How much of your income you should invest is a common question, and the answer depends on your financial goals, risk tolerance, and current market conditions. A general rule of thumb is that you should invest a set percentage of your income, which can vary depending on your income, savings, and debts. Experts recommend investing between 10% to 25% of your income, with 15% being a common benchmark. This can be further broken down into the 50/15/5 rule, where 50% of your income goes to essential expenses, 15% to retirement investments, and 5% to short-term savings.

| Characteristics | Values |

|---|---|

| Percentage of income to invest | 10-15% of after-tax income |

| Percentage of income for essential expenses | 50% |

| Percentage of pretax income to invest for retirement | 15% |

| Percentage of income for short-term savings | 5% |

| Percentage of income for discretionary expenses | 30% |

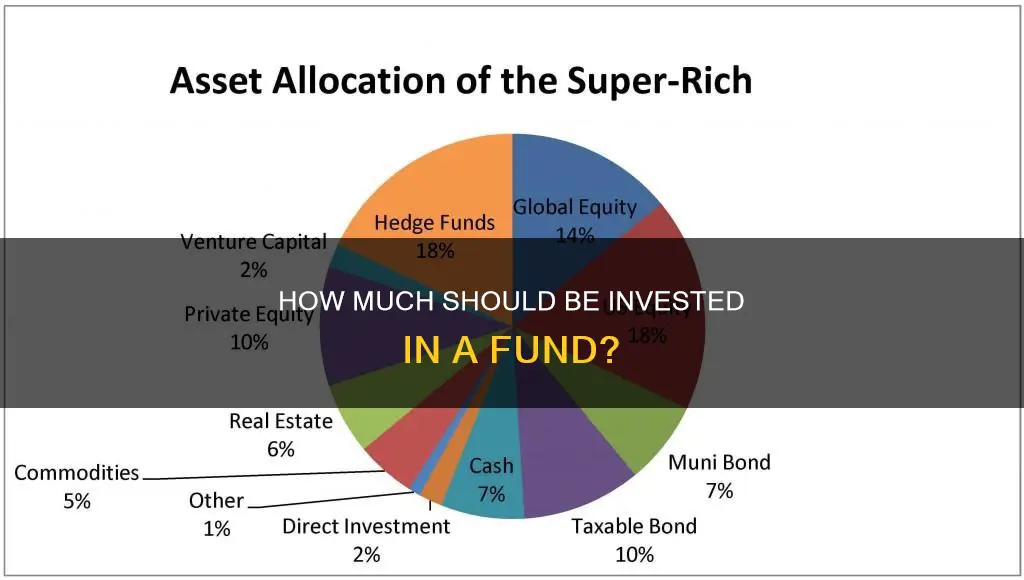

| Percentage of cash in portfolio | 2-10% |

What You'll Learn

What percentage of your income should you invest?

The percentage of your income that you should invest depends on a variety of factors, including your income, age, risk tolerance, and investment goals.

Expert Recommendations

Many experts recommend investing 15% of your income. This is supported by Mark Henry, the founder and CEO of Alloy Wealth Management, who suggests investing "somewhere around 15%–25%" of your post-tax income. Matt Rogers, a CFP and director of financial planning at eMoney Advisor, also recommends the 50/15/5 rule, where 15% of your pretax income is invested for retirement.

Other Factors to Consider

Your income level, age, and risk tolerance will also influence the percentage of your income that you should invest. If you are just starting out in your career, you may need to start with a lower percentage and gradually increase it as your income grows. Additionally, if you have a low-risk tolerance, you may want to invest in less volatile options, which may require a higher annual investment amount to achieve the same returns.

Rules of Thumb

As a general rule of thumb, it is recommended that you invest between 10% and 15% of your annual income. This can be adjusted based on your unique financial situation and investment strategy.

Other Rules to Consider

Another budgeting strategy to consider is the 50/30/20 rule, which allocates 50% of your monthly budget to needs, 30% to wants, and 20% to debt repayment, savings, and investments. This rule provides more flexibility and allows you to allocate a larger portion of your income to investments if you have fewer expenses.

In summary, the percentage of your income that you should invest depends on a variety of factors, and you should consider seeking expert advice to determine the best approach for your individual circumstances.

Hedge Funds: Investment Firms or Something Different?

You may want to see also

How much should you invest for retirement?

