Unrestricted cash is a term used in business and accounting to refer to money that is readily available to be spent by a company for any purpose. It is not tied to a particular use within or outside a business entity and is not held in reserve. Unrestricted cash is a part of an organisation's liquid funds, which also include short-term investments and cash equivalents. It is important because it shows how much cash a company has to meet its short-term bills and credit obligations. Unrestricted cash is listed as a current asset on a company's balance sheet.

Characteristics of Unrestricted Cash and Investments

| Characteristics | Values |

|---|---|

| Definition | Unrestricted cash refers to cash that is readily available to be spent for any purpose and has not been pledged as collateral for a debt obligation or other purpose. |

| Purpose | Unrestricted cash is not tied to a particular use within or outside the business entity. |

| Nature | Unrestricted cash is extremely liquid and can be used readily for any purpose when required. |

| Importance | Unrestricted cash is important since it shows how much cash a company has to meet its short-term bills and credit obligations. |

| Accounting | Unrestricted cash is listed as a current asset on the balance sheet since it can be used to satisfy short-term obligations or current liabilities. |

| Comparison with Restricted Cash | Restricted cash refers to cash that is held by a company for specific reasons and is, therefore, not available for immediate ordinary business use. |

What You'll Learn

- Unrestricted cash is readily available to be spent for any purpose

- It is not tied to a particular use within or outside the business entity

- It is not held in reserve accounts or legally restricted

- It is not pledged as collateral for a debt obligation

- It is listed as a current asset on a company's balance sheet

Unrestricted cash is readily available to be spent for any purpose

Unrestricted cash is a term used in business and accounting to describe funds that are readily available to be spent for any purpose. It is cash that is not tied to a particular use within or outside a business entity and is not held in reserve. Unrestricted cash is an essential part of an organisation's liquid funds and is considered highly liquid. This means that it can be easily converted into other assets or used to meet short-term financial obligations.

Unrestricted cash is important for businesses to meet their short-term financial obligations, such as paying bills and credit obligations. It is also necessary to ensure that a company has enough working capital, which is the difference between its current assets and current liabilities. In other words, unrestricted cash is money that a company can spend today.

Unrestricted cash is often listed on a company's balance sheet as "cash and cash equivalents". This means that it includes not only physical currency but also short-term investments that can be easily converted into cash, such as certificates of deposit or U.S. Treasury bills. Unrestricted cash is considered a current asset on the balance sheet, indicating that it can be readily accessed and spent in the short term.

The availability of unrestricted cash is important for a company's financial health and stability. It allows companies to meet their short-term debt obligations, pay their vendors and suppliers, and cover their operating expenses. Unrestricted cash also provides flexibility for businesses to take advantage of new opportunities or respond to unexpected challenges.

It is worth noting that unrestricted cash is different from restricted cash. Restricted cash refers to funds that are held by a company for specific reasons and are not available for immediate ordinary business use. Reasons for cash restrictions include bank loan requirements, payment deposits, and collateral pledges. Restricted cash is typically listed separately on a company's balance sheet, along with an explanation of the restrictions.

Cash or Invest: Where Should Your Money Go?

You may want to see also

It is not tied to a particular use within or outside the business entity

Unrestricted cash is cash that is not tied to a particular use within or outside a business entity. It is not restricted to any specific purpose and can be used for sudden monetary requirements. Unrestricted cash is an essential part of a business entity's liquid funds. It is considered a current asset, as it can be readily accessed and spent in the short term.

Unrestricted cash is important for a business entity as it helps satisfy debt covenants. Most businesses need to maintain and demonstrate a stable amount of financial reserves on their balance sheets. Unrestricted cash is any amount that exceeds the requirements of the business entity. It is readily available to the entity when needed and can be easily liquefied.

Unrestricted cash is not pledged as collateral for a debt obligation or any other purpose. It is not held aside to secure a bank loan or credit facility. Instead, it is an instant reservoir of cash that can be used for any purpose when required. This makes it a valuable resource for businesses to meet their short-term financial obligations.

Unrestricted cash is often listed as "cash and cash equivalents" on a company's balance sheet. It represents the money that an organisation can spend today and is, therefore, highly liquid. Unrestricted cash includes currency notes, coins, and all cash held in a bank account, such as a demand deposit or savings account. It also includes short-term investments that can be easily converted into cash, such as certificates of deposit or certain marketable securities.

