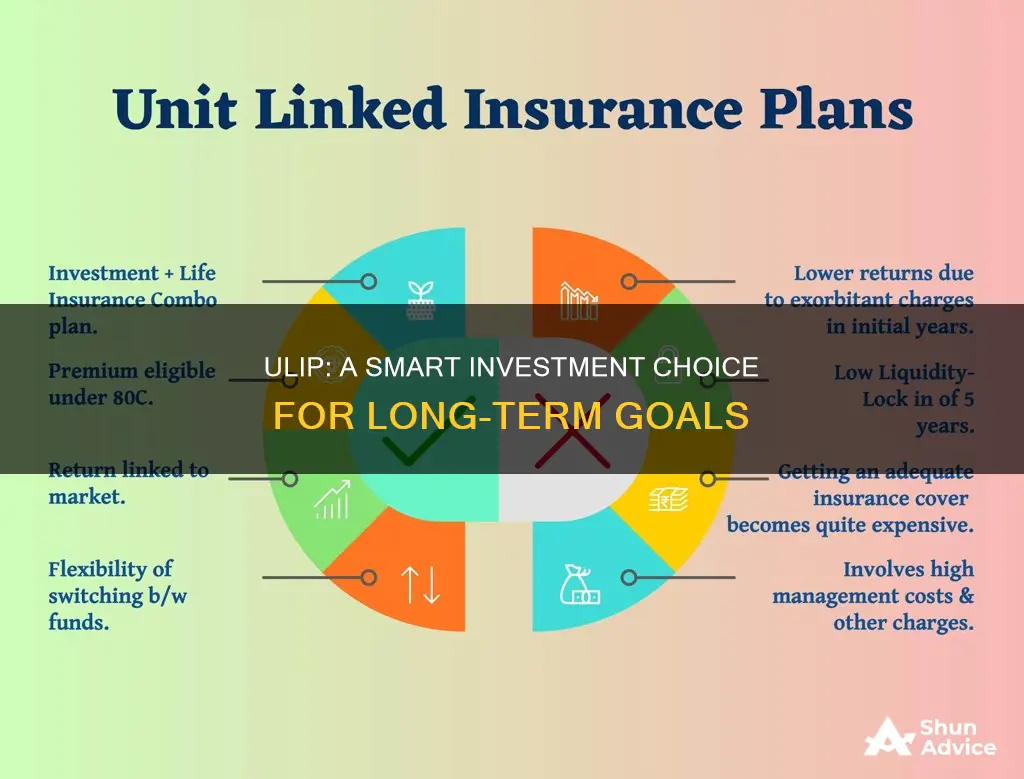

Unit-Linked Insurance Plans (ULIPs) are a type of insurance policy that combines investment and insurance features. ULIPs are a good option for those seeking a combination of investment and insurance benefits. They offer tax benefits, flexible withdrawals, and long-term growth but come with high costs, market risks, and lock-in periods. Here are some reasons why you should invest in ULIPs:

- ULIPs offer the dual benefits of insurance and investment, allowing you to participate in the stock market's potential upside while also providing life insurance coverage.

- ULIPs provide flexibility in investment choices, allowing you to choose from equity, debt, or balanced funds based on your risk appetite.

- ULIPs have the potential to give higher returns as they invest in equity, debt, or a combination of both.

- ULIPs offer tax benefits under Section 80C of the Income Tax Act, 1961, helping you reduce your tax liability.

- ULIPs have a lock-in period, which helps in disciplined investing and compounding of money.

- ULIPs support long-term financial goals and can be ideal for first-time investors due to their flexibility and reduced risks.

| Characteristics | Values |

|---|---|

| Tax benefits | Premiums are tax-deductible, death payments are tax-free, and returns are not taxed |

| Long-term financial investment | Ideal for long-term objectives as short-term market volatility provides lower returns |

| Withdrawals in parts | After the lock-in period, withdrawals of up to 20% of the fund value are allowed without taxation |

| Encourages goal-based savings | Supports disciplined investing to help achieve important financial objectives |

| Deductions on top-ups | Top-up premiums qualify for income tax deductions, lowering your tax burden |

| Premium redirection | Future premiums can be redirected to a different fund to align with goals and market opportunities |

| First-time investors | ULIPs are a good choice for new investors due to their market-linked nature and low costs |

| Dual advantage | ULIPs offer life cover and tax advantages, unlike term insurance plans |

| Transparency | All expenses are clearly stated upfront |

What You'll Learn

Maximise your returns

Unit-Linked Insurance Plans (ULIPs) are a great way to maximise your returns. ULIPs offer a unique blend of insurance and investment, allowing you to achieve multiple financial goals with a single product. Here are some ways ULIPs can help you maximise your returns:

Flexibility to choose from various investment options:

ULIPs offer a range of investment options, including equity funds, debt funds, and balanced funds. You can choose the option that best suits your risk appetite and financial goals. Equity funds are ideal for those seeking higher returns and willing to take on more risk, while debt funds are better for risk-averse investors. Balanced funds offer a mix of equity and debt, providing a balance between risk and return.