When it comes to investing for retirement, experts recommend saving between 10% and 15% of your pre-tax income each year. This is based on the assumption that most people will need between 55% and 80% of their pre-retirement income to maintain their standard of living after they stop working.

However, the exact amount you should invest depends on a variety of factors, including your current income, savings, and debts, and your investment goals. It's important to consider your unique financial situation and create an investment strategy that aligns with your budget.

For example, if you're just starting your career, you might not be able to invest 15% of your income immediately. In that case, you can start with a smaller percentage and gradually increase it over time as your income grows. Additionally, if you have access to an employer match program, such as a 401(k), contributing enough to meet the match is a good way to boost your retirement savings.

It's also worth noting that investing for retirement is a long-term project. The earlier you start, the more time your investments have to grow and compound in value. Even if you can only invest a small amount each month, consistency is key.

- Your income: Assess your monthly income and how much money you have leftover after covering essential expenses.

- Your debts: Create a plan to manage your debt balances, especially high-interest debt, and determine how much you can comfortably invest while still making minimum payments.

- Your savings: Build an emergency fund to cover unexpected expenses, and consider your short-term and long-term savings goals.

- Your investment goals: Define your end goal, whether it's retirement, purchasing a home, or funding your child's education. This will help you set a realistic timeline and investment strategy.

- Your risk tolerance: Assess your comfort level with taking on investment risk. Diversifying your portfolio across different asset classes can help manage risk.

Remember to periodically re-evaluate your investment strategy as your financial situation and goals evolve.

A Guide to Investing in Mutual Funds via Zerodha

You may want to see also

How much cash should be in your portfolio?

How much cash you should keep in your portfolio depends on several factors, including your financial goals, risk tolerance, and current life stage. Here are some guidelines and considerations to help you determine the appropriate cash allocation for your investment portfolio:

General Guidelines

As a general rule of thumb, it is recommended that cash and cash equivalents, such as savings and money market accounts, comprise between 2% and 10% of your portfolio. This range, however, can vary from person to person and is influenced by individual circumstances and market conditions.

Financial Goals and Objectives

The appropriate level of cash in your portfolio depends on your financial goals and objectives. If you are planning for retirement, for example, allocating a portion of your portfolio to cash and cash equivalents can provide liquidity and peace of mind. This ensures that you have sufficient reserves to weather uncertain periods or economic downturns.

Time Horizon for Investing

Your time horizon for investing also plays a role in determining your cash allocation. If you are years away from retirement and focused on wealth accumulation, you may have more flexibility to take on investment risk. In this case, holding a modest percentage of your portfolio in cash can provide the advantage of quickly capitalising on investment opportunities, especially during market disruptions or fluctuations.

Risk Tolerance

Your risk tolerance is a crucial factor in deciding how much cash to keep in your portfolio. If you have a higher risk tolerance, you may be comfortable with a smaller cash position, as this allows you to maintain more money in stocks and bonds, which offer higher potential returns. On the other hand, if you are more risk-averse, having a larger cash position can provide stability and flexibility to take advantage of new investment opportunities.

Current Life Stage

Your current life stage and income stability are important considerations. For retirees, having a higher cash position can provide reassurance and meet income needs over a 2-3 year period without being subject to market fluctuations. If you have a steady income and can rely on regular paychecks or bonuses, a smaller cash position may be sufficient. However, if your income varies, such as in the case of independent contractors, maintaining higher cash reserves can protect against unexpected income shortfalls or expenses.

Emergency Funds and Short-Term Goals

It is generally recommended to have emergency funds and short-term savings set aside, typically advised to cover at least six months' worth of essential expenses. This ensures that you have liquidity to manage unforeseen circumstances or short-term financial goals.

Diversification and Reevaluation

Diversification is essential in managing your cash position. This involves finding the right balance between cash and cash equivalents, such as CDs, bonds, and treasuries, to match your financial goals and time horizon. It is also important to periodically reevaluate your cash allocation, at least annually, to ensure it remains aligned with your evolving financial plan and goals.

In summary, determining the right amount of cash to hold in your portfolio depends on various factors, including your financial goals, risk tolerance, time horizon, and current life stage. By considering these factors and staying aligned with your investment strategy, you can make informed decisions about how much cash to include in your portfolio.

Key Fund Risks: What You Need to Know

You may want to see also

How much should you save for a house?

