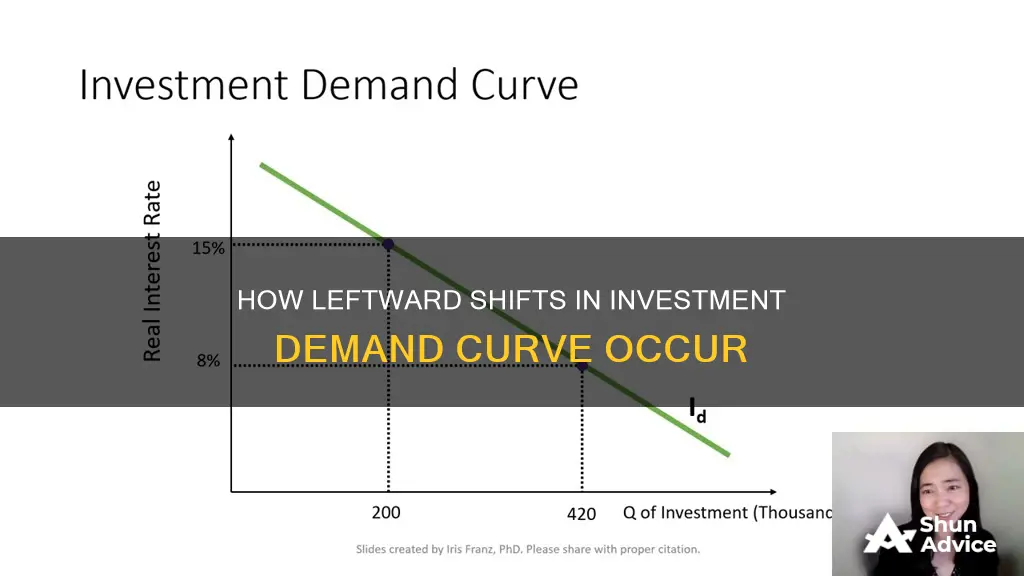

The investment demand curve illustrates the relationship between interest rates and investment, with interest rates on the vertical axis and investment demand on the horizontal axis. A shift in the demand curve occurs when a determinant of demand other than price changes. In the case of the investment demand curve, a shift to the left indicates a decrease in demand at the same price, which can be caused by several factors. For example, an increase in business taxes will reduce the expected profits of firms after taxes, leading to a decrease in investment demand. Similarly, if firms have a lot of unused inventories, they are less likely to invest in new projects, resulting in a leftward shift of the curve. Expectations about future sales and profitability also play a crucial role in shifting the investment demand curve. During a recession, when buyers' incomes drop, the demand curve shifts to the left as consumers buy less even though the price remains unchanged.

| Characteristics | Values |

|---|---|

| Determinants of Investment other than Interest Rates | Expectations, the level of economic activity, the stock of capital, capacity utilisation, the cost of capital goods, other factor costs, technological change, and public policy |

| Business taxes | Decrease in taxes leads to a right shift in the demand curve |

| Expected return on capital | Increase in expected return leads to a right shift in the demand curve |

| Unused production capacity | High unused capacity leads to a left shift in the demand curve |

| Planned inventory changes | Firms planning to increase inventories leads to a right shift in the demand curve |

What You'll Learn

Increased business taxes

An increase in business taxes will reduce the expected profit of firms after taxes. This is because firms only consider the predicted profit earned after deducting taxes when deciding on an investment—it is what goes directly to their pocket. As a result, increasing business taxes will reduce investment demand and shift the demand curve to the left.

Business tax cuts, on the other hand, can boost business demand by reducing the cost of capital, making investment spending more attractive. They also increase firms' after-tax cash flow, which can be used to pay dividends and expand activity.

The Kennedy administration introduced an investment tax credit in the 1960s, which allowed firms to reduce their tax liability by a percentage of the investment made during a particular period. This stimulated private sector investment.

Public policy can have a significant effect on the demand for capital. Policies that affect the cost of capital to firms, such as accelerated depreciation, investment tax credits, and lower taxes on corporate profits, can increase the demand for private physical capital.

The demand curve illustrates the negative relationship between the interest rate and the level of investment. A higher interest rate means a higher opportunity cost of investing, as the potential gain from investing is compared to the interest that could be earned from a financial investment. Therefore, higher interest rates tend to reduce the quantity of investment, while lower interest rates increase it.

Trade Deficit: Investment, Savings and the Economy

You may want to see also

Firms have unused inventories

When firms have unused inventories, they are less likely to invest in new projects. This is because they are unable to sell their existing stock, so there is no incentive to add more inventory. As a result, the expected profit on further investments declines, leading to a decrease in investment demand. This causes a leftward shift in the investment demand curve.

Firms with unused inventories may be reluctant to invest in new projects for several reasons. Firstly, they may have made significant investments in their current inventories, and failing to sell these stocks would result in financial losses. Secondly, unused inventories could indicate a lack of demand for the firm's products, which would further discourage investment in similar projects. Additionally, firms with unused inventories may have issues with their products' quality, pricing, or marketing, which could be a reason for their inability to sell their existing stock.

When firms have unused inventories, it is essential to assess the situation and make necessary adjustments. This may involve evaluating the product-market fit, conducting market research to understand consumer preferences, and making changes to the product or its positioning. Firms may also consider offering discounts or promotions to clear their unused inventories. By addressing these issues, firms can regain their motivation to invest and potentially shift the investment demand curve back to the right.

It is worth noting that while unused inventories can lead to a leftward shift in the investment demand curve, other factors may also influence this shift. For example, if firms expect higher returns on their capital investments, the curve may shift to the right. Similarly, during economic booms, firms' incomes tend to rise, leading to increased investment and a rightward shift in the curve. Conversely, an increase in business taxes can reduce expected profits, causing a leftward shift in the curve.