Potential for higher returns:

ULIPs have the potential to generate higher returns compared to other insurance policies and savings schemes. By investing in equity, debt, or a combination of both, ULIPs can provide market-linked returns. The performance of the equity market during the policy tenure significantly influences the maturity amount. Additionally, experienced fund managers handle ULIP investments, further enhancing the potential for higher returns.

Flexibility to switch between funds:

ULIPs offer the flexibility to switch between different funds without incurring charges, allowing you to adapt your investment strategy based on market conditions and your financial goals. This feature, known as fund switching or fund rebalancing, helps you optimise your returns by allocating your investments across different asset classes.

Long-term growth:

ULIPs are ideal for long-term financial goals as they provide the benefit of long-term growth. By investing in ULIPs, you can pay premiums over a more extended period and benefit from investing in the market for a longer tenure. The accumulated amount can then be used to meet significant financial goals, such as your children's education, buying a home, or planning for retirement.

Tax benefits:

ULIPs offer tax benefits that can help maximise your returns. The premiums paid towards ULIPs are eligible for tax deductions under Section 80C of the Income Tax Act, 1961. Additionally, the maturity proceeds and death benefits are tax-free under Section 10(10D) of the Act. This triple tax exemption (EEE-Exempt-Exempt-Exempt) helps you maximise your returns by reducing your tax liability.

Life cover:

ULIPs provide life insurance coverage, ensuring that your family is financially secure even in your absence. In the unfortunate event of the policyholder's death, the sum assured can be used by the beneficiaries to meet their financial obligations, such as daily expenses, loan repayments, or maintaining their lifestyle. This life cover adds a layer of protection to your investment, providing peace of mind.

In conclusion, ULIPs offer a range of features that can help you maximise your returns, including investment options, potential for higher returns, fund switching, long-term growth, tax benefits, and life cover. However, it is essential to carefully consider your financial goals, risk appetite, and investment horizon before investing in ULIPs to make an informed decision.

Agricultural Commodities: A Guide to Investing in India's Bounty

You may want to see also

Enjoy life cover

Unit-Linked Insurance Plans (ULIPs) are a great way to ensure that your family is financially secure even in your absence. ULIPs offer life cover, which means that your beneficiaries will receive a sum assured amount in the unfortunate event of your death. This can help them meet their financial obligations, such as daily expenses, loan repayments, or maintaining their lifestyle.

The life cover benefit of ULIPs provides peace of mind and ensures that your loved ones are taken care of even when you're not there to provide for them. This financial security can be especially important if you are the primary breadwinner in your family or have dependents who rely on your income.

In addition to the life cover, ULIPs also offer investment opportunities. A portion of the premium you pay goes towards providing life insurance coverage, while the remaining amount is invested in a variety of asset classes such as equity, debt, or balanced funds. This means that you can grow your wealth over time while also having the assurance of life insurance protection.

The investment options within ULIPs offer flexibility, allowing you to choose between different types of funds based on your risk appetite and financial goals. You can invest in equity funds if you're willing to take on more risk for potentially higher returns, or you can opt for balanced or debt funds if you prefer a more conservative approach.

ULIPs also provide tax benefits, which can further enhance the attractiveness of these plans. The premiums you pay are tax-deductible under Section 80C of the Income Tax Act, 1961, and the death benefit paid under these schemes is completely tax-free. This means that you can reduce your tax liability while also providing financial security for your loved ones.

Overall, the life cover benefit of ULIPs is a significant advantage, offering financial protection and peace of mind for you and your family. By investing in ULIPs, you can ensure that your loved ones will be taken care of, no matter what happens. This makes ULIPs a wise choice for those seeking to combine investment opportunities with life insurance coverage.

Investment Management: What You Need to Study and Know

You may want to see also

Benefit from long-term growth

One of the greatest advantages of investing in a ULIP is its long-term benefits. You may pay premiums for a greater time horizon and enjoy the benefit of long-term growth by investing in the market for a longer tenure to receive higher returns. The accumulated amount may be used to meet specific goals such as your children’s educational expenses, down payment for a home loan, or retirement planning.

