would not be appropriate for a reporting entity preparing consolidated financial statements to account for an investment in common stock that represents a controlling financial interest under the equity method of accounting.

An investment held by an investment company, as defined in ASC 946, is required to be accounted for at fair value, except when an investment company has an investment in an operating entity that provides services to the investment company, such as investment advisory or transfer agent services. The purpose of this type of investment is to provide services to the investment company and not to realise a gain on the sale of the investment. These types of investments should be accounted for under the equity method of accounting, provided that the investment otherwise qualifies for its use.

An investor may have significant influence over the operating and financial policies of an investee, but if the investment does not qualify as common stock or in-substance common stock, the application of the equity method would not be appropriate. Per ASC 860-20, investments in LLCs that can be contractually prepaid or settled in a way that the investor would not recover substantially all of its recorded investment are accounted for as debt securities under ASC 320. These types of securities are outside the scope of the equity method.

Equity method investments are financial assets and are generally eligible for the fair value option under ASC 825-10. However, if the investor’s interest includes a significant compensatory element and no bifurcation of the compensatory element is required, the investor is precluded from electing the fair value option for its equity investment. For example, if an equity investment included a substantive obligation for the investor to provide services to the investee, the election of the fair value option would not be appropriate as it could result in the acceleration of revenue that should be earned when future services are provided to the investee.

The exemptions from applying the equity method differ between IFRS Accounting Standards and US GAAP. Exemptions from applying the equity method of accounting are available to a broader group of entities under US GAAP. Additionally, more entities may elect the fair value option for equity method investments under US GAAP.

Equity Method: What Investments Are Reported This Way?

You may want to see also

Differences between US GAAP and IFRS standards

When a company purchases equity securities or invests in another company, there are three ways the investment can be reported: the fair value method, the equity method, and the consolidation method. The fair value method is used when ownership is less than 20% of the company's outstanding shares and the investor does not have significant influence.

US GAAP and IFRS standards differ in their treatment of the fair-value option for reporting equity method investments. Here are some of the key differences:

- Local vs Global: IFRS is used in over 110 countries, including the EU and many Asian and South American countries. On the other hand, US GAAP is only used in the United States. Companies operating in the US and overseas may face more complex accounting procedures.

- Rules vs Principles: US GAAP tends to be more rules-based, while IFRS is more principles-based. US GAAP provides industry-specific rules and guidelines, whereas IFRS requires judgment and interpretation to determine how principles should be applied in specific situations.

- Inventory Methods: Both US GAAP and IFRS permit the First In, First Out (FIFO), weighted-average cost, and specific identification methods for valuing inventories. However, US GAAP also allows the Last In, First Out (LIFO) method, which is prohibited under IFRS. Using the LIFO method may result in lower net income that does not reflect the actual flow of inventory items.

- Inventory Write-Down Reversals: Both methods allow inventories to be written down to market value, but only IFRS permits the write-down to be reversed if the market value increases subsequently. Reversal of earlier write-downs is prohibited under US GAAP.

- Fair Value Revaluations: IFRS allows the revaluation of inventories, property, plant and equipment, intangible assets, and investments in marketable securities to fair value if it can be measured reliably. In contrast, US GAAP prohibits revaluation except for marketable securities.

- Impairment Losses: Both standards recognise impairment losses on long-lived assets when the market value declines. However, IFRS allows impairment losses to be reversed for all asset types except goodwill, whereas US GAAP takes a more conservative approach and does not allow reversals for any asset types.

- Intangible Assets: Under IFRS, internal costs to create intangible assets, such as development costs, can be capitalised if certain criteria are met, including future economic benefits. In contrast, US GAAP requires expensing development costs as they are incurred, except for internally developed software.

- Investment Property: IFRS includes a distinct category for investment property, defined as property held for rental income or capital appreciation. This category is not present in US GAAP.

- Lease Accounting: While there are similarities between the two methods, IFRS has a de minimis exception that allows lessees to exclude leases for low-valued assets. US GAAP does not have a similar exception. Additionally, the IFRS standard includes leases for some intangible assets, whereas US GAAP excludes leases of all intangible assets from the lease accounting standard.

- Treatment of Equity Method Investments: An entity using IFRS rules can classify equity method investments as "held for sale", which is not possible under US GAAP. This difference provides IFRS users with more flexibility in reporting their investments.

Trading Investments: Debt or Equity?

You may want to see also

Frequently asked questions

The fair-value option is a method for a business to record its financial instruments at their fair values. This option is available for equity method investments, which are investments in another company where the investor has significant influence (generally considered to be ownership of 20% or more of the company's stock). The fair-value option is one of three ways of reporting such investments, the other two being the equity method and the consolidation method.

The fair-value option is used when a company owns less than 20% of another company's outstanding shares and does not have significant influence. In this case, the investment is classified as "trading" or "available-for-sale".

The fair-value option provides a more complete and accurate picture of the economic interest that one company has in another. It allows for more consistent financial reporting over time and gives a clearer picture of how the investee's finances can impact the investor's.

When the fair-value option is elected, eligible items are measured at fair value on an instrument-by-instrument basis. This means that the company can elect the fair-value option for certain instruments, but not for others within a group of similar instruments. The fair value and non-fair-value amounts can be presented either aggregated in the same balance sheet line item or in two separate line items.

The fair-value option cannot be applied to certain items, such as investments in a subsidiary or variable interest entity that will be consolidated, deposit liabilities of depository institutions, and financial instruments classified as an element of shareholders' equity. Additionally, as the fair-value option is not a requirement, its use may result in reduced comparability of financial reporting.