Futures Trading: A Guide to Making Smart Investment Choices

You may want to see also

Pessimism about the future

During periods of pessimism, businesses tend to adopt a more cautious approach by reducing their investment demand. This behaviour is driven by the expectation of lower returns on investments, which discourages firms from making new investments. This shift in sentiment can have a significant impact on the overall economy, potentially leading to reduced economic growth and lower levels of innovation as businesses opt to maintain their current operations rather than explore new opportunities.

The impact of pessimism on investment decisions is particularly notable when businesses have unused production capacity or existing inventories that are not fully utilised. In such cases, firms may be reluctant to expand their operations or invest in new projects until they have maximised the use of their current resources. This wait-and-see approach can further contribute to a leftward shift in the investment demand curve as businesses delay their investment plans.

It is worth noting that pessimism about the future can be self-fulfilling. If businesses reduce their investment spending due to pessimistic expectations, it can contribute to a slowdown in economic growth and reinforce their initial concerns. This dynamic illustrates the complex relationship between investment decisions and economic outlook, where expectations and reality can influence each other in a cyclical manner.

Furthermore, pessimism about the future can also impact the types of investments businesses choose to make. During uncertain times, firms may favour investments that offer lower potential returns but are perceived as safer options. This shift in investment preferences can lead to a reduction in risk-taking and innovation, potentially hindering the development of new technologies or business ventures.

Aggressive Investment Portfolio: High-Risk, High-Reward Strategy

You may want to see also

High current profits

Another factor that can lead to a leftward shift in the investment demand curve is a decrease in the real interest rate. While this doesn't shift the curve itself, it makes borrowing cheaper, which can influence investment decisions. If the real interest rate falls below the expected rate of return, businesses may be incentivised to invest in projects with higher expected returns, leading to a potential leftward shift in the curve.

The level of economic activity also plays a role in shifting the investment demand curve. During recessions, when buyer incomes drop, there is a decrease in demand for goods and services, even if prices remain the same. This can lead to a leftward shift in the curve as businesses anticipate lower profitability and become more cautious about investing.

Furthermore, the stock of capital can also influence the investment demand curve. While a larger capital stock can lead to more investment due to the need to replace depreciated capital, it can also reduce investment. This is because the amount of new capital required to reach the desired level of capital decreases as the current capital stock increases, leading to a potential leftward shift in the curve.

Finally, public policy can also impact the investment demand curve. Changes in tax policies, such as increased taxes on business profits, can reduce expected profits after taxes, making businesses less likely to invest and potentially shifting the curve to the left.

A Secure Guide to EPF India Investments

You may want to see also

Low interest rates

The Relationship Between Interest Rates and Investment

The relationship between interest rates and investment is crucial to understanding how low-interest rates can shift the investment demand curve. Interest rates play a pivotal role in determining the desired stock of capital, and thus, they have a direct impact on investment decisions. When interest rates are low, the cost of borrowing funds is reduced, making it more attractive for businesses to invest in projects with potential returns exceeding the borrowing cost. This relationship holds true for both borrowing funds and investing existing funds.

Impact on Investment Decisions

Low-interest rates can stimulate investment demand, particularly in sectors such as housing construction. They encourage businesses and individuals to borrow funds for investments as the opportunity cost of borrowing is lower. This increased demand can shift the investment demand curve to the right. Additionally, with low-interest rates, more investment opportunities become viable as the threshold for potential returns is lower. This can further increase investment demand and push the curve to the right.

Comparison with Other Investment Options

When interest rates are low, the attractiveness of alternative investment options, such as bonds, may decrease. With lower interest rates, the potential returns from bonds are less appealing compared to investing in projects with potentially higher returns. As a result, investors may shift their focus from bonds to other investment opportunities, which can also contribute to a rightward shift in the investment demand curve.

Expectations and Profitability

The impact of low-interest rates on investment demand is closely tied to expectations and profitability. If businesses expect greater earnings from their projects compared to the borrowing cost, they will be more inclined to invest. Low-interest rates can make these projects more feasible and attractive, increasing investment demand and shifting the curve to the right. Similarly, if low-interest rates are expected to persist, businesses may be more willing to invest in long-term projects that can provide returns over an extended period.

The Role of Public Policy

Public policy decisions can also influence the impact of low-interest rates on investment demand. Government agencies play a role in adding to the public stock of capital, and their investment decisions may be influenced by low-interest rates. Additionally, tax and regulatory policies can affect the investment choices of private firms and individuals. For example, tax breaks or incentives for specific industries or investment types may encourage more investment, further shifting the curve to the right.

In summary, low-interest rates can have a significant impact on investment demand and the position of the investment demand curve. They can stimulate investment by making borrowing more attractive and increasing the number of viable investment opportunities. However, it is important to consider other factors, such as expectations, profitability, and public policy, which can also influence the relationship between low-interest rates and investment demand.

Creating a Schedule for Investment Savings

You may want to see also

Frequently asked questions

The investment demand curve shows the amount of investment demanded by an economy at a series of real interest rates. It is a curve that shows the quantity of investment demanded at each interest rate, with all other determinants of investment unchanged.

An increase in business taxes, a decrease in expected profitability, firms having a lot of unused production capacity or inventory, and an increase in the cost of capital goods can all cause the investment demand curve to shift left.

The interest rate represents the cost of borrowed funds or the opportunity cost of investing one's own funds. When the interest rate exceeds the expected rate of return, the investment should not be made, and vice versa. Thus, changes in interest rates can cause a movement along the investment demand curve.