Foreign Direct Investment (FDI) is a significant concept in international business and economics, referring to the investment made by a company or individual in a foreign country, often involving the acquisition of a lasting interest in a business enterprise in the host country. This investment can take various forms, such as establishing a new operation, acquiring an existing business, or merging with a local company. FDI is a crucial driver of economic growth, technology transfer, and job creation, as it brings capital, expertise, and management practices from one country to another, fostering development and competition in the host nation's economy. Understanding the definition and implications of FDI is essential for policymakers, investors, and researchers to analyze global economic trends and make informed decisions regarding international trade and investment strategies.

What You'll Learn

- Foreign Direct Investment (FDI) is an investment involving a long-term relationship between an investor and an enterprise

- FDI involves the acquisition of a lasting interest in an enterprise operating in another country

- It is a capital outflow from one country and a capital inflow into another

- FDI can take the form of equity capital, reinvested earnings, or intra-company loans

- The definition includes cross-border mergers, acquisitions, and greenfield investments

Foreign Direct Investment (FDI) is an investment involving a long-term relationship between an investor and an enterprise

Foreign Direct Investment (FDI) is a significant concept in international business and economics, representing a powerful tool for economic growth and development. It involves a long-term, substantial financial commitment by an investor to an enterprise in a different country, often with the aim of establishing a lasting business relationship. This type of investment is distinct from portfolio investments, which are typically short-term and involve buying and selling shares or securities without a direct involvement in the management of the enterprise.

The key aspect of FDI is the investor's intention to create a lasting connection with the host country's business environment. This can be achieved through various means, such as establishing a new subsidiary or acquiring an existing business in the target country. For instance, an investor might set up a manufacturing plant in a foreign market to produce goods for the local market or for export back to their home country. Alternatively, they could purchase a local enterprise to gain a foothold in a new market, often with the goal of expanding their global operations.

FDI is a critical driver of economic development, as it brings capital, technology, and expertise to the host country. It can lead to job creation, infrastructure development, and the transfer of skills and knowledge. The long-term relationship fostered by FDI can also encourage the development of local suppliers and business partners, contributing to the overall growth of the host country's economy. This is particularly important in developing nations, where FDI can play a vital role in poverty reduction and the improvement of living standards.

The definition of FDI emphasizes the importance of the investor's involvement in the management and operations of the enterprise. This is in contrast to portfolio investments, where the investor's role is more passive and focused on financial returns. FDI often involves the transfer of management practices, business strategies, and sometimes even corporate culture, as the investor integrates their operations into the host country's business environment.

In summary, Foreign Direct Investment is a powerful economic tool that fosters long-term relationships between investors and host countries. It involves substantial financial commitments and a direct involvement in the management of enterprises, leading to economic growth, job creation, and the transfer of valuable assets and knowledge. Understanding FDI is essential for businesses and policymakers alike, as it shapes international trade and investment strategies.

Cashing Out Investments: When and How to Do It

You may want to see also

FDI involves the acquisition of a lasting interest in an enterprise operating in another country

Foreign Direct Investment (FDI) is a significant concept in international business and economics, representing a powerful tool for global economic integration. It involves a substantial and enduring financial commitment by an investor in a foreign country, typically through the acquisition of a substantial stake in a local enterprise. This investment is not merely a short-term venture but rather a long-term strategic move, often aimed at establishing a solid presence and influence in the host country's market.

The key aspect of FDI is the acquisition of a lasting interest in a foreign enterprise. This interest can take various forms, such as purchasing a significant share of the company's stock, acquiring a controlling stake, or even taking over the entire business. The investor's goal is to gain a substantial and enduring position that allows them to exert influence over the management and operations of the foreign company. This interest is not just a financial transaction but a strategic move to establish a long-term relationship with the host country's business environment.

FDI is a powerful catalyst for economic growth and development. When a foreign investor acquires a lasting interest in a local enterprise, it brings several benefits to the host country. Firstly, it introduces capital and technology, which can be crucial for the development of local industries. The investor often brings advanced management practices and expertise, contributing to the modernization and efficiency of the host country's businesses. This can lead to improved productivity, enhanced competitiveness, and the creation of new job opportunities.