Saving for a house is an exciting prospect, but it can be tricky to know exactly how much you need to put away. The amount you should save depends on several factors, including the cost of the house, the type of mortgage, and other associated costs. Here is a detailed and direct guide on how much you should save for a house.

Down Payment

A good rule of thumb is to save at least 20% of the purchase price of the house for your down payment. A larger down payment reduces your overall financing needs, resulting in a smaller loan and lower monthly mortgage payments. Additionally, a 20% down payment usually exempts you from expensive private mortgage insurance (PMI) payments. PMI is a supplemental insurance policy that protects the lender if you default on your loan. If you are unable to save 20%, most lenders will accept a smaller down payment, but you may have to pay PMI or a higher interest rate on your loan.

Closing Costs

Closing costs refer to the fees and taxes related to purchasing a home, typically paid before receiving the keys to your new home. These costs can vary depending on your location and mortgage but usually include loan origination fees, homeowners' insurance, and property taxes. Closing costs generally total between 3% and 5% of the home's purchase price. For example, if you're buying a $350,000 house, you can expect to pay between $10,500 and $17,500 in closing costs.

Miscellaneous and Hidden Costs

When saving for a house, don't forget to account for miscellaneous and hidden costs that can quickly add up. These include homeowner association (HOA) dues, monthly mortgage and utility payments, and unexpected repairs or maintenance issues. It's a good idea to set aside a buffer of 1% to 5% of the purchase price to cover these unplanned expenses, depending on your risk tolerance. Additionally, setting aside 1% to 2% of the home's purchase price each year can help cover ongoing maintenance costs.

Emergency Fund

Before you start saving for a house, it's crucial to have an emergency fund in place. This will ensure that you have financial security if unexpected expenses arise during the home-buying process or after you've purchased the house. Aim to save 3–6 months' worth of your typical living expenses in a fully-funded emergency fund.

Total Savings Goal

To calculate your total savings goal, consider the purchase price of the house, the down payment, closing costs, and miscellaneous expenses. For example, if you're buying a $350,000 house, a 20% down payment would be $70,000, 5% closing costs would be $17,500, and 2% miscellaneous costs would be $7,000, resulting in a total savings goal of $94,500.

Remember, the sooner you start saving, the less money you'll need to put away each month to reach your goal. It's also important to consider your income, existing debts, and financial priorities when determining how much you can comfortably save for a house.

Angel Fund Investments: Dollars, Income, and Corporations

You may want to see also

How much should you invest vs put in a HYSA?

The amount of money you should invest in a High-Yield Savings Account (HYSA) depends on your financial goals and personal circumstances. HYSAs are a good option for those building an emergency fund, saving for a vacation, or working towards a down payment on a house.

HYSAs provide a higher interest rate than traditional savings accounts, making them an excellent vehicle for short-term savings goals. The money in most HYSAs is insured and easily accessible, though some accounts may have withdrawal limits or fees.

When deciding how much to put in a HYSA, consider your income, savings, debts, and financial priorities. Many experts recommend investing a set percentage of your income, often quoted as 15% of your pretax income. This can be a good starting point, but the specific percentage will depend on your unique situation.

- Emergency fund: A common rule of thumb is to save 3 to 6 months' worth of living expenses in an emergency fund.

- Down payment on a home: Typically, a 20% down payment is recommended to avoid paying mortgage insurance.

- Vacation: Calculate the full cost of your trip, including transportation, lodging, food, and activities, and work backward to determine your monthly savings goal.

- Other short-term goals: Consider any other short-term financial goals you may have, such as saving for a car down payment or a wedding.

In addition to these factors, it's important to assess your risk tolerance and time horizon. If you are saving for retirement, for example, you may opt for more conservative investments like bonds or money market accounts. If you are saving for a down payment on a home, you may be more comfortable taking on more risk with a portion of your savings by investing in stocks or mutual funds.

Remember, there is no one-size-fits-all answer to how much you should invest in a HYSA. The key is to set clear financial goals, understand your risk tolerance and time horizon, and create a plan that works for your unique circumstances.

Mutual Funds vs. ETFs: Where Should Your IRA Go?

You may want to see also

Frequently asked questions

Experts recommend investing 15% of your income, although this can vary depending on your income, savings, and debts.

If you're looking to retire at 65 with $1 million in retirement money, you should put away $500 a month, assuming a 6.5% average annual return.

Cash and cash equivalents should make up between 2% and 10% of your portfolio.

You should consider your financial goals, risk tolerance, and time horizon.