In summary, unrestricted cash is not tied to a particular use within or outside a business entity. It is a vital part of a company's liquid funds, providing flexibility and the ability to meet short-term financial commitments. Unrestricted cash is listed on the balance sheet and includes various forms of easily accessible cash and short-term investments.

Is Paying for Ads with Cash an Investment?

You may want to see also

It is not held in reserve accounts or legally restricted

Unrestricted cash is cash that is not held in reserve accounts or legally restricted. It is cash that is readily available to be spent by a company for any purpose and is not tied to a particular use within or outside the business entity. It is not pledged as collateral for a debt obligation or other purposes and is not held aside to secure a bank loan or credit facility.

Unrestricted cash is an essential part of an organisation's liquid funds. It is highly liquid and can be used to meet short-term debt obligations, pay vendors and suppliers, and cover current liabilities. It is considered a current asset on a company's balance sheet as it can be readily accessed and spent in the short term.

The unrestricted cash amount is calculated by taking the total cash and cash equivalents of a company and its subsidiaries and subtracting any amounts that are subject to pledges, liens, or control agreements. It is important to note that unrestricted cash does not include accounts payable and investments, which are not considered cash equivalents.

Unrestricted cash is crucial for a company's financial health as it provides flexibility and the ability to meet short-term financial obligations. It is also a key indicator of a company's liquidity position and overall financial health.

Cash App Investing: Smart Move or Risky Gamble?

You may want to see also

It is not pledged as collateral for a debt obligation

Unrestricted cash is cash that is readily available to be spent for any purpose and has not been pledged as collateral for a debt obligation or other purpose. It is not tied to a particular use within or outside the business entity and is considered a liquid asset.

Unrestricted cash is an essential part of an organisation's liquid fund. It is important because it shows how much cash a company has to meet its short-term bills and credit obligations. It is also crucial for companies to have enough cash available to meet their short-term debt obligations and pay their vendors and suppliers.

Cash that is not unrestricted may be required to be held aside to secure a bank loan or credit facility. This is known as restricted cash, which is not readily available to be spent or used by the company. Restricted cash is typically listed as a separate line item on the balance sheet, with an explanation of why the cash is restricted found in the notes section of a company's financial statements.

Unrestricted cash, on the other hand, is listed as a current asset on the balance sheet and can be used for any purpose since it has not been pledged to secure an obligation.