Secondly, FDI fosters economic cooperation and integration. It encourages the exchange of goods, services, and ideas between countries, promoting a more interconnected global economy. The investor's presence in the host country can lead to increased trade and investment flows, creating a mutually beneficial relationship. Over time, this can result in the transfer of knowledge, skills, and best practices, benefiting both the host country and the investor's home nation.

Furthermore, FDI has the potential to address specific economic challenges. For developing countries, it can provide much-needed capital for infrastructure development, industrialization, and poverty reduction. The influx of foreign investment can stimulate local economies, attract additional capital, and create a positive feedback loop for further growth. In contrast, for developed countries, FDI can help diversify their economies, access new markets, and maintain a competitive edge in a globalized world.

In summary, FDI is a powerful economic tool that involves acquiring a lasting interest in a foreign enterprise. It brings capital, technology, and expertise to the host country, fostering economic growth, cooperation, and integration. The impact of FDI can be far-reaching, influencing not only the host country's economy but also contributing to the global economic landscape. Understanding and embracing FDI can be a strategic move for nations aiming to enhance their economic standing and promote international trade.

Where Should Your Cash Live: CDs or Investments?

You may want to see also

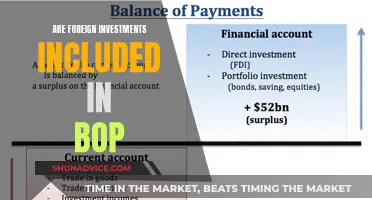

It is a capital outflow from one country and a capital inflow into another

Foreign direct investment (FDI) is a significant concept in international finance and trade, representing a crucial flow of capital across borders. It occurs when an investor from one country makes a substantial investment in a business or asset in another country, gaining a lasting interest in the recipient country's company. This investment can take various forms, such as acquiring a controlling stake in a foreign enterprise, establishing a new venture, or merging with an existing local company.

The process begins with a capital outflow from the investor's home country. This outflow can be substantial, as it involves the transfer of financial resources, often in the form of equity, debt, or other financial instruments. The investor may be an individual, a corporation, or even a government entity, and their decision to invest abroad is driven by various factors, including market opportunities, resource acquisition, or strategic expansion.

Simultaneously, FDI results in a capital inflow into the recipient country. This inflow is essential for the recipient nation's economic growth and development. It brings foreign capital, which can be utilized for various purposes, such as funding business ventures, expanding infrastructure, or supporting local industries. The recipient country benefits from increased investment, which can lead to job creation, technological transfer, and improved productivity.

The key aspect of FDI is the establishment of a long-term relationship between the investor and the host country. Unlike portfolio investments, which are typically short-term and involve buying and selling securities, FDI is a more permanent engagement. It often involves the transfer of knowledge, technology, and management practices, contributing to the recipient country's economic development and modernization.

In summary, foreign direct investment is a critical mechanism for international capital flow, facilitating economic growth and development on a global scale. It involves a strategic decision by investors to allocate capital across borders, creating a lasting impact on the recipient country's economy and fostering international economic cooperation. Understanding FDI is essential for policymakers, businesses, and investors alike, as it shapes global economic dynamics and influences the prosperity of nations.

Sharpe Ratio: Smart Investment Decision-Making Tool

You may want to see also

FDI can take the form of equity capital, reinvested earnings, or intra-company loans

Foreign Direct Investment (FDI) is a significant concept in international business and economics, representing a crucial aspect of global capital flows. It occurs when an investor based in one country makes an investment in a business or asset located in another country, with the primary goal of establishing a lasting interest in the host country's economy. This investment can take various forms, each contributing to the expansion of international trade and economic integration.

One of the primary ways FDI manifests is through equity capital. This involves an investor acquiring a stake in a foreign company, typically by purchasing shares or ownership in the business. By doing so, the investor gains a direct involvement in the company's operations and decision-making processes. Equity capital FDI can range from small-scale investments in local startups to large-scale acquisitions of multinational corporations, often leading to the establishment of foreign subsidiaries or branches.

