Mutual funds that track the S&P 500 are a popular investment vehicle for those seeking to mirror the performance of the S&P 500 index, which is composed of 500 of the largest U.S. companies. These funds are passively managed, aiming to replicate the performance of the index rather than outperform it. As such, they offer investors broad exposure to the U.S. stock market at a low cost, making them ideal for long-term investment strategies. This paragraph will discuss some of the best S&P 500 mutual funds available in the market and the criteria for choosing one.

| Characteristics | Values |

|---|---|

| Number of companies | 500 leading U.S. publicly traded companies (as of May 2024, 503 companies were included) |

| Index type | Market-capitalization-weighted index |

| Index launch | 1957 |

| Companies' criteria | Must be a U.S. company, have an unadjusted market cap of at least $12.7 billion, a float-adjusted market cap of at least 50% of the minimum threshold, and positive as-reported earnings over the most recent quarter and the four most recent quarters combined |

| Investment options | Index funds, ETFs, individual stocks, brokerage account, 401(k), IRA |

| Top 10 constituents (as of Apr. 30, 2024) | Microsoft Corp. (MSFT), Amazon.com Inc. (AMZN), Alphabet Inc. A (GOOGL), Meta Platforms Inc. Class A (META), Alphabet Inc. C (GOOG), Berkshire Hathaway B (BRK.B), Eli Lilly & Co. (LLY), Broadcom Inc. (AVGO) |

| Top sectors (as of Apr. 2024) | Information Technology, Financials, Healthcare |

What You'll Learn

Vanguard 500 Index Fund - Admiral Shares (VFIAX)

The Vanguard 500 Index Fund - Admiral Shares (VFIAX) is a mutual fund that tracks the S&P 500, a market index that measures the performance of about 500 large U.S. companies. The fund attempts to replicate the performance of the S&P 500 by investing in the stocks that make up the index, with the same approximate weightings.

The Vanguard 500 Index Fund is one of the largest index funds and has been described as a "dominant offering". It has over $464 billion in total net assets and a net expense ratio of 0.04%. This means that for every $10,000 invested, you will pay $4 in annual fees. The fund had a 52-week average return of 28.81% and is ranked in the 12th percentile for its performance.

Compared to other S&P 500 index funds, the Vanguard 500 Index Fund has a higher investment minimum and fee structure. However, it still offers accessibility with a minimum investment that is on the high end of average and a comparatively affordable cost structure when compared to other mutual funds and many ETFs.

The fund is a good option for investors who prefer Vanguard as their go-to platform for mutual funds and want a long-term holding.

Mutual Fund App Investments: Safe or Scam?

You may want to see also

Schwab S&P 500 Index Fund (SWPPX)

The Schwab S&P 500 Index Fund (SWPPX) is a straightforward, low-cost mutual fund with no investment minimum. The fund's goal is to track the total return of the S&P 500 Index, which is a market index that measures the performance of about 500 large U.S. companies. The fund was launched in May 1997 and has a total expense ratio of 0.020%.

SWPPX is one of the cheapest and most established S&P 500 index funds available, with a cost structure among the lowest of any mutual fund globally. The fund provides simple access to 500 leading U.S. companies and captures approximately 80% coverage of the available U.S. market capitalization. It invests in some of the most well-known U.S.-based companies, including Meta Platforms, Alphabet, and Berkshire Hathaway.

The fund can serve as a core component of a diversified portfolio and is suitable for investors seeking long-term appreciation and broad exposure to the constituent stocks of the S&P 500 Index. The fund has a large blend investment style, with the majority of its assets invested in stocks with market capitalisations above $10 billion. As of September 30, 2024, the fund had total assets of 106.1 billion USD.

In terms of performance, the Schwab S&P 500 Index Fund has delivered annualized returns of 11.43% over the past five years and 9.14% over the past ten years. It is important to note that past performance does not guarantee future results, and investment returns may fluctuate.

Invest in Precious Metals Mutual Funds: Diversify Your Portfolio

You may want to see also

Fidelity Zero Large Cap Index (FNILX)

Index funds aim to mirror a particular market index, such as the S&P 500, the Dow Jones Industrial Average, or the Nasdaq Composite Index. As such, an index fund's performance will likely be similar to that of the overall market index.

FNILX has a minimum initial investment amount of 0 dollars, and its top holdings as of September 30, 2024, were Meta Platforms Inc Class A, Alphabet Inc Class A, Berkshire Hathaway Inc Class B, and Alphabet Inc Class C.

Growth Funds: Smart 401k Investment Strategy?

You may want to see also

Fidelity 500 Index Fund (FXAIX)

The Fidelity 500 Index Fund (FXAIX) is a mutual fund that tracks the S&P 500 index, which is one of the main benchmarks for US stocks. The S&P 500 covers about 80% of the investable market capitalisation of the US equity market and is considered a good addition to retirement portfolios due to its broad diversification across all sectors.

The FXAIX fund was launched in October 2005 and is managed by Geode Capital Management. The fund's goal is to replicate the performance of the S&P 500 Index, which consists of 500 large common stocks traded in the US stock market. To achieve this, the fund invests at least 80% of its assets in common stocks included in the S&P 500.

As of November 27, 2023, the fund had assets totalling almost $407.6 billion invested in 508 different holdings. Over the past year, the fund has returned 10.14%, and over the past decade, it has returned 11.17%. The fund has a low expense ratio of 0.02%, compared to a category average of 0.85%.

The FXAIX fund is a good option for investors seeking to track the performance of the S&P 500 index due to its low cost structure and no minimums on the initial investment.

Vanguard Mutual Funds: Choosing Wellesley or Wellington

You may want to see also

T. Rowe Price Equity Index 500 Fund (PREIX)

The fund is passively managed, meaning it does not reallocate holdings based on market changes or outlooks. This passive management style contributes to its lower expenses compared to actively managed funds, and these lower expenses can increase total returns. The fund's lower turnover also means smaller capital gain distributions, which can raise after-tax returns.

PREIX is designed for investors seeking capital appreciation over time who can accept the risk of loss inherent in common stock investing. It is appropriate for both regular and tax-deferred accounts, such as IRAs.

As of November 1, 2024, the fund had total assets of $33.2 billion and a minimum initial investment of $2,500. Its net expense ratio was 0.190%, and its 1-day return was -1.85%.

The fund's top holdings as of September 30, 2024, included Meta Platforms Inc Class A, Alphabet Inc Class A, Berkshire Hathaway Inc Class B, and Alphabet Inc Class C.

Invest Money with Fidelity: A Guide to Getting Started

You may want to see also

Frequently asked questions

An S&P 500 index fund tracks the S&P 500, a market index that measures the performance of about 500 U.S. companies.

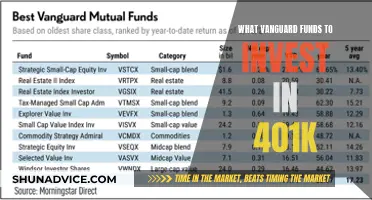

Some of the best S&P 500 index funds on the market in terms of costs and minimums include Vanguard 500 Index Fund - Admiral Shares (VFIAX), Schwab S&P 500 Index Fund (SWPPX), Fidelity Zero Large Cap Index (FNILX), Fidelity 500 Index Fund (FXAIX), and T. Rowe Price Equity Index 500 Fund (PREIX).

Investing in the S&P 500 exposes individuals to some of the world's most dynamic companies, such as Apple, Amazon, and Microsoft. It also offers consistent long-term returns and does not require intricate analysis, as investing in the S&P 500 through an ETF or index fund means investors do not have to analyze or pick stocks.