The True Cost of Cashing in Your Investments

You may want to see also

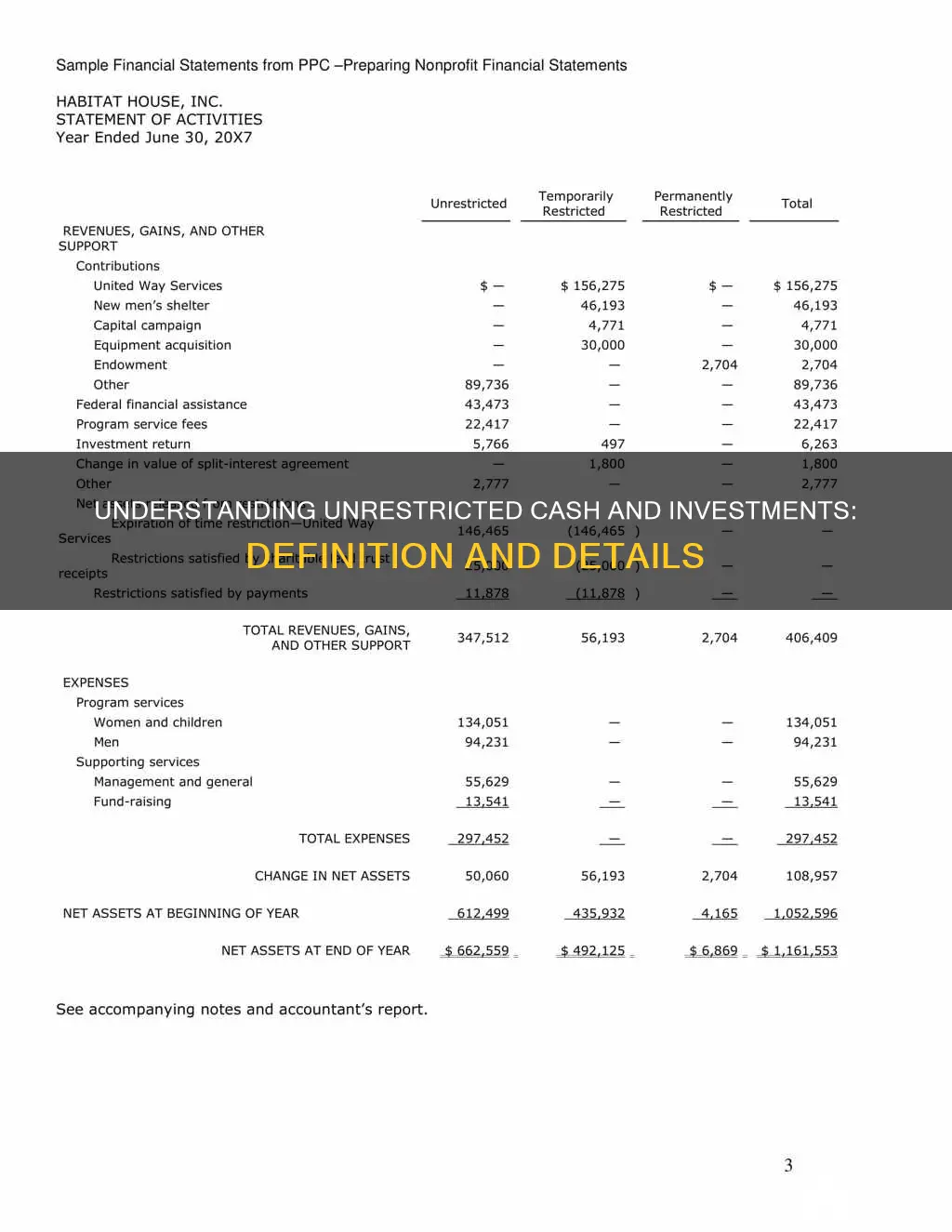

It is listed as a current asset on a company's balance sheet

Unrestricted cash is cash that is readily available to be spent for any purpose and has not been pledged as collateral for a debt obligation or other purpose. It is an essential part of a company's liquid funds, which also include cash, short-term investments, cash equivalents, unrestricted short-term investments, and the short-term borrowing capacity of a business entity. Unrestricted cash is significant because it helps companies meet their short-term debt obligations, pay their vendors and suppliers, and cover their current liabilities, also known as working capital.

Unrestricted cash is listed as a current asset on a company's balance sheet. Current assets are those that can be converted to cash within one year and are considered highly liquid. They are placed in the current section of the balance sheet, separate from illiquid or non-current assets. Current assets are vital as they demonstrate a company's short-term liquidity and ability to pay off its short-term obligations.

The balance sheet is one of the three fundamental financial statements and is key to financial modelling and accounting. It displays the company's total assets and how they are financed, either through debt or equity. The balance sheet is divided into two sides, with the left side outlining all of a company's assets and the right side outlining its liabilities and shareholders' equity.

Current assets are listed under the Assets section of the balance sheet and include unrestricted cash, cash equivalents, accounts receivable, stock inventory, marketable securities, prepaid liabilities, and other liquid assets. These assets are typically displayed in order of liquidity, with the most liquid assets ranked higher. Unrestricted cash is considered a current asset because it can be readily accessed and spent in the short term.

The unrestricted cash amount listed on the balance sheet is important for investors as it provides insight into the company's financial strength and ability to meet its short-term obligations. It also helps determine the company's liquidity, which is a critical metric for assessing its financial health and risk of default.

Commercial Paper: Investing or Cash Flow?

You may want to see also

Frequently asked questions

Unrestricted cash is cash that can be used for any purpose and is not tied to a particular use within or outside a business entity. It is an essential part of an organisation's liquid funds.

Restricted cash is cash that is held by a company for specific reasons and is, therefore, not available for immediate use. It is commonly associated with bank loan requirements, payment deposits, and collateral pledges.

Unrestricted cash is important as it helps a company meet its short-term debt obligations, pay vendors and suppliers, and cover its short-term bills and credit obligations.

Unrestricted cash is listed as a current asset on the balance sheet as it can be used to satisfy short-term obligations or current liabilities. It is readily available and can be easily accessed and spent in the short term.

Currency notes, coins, and cash held in a bank account, such as a demand deposit or savings account, are all examples of unrestricted cash.