Reinvested earnings are another critical aspect of FDI. When a multinational corporation generates profits in a foreign market, it can choose to reinvest these earnings into the same or another related business in the host country. This practice allows companies to expand their operations, fund research and development, or acquire additional assets in the foreign market. Reinvested earnings contribute to the growth of local businesses and can stimulate economic development in the host country.

Intra-company loans also play a vital role in FDI. These are loans provided by a parent company to its foreign subsidiary or affiliate. Intra-company loans can be used to finance various activities, such as working capital, project development, or the acquisition of assets. This form of FDI facilitates the transfer of funds and resources between parent companies and their foreign operations, enabling efficient management of cash flows and supporting the overall growth strategy of the multinational enterprise.

In summary, FDI encompasses a range of investment activities, including equity capital, reinvested earnings, and intra-company loans. Each of these forms contributes to the global flow of capital and the establishment of international business relationships. Understanding these different facets of FDI is essential for analyzing the economic impact of foreign investments and their role in fostering international trade and development.

Cash Investment Qualifications: Understanding the Basics

You may want to see also

The definition includes cross-border mergers, acquisitions, and greenfield investments

Foreign Direct Investment (FDI) is a significant concept in international business and economics, representing a crucial aspect of global economic integration. The definition of FDI encompasses various activities that involve an investment made by a resident entity in one country into business interests located in another country. This definition is crucial to understanding the flow of capital and the establishment of international business relationships.

One key element of this definition is the involvement of cross-border transactions. FDI involves the investment of capital across international borders, which can take several forms. These include cross-border mergers, where a company in one country acquires a controlling interest in a company in another country, effectively integrating the two businesses. This process can lead to the expansion of a company's global presence and the consolidation of its market position.

Another critical aspect is the acquisition of assets or businesses in a foreign country. This can involve purchasing existing companies, assets, or even taking control of a company's operations in a new market. Such acquisitions can provide immediate access to new markets, resources, or expertise, allowing companies to rapidly expand their international footprint.

Greenfield investments are also a significant part of the FDI definition. This term refers to the establishment of new operations or facilities in a foreign country. It involves creating a new business entity or venture from the ground up, often with the aim of entering a new market or expanding into an existing one. Greenfield investments can take the form of building new factories, offices, or other infrastructure, and they play a vital role in fostering economic growth and development in the host country.

In summary, the definition of Foreign Direct Investment includes cross-border mergers, acquisitions, and greenfield investments. These activities facilitate the flow of capital, technology, and expertise across international borders, driving economic growth and fostering international business relationships. Understanding these components is essential for businesses and policymakers alike, as it provides insights into the dynamics of global investment and the potential for economic development.

Intraday Trading Strategies Using Investing.com's Features

You may want to see also

Frequently asked questions

Foreign direct investment (FDI) is a type of investment where a person or company from one country makes a significant equity investment in a business or asset in another country. It involves acquiring a lasting interest in a foreign enterprise, which can be an established business or a new venture. FDI is a crucial aspect of international business and plays a significant role in the global economy.

FDI is distinct from portfolio investment, where investors buy and sell financial assets like stocks or bonds without establishing a lasting business relationship. In FDI, the investor seeks to gain a degree of control or influence over the management and operations of the target company. This can be achieved through various means, such as acquiring a significant shareholding, forming a joint venture, or merging with a local company. FDI often involves a more substantial and long-term commitment compared to other investment types.

FDI is characterized by several key features: it involves a substantial financial commitment, often in the form of capital inflows into the host country; it creates a lasting interest or control in the foreign enterprise; and it can take various forms, including greenfield investments (establishing a new operation in a foreign market), mergers and acquisitions (acquiring an existing business), and joint ventures (a collaboration between companies from different countries). FDI is a strategic decision that aims to establish a long-term presence and gain a competitive advantage in the foreign market.