ULIPs are ideal for consumers who want to put money down for a long-term objective since short-term market volatility provides lower returns. Still, long-term market investments produce handsome returns.

ULIPs have the potential to give higher returns as they invest in equity, debt, or a combination of both. The equity-oriented ULIPs have the potential to give higher returns compared to debt-oriented ULIPs. However, this is dependent on several factors, such as the performance of the investment portfolio and your investment horizon.

ULIPs are a good choice for those who want to start young and take advantage of the equity advantage over time. They are ideal for long-term goals. They thrive on market volatility and generate tax-free income, but short-term gains might be lower.

ULIPs can be a complex financial product, and it is important to understand them fully before investing. Here are some key considerations:

- ULIPs typically have high initial charges (front-load) that can eat into your investment significantly in the early years.

- Most ULIPs come with a lock-in period of 5-6 years, during which you cannot withdraw your money without facing surrender charges.

- ULIPs may have lower returns in the short term as you are still getting used to the market and may miss out on potential opportunities for gains.

- ULIPs often require active monitoring and switching between funds to optimize returns, which can be time-consuming and may not suit everyone.

Investing in New York's 529: A College Savings Guide

You may want to see also

Avail of tax benefits

ULIPs offer tax benefits, allowing investors to claim a tax deduction of up to ₹1.5 lakh annually under Section 80C of the Income Tax Act, provided the premium does not exceed 10% of the total insured amount. The premiums paid are tax-deductible, and the death benefit payments received are also tax-free. ULIPs offer a triple E-E-E (Exempt-Exempt-Exempt) tax benefit, allowing tax deductions on premiums paid, tax-free withdrawals with accumulated returns, and tax exemption on ULIP returns or sum assured.

ULIPs are also beneficial for long-term growth, as investors can pay premiums for a more extended period and benefit from long-term market investments, which produce higher returns. The accumulated amount can be used to meet specific long-term financial goals, such as education expenses, a down payment on a home loan, or retirement planning.

ULIPs also offer tax advantages over other investment options. For example, tax-saving fixed deposits (FDs) have a lock-in period of five years, but the returns are added to your income and taxed accordingly. In contrast, ULIPs provide tax-free maturity proceeds. Additionally, ULIPs allow investors to switch between equity and debt funds without any tax implications, a significant advantage over other investment options.

The lock-in period of five years for ULIPs is also essential for availing of the tax benefits associated with this investment. During this lock-in period, investors can switch between different investment options offered by the ULIP plan without incurring any charges, allowing them to adapt their investment strategy based on market conditions and their goals.

Saving and Investing: Economy's Growth Engine

You may want to see also

Gain flexibility

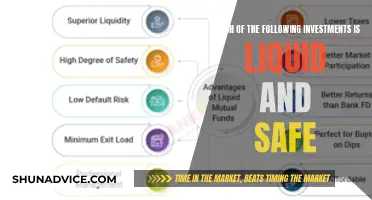

One of the most significant advantages of investing in ULIPs is the flexibility they offer. Here are some ways in which ULIPs provide flexibility:

Fund Switching

ULIPs allow investors to switch between different funds without incurring any charges. This enables investors to adjust their investment ratio in equity, hybrid, or debt funds based on their risk profile and the performance of various ULIP plan funds. This feature provides investors with the flexibility to adapt their investment strategy and manage their exposure to different asset classes.

Various Investment Options

ULIPs offer a wide range of investment options, including equity, debt, and balanced funds. Investors can choose the investment scheme that aligns with their investment goals, risk appetite, and financial circumstances. This flexibility ensures that ULIPs cater to a diverse range of investors with varying needs and risk tolerances.

Premium Redirection

ULIPs offer the benefit of premium redirection, allowing investors to redirect future premiums to different funds. This feature ensures that your investment stays aligned with your financial goals and market opportunities. By adjusting the allocation of future premiums, you can protect your portfolio from risks while maximizing potential gains.

Top-up Options

ULIPs provide the flexibility to increase your investment amount through top-up facilities. You can invest extra money in your existing ULIP policy if the fund is performing well. This allows you to take advantage of the growth of your ULIP investment fund and accelerate your wealth creation.

Partial Withdrawals

After the lock-in period, ULIPs offer the flexibility of partial withdrawals. Policyholders can withdraw up to 20% of the fund value without incurring any taxes or penalties. This feature provides liquidity and allows investors to access their funds for immediate requirements while continuing to grow their investment.

Retirement Investments: Strategies for Effective Money Management

You